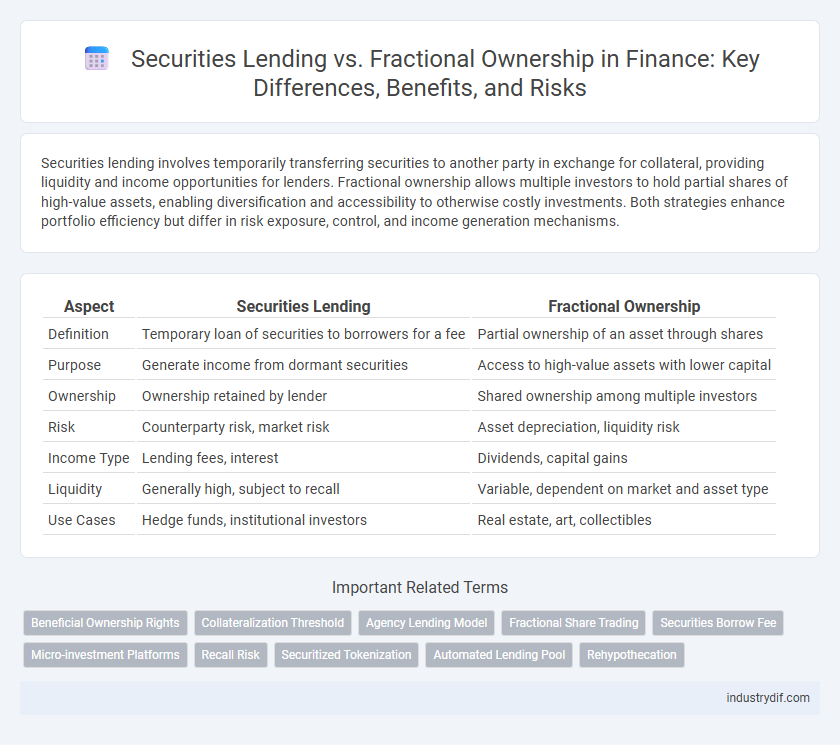

Securities lending involves temporarily transferring securities to another party in exchange for collateral, providing liquidity and income opportunities for lenders. Fractional ownership allows multiple investors to hold partial shares of high-value assets, enabling diversification and accessibility to otherwise costly investments. Both strategies enhance portfolio efficiency but differ in risk exposure, control, and income generation mechanisms.

Table of Comparison

| Aspect | Securities Lending | Fractional Ownership |

|---|---|---|

| Definition | Temporary loan of securities to borrowers for a fee | Partial ownership of an asset through shares |

| Purpose | Generate income from dormant securities | Access to high-value assets with lower capital |

| Ownership | Ownership retained by lender | Shared ownership among multiple investors |

| Risk | Counterparty risk, market risk | Asset depreciation, liquidity risk |

| Income Type | Lending fees, interest | Dividends, capital gains |

| Liquidity | Generally high, subject to recall | Variable, dependent on market and asset type |

| Use Cases | Hedge funds, institutional investors | Real estate, art, collectibles |

Introduction to Securities Lending and Fractional Ownership

Securities lending involves the temporary transfer of securities from one party to another, allowing the borrower to use the assets for activities like short selling or hedging while the lender earns fees. Fractional ownership enables investors to buy partial shares of securities, making high-value investments more accessible and diversifying portfolios without requiring full-share purchases. Both mechanisms enhance market liquidity and provide innovative approaches to asset utilization and investment participation in modern finance.

Key Definitions and Concepts

Securities lending involves the temporary transfer of securities from one party to another, typically to provide liquidity or facilitate short selling, with the borrower agreeing to return the equivalent securities later. Fractional ownership allows multiple investors to own a portion of a high-value asset, such as stocks or real estate, enabling diversified investment and reduced capital requirements. Understanding these concepts highlights differences in risk exposure, asset control, and liquidity management within financial markets.

How Securities Lending Works

Securities lending involves the temporary transfer of securities from a lender to a borrower, typically facilitated by a custodian or intermediary, to generate additional income through lending fees. The borrower provides collateral, often in the form of cash or other securities, which mitigates credit risk for the lender. This process enhances market liquidity and supports short-selling activities, while the lender retains ownership benefits such as dividends and voting rights during the loan period.

Understanding Fractional Ownership

Fractional ownership allows multiple investors to hold proportional shares of high-value securities, enhancing liquidity and accessibility in the finance market. This model contrasts with securities lending, where temporary transfer of securities occurs to generate additional income through collateralized loans. Understanding fractional ownership helps investors diversify portfolios and participate in asset classes that might otherwise require substantial capital.

Mechanisms and Processes Compared

Securities lending involves temporary transferring of securities from a lender, typically a financial institution, to a borrower, often for short selling or hedging, with collateral exchanged to mitigate risk. Fractional ownership allows multiple investors to hold proportional shares of an asset, enabling diversified access and liquidity without full asset acquisition. The securities lending process hinges on contractual agreements and margin requirements, while fractional ownership relies on shared legal titles and digital platforms for transaction management.

Risk Factors in Securities Lending and Fractional Ownership

Securities lending carries counterparty risk, as borrowers may default on returning the securities, exposing lenders to potential losses. Fractional ownership reduces this risk by dividing asset ownership among multiple investors, but it introduces liquidity risk due to limited secondary market availability. Market volatility affects both models, impacting the value and returns of the underlying securities in different ways.

Benefits and Drawbacks for Investors

Securities lending offers investors the benefit of generating additional income through lending fees but carries risks such as counterparty default and reduced voting rights on lent shares. Fractional ownership allows investors to access high-value assets with lower capital requirements and increased diversification, yet it may involve limited liquidity and potential management fees. Evaluating the trade-offs between income potential and asset control is crucial for optimizing investment strategies within these frameworks.

Regulatory Considerations and Compliance

Securities lending involves transferring ownership of securities temporarily, requiring compliance with regulations such as SEC Rule 204 and Regulation SHO to prevent market manipulation and ensure proper disclosure. Fractional ownership, where investors hold a percentage of an asset, must adhere to securities laws related to investor protections and registration under the Securities Act of 1933 or exemptions like Regulation D. Both structures demand rigorous compliance frameworks to manage counterparty risk, transparency, and reporting obligations under the Financial Industry Regulatory Authority (FINRA) and other regulatory bodies.

Market Applications and Use Cases

Securities lending facilitates liquidity and short-selling strategies by enabling investors to temporarily loan out their securities in exchange for collateral, primarily benefiting hedge funds and market makers. Fractional ownership allows retail investors to gain exposure to high-value assets such as blue-chip stocks and real estate through partial shareholding, promoting diversification and affordability. Market applications of securities lending emphasize institutional finance efficiency, while fractional ownership drives broader retail participation and portfolio accessibility.

Future Trends in Securities Lending and Fractional Ownership

Future trends in securities lending indicate increased integration of blockchain technology to enhance transparency, reduce settlement times, and improve collateral management. Fractional ownership platforms are expected to expand, driven by regulatory advancements and growing investor demand for accessible, diversified portfolios in digital assets. Both markets show potential for convergence through tokenization, enabling more efficient asset liquidity and democratized access to traditionally illiquid securities.

Related Important Terms

Beneficial Ownership Rights

Securities lending temporarily transfers ownership rights to the borrower, limiting the lender's ability to exercise beneficial ownership rights such as voting and dividends during the loan period. Fractional ownership provides investors with partial beneficial ownership, enabling proportional rights to dividends, voting, and asset appreciation without full transfer of title.

Collateralization Threshold

In securities lending, the collateralization threshold typically ranges from 102% to 105% of the loaned securities' market value to mitigate counterparty risk, whereas fractional ownership rarely involves collateral as investors hold direct shares proportional to their investment. The higher collateralization threshold in securities lending ensures protection against market volatility and borrower default, contrasting with fractional ownership structures where asset control is inherently secured through direct equity stakes.

Agency Lending Model

The Agency Lending Model in securities lending enables beneficial owners to lend their assets through intermediaries, optimizing returns while maintaining control and transparency. Fractional ownership, conversely, involves dividing asset rights among investors, which offers shared benefits but lacks the direct lending revenue potential inherent in agency-based securities lending.

Fractional Share Trading

Fractional share trading enables investors to purchase partial shares of high-value securities, lowering the entry barrier and enhancing portfolio diversification without the need for full share ownership. This approach contrasts with securities lending, where institutions temporarily loan shares to boost liquidity and market efficiency but doesn't alter ownership rights.

Securities Borrow Fee

Securities borrow fees represent the cost paid by borrowers in securities lending transactions, typically expressed as an annualized percentage of the loaned security's value, influencing liquidity and short-selling strategies. Fractional ownership does not incur borrow fees since investors directly hold a portion of the asset, avoiding borrowing costs and counterparty risk inherent in securities lending markets.

Micro-investment Platforms

Micro-investment platforms leverage fractional ownership to enable investors to buy portions of high-value securities, increasing accessibility and diversification with minimal capital. In contrast, securities lending allows investors to earn additional income by temporarily loaning their shares to borrowers, enhancing portfolio returns without relinquishing ownership.

Recall Risk

Securities lending involves the temporary transfer of securities with the obligation to return them, exposing lenders to recall risk if the borrower fails to return the securities on demand, potentially disrupting the lender's trading or settlement activities. Fractional ownership minimizes recall risk since investors hold proportional shares of the asset without transferring actual securities, ensuring continuous rights and reducing exposure to counterparty default.

Securitized Tokenization

Securitized tokenization enhances securities lending by converting traditional assets into blockchain-based tokens, enabling fractional ownership and increasing liquidity in financial markets. This digital transformation facilitates efficient collateral management and broadens investor access, differentiating it from conventional securities lending methods that lack fractionalization features.

Automated Lending Pool

Automated lending pools in securities lending streamline the process by using algorithms to allocate assets efficiently, maximizing returns while minimizing risk exposure for fractional owners. Fractional ownership benefits from these pools through enhanced liquidity and diversified lending opportunities without the need for individual asset management.

Rehypothecation

Securities lending involves temporarily transferring securities to borrowers with the potential for rehypothecation, where the borrowed securities can be reused as collateral in other transactions, increasing leverage but also risk exposure. Fractional ownership, in contrast, grants investors a proportional stake in an asset without typically enabling rehypothecation, thereby limiting the chain of collateral reuse and associated systemic risks.

Securities Lending vs Fractional Ownership Infographic

industrydif.com

industrydif.com