Risk assessment traditionally relies on historical financial data and market trends to evaluate potential losses and uncertainties. Alternative data analysis incorporates non-traditional sources like social media, satellite imagery, and transaction data to enhance predictive accuracy and uncover hidden patterns. Combining these approaches can provide a more comprehensive understanding of risk by integrating quantitative metrics with real-time, unstructured data insights.

Table of Comparison

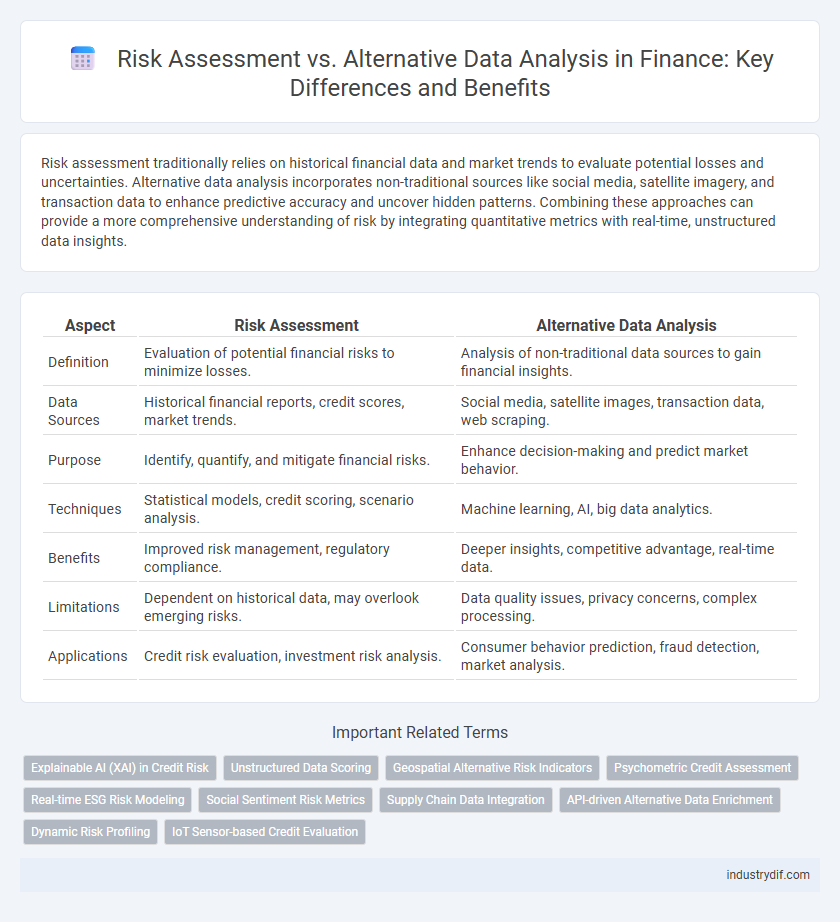

| Aspect | Risk Assessment | Alternative Data Analysis |

|---|---|---|

| Definition | Evaluation of potential financial risks to minimize losses. | Analysis of non-traditional data sources to gain financial insights. |

| Data Sources | Historical financial reports, credit scores, market trends. | Social media, satellite images, transaction data, web scraping. |

| Purpose | Identify, quantify, and mitigate financial risks. | Enhance decision-making and predict market behavior. |

| Techniques | Statistical models, credit scoring, scenario analysis. | Machine learning, AI, big data analytics. |

| Benefits | Improved risk management, regulatory compliance. | Deeper insights, competitive advantage, real-time data. |

| Limitations | Dependent on historical data, may overlook emerging risks. | Data quality issues, privacy concerns, complex processing. |

| Applications | Credit risk evaluation, investment risk analysis. | Consumer behavior prediction, fraud detection, market analysis. |

Introduction to Risk Assessment in Finance

Risk assessment in finance involves evaluating the potential for losses within investments, loans, or financial portfolios by systematically identifying and quantifying risks such as credit risk, market risk, and operational risk. Traditional risk assessment relies on historical financial statements, credit scores, and economic indicators to predict the likelihood of default or adverse market movements. Alternative data analysis supplements this process by incorporating non-traditional data sources such as social media sentiment, transaction patterns, and satellite imagery to enhance risk models and improve predictive accuracy.

Defining Alternative Data Analysis

Alternative data analysis in finance involves examining non-traditional data sources such as social media activity, satellite imagery, and transaction records to uncover hidden patterns relevant to risk assessment. This approach enhances predictive accuracy by integrating high-dimensional, real-time datasets that traditional risk models often overlook. By leveraging machine learning algorithms, financial institutions gain deeper insights into creditworthiness, market sentiment, and operational risks beyond conventional metrics.

Key Differences: Traditional Risk Assessment vs Alternative Data Analysis

Traditional risk assessment relies on historical financial statements, credit scores, and market data to evaluate creditworthiness and predict default probabilities. Alternative data analysis leverages non-traditional sources such as social media activity, transaction patterns, and geolocation data to capture real-time behavioral insights and enhance predictive accuracy. The key difference lies in the scope and timeliness of data, where alternative data provides a broader, more dynamic view compared to the static and retrospective nature of traditional risk models.

Data Sources Used in Risk Assessment

Risk assessment primarily relies on traditional financial data sources such as credit scores, payment histories, financial statements, and market trends to evaluate an entity's creditworthiness and potential exposure. Alternative data analysis incorporates non-traditional sources including social media activity, utility payments, rental histories, and online behavior patterns, offering a broader perspective on risk. Combining conventional and alternative data enhances predictive accuracy by uncovering hidden risk factors and improving the robustness of financial risk models.

The Role of Big Data in Alternative Data Analysis

Big Data plays a crucial role in alternative data analysis by enabling the processing of vast and diverse datasets such as social media activity, transaction records, and satellite images to uncover hidden risk factors and market trends. Advanced algorithms and machine learning models leverage this data to enhance predictive accuracy in risk assessment, providing a more comprehensive view of borrower creditworthiness and investment risks. The integration of Big Data into alternative data analysis transforms traditional risk assessment methods, driving more informed and dynamic financial decision-making.

Predictive Modeling Techniques in Finance

Risk assessment in finance relies on traditional predictive modeling techniques such as logistic regression and credit scoring to evaluate borrower default probabilities based on historical financial data. Alternative data analysis enhances these models by incorporating non-traditional data sources like social media activity, utility payments, and real-time transaction patterns, improving predictive accuracy. Machine learning algorithms including random forests and gradient boosting methods optimize risk prediction by uncovering complex patterns in both conventional and alternative datasets.

Accuracy and Reliability: Comparing Risk Metrics

Risk assessment traditionally relies on established financial indicators such as credit scores and historical default rates to determine borrower reliability. Alternative data analysis incorporates non-traditional metrics like social media behavior, utility payments, and transactional data, enhancing predictive accuracy by capturing real-time consumer behavior. Comparing risk metrics, alternative data often improves reliability in dynamic financial environments, offering finer granularity and faster response times than conventional models.

Regulatory Implications for Data Usage

Risk assessment in finance relies heavily on traditional data, subject to strict regulatory frameworks such as GDPR and the Fair Credit Reporting Act, which mandate transparency and consumer consent in data usage. Alternative data analysis, incorporating non-traditional sources like social media and satellite imagery, presents challenges for compliance, raising concerns over data privacy, accuracy, and potential biases under current regulations. Financial institutions must navigate evolving regulatory landscapes to balance innovative risk models with legal standards safeguarding consumer rights and data integrity.

Enhancing Credit Scoring with Alternative Data

Enhancing credit scoring through alternative data analysis improves risk assessment by integrating non-traditional data sources such as utility payments, social media behavior, and transaction histories to capture a more comprehensive borrower profile. This approach enables financial institutions to refine predictive models, reduce default rates, and extend credit access to underserved populations lacking extensive credit histories. Leveraging machine learning algorithms with alternative data enhances accuracy and timeliness in assessing creditworthiness beyond conventional credit bureau reports.

Future Trends: Integrating Alternative Data in Risk Management

Future trends in risk assessment emphasize integrating alternative data sources such as social media analytics, satellite imagery, and transaction data to enhance predictive accuracy and real-time decision-making. Machine learning algorithms enable the processing of unstructured alternative data, uncovering hidden risk patterns that traditional models may miss. Financial institutions increasingly adopt hybrid risk management frameworks combining conventional metrics with alternative data to improve credit scoring, fraud detection, and portfolio risk optimization.

Related Important Terms

Explainable AI (XAI) in Credit Risk

Explainable AI (XAI) enhances credit risk assessment by integrating traditional risk models with alternative data analysis, providing transparent, interpretable insights into borrower behavior and creditworthiness. Leveraging XAI techniques facilitates regulatory compliance and builds stakeholder trust by clarifying how non-traditional data sources impact risk predictions.

Unstructured Data Scoring

Risk assessment increasingly relies on unstructured data scoring to enhance predictive accuracy by analyzing diverse data sources such as social media, customer reviews, and transaction logs. Alternative data analysis leverages machine learning algorithms to process complex unstructured datasets, improving credit risk evaluation and fraud detection in financial services.

Geospatial Alternative Risk Indicators

Geospatial alternative risk indicators leverage satellite imagery and location-based data to capture real-time environmental, economic, and social conditions, enhancing the granularity and accuracy of financial risk assessment. Integrating these geospatial insights with traditional risk models enables more dynamic evaluation of creditworthiness, portfolio risk, and market volatility by detecting patterns otherwise missed by conventional data sources.

Psychometric Credit Assessment

Psychometric credit assessment leverages behavioral and psychological data to evaluate borrower creditworthiness, offering a nuanced alternative to traditional risk assessment models reliant on financial history and credit scores. Integrating alternative data such as personality traits, decision-making patterns, and social behavior enhances predictive accuracy in credit risk evaluation, especially for underserved or thin-file borrowers.

Real-time ESG Risk Modeling

Real-time ESG risk modeling leverages alternative data analysis, including satellite imagery, social media sentiment, and supply chain data, to provide dynamic insights beyond traditional risk assessment metrics. This approach enables investors to identify emerging environmental, social, and governance risks promptly, enhancing portfolio resilience and compliance with evolving regulatory standards.

Social Sentiment Risk Metrics

Social sentiment risk metrics enhance traditional risk assessment by analyzing real-time data from social media platforms, news, and online forums to detect emerging market sentiments and potential financial threats. Integrating alternative data such as social sentiment enables more dynamic and predictive insights, improving credit scoring accuracy and investment risk management strategies.

Supply Chain Data Integration

Risk assessment in finance increasingly relies on supply chain data integration to identify vulnerabilities and predict potential disruptions, enhancing the accuracy of creditworthiness evaluations. Alternative data analysis leverages real-time supply chain metrics such as vendor performance, shipment timelines, and inventory levels to supplement traditional financial indicators for a comprehensive risk profile.

API-driven Alternative Data Enrichment

API-driven alternative data enrichment enhances risk assessment by integrating real-time, granular datasets such as social media sentiment, geolocation patterns, and transaction histories, enabling more accurate credit scoring and fraud detection. This approach reduces dependency on traditional financial metrics, offering a comprehensive view of borrower behavior and market dynamics for improved decision-making.

Dynamic Risk Profiling

Dynamic risk profiling leverages real-time alternative data analysis, integrating non-traditional data sources such as social media sentiment, transaction patterns, and geolocation data to provide a more granular and adaptive risk assessment. This approach enhances predictive accuracy by continuously updating risk profiles, enabling financial institutions to identify emerging threats and optimize decision-making in volatile markets.

IoT Sensor-based Credit Evaluation

IoT sensor-based credit evaluation enhances traditional risk assessment by integrating real-time data streams from connected devices, enabling more accurate and dynamic financial profiling. This alternative data analysis leverages granular behavioral and environmental metrics to identify creditworthiness beyond conventional financial statements, reducing default risk.

Risk Assessment vs Alternative Data Analysis Infographic

industrydif.com

industrydif.com