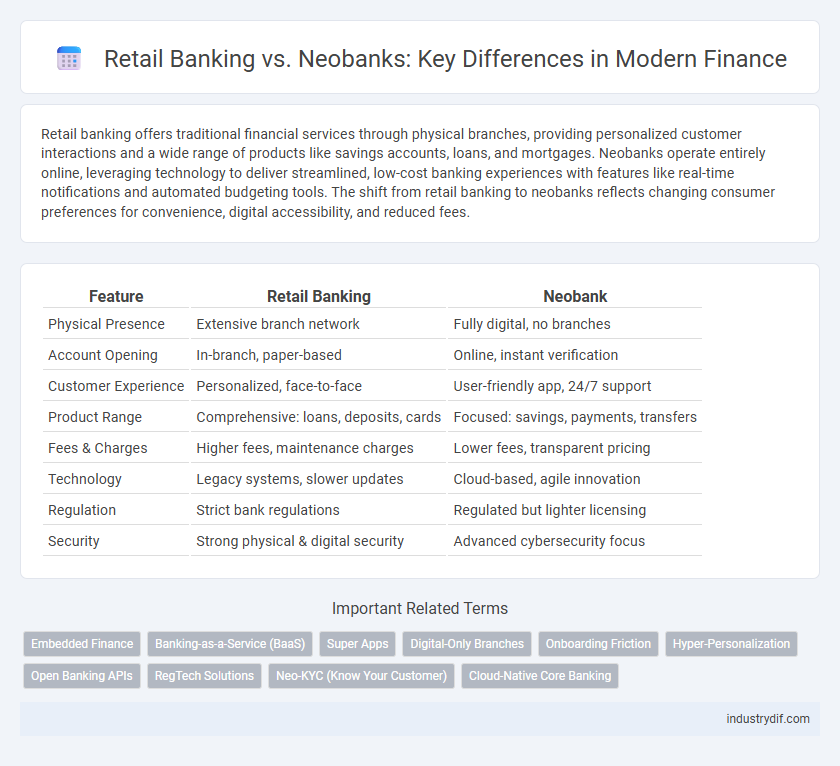

Retail banking offers traditional financial services through physical branches, providing personalized customer interactions and a wide range of products like savings accounts, loans, and mortgages. Neobanks operate entirely online, leveraging technology to deliver streamlined, low-cost banking experiences with features like real-time notifications and automated budgeting tools. The shift from retail banking to neobanks reflects changing consumer preferences for convenience, digital accessibility, and reduced fees.

Table of Comparison

| Feature | Retail Banking | Neobank |

|---|---|---|

| Physical Presence | Extensive branch network | Fully digital, no branches |

| Account Opening | In-branch, paper-based | Online, instant verification |

| Customer Experience | Personalized, face-to-face | User-friendly app, 24/7 support |

| Product Range | Comprehensive: loans, deposits, cards | Focused: savings, payments, transfers |

| Fees & Charges | Higher fees, maintenance charges | Lower fees, transparent pricing |

| Technology | Legacy systems, slower updates | Cloud-based, agile innovation |

| Regulation | Strict bank regulations | Regulated but lighter licensing |

| Security | Strong physical & digital security | Advanced cybersecurity focus |

Introduction to Retail Banking and Neobanks

Retail banking represents traditional branch-based financial services provided by established banks, focusing on deposit accounts, personal loans, mortgages, and in-person customer interaction. Neobanks operate entirely online without physical branches, leveraging digital platforms and mobile apps to offer streamlined banking services, lower fees, and enhanced user experience. The rise of neobanks reflects a shift towards technology-driven financial solutions, catering to tech-savvy customers seeking convenience and innovative features.

Key Differences Between Retail Banks and Neobanks

Retail banks operate through physical branches offering a wide range of financial services including loans, mortgages, and wealth management, while neobanks function entirely online with no physical presence, emphasizing streamlined digital experiences and lower fees. Retail banks are regulated under traditional banking laws and often provide insurance on deposits via entities like the FDIC in the U.S., whereas neobanks typically partner with licensed banks to offer insured deposit accounts. Customer service in retail banks includes face-to-face interactions, contrasting with neobanks' reliance on AI-driven chatbots and mobile app support for real-time assistance and personalized financial insights.

Digital-First Approach: How Neobanks Operate

Neobanks leverage a digital-first approach that eliminates physical branches, enabling seamless mobile and online banking experiences tailored to tech-savvy customers. These fintech-driven platforms prioritize real-time account management, instant fund transfers, and AI-powered financial insights to enhance user engagement and financial decision-making. Unlike traditional retail banks, neobanks reduce operational costs through automation and cloud infrastructure, passing savings onto customers via lower fees and higher interest rates.

Traditional Retail Banking: Legacy Systems and Services

Traditional retail banking relies heavily on legacy systems that often lack flexibility and agility, resulting in slower service delivery and higher operational costs. These banks maintain extensive physical branch networks, offering personalized customer service but facing challenges in digital innovation and integration. Legacy infrastructures hinder real-time data processing and seamless omnichannel experiences, creating a gap between customer expectations and service capabilities.

Customer Experience: Neobanks vs Retail Banks

Neobanks offer streamlined digital interfaces with personalized financial tools, enhancing user convenience and accessibility compared to traditional retail banks. Retail banks maintain comprehensive branch networks and face-to-face services, catering to customers valuing in-person interaction and complex financial advice. Customer experience in neobanks emphasizes speed and innovation, while retail banks prioritize trust and established relationships.

Security and Compliance in Retail Banking vs Neobanking

Retail banking maintains robust security frameworks with long-established regulatory compliance measures, including stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols overseen by government agencies. Neobanks leverage advanced encryption technologies and biometrics to enhance user authentication but face evolving regulatory scrutiny due to their digital-only model and faster onboarding processes. Both prioritize data protection, yet retail banks' legacy systems often enable more comprehensive compliance reporting, whereas neobanks excel in real-time fraud detection through AI-driven analytics.

Cost Structure: Fees and Charges Comparison

Retail banking typically incurs higher operational costs due to branch maintenance, resulting in a wider range of fees such as account maintenance charges, ATM withdrawal fees, and overdraft penalties. Neobanks operate with a digital-only model, significantly reducing overhead costs and often offering lower or no fees for services like transfers, account management, and international payments. The cost structure advantage of neobanks attracts tech-savvy customers seeking transparent, affordable banking solutions without traditional fee burdens.

Financial Products and Services Offered

Retail banks provide a comprehensive range of financial products including savings accounts, checking accounts, personal loans, mortgages, and credit cards, supported by extensive branch networks and personalized customer service. Neobanks, operating entirely online, specialize in streamlined digital offerings such as mobile checking accounts, automated savings tools, and low-fee payment solutions, often integrating advanced technologies like AI for personalized financial management. The contrast in service delivery highlights traditional retail banking's emphasis on in-person access and broad product variety versus neobanks' focus on convenience, low costs, and innovative digital experiences.

Market Trends: Growth of Neobanks in Finance

Neobanks have experienced exponential growth, capturing significant market share by appealing to digitally savvy consumers seeking seamless, low-cost banking solutions. Unlike traditional retail banks, neobanks leverage advanced technology platforms to offer real-time account management, personalized financial products, and enhanced user experiences. Market trends indicate that neobanks are driving innovation in finance, accelerating digital transformation, and challenging incumbent banks through agile business models and data-driven approaches.

Future Outlook: The Evolution of Banking Services

Retail banking is expected to evolve by integrating advanced digital technologies while maintaining personalized in-branch experiences. Neobanks leverage AI-driven analytics and seamless mobile interfaces to attract tech-savvy customers, driving rapid adoption of contactless payments and real-time financial management. The future landscape will likely see a hybrid model combining traditional trust with digital innovation, enhancing customer convenience and financial inclusion worldwide.

Related Important Terms

Embedded Finance

Embedded finance integrates banking services directly into non-bank platforms, offering seamless payment, lending, and insurance options that enhance customer convenience beyond traditional retail banking branches. Neobanks leverage embedded finance to provide agile, API-driven financial solutions that outpace legacy retail banks in personalization and real-time digital experiences.

Banking-as-a-Service (BaaS)

Retail banking relies on traditional branch networks and legacy systems to deliver services, whereas neobanks leverage Banking-as-a-Service (BaaS) platforms to provide seamless, API-driven digital banking experiences. BaaS enables neobanks to integrate third-party financial products quickly, reduce operational costs, and scale efficiently without owning core banking infrastructure.

Super Apps

Retail banking relies on traditional branch networks and legacy systems to offer comprehensive financial services, while neobanks leverage digital platforms and APIs to deliver seamless, user-friendly experiences. Super apps integrate retail banking and neobank functions within a single ecosystem, enabling customers to access payments, loans, investments, and insurance effortlessly through one interface.

Digital-Only Branches

Retail banking relies on physical branches to provide a wide range of financial services, while neobanks operate exclusively through digital-only platforms, offering streamlined account management and lower fees. Digital-only branches enable neobanks to leverage advanced fintech technologies, delivering enhanced customer experiences with real-time transactions and personalized financial insights.

Onboarding Friction

Retail banking often involves extensive paperwork and in-branch visits that increase onboarding friction, resulting in slower account opening processes. Neobanks utilize digital-first platforms with streamlined KYC and instant verification technologies, significantly reducing onboarding friction and enabling faster customer acquisition.

Hyper-Personalization

Retail banking leverages extensive customer data and branch networks to offer tailored financial products, while neobanks excel in hyper-personalization by utilizing AI-driven analytics and real-time data integration to deliver highly customized user experiences. Neobanks' digital-first platforms enable adaptive financial management tools that dynamically respond to individual spending patterns, optimizing customer engagement and satisfaction.

Open Banking APIs

Retail banking increasingly integrates Open Banking APIs to enhance customer experience through personalized financial services and seamless third-party app connectivity. Neobanks leverage these APIs extensively, enabling real-time data sharing and innovative product offerings that challenge traditional retail banking models.

RegTech Solutions

RegTech solutions in retail banking typically emphasize compliance automation, risk management, and fraud detection through legacy system integration, while neobanks leverage cloud-native technologies and AI-driven tools to streamline regulatory reporting and real-time monitoring. The adoption of advanced data analytics and blockchain enhances transparency and reduces operational costs in both models, but neobanks offer greater agility in implementing innovative RegTech frameworks.

Neo-KYC (Know Your Customer)

Neo-KYC leverages advanced AI-powered digital identity verification and biometric authentication, enabling neobanks to streamline customer onboarding and enhance fraud detection compared to traditional retail banking's manual and paper-based processes. This digital-first approach reduces operational costs and accelerates compliance with regulatory requirements, positioning neobanks as agile competitors in the evolving financial services landscape.

Cloud-Native Core Banking

Retail banking relies on traditional core banking systems often hosted on-premises, limiting scalability and agility, whereas neobanks leverage cloud-native core banking platforms to enable real-time processing, seamless integration, and cost-efficient scalability. Cloud-native architectures in neobanks enhance customer experience through faster innovation cycles, robust API ecosystems, and improved data analytics capabilities, positioning them favorably against legacy retail banking infrastructures.

Retail Banking vs Neobank Infographic

industrydif.com

industrydif.com