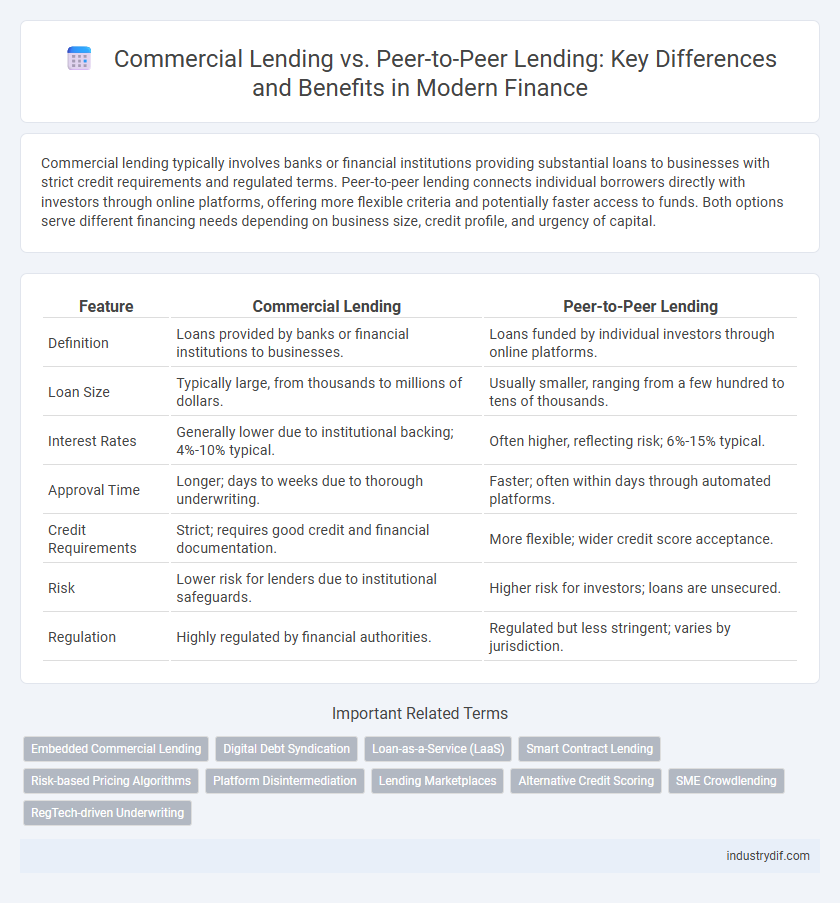

Commercial lending typically involves banks or financial institutions providing substantial loans to businesses with strict credit requirements and regulated terms. Peer-to-peer lending connects individual borrowers directly with investors through online platforms, offering more flexible criteria and potentially faster access to funds. Both options serve different financing needs depending on business size, credit profile, and urgency of capital.

Table of Comparison

| Feature | Commercial Lending | Peer-to-Peer Lending |

|---|---|---|

| Definition | Loans provided by banks or financial institutions to businesses. | Loans funded by individual investors through online platforms. |

| Loan Size | Typically large, from thousands to millions of dollars. | Usually smaller, ranging from a few hundred to tens of thousands. |

| Interest Rates | Generally lower due to institutional backing; 4%-10% typical. | Often higher, reflecting risk; 6%-15% typical. |

| Approval Time | Longer; days to weeks due to thorough underwriting. | Faster; often within days through automated platforms. |

| Credit Requirements | Strict; requires good credit and financial documentation. | More flexible; wider credit score acceptance. |

| Risk | Lower risk for lenders due to institutional safeguards. | Higher risk for investors; loans are unsecured. |

| Regulation | Highly regulated by financial authorities. | Regulated but less stringent; varies by jurisdiction. |

Overview of Commercial Lending and Peer-to-Peer Lending

Commercial lending involves financial institutions providing loans to businesses, typically secured by assets and accompanied by structured repayment terms. Peer-to-peer lending connects individual investors directly with borrowers through online platforms, offering a more flexible and often faster alternative to traditional bank loans. Both methods serve distinct market segments, with commercial lending catering to established businesses while peer-to-peer lending appeals to startups and smaller enterprises seeking accessible financing options.

Key Players in Commercial Lending vs Peer-to-Peer Lending

Key players in commercial lending include large financial institutions such as JPMorgan Chase, Bank of America, and Wells Fargo, which provide substantial capital for businesses through structured loan products. Peer-to-peer lending platforms like LendingClub, Prosper, and Funding Circle connect individual investors directly with borrowers, bypassing traditional banks and enabling more accessible lending options. The difference in key players highlights the contrast between established banking institutions' regulatory frameworks and the innovative, technology-driven models of P2P platforms.

Eligibility Criteria Comparison: Commercial vs. P2P Lending

Commercial lending typically requires established credit history, significant annual revenue, and collateral to secure loans, reflecting stringent eligibility standards set by traditional financial institutions. Peer-to-peer lending platforms offer more flexible criteria, often focusing on credit scores, income verification, and debt-to-income ratios, making them accessible to small businesses and individual entrepreneurs with limited credit history. The contrast in eligibility underscores the trade-off between conventional financing security and the inclusivity of alternative lending sources.

Application Process Differences in Business Loans

Commercial lending typically requires a comprehensive application involving detailed financial statements, credit history, and collateral assessment, often taking several weeks for approval. Peer-to-peer lending platforms streamline the process with online applications, automated credit evaluations, and faster decision times, usually within days. Business owners seeking speed and convenience may prefer peer-to-peer lending, while those needing larger loan amounts often turn to commercial lenders.

Interest Rates: Commercial Lending vs P2P Lending Platforms

Interest rates in commercial lending typically range from 4% to 13%, influenced by creditworthiness, loan amount, and term length, offering relatively stable and predictable costs for businesses. Peer-to-peer lending platforms often present higher risk-based rates, averaging between 6% and 30%, reflecting borrower credit profiles and platform fees, with interest rates frequently more competitive for prime borrowers compared to traditional bank loans. Businesses must assess liquidity needs and risk tolerance when comparing fixed or variable commercial loan interest rates against potentially fluctuating rates in P2P loans.

Risk Assessment and Underwriting Practices

Commercial lending involves rigorous risk assessment and underwriting practices that rely heavily on credit scores, cash flow analysis, and collateral evaluation to mitigate lender risk. Peer-to-peer lending platforms use alternative data points, including social reputation and transactional behavior, to underwrite loans, often employing automated algorithms to evaluate borrower risk more rapidly. While commercial lenders prioritize regulatory compliance and detailed financial documentation, peer-to-peer lenders tend to focus on speed and accessibility, accepting higher risk levels in exchange for potentially higher returns.

Loan Terms and Repayment Schedules

Commercial lending typically involves fixed loan terms ranging from one to ten years with structured repayment schedules including monthly principal and interest payments. Peer-to-peer lending offers more flexible terms, allowing borrowers to negotiate repayment schedules that can vary from a few months to several years, often with fixed or variable interest rates. Both lending types require clear agreements on repayment frequency and loan maturity to manage cash flow and risk effectively.

Regulatory Frameworks Governing Each Lending Type

Commercial lending operates under stringent regulatory frameworks such as the Dodd-Frank Act, Basel III standards, and specific banking regulations imposed by bodies like the Federal Reserve and OCC, ensuring borrower protection and financial stability. Peer-to-peer lending is regulated by the Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB), requiring registration of platforms and adherence to investor protection rules under the Securities Act of 1933. These distinct regulatory environments influence risk assessment, transparency, and compliance practices across the two lending types.

Pros and Cons: Commercial Lending vs Peer-to-Peer Lending

Commercial lending offers businesses access to substantial capital with structured repayment terms and established credit evaluations, but often involves stringent qualification criteria and slower approval processes. Peer-to-peer lending provides quicker funding with potentially lower interest rates by connecting borrowers directly to individual lenders, yet carries higher risk of default and less regulatory oversight. The choice depends on factors like loan amount, creditworthiness, desired speed, and risk tolerance.

Choosing the Right Lending Solution for Your Business

Commercial lending offers established businesses access to larger loan amounts with structured repayment terms and typically lower interest rates, supported by detailed credit assessments. Peer-to-peer lending provides a faster, more flexible alternative with potentially easier approval, leveraging a network of individual investors and often suitable for startups or small enterprises seeking modest funding. Assessing your business's credit profile, funding needs, and repayment capacity is crucial to selecting the optimal lending solution that aligns with your financial strategy and growth objectives.

Related Important Terms

Embedded Commercial Lending

Embedded commercial lending integrates financing options directly within business platforms, streamlining access to credit for commercial clients without traditional bank intermediaries. This approach contrasts with peer-to-peer lending by leveraging existing commercial ecosystems, enabling faster loan approvals and tailored credit solutions for businesses.

Digital Debt Syndication

Digital debt syndication streamlines commercial lending by aggregating institutional investors to fund large corporate loans, enhancing transparency and efficiency compared to traditional methods. Peer-to-peer lending, while enabling smaller-scale loans directly between individuals or businesses, lacks the scale and structured syndication platforms that digital debt syndication provides for commercial finance.

Loan-as-a-Service (LaaS)

Loan-as-a-Service (LaaS) platforms streamline commercial lending by integrating automation, compliance, and risk assessment tools, enabling faster loan origination and management compared to traditional peer-to-peer lending models. These LaaS solutions leverage advanced analytics and API-driven workflows to optimize loan underwriting, enhancing scalability and efficiency in financing for businesses.

Smart Contract Lending

Smart contract lending in commercial finance automates loan agreements on blockchain networks, reducing intermediaries and increasing transaction speed for businesses seeking capital. Peer-to-peer lending platforms leverage smart contracts to ensure transparent, secure exchanges between individual lenders and borrowers, optimizing risk management and payment enforcement.

Risk-based Pricing Algorithms

Commercial lending employs sophisticated risk-based pricing algorithms that analyze credit scores, financial statements, and market conditions to determine interest rates tailored to business risk profiles. Peer-to-peer lending platforms use similar algorithms but rely more heavily on alternative data points and borrower behavior patterns to price loans, often resulting in more dynamic rate adjustments based on real-time risk assessments.

Platform Disintermediation

Commercial lending typically involves banks acting as intermediaries between borrowers and investors, ensuring regulatory compliance and risk assessment, whereas peer-to-peer lending platforms reduce platform disintermediation by directly connecting individual lenders with borrowers, minimizing fees and increasing accessibility. This disintermediation in P2P lending enhances capital flow efficiency and allows for more competitive interest rates compared to traditional commercial loans.

Lending Marketplaces

Lending marketplaces serve as digital platforms that connect borrowers directly with lenders, streamlining the loan approval process while reducing costs in both commercial and peer-to-peer lending sectors. Commercial lending marketplaces primarily facilitate larger, business-focused loans with stricter underwriting criteria, whereas peer-to-peer lending platforms target individual borrowers and investors, emphasizing transparency and accessibility.

Alternative Credit Scoring

Alternative credit scoring in commercial lending leverages comprehensive financial data such as cash flow analysis, business revenue trends, and industry performance to assess borrower risk more accurately than traditional credit scores. Peer-to-peer lending platforms utilize alternative data points including social media behavior, transaction history, and personal networks to evaluate creditworthiness, enabling access to funds for borrowers with limited or non-traditional credit profiles.

SME Crowdlending

SME crowdlending, a subset of peer-to-peer lending, offers small and medium-sized enterprises direct access to capital by pooling funds from individual investors, bypassing traditional commercial banks and their stringent credit requirements. This financing model provides SMEs with faster approval times and often lower interest rates, while giving investors diversified opportunities and the potential for higher returns compared to conventional commercial lending channels.

RegTech-driven Underwriting

Commercial lending leverages RegTech-driven underwriting to enhance compliance and risk assessment through automated data analysis and real-time regulatory monitoring, ensuring accurate credit evaluation for businesses. Peer-to-peer lending platforms integrate RegTech tools to streamline borrower verification and fraud detection, enabling efficient, transparent credit decisions while reducing operational costs.

Commercial lending vs Peer-to-peer lending Infographic

industrydif.com

industrydif.com