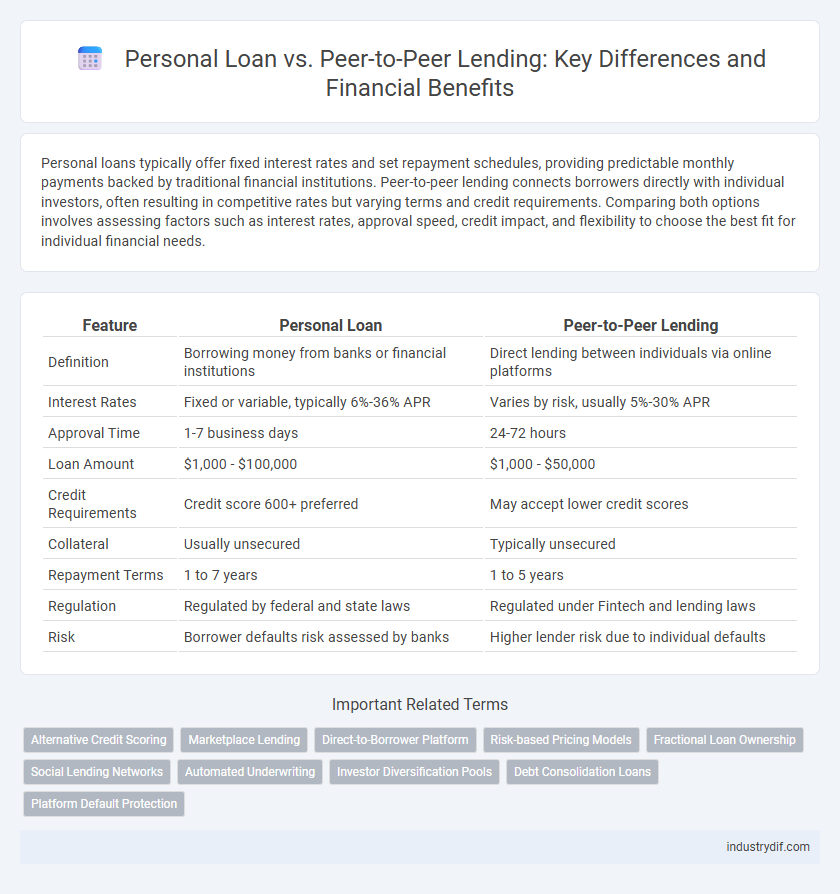

Personal loans typically offer fixed interest rates and set repayment schedules, providing predictable monthly payments backed by traditional financial institutions. Peer-to-peer lending connects borrowers directly with individual investors, often resulting in competitive rates but varying terms and credit requirements. Comparing both options involves assessing factors such as interest rates, approval speed, credit impact, and flexibility to choose the best fit for individual financial needs.

Table of Comparison

| Feature | Personal Loan | Peer-to-Peer Lending |

|---|---|---|

| Definition | Borrowing money from banks or financial institutions | Direct lending between individuals via online platforms |

| Interest Rates | Fixed or variable, typically 6%-36% APR | Varies by risk, usually 5%-30% APR |

| Approval Time | 1-7 business days | 24-72 hours |

| Loan Amount | $1,000 - $100,000 | $1,000 - $50,000 |

| Credit Requirements | Credit score 600+ preferred | May accept lower credit scores |

| Collateral | Usually unsecured | Typically unsecured |

| Repayment Terms | 1 to 7 years | 1 to 5 years |

| Regulation | Regulated by federal and state laws | Regulated under Fintech and lending laws |

| Risk | Borrower defaults risk assessed by banks | Higher lender risk due to individual defaults |

Overview of Personal Loans and Peer-to-Peer Lending

Personal loans are unsecured loans offered by banks, credit unions, and online lenders with fixed interest rates and repayment terms, typically used for debt consolidation, home improvements, or emergencies. Peer-to-peer (P2P) lending connects individual borrowers directly with investors through online platforms, often providing more competitive rates based on creditworthiness and loan purpose. Both options offer distinct advantages in accessibility, interest rates, and approval processes, making them viable alternatives depending on financial goals and credit profiles.

Key Differences: Personal Loans vs Peer-to-Peer Lending

Personal loans are typically offered by traditional financial institutions like banks and credit unions, featuring fixed interest rates and repayment terms, while peer-to-peer lending connects borrowers directly with individual investors through online platforms, often providing more competitive rates. Personal loans usually require a thorough credit check and may have stricter qualification criteria compared to peer-to-peer lending, which can offer more flexible approval processes based on varied risk assessments. Risk distribution also differs; personal loans place repayment responsibility solely on the borrower, whereas peer-to-peer lending spreads risk across multiple investors funding the loan.

Interest Rates: Traditional Lenders vs P2P Platforms

Interest rates for personal loans from traditional lenders typically range between 6% and 36%, influenced by credit scores and borrowing history. Peer-to-peer lending platforms often offer competitive rates, averaging 5% to 30%, leveraging direct borrower-to-investor connections and reduced overhead costs. Borrowers with strong credit profiles may secure lower rates on P2P platforms, while riskier profiles might face higher interest compared to traditional banks.

Eligibility Criteria: Banks versus P2P Networks

Banks typically require a strong credit score, stable income, and documented financial history to approve personal loans, reflecting stringent eligibility criteria. Peer-to-peer lending networks often have more flexible requirements, focusing on alternative data points and risk assessments beyond traditional credit scores. Borrowers with limited credit history may find P2P platforms more accessible than conventional banks for personal loan financing.

Application Process Comparison

The application process for personal loans typically involves submitting detailed financial information to traditional banks or credit unions, followed by a thorough credit check and approval timeline that may take several days. Peer-to-peer lending platforms streamline this process through online applications, reducing approval times by using automated credit assessments and connecting borrowers directly with individual investors. This digital approach often results in faster funding decisions and increased accessibility for borrowers with varied credit profiles.

Loan Approval Timeframes

Personal loans typically have faster approval timeframes, often disbursing funds within 24 to 48 hours due to streamlined processes at traditional banks and credit unions. Peer-to-peer lending platforms usually require several days to a week for loan approval, as they involve multiple individual investors assessing the borrower's credit profile. Understanding these time differences is crucial for borrowers needing quick access to funds versus those seeking potentially lower interest rates through P2P options.

Risk Factors for Borrowers and Investors

Personal loans typically involve lower risk for borrowers due to established credit checks and regulated interest rates, whereas peer-to-peer lending exposes borrowers to potentially higher interest rates based on platform risk assessments and investor demand. Investors in peer-to-peer lending assume credit risk directly, facing borrower default without traditional bank guarantees, while personal loan investors are usually financial institutions that mitigate risk through diversified loan portfolios. Understanding these risk differentials helps borrowers choose appropriate financing and investors to evaluate the risk-return balance effectively.

Regulatory Environment and Consumer Protection

Personal loans are typically regulated by established financial authorities such as the Consumer Financial Protection Bureau (CFPB) in the United States, ensuring standardized consumer protection measures like transparent interest rates and fair lending practices. Peer-to-peer (P2P) lending platforms, while increasingly regulated, often fall under a hybrid regulatory framework involving both federal and state laws, which can create variability in borrower protections and disclosure requirements. Consumers should carefully evaluate the regulatory environment of P2P lenders to understand the extent of protection, as it may not be as comprehensive as that provided for traditional personal loan products.

Pros and Cons: Personal Loans vs Peer-to-Peer Lending

Personal loans offer fixed interest rates, predictable repayment schedules, and are typically provided by established financial institutions, ensuring a higher level of security and regulatory oversight. Peer-to-peer lending often provides faster access to funds with potentially lower interest rates, but it carries higher risks due to less stringent credit evaluation and limited regulatory protection. Borrowers must weigh the trade-offs between the stability and reliability of personal loans versus the flexibility and potential cost savings of peer-to-peer lending platforms.

Which Option Is Best for Your Financial Needs?

Personal loans typically offer fixed interest rates and predictable repayment schedules, making them ideal for borrowers seeking stability and quick access to funds through traditional banks or credit unions. Peer-to-peer lending platforms connect borrowers directly with individual investors, often providing more flexible terms and competitive rates, particularly for those with good credit scores or unique financing needs. Evaluate factors such as interest rates, loan terms, eligibility criteria, and repayment flexibility to determine which option aligns best with your financial goals and risk tolerance.

Related Important Terms

Alternative Credit Scoring

Alternative credit scoring models in peer-to-peer lending utilize non-traditional data points such as social behavior, employment history, and digital footprints to assess borrower risk more inclusively than conventional personal loan credit scoring, which heavily relies on credit bureau scores and financial statements. This innovation enables underserved borrowers with limited credit history to access financing through peer-to-peer platforms, often resulting in more personalized interest rates and improved loan approval rates compared to traditional personal loans.

Marketplace Lending

Marketplace lending platforms facilitate peer-to-peer lending by connecting borrowers directly with individual investors, often offering lower interest rates and more flexible terms compared to traditional personal loans from banks. This model reduces overhead costs and leverages technology to evaluate credit risk efficiently, providing borrowers access to alternative financing options while enabling investors to diversify their portfolios.

Direct-to-Borrower Platform

Direct-to-borrower platforms in peer-to-peer lending connect individuals directly with investors, offering competitive interest rates and flexible terms compared to traditional personal loans issued by banks. This model reduces intermediary costs, enabling borrowers with varied credit profiles to access funds swiftly while investors earn higher returns through diversified lending portfolios.

Risk-based Pricing Models

Risk-based pricing models in personal loans assess borrowers' creditworthiness using credit scores, income, and debt-to-income ratios, resulting in interest rates that reflect individual default risk; peer-to-peer lending platforms use similar algorithms but incorporate investor risk tolerance and platform fees, which can lead to wider rate variability based on market demand and borrower profiles. These differentiated risk evaluations influence loan accessibility and cost, highlighting the importance of understanding each model's pricing mechanics for informed borrowing decisions.

Fractional Loan Ownership

Personal loans offer full loan ownership where a single borrower is responsible for repayment, whereas peer-to-peer lending enables fractional loan ownership by distributing investment across multiple lenders, reducing individual risk. Fractional ownership in P2P lending promotes diversification and increases access to varied funding sources compared to traditional personal loans.

Social Lending Networks

Social lending networks facilitate peer-to-peer lending by connecting borrowers directly with individual investors, often offering lower interest rates compared to traditional personal loans from banks. These platforms leverage social data and community trust to minimize risk, making them a viable alternative for financing with more flexible terms and faster approval processes.

Automated Underwriting

Automated underwriting in personal loans utilizes advanced algorithms to quickly evaluate creditworthiness based on financial data, enabling faster approval times and reduced lender risk. Peer-to-peer lending platforms employ automated underwriting systems to assess borrower profiles and match them with investors, enhancing transparency and optimizing loan pricing through machine learning models.

Investor Diversification Pools

Investor diversification pools in personal loans typically consist of institutional lenders or banks offering a broad range of credit profiles, while peer-to-peer lending platforms aggregate individual investors who can diversify by funding multiple borrowers across various risk categories. Peer-to-peer lending enhances investor diversification by enabling smaller, more targeted investments across numerous loans, potentially reducing risk compared to traditional personal loan portfolios concentrated within fewer financial institutions.

Debt Consolidation Loans

Personal loans offer fixed interest rates and structured repayment terms ideal for consolidating multiple debts into a single monthly payment, whereas peer-to-peer lending platforms often provide competitive rates by connecting borrowers directly with individual investors, potentially lowering costs for borrowers with strong credit profiles. Debt consolidation through personal loans typically involves traditional banks or credit unions, while peer-to-peer lending platforms like LendingClub and Prosper facilitate quicker access to funds with varied credit requirements.

Platform Default Protection

Personal loans from traditional banks offer structured default protection through credit underwriting and collateral requirements, reducing lender risk and providing borrowers with clearer repayment terms. Peer-to-peer lending platforms mitigate default risk by diversifying investments across multiple borrowers and employing platform-level insurance funds, but they generally carry higher risk compared to conventional personal loans due to less stringent credit assessment.

Personal Loan vs Peer-to-Peer Lending Infographic

industrydif.com

industrydif.com