Fixed income investments provide predictable returns through regular interest payments, appealing to investors seeking stability and income generation. Green bonds, a subset of fixed income, finance environmentally sustainable projects and attract investors prioritizing social responsibility alongside financial returns. The growing demand for green bonds reflects a shift in investment strategies toward balancing profitability with environmental impact.

Table of Comparison

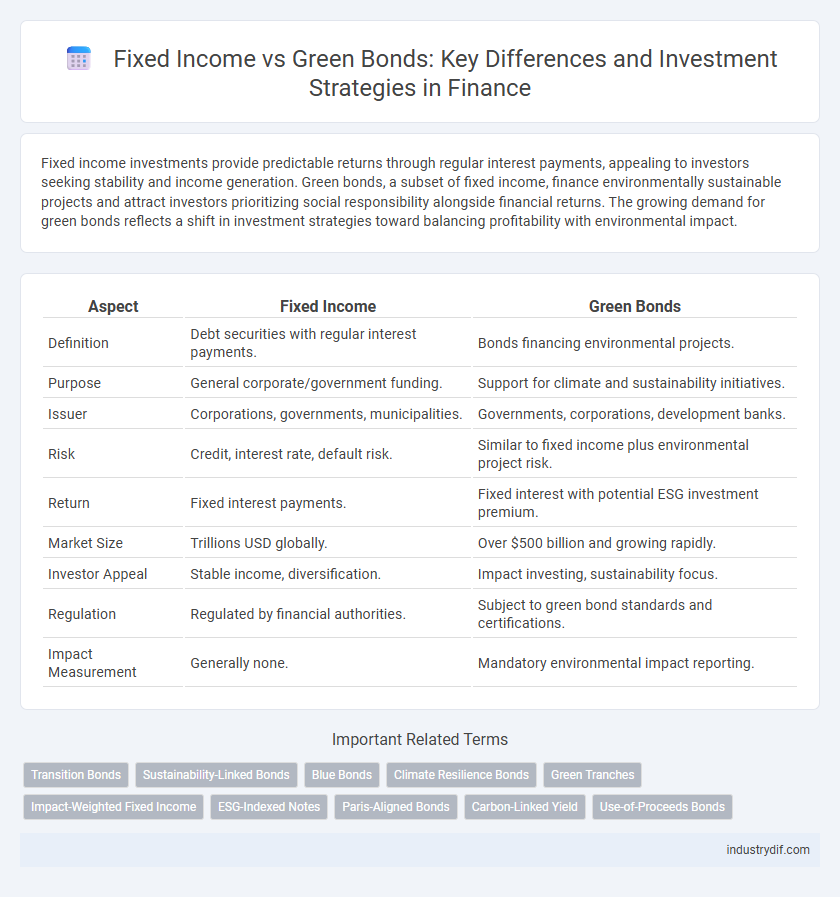

| Aspect | Fixed Income | Green Bonds |

|---|---|---|

| Definition | Debt securities with regular interest payments. | Bonds financing environmental projects. |

| Purpose | General corporate/government funding. | Support for climate and sustainability initiatives. |

| Issuer | Corporations, governments, municipalities. | Governments, corporations, development banks. |

| Risk | Credit, interest rate, default risk. | Similar to fixed income plus environmental project risk. |

| Return | Fixed interest payments. | Fixed interest with potential ESG investment premium. |

| Market Size | Trillions USD globally. | Over $500 billion and growing rapidly. |

| Investor Appeal | Stable income, diversification. | Impact investing, sustainability focus. |

| Regulation | Regulated by financial authorities. | Subject to green bond standards and certifications. |

| Impact Measurement | Generally none. | Mandatory environmental impact reporting. |

Understanding Fixed Income Securities

Fixed income securities represent debt instruments that provide investors with regular interest payments and the return of principal at maturity, including government bonds, corporate bonds, and municipal bonds. Green bonds are a specialized subset of fixed income securities designed to finance environmentally sustainable projects, offering investors a way to support ecological initiatives while earning predictable returns. Understanding the risk profiles, yield expectations, and market demand for both fixed income and green bonds is crucial for optimizing portfolio diversification and impact investing strategies.

What Are Green Bonds?

Green bonds are fixed-income securities specifically issued to finance projects that generate environmental benefits, such as renewable energy, energy efficiency, and pollution reduction initiatives. These bonds provide investors with a way to support sustainability while receiving steady interest payments, similar to traditional fixed income instruments. Growing demand for environmentally responsible investing has driven the expansion of the green bond market, attracting both institutional and retail investors.

Key Differences: Fixed Income vs Green Bonds

Fixed income securities typically include government and corporate bonds that provide regular interest payments with a priority on capital preservation and predictable returns. Green bonds are a subset of fixed income instruments specifically designated to fund environmentally sustainable projects, often featuring similar credit risk profiles but appealing to investors prioritizing environmental, social, and governance (ESG) criteria. The primary difference lies in the allocation of proceeds and impact reporting, where green bonds require transparency on the environmental benefits generated by the financed projects.

Risk and Return Profiles

Fixed income securities typically offer predictable interest payments and lower risk, making them attractive for conservative investors seeking steady returns. Green bonds, a subset of fixed income, finance environmentally sustainable projects and may carry slightly higher risk due to project-specific factors but can deliver competitive returns aligned with ESG goals. Investors must evaluate credit quality, maturity, and sector exposure to balance the enhanced impact potential of green bonds with their risk-return trade-offs.

Environmental Impact and Sustainability

Fixed income instruments traditionally prioritize steady returns but may lack direct environmental benefits, whereas green bonds specifically fund projects aimed at reducing carbon emissions and promoting renewable energy. Green bonds enhance sustainability by directing capital towards climate-friendly infrastructure, making them a key tool in financing the global transition to a low-carbon economy. Investors seeking both financial security and positive environmental impact increasingly favor green bonds for their dual focus on profitability and ecological responsibility.

Market Trends in Fixed Income and Green Bonds

The fixed income market continues to exhibit steady growth driven by investor demand for stable returns, while green bonds have surged in popularity due to increased emphasis on environmental, social, and governance (ESG) criteria. Recent data shows that green bond issuance reached a record $530 billion globally in 2023, reflecting heightened corporate and sovereign commitment to sustainable finance. Market trends indicate that fixed income portfolios increasingly integrate green bonds to balance risk management with sustainability objectives.

Regulatory Landscape and Compliance

The regulatory landscape for fixed income securities is well-established with stringent disclosure requirements governed by agencies like the SEC, ensuring transparency and investor protection. Green bonds, while subject to traditional fixed income regulations, face additional compliance standards related to environmental impact verification and adherence to frameworks such as the Green Bond Principles (GBP) and Climate Bonds Standard. These enhanced regulatory requirements for green bonds promote greater accountability in sustainable financing but also increase the complexity of compliance compared to conventional fixed income instruments.

Investor Demand and Demographics

Investor demand for fixed income securities remains robust among conservative portfolios seeking steady returns, predominantly attracting older demographics such as baby boomers. In contrast, green bonds experience rapid growth driven by socially conscious investors and millennials prioritizing environmental impact alongside financial returns. Market data indicates a shifting investor base where younger investors increasingly allocate assets to green bonds, anticipating both sustainability and moderate risk.

Challenges in Green Bond Verification

Green bond verification faces significant challenges due to inconsistent standards and the lack of a unified global taxonomy, complicating the assessment of environmental impact. The reliance on third-party reviewers introduces variability in credibility and increases costs compared to traditional fixed income instruments. These verification challenges often delay issuance and limit investor confidence, affecting market growth and pricing transparency.

Future Outlook for Fixed Income and Green Bonds

Fixed income markets are anticipated to experience steady growth driven by rising interest rates and increasing demand for stable yield amidst economic uncertainties. Green bonds, a subset of fixed income assets, are projected to expand rapidly due to heightened investor interest in sustainable finance and global climate initiatives targeting carbon neutrality by 2050. Regulatory support and ESG integration will further enhance the appeal of green bonds, positioning them as a key driver of fixed income market innovation and long-term value creation.

Related Important Terms

Transition Bonds

Transition bonds are a subset of green bonds specifically designed to finance companies' efforts in shifting from high-carbon to low-carbon operations, supporting projects that contribute to carbon neutrality but do not yet meet traditional green bond criteria. Fixed income investors view transition bonds as a strategic tool for fostering sustainable development while balancing risk and return in portfolios focused on environmental, social, and governance (ESG) objectives.

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) integrate specific environmental, social, and governance (ESG) performance targets into fixed income instruments, offering investors measurable impact alongside financial returns. Unlike traditional fixed income or green bonds, SLBs provide flexibility without restricting capital use to predefined green projects, aligning issuer incentives with sustainability outcomes through penalty or reward mechanisms tied to ESG metrics.

Blue Bonds

Blue bonds are a specialized category of fixed income securities earmarked to fund marine and ocean conservation projects, offering investors a sustainable investment option with a potential steady return. Unlike traditional green bonds that target environmental initiatives broadly, blue bonds specifically address challenges like ocean pollution, fisheries management, and marine biodiversity, aligning financial returns with ecological impact.

Climate Resilience Bonds

Climate Resilience Bonds, a subset of Green Bonds, specifically finance projects aimed at strengthening infrastructure and communities against climate change impacts, whereas traditional Fixed Income securities primarily focus on stable, predictable returns without environmental considerations. Investors seeking to align portfolios with sustainability targets increasingly favor Climate Resilience Bonds due to their contribution to mitigating climate risks and promoting ecological sustainability.

Green Tranches

Green tranches within fixed income securities offer investors environmentally focused investment opportunities with the potential for stable returns, targeting projects that support sustainability and climate goals. These green tranches are structured to align with ESG criteria, providing transparency and impact reporting that differentiate them from traditional fixed income assets.

Impact-Weighted Fixed Income

Impact-weighted fixed income integrates environmental, social, and governance (ESG) metrics into traditional bond evaluation, offering investors measurable outcomes alongside financial returns. Green bonds specifically fund environmentally beneficial projects, but impact-weighted fixed income expands this scope by quantifying holistic social and environmental impact across diverse fixed income portfolios.

ESG-Indexed Notes

ESG-indexed notes combine fixed income stability with sustainability by linking returns to environmental, social, and governance performance metrics, offering investors a dual benefit of predictable income and positive impact. Unlike traditional fixed income bonds, green bonds specifically finance environmentally friendly projects, while ESG-indexed notes expand impact criteria by incorporating social and governance factors for more comprehensive sustainable investing.

Paris-Aligned Bonds

Paris-Aligned Bonds, a subset of green bonds, specifically target projects that comply with the Paris Agreement's climate goals, offering fixed income investors a sustainable investment avenue aligned with carbon neutrality by 2050. Unlike traditional fixed income securities, Paris-Aligned Bonds integrate environmental impact metrics into their risk and return profiles, attracting investors prioritizing both financial stability and climate-related outcomes.

Carbon-Linked Yield

Fixed income securities typically offer stable returns based on interest payments, while green bonds integrate environmental objectives by linking yields to carbon reduction targets, creating a carbon-linked yield structure. This mechanism incentivizes issuers to achieve specific sustainability outcomes, aligning investor returns with measurable carbon impact goals.

Use-of-Proceeds Bonds

Fixed Income securities generate predictable cash flows primarily through interest payments, while Green Bonds are a specialized category of Use-of-Proceeds Bonds dedicated exclusively to financing environmentally sustainable projects such as renewable energy and climate resilience. Investors in Green Bonds gain exposure to fixed income returns alongside positive environmental impact, benefiting from increased transparency through third-party verification and reporting standards.

Fixed Income vs Green Bonds Infographic

industrydif.com

industrydif.com