Venture capital offers high-value investments from accredited investors, providing strategic guidance and substantial funding for startups with scalable potential. Crowdfunding tokenization democratizes investment by allowing a broad audience to purchase digital tokens representing equity or assets, increasing liquidity and accessibility. Both methods facilitate capital raising, but venture capital emphasizes concentrated expertise, while tokenization leverages blockchain technology for transparency and fractional ownership.

Table of Comparison

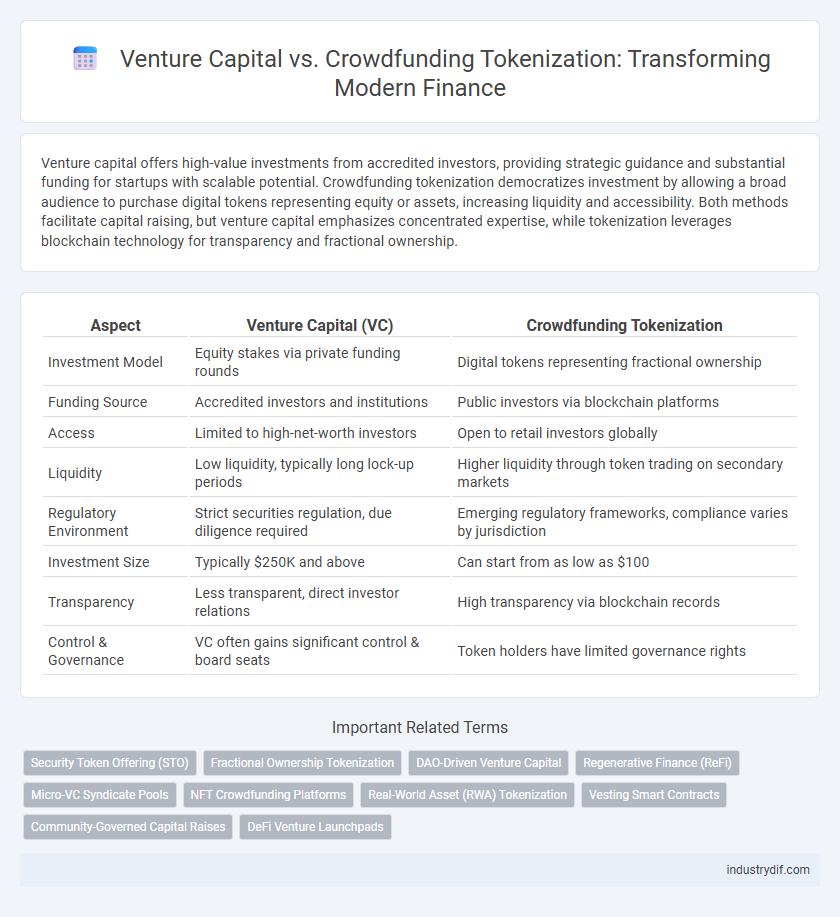

| Aspect | Venture Capital (VC) | Crowdfunding Tokenization |

|---|---|---|

| Investment Model | Equity stakes via private funding rounds | Digital tokens representing fractional ownership |

| Funding Source | Accredited investors and institutions | Public investors via blockchain platforms |

| Access | Limited to high-net-worth investors | Open to retail investors globally |

| Liquidity | Low liquidity, typically long lock-up periods | Higher liquidity through token trading on secondary markets |

| Regulatory Environment | Strict securities regulation, due diligence required | Emerging regulatory frameworks, compliance varies by jurisdiction |

| Investment Size | Typically $250K and above | Can start from as low as $100 |

| Transparency | Less transparent, direct investor relations | High transparency via blockchain records |

| Control & Governance | VC often gains significant control & board seats | Token holders have limited governance rights |

Understanding Venture Capital: Key Concepts and Mechanisms

Venture capital involves investing in early-stage companies with high growth potential by providing equity financing in exchange for ownership shares and influence on business decisions. Key mechanisms include staged funding rounds, due diligence, valuation, and active portfolio management to drive company growth and maximize returns. Understanding these concepts enables investors to assess risks, potential rewards, and the strategic role of venture capital in startup ecosystems.

Crowdfunding Tokenization: Definition and Core Principles

Crowdfunding tokenization refers to the process of digitizing investment opportunities by issuing blockchain-based tokens that represent shares in a project or startup. This method enables fractional ownership, enhances liquidity, and facilitates global investor participation without traditional intermediaries. Core principles include transparency, security through smart contracts, regulatory compliance, and democratized access to early-stage funding.

Investment Structure: Venture Capital vs Crowdfunding Tokenization

Venture capital investment structures involve equity stakes with active management roles, typically requiring significant capital commitments from accredited investors. Crowdfunding tokenization leverages blockchain technology to issue digital tokens representing fractional ownership, enabling broader market access and secondary trading opportunities. These decentralized tokens provide liquidity and lower entry barriers compared to traditional venture capital equity agreements.

Fundraising Processes: Traditional VC vs Blockchain Crowdfunding

Venture Capital fundraising relies on a rigorous due diligence process, significant capital commitments from accredited investors, and structured equity agreements, often taking months to finalize. Blockchain crowdfunding tokenization streamlines fundraising by enabling fractional ownership through digital tokens, offering global investor access with faster transaction settlements and reduced intermediaries. This shift enhances liquidity and transparency while lowering barriers for startups to raise capital compared to traditional VC models.

Regulatory Considerations: Compliance in VC and Tokenization

Venture capital investments are subject to stringent regulatory frameworks like the Securities Act and require thorough compliance with registration or exemption provisions. Crowdfunding tokenization operates under evolving regulations such as the SEC's Regulation CF and emerging guidelines for digital assets, demanding meticulous adherence to anti-money laundering (AML) and know-your-customer (KYC) protocols. Understanding the nuances in compliance obligations is crucial for investors and issuers to mitigate legal risks and ensure transparent fundraising processes.

Investor Access and Participation Models

Venture capital typically offers investors access through selective equity stakes in early-stage companies, often requiring significant capital and accredited investor status. Crowdfunding tokenization democratizes participation by enabling fractional ownership through digital tokens, lowering entry barriers and expanding access to a broader investor base. These distinct models influence liquidity, governance rights, and investment diversification opportunities within the financial ecosystem.

Risk Profiles: Comparing VC and Tokenized Crowdfunding

Venture capital involves high capital commitment with extensive due diligence, offering potentially higher returns but greater risk from market volatility and startup failures. Tokenized crowdfunding distributes investment across numerous small contributors, reducing individual exposure but increasing susceptibility to regulatory uncertainties and liquidity challenges. Evaluating risk profiles requires understanding VC's concentrated investment approach versus the diversified, yet less regulated, nature of tokenized crowdfunding.

Liquidity and Exit Strategies

Venture capital offers defined exit strategies through acquisitions or initial public offerings, providing clearer liquidity events for investors. Crowdfunding tokenization enhances liquidity by enabling fractional ownership and secondary market trading, but exit timing can be less predictable due to market demand. Both methods diversify funding options, with tokenization allowing faster asset transfer yet requiring robust regulatory frameworks for investor protection.

Deal Transparency and Due Diligence Processes

Venture capital offers rigorous due diligence processes with extensive deal transparency through detailed financial analyses and regulatory compliance, ensuring investor confidence. Crowdfunding tokenization provides greater accessibility but often lacks standardized due diligence, resulting in varying transparency levels and increased risk exposure. Investors must weigh the thorough vetting of venture capital against the democratized yet sometimes opaque nature of tokenized crowdfunding deals.

Future Trends: The Evolving Landscape of Venture Funding

Venture capital is expected to integrate blockchain technology, enabling tokenized equity shares that enhance liquidity and transparency in fundraising. Crowdfunding tokenization democratizes early-stage investment by allowing fractional ownership and access to a broader investor base globally. Future trends indicate a hybrid model may emerge, combining institutional discipline of venture capital with decentralized, community-driven crowdfunding platforms.

Related Important Terms

Security Token Offering (STO)

Security Token Offerings (STOs) provide a regulated investment vehicle combining the liquidity of crowdfunding tokenization with the legal protections of traditional venture capital, allowing investors to acquire equity or debt-backed tokens that comply with securities laws. This hybrid model enhances transparency, reduces entry barriers, and facilitates fractional ownership while ensuring robust investor protections typically absent in unregulated crowdfunding platforms.

Fractional Ownership Tokenization

Fractional ownership tokenization enables venture capital investors to divide equity into digital tokens, increasing liquidity and accessibility compared to traditional crowdfunding methods that often lack secondary market options. This blockchain-based approach enhances transparency, reduces entry barriers for smaller investors, and streamlines asset transferability within the venture capital ecosystem.

DAO-Driven Venture Capital

DAO-driven venture capital leverages decentralized autonomous organizations to enable collective investment decisions, enhancing transparency and democratizing access to early-stage funding. Tokenization within these DAOs allows fractional ownership and liquidity of venture assets, contrasting with traditional crowdfunding by providing programmable governance and automated distribution of returns through smart contracts.

Regenerative Finance (ReFi)

Venture capital in Regenerative Finance (ReFi) offers targeted, high-risk investments with strategic expertise, while crowdfunding tokenization democratizes capital access by enabling fractional ownership and transparent, blockchain-based transactions. This contrast highlights a shift towards decentralized funding models that drive ecological and social impact through programmable tokens and smart contracts in sustainable projects.

Micro-VC Syndicate Pools

Micro-VC syndicate pools leverage venture capital structures by aggregating small investors to participate in early-stage funding rounds, offering higher deal flow and curated investment opportunities compared to crowdfunding tokenization, which provides broader access but often with less control and due diligence. These syndicates enhance capital deployment efficiency and risk management through collective expertise and strategic syndication, optimizing returns in high-growth startup ecosystems.

NFT Crowdfunding Platforms

NFT crowdfunding platforms revolutionize venture capital by enabling fractional ownership and liquidity through blockchain technology, attracting a broader range of investors while reducing entry barriers. These platforms leverage smart contracts to ensure transparency, automate transactions, and provide real-time asset valuation, outperforming traditional venture capital methods in efficiency and global accessibility.

Real-World Asset (RWA) Tokenization

Real-World Asset (RWA) tokenization in venture capital enables fractional ownership and liquidity of high-value assets like property and infrastructure, attracting institutional investors through transparency and regulatory compliance. Crowdfunding tokenization democratizes access to RWA investments by lowering entry barriers for retail investors, leveraging blockchain technology for secure and efficient asset transfers.

Vesting Smart Contracts

Vesting smart contracts in venture capital ensure staged token release to founders and investors, promoting long-term commitment and mitigating premature asset liquidation risks. In crowdfunding tokenization, these contracts automate eligibility and distribution, enhancing transparency and compliance while reducing administrative overhead.

Community-Governed Capital Raises

Venture capital typically involves institutional investors providing large sums of money in exchange for equity, whereas crowdfunding tokenization leverages blockchain technology to democratize access by allowing a broad community to invest small amounts through digital tokens. Community-governed capital raises empower investors with voting rights and transparent decision-making, fostering decentralized control and enhanced alignment between startups and their supporters.

DeFi Venture Launchpads

DeFi venture launchpads leverage tokenization to revolutionize traditional venture capital by enabling fractional ownership and global access to early-stage investments through crowdfunding mechanisms. This innovative approach enhances liquidity, democratizes fundraising, and streamlines capital allocation in decentralized finance ecosystems.

Venture Capital vs Crowdfunding Tokenization Infographic

industrydif.com

industrydif.com