Wealth management offers personalized financial planning and tailored investment strategies through human advisors, providing comprehensive support for complex financial needs. Robo-advisors use algorithms and technology to deliver cost-effective, automated portfolio management with minimal human intervention. Choosing between wealth management and robo-advisors depends on individual preferences for customization, cost, and the level of personal interaction desired.

Table of Comparison

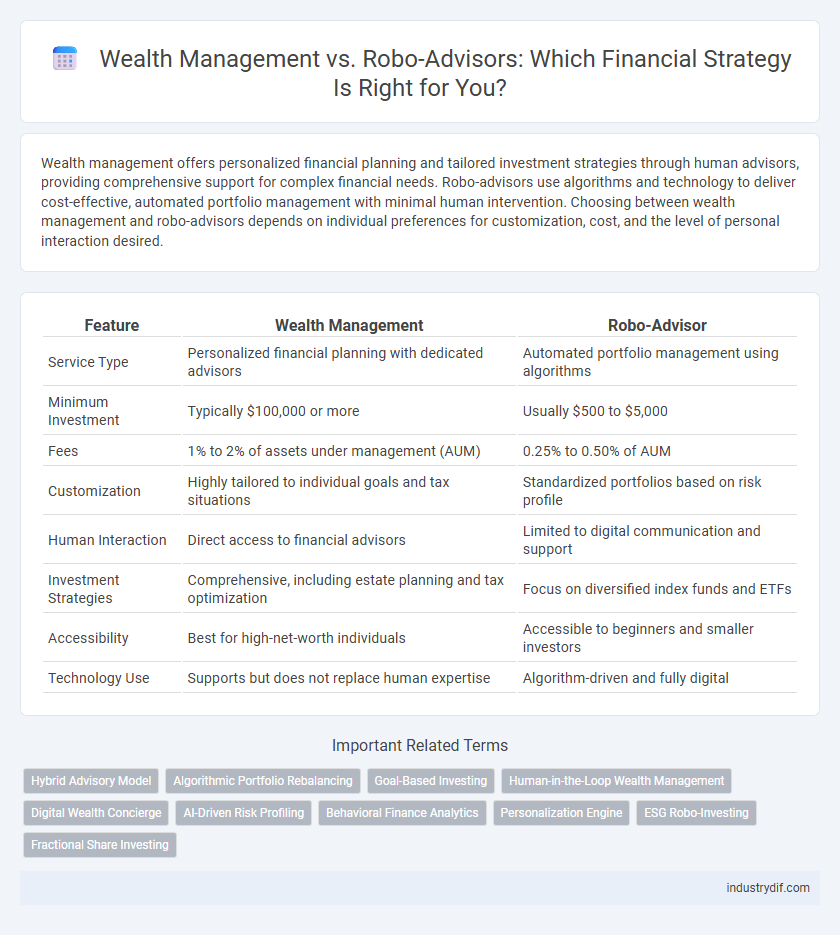

| Feature | Wealth Management | Robo-Advisor |

|---|---|---|

| Service Type | Personalized financial planning with dedicated advisors | Automated portfolio management using algorithms |

| Minimum Investment | Typically $100,000 or more | Usually $500 to $5,000 |

| Fees | 1% to 2% of assets under management (AUM) | 0.25% to 0.50% of AUM |

| Customization | Highly tailored to individual goals and tax situations | Standardized portfolios based on risk profile |

| Human Interaction | Direct access to financial advisors | Limited to digital communication and support |

| Investment Strategies | Comprehensive, including estate planning and tax optimization | Focus on diversified index funds and ETFs |

| Accessibility | Best for high-net-worth individuals | Accessible to beginners and smaller investors |

| Technology Use | Supports but does not replace human expertise | Algorithm-driven and fully digital |

Understanding Wealth Management

Wealth management encompasses comprehensive financial services tailored to high-net-worth individuals, including investment advice, tax planning, estate planning, and retirement strategies. Unlike robo-advisors that rely on automated algorithms and limited personalization, wealth management offers customized solutions driven by human financial advisors. This personalized approach ensures alignment with clients' unique goals, risk tolerance, and long-term financial objectives.

What is a Robo-Advisor?

A robo-advisor is an automated online platform that provides algorithm-driven financial planning services with minimal human supervision. It uses advanced algorithms and data analytics to create and manage personalized investment portfolios based on individual risk tolerance and financial goals. Robo-advisors offer cost-effective, efficient wealth management solutions by automating asset allocation, rebalancing, and tax optimization.

Key Differences Between Wealth Management and Robo-Advisors

Wealth management offers personalized financial planning and investment strategies tailored by human advisors, focusing on comprehensive asset allocation, tax optimization, and estate planning. Robo-advisors utilize automated algorithms to provide cost-effective, portfolio management services with lower fees, targeting clients seeking simple, automated investment solutions. The key differences lie in customization depth, service complexity, and advisor accessibility, with wealth management catering to high-net-worth individuals and robo-advisors serving broader, tech-savvy audiences.

Personalized Financial Planning: Human vs. Digital

Wealth management offers highly personalized financial planning through human advisors who tailor strategies based on in-depth client interactions and nuanced understanding of individual goals, risk tolerance, and life circumstances. Robo-advisors provide algorithm-driven portfolio management with automated rebalancing and tax-loss harvesting, delivering cost-effective solutions but with limited customization and emotional intelligence. Clients prioritizing bespoke advice and relationship-driven guidance often favor wealth managers, while those seeking efficiency and lower fees may opt for robo-advisory services.

Costs and Fee Structures Compared

Wealth management services typically involve personalized financial advice with fees ranging from 0.5% to 2% of assets under management (AUM), often including additional charges for performance and transactions. Robo-advisors offer automated portfolio management with lower fees, generally between 0.25% and 0.5% of AUM, leveraging algorithms to minimize costs and eliminate human advisory expenses. The transparent and fixed fee structures of robo-advisors contrast with traditional wealth managers' variable fees, making robo-advisors more cost-effective for investors with moderate portfolios.

Investment Strategies: Manual vs. Algorithmic

Wealth management relies on manual investment strategies tailored through personalized financial planning and active portfolio management by experienced advisors. In contrast, robo-advisors utilize algorithmic investment strategies that automatically allocate assets based on predefined risk profiles and market data analysis. The choice between manual and algorithmic approaches impacts portfolio customization, responsiveness to market changes, and cost efficiency.

Accessibility and Minimum Investment Requirements

Wealth management typically requires higher minimum investments, often starting at $100,000 or more, limiting accessibility for many individual investors. Robo-advisors offer a more inclusive alternative with lower minimums, sometimes as little as $500, making automated portfolio management accessible to a broader audience. The contrast in entry thresholds significantly influences investor choice between personalized wealth management and digital advisory platforms.

Risk Management Approaches

Wealth management employs personalized risk assessment strategies, utilizing comprehensive client profiles and active portfolio adjustments to mitigate financial exposure. Robo-advisors rely on algorithm-driven models that apply automated diversification and rebalancing techniques based on predefined risk tolerance levels. The human oversight in wealth management allows for adaptive risk responses, whereas robo-advisors provide consistent, data-driven risk controls at scale.

Technology Integration in Wealth Management

Wealth management increasingly integrates advanced technologies such as artificial intelligence, big data analytics, and machine learning to provide personalized financial advice and improve client portfolio management. Robo-advisors leverage algorithm-driven platforms for automated, low-cost investment solutions, but wealth management firms combine these tools with human expertise for tailored, holistic financial planning. This hybrid approach enhances decision-making accuracy, risk assessment, and client engagement by utilizing technology alongside personal advisory services.

Choosing the Right Solution for Your Financial Goals

Wealth management offers personalized, comprehensive financial planning with tailored investment strategies and direct expert advice, ideal for complex portfolios and long-term goals. Robo-advisors provide automated, algorithm-driven investment management with lower fees and easy access, suitable for investors seeking cost-efficient, hands-off portfolio solutions. Understanding your risk tolerance, financial objectives, and preference for human interaction helps determine the optimal approach between full-service wealth management and digital robo-advisor platforms.

Related Important Terms

Hybrid Advisory Model

The hybrid advisory model combines personalized wealth management with algorithm-driven robo-advisory services, offering clients tailored investment strategies alongside automated portfolio management. This approach enhances cost efficiency and scalability while maintaining the human insight essential for complex financial planning and risk assessment.

Algorithmic Portfolio Rebalancing

Algorithmic portfolio rebalancing in robo-advisors uses automated, data-driven models to adjust asset allocations based on market conditions and risk tolerance, ensuring continuous alignment with investment goals. In contrast, traditional wealth management relies on human advisors who incorporate personalized insights and market experience into rebalancing decisions, potentially offering more nuanced strategy adjustments.

Goal-Based Investing

Goal-based investing in wealth management offers personalized strategies tailored to individual financial objectives, incorporating comprehensive risk assessments and ongoing portfolio adjustments by human advisors. Robo-advisors provide automated, algorithm-driven investment solutions focused on goal-based outcomes, emphasizing cost efficiency and accessibility through digital platforms.

Human-in-the-Loop Wealth Management

Human-in-the-loop wealth management combines advanced robo-advisor algorithms with personalized oversight from financial experts to optimize portfolio performance and risk management. This hybrid approach ensures tailored investment strategies that adapt to evolving market conditions and individual client goals, enhancing both precision and trust in financial decision-making.

Digital Wealth Concierge

Digital wealth concierges blend personalized financial strategies with AI-driven insights to optimize investment portfolios more effectively than traditional wealth management or standard robo-advisors. By integrating real-time market data and adaptive algorithms, digital wealth concierges deliver tailored asset allocation and holistic financial planning that enhances client engagement and long-term wealth growth.

AI-Driven Risk Profiling

AI-driven risk profiling in wealth management leverages machine learning algorithms to analyze client data, behavioral patterns, and market trends, delivering personalized investment strategies with enhanced precision. Robo-advisors utilize these AI capabilities to automate portfolio optimization and real-time risk assessment, offering cost-efficient, scalable solutions for diverse investor profiles.

Behavioral Finance Analytics

Wealth management integrates behavioral finance analytics to tailor investment strategies based on client psychology, enhancing personalized decision-making and risk tolerance assessment. Robo-advisors utilize algorithm-driven behavioral data analysis for automated portfolio adjustments, offering scalable but less nuanced emotional insight compared to human advisors.

Personalization Engine

Wealth management leverages advanced personalization engines that analyze comprehensive client data, including financial goals, risk tolerance, and lifestyle preferences, to deliver tailored investment strategies and proactive portfolio adjustments. In contrast, robo-advisors utilize algorithm-driven models with limited customization, providing automated asset allocation based on standardized risk profiles and predefined criteria.

ESG Robo-Investing

Wealth management offers personalized financial planning, while ESG robo-investing leverages algorithm-driven strategies to optimize socially responsible portfolios with real-time data on environmental, social, and governance factors. ESG robo-advisors enable cost-effective, automated asset allocation tailored to investors prioritizing sustainability metrics and impact investing goals.

Fractional Share Investing

Fractional share investing allows investors to purchase portions of high-priced stocks, enhancing portfolio diversification with lower capital requirements compared to traditional wealth management. Robo-advisors leverage fractional shares to automatically rebalance portfolios and optimize asset allocation, offering cost-efficient, algorithm-driven investment strategies.

Wealth Management vs Robo-Advisor Infographic

industrydif.com

industrydif.com