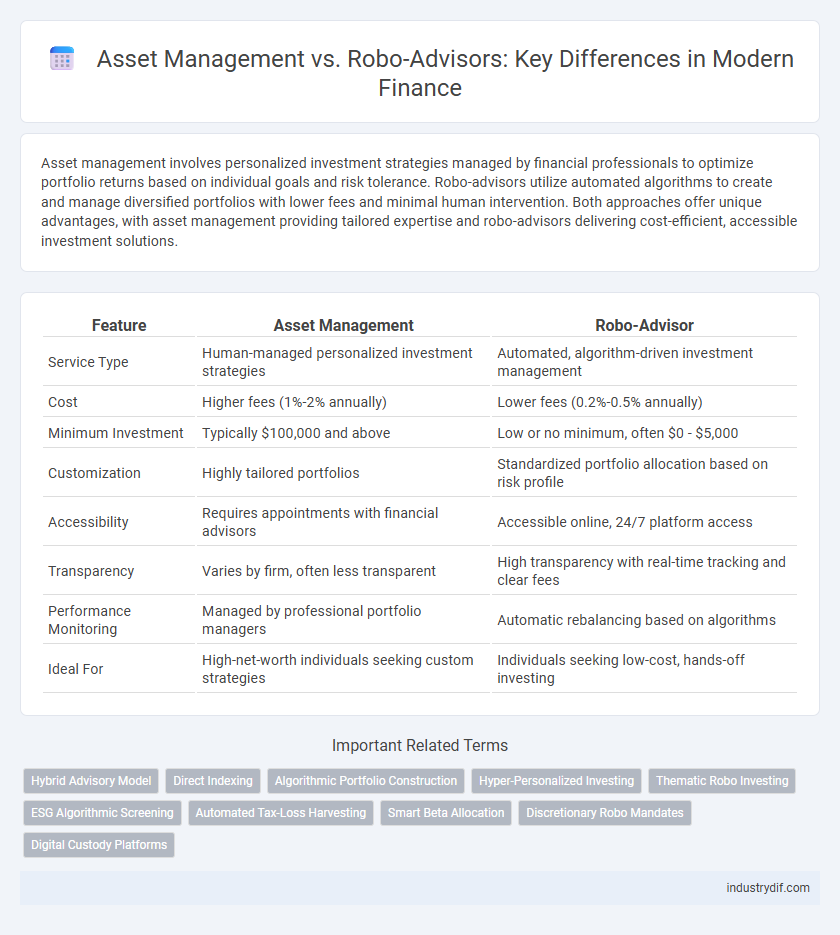

Asset management involves personalized investment strategies managed by financial professionals to optimize portfolio returns based on individual goals and risk tolerance. Robo-advisors utilize automated algorithms to create and manage diversified portfolios with lower fees and minimal human intervention. Both approaches offer unique advantages, with asset management providing tailored expertise and robo-advisors delivering cost-efficient, accessible investment solutions.

Table of Comparison

| Feature | Asset Management | Robo-Advisor |

|---|---|---|

| Service Type | Human-managed personalized investment strategies | Automated, algorithm-driven investment management |

| Cost | Higher fees (1%-2% annually) | Lower fees (0.2%-0.5% annually) |

| Minimum Investment | Typically $100,000 and above | Low or no minimum, often $0 - $5,000 |

| Customization | Highly tailored portfolios | Standardized portfolio allocation based on risk profile |

| Accessibility | Requires appointments with financial advisors | Accessible online, 24/7 platform access |

| Transparency | Varies by firm, often less transparent | High transparency with real-time tracking and clear fees |

| Performance Monitoring | Managed by professional portfolio managers | Automatic rebalancing based on algorithms |

| Ideal For | High-net-worth individuals seeking custom strategies | Individuals seeking low-cost, hands-off investing |

Introduction to Asset Management and Robo-Advisors

Asset management involves professional management of diverse investment portfolios by experienced financial experts to optimize returns and mitigate risks for clients. Robo-advisors utilize advanced algorithms and automation to provide cost-effective, personalized investment advice without human intervention. Both approaches aim to grow assets, but asset management relies on human expertise, while robo-advisors emphasize scalability and technology-driven solutions.

Key Differences Between Traditional Asset Management and Robo-Advisors

Traditional asset management involves personalized portfolio management by human advisors who tailor investment strategies based on deep client relationships and market expertise. Robo-advisors utilize algorithms and automated platforms to provide low-cost, scalable investment services, often focusing on passive index-based portfolios with minimal human intervention. Key differences include cost structure, level of customization, and the role of technology in portfolio monitoring and rebalancing.

How Asset Management Works: An Overview

Asset management involves professional handling of investment portfolios by financial experts who analyze market trends, allocate assets strategically, and continuously monitor performance to maximize returns while managing risk. It typically includes customized investment strategies tailored to individual client goals, incorporating diverse asset classes such as equities, bonds, and real estate. This hands-on approach contrasts with algorithm-driven robo-advisors, emphasizing human expertise and personalized financial planning.

Understanding Robo-Advisors: Automation in Finance

Robo-advisors utilize algorithm-driven platforms to provide automated portfolio management, reducing the need for human intervention while maintaining diversification and risk assessment based on individual financial goals. These digital investment tools leverage artificial intelligence and machine learning to continuously rebalance portfolios and optimize asset allocation with minimal fees. Compared to traditional asset management, robo-advisors offer scalable, efficient, and accessible investment solutions, particularly appealing to tech-savvy and cost-conscious investors.

Cost Comparison: Fees and Charges

Asset management firms typically charge annual fees ranging from 0.50% to 2% of assets under management, alongside potential performance-based fees, while robo-advisors offer lower fees generally between 0.20% and 0.50% due to automated portfolio management. Traditional asset management often includes additional costs such as trading fees, account maintenance fees, and advisory charges that can increase overall expenses. Robo-advisors streamline costs by leveraging algorithms and digital platforms, making them a more cost-effective option for investors seeking diversified portfolios at reduced fee structures.

Investment Strategies: Human Expertise vs Algorithmic Models

Asset management leverages human expertise to tailor investment strategies based on market insights, client goals, and risk tolerance, offering personalized portfolio adjustments and active decision-making. Robo-advisors utilize algorithmic models and automated processes that apply quantitative data and predefined rules to provide cost-effective, diversified investment solutions with minimal human intervention. The choice between these approaches depends on the investor's preference for personalized advice versus scalability and efficiency enabled by technology.

Accessibility and Client Experience

Asset management traditionally offers personalized services with dedicated financial advisors, resulting in a tailored client experience but higher minimum investments and fees that can limit accessibility for retail investors. Robo-advisors leverage algorithms and automation to provide lower-cost, user-friendly platforms with minimal account requirements, significantly enhancing accessibility for a broader client base. The digital interface of robo-advisors streamlines portfolio management and offers 24/7 access, improving convenience compared to conventional asset management.

Performance and Returns: What to Expect

Asset management typically offers personalized strategies and active portfolio management aimed at maximizing returns based on market conditions and investor goals. Robo-advisors utilize algorithm-driven models with lower fees, often delivering consistent, market-average returns through passive investment strategies. Investors should expect asset managers to potentially outperform in volatile markets, while robo-advisors provide cost-effective, steady growth aligned with risk tolerance.

Regulatory Considerations and Risk Management

Asset management firms are subject to stringent regulatory frameworks such as the Investment Advisers Act of 1940, requiring comprehensive risk management protocols to protect client assets and ensure fiduciary compliance. Robo-advisors operate under similar Securities and Exchange Commission (SEC) oversight but leverage algorithms to deliver cost-efficient portfolio management while mitigating risks through automated rebalancing and diversification strategies. Both entities must adhere to Anti-Money Laundering (AML) regulations and maintain robust cybersecurity measures to safeguard sensitive financial data and uphold operational resilience.

Choosing the Right Solution: Factors to Consider

Evaluating asset management and robo-advisors requires assessing factors such as investment goals, risk tolerance, and fee structures. Asset management offers personalized portfolio strategies through human advisors, while robo-advisors provide automated, low-cost solutions driven by algorithms. Consider account minimums, level of customization, and desired human interaction to select the most suitable financial service.

Related Important Terms

Hybrid Advisory Model

Hybrid advisory models combine traditional asset management expertise with robo-advisor technology, optimizing portfolio customization and cost-efficiency. This approach enhances investment strategies by leveraging automated algorithms alongside human judgment to deliver personalized financial advice and dynamic asset allocation.

Direct Indexing

Direct indexing in asset management offers personalized portfolio construction by owning individual securities, enabling tax-loss harvesting and customization beyond the automated algorithms of robo-advisors. This approach delivers greater transparency, control, and potential tax efficiency compared to traditional robo-advisor models that rely on ETFs or mutual funds for diversification.

Algorithmic Portfolio Construction

Algorithmic portfolio construction in asset management leverages advanced quantitative models and real-time data analytics to optimize asset allocation and risk management, delivering customized investment strategies based on client-specific goals and constraints. Robo-advisors utilize automated algorithms and low-cost technology platforms to provide scalable, diversified portfolios with continuous rebalancing, making sophisticated portfolio construction accessible to a broader range of investors.

Hyper-Personalized Investing

Hyper-personalized investing in asset management utilizes advanced data analytics and human expertise to tailor portfolios precisely to individual client goals and risk tolerance. Robo-advisors leverage algorithm-driven models to offer scalable, cost-effective investment strategies but may lack the nuanced customization achievable through traditional asset management.

Thematic Robo Investing

Thematic robo investing leverages algorithm-driven platforms to provide tailored asset management focused on specific investment themes such as sustainability, technology, or healthcare innovation, enabling precise portfolio diversification. By integrating real-time data analysis and thematic trends, these digital advisors offer a cost-effective alternative to traditional asset management with enhanced personalization and dynamic rebalancing.

ESG Algorithmic Screening

Asset management firms integrate ESG algorithmic screening to enhance portfolio sustainability by systematically evaluating environmental, social, and governance factors, optimizing investment selections for ethical impact and risk mitigation. Robo-advisors leverage automated ESG scoring models to provide cost-effective, personalized investment strategies that align with clients' sustainability preferences while maintaining diversified asset allocations.

Automated Tax-Loss Harvesting

Automated tax-loss harvesting technology in robo-advisors efficiently identifies and sells securities at a loss to offset gains, minimizing tax liabilities without manual intervention. Traditional asset management typically requires personalized strategies and manual review to implement tax-loss harvesting, often resulting in less frequent and less systematic tax optimization.

Smart Beta Allocation

Smart Beta Allocation in asset management strategically blends passive and active investing by targeting specific risk factors and market inefficiencies to enhance portfolio performance. Robo-advisors leverage algorithm-driven Smart Beta strategies to offer automated, cost-efficient portfolio customization and rebalancing tailored to individual risk profiles.

Discretionary Robo Mandates

Discretionary robo mandates in asset management leverage algorithm-driven investment strategies that autonomously adjust portfolios based on real-time market data, enhancing portfolio diversification and risk management without human intervention. These mandates offer cost-effective, scalable solutions compared to traditional asset management, delivering personalized investment approaches with lower fees and consistent adherence to client risk profiles.

Digital Custody Platforms

Digital custody platforms in asset management offer robust security features and seamless integration with traditional financial services, enhancing client asset protection and regulatory compliance. Robo-advisors leverage these platforms to provide automated, cost-effective portfolio management with real-time digital custody, streamlining investment processes for tech-savvy investors.

Asset Management vs Robo-Advisor Infographic

industrydif.com

industrydif.com