Crowdfunding allows multiple investors to pool funds into a project or business in exchange for equity or rewards, providing straightforward access to capital. Tokenized assets represent ownership through blockchain-based digital tokens, enabling fractional ownership, enhanced liquidity, and easier transferability compared to traditional crowdfunding models. The rise of tokenized assets introduces increased transparency and security, reshaping how investors participate in funding opportunities.

Table of Comparison

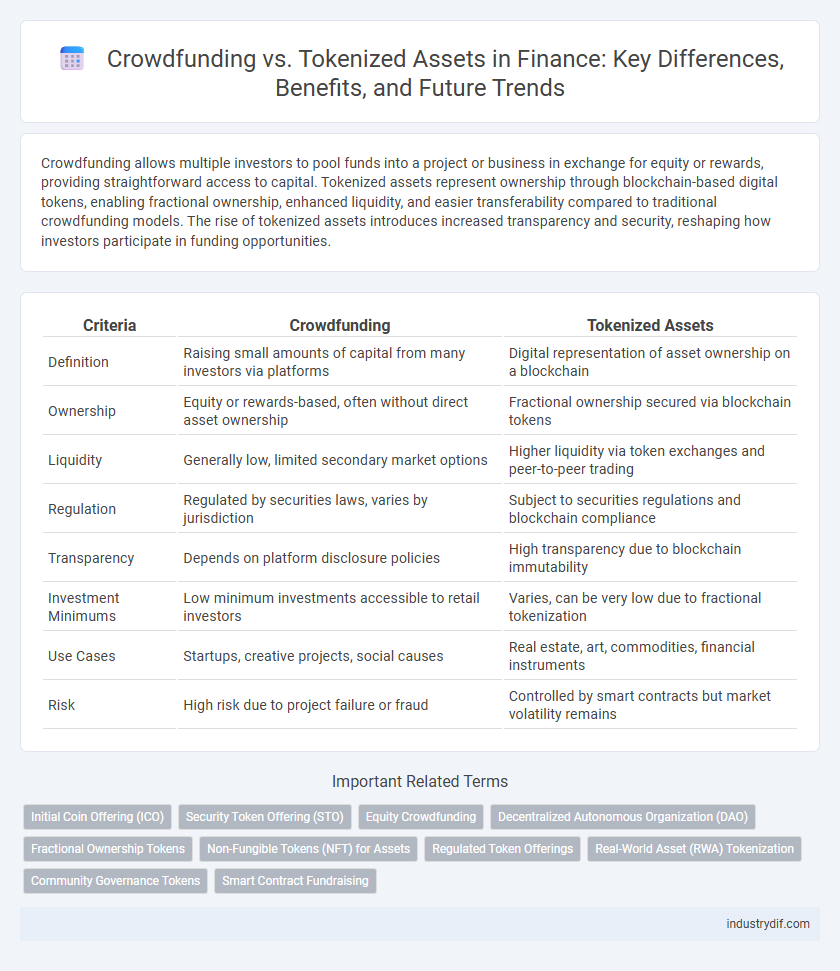

| Criteria | Crowdfunding | Tokenized Assets |

|---|---|---|

| Definition | Raising small amounts of capital from many investors via platforms | Digital representation of asset ownership on a blockchain |

| Ownership | Equity or rewards-based, often without direct asset ownership | Fractional ownership secured via blockchain tokens |

| Liquidity | Generally low, limited secondary market options | Higher liquidity via token exchanges and peer-to-peer trading |

| Regulation | Regulated by securities laws, varies by jurisdiction | Subject to securities regulations and blockchain compliance |

| Transparency | Depends on platform disclosure policies | High transparency due to blockchain immutability |

| Investment Minimums | Low minimum investments accessible to retail investors | Varies, can be very low due to fractional tokenization |

| Use Cases | Startups, creative projects, social causes | Real estate, art, commodities, financial instruments |

| Risk | High risk due to project failure or fraud | Controlled by smart contracts but market volatility remains |

Introduction to Crowdfunding and Tokenized Assets

Crowdfunding enables individuals and businesses to raise capital from a large pool of investors through online platforms, often in exchange for early access or equity stakes. Tokenized assets represent ownership rights or shares in real-world assets, such as real estate or art, digitized on blockchain technology for enhanced liquidity and transparency. Both methods democratize investment access but differ fundamentally in structure and regulatory frameworks.

Key Differences Between Crowdfunding and Tokenized Assets

Crowdfunding involves raising capital from a large number of individuals, typically in exchange for rewards or equity, while tokenized assets represent ownership rights secured on a blockchain, enabling fractional ownership and enhanced liquidity. Tokenized assets provide greater transparency through immutable ledger technology and facilitate faster, borderless transactions compared to traditional crowdfunding platforms. Regulatory frameworks also differ, with tokenized assets often falling under securities laws, requiring compliance with digital asset regulations unlike many reward-based crowdfunding models.

Regulatory Landscape for Crowdfunding vs Tokenization

Crowdfunding platforms typically operate under regulations such as the JOBS Act in the United States, which mandates limits on investment amounts and requires disclosures to protect investors. Tokenized assets face evolving regulatory frameworks that vary by jurisdiction but generally involve securities laws, requiring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to ensure transparency and reduce fraud. Regulatory clarity for tokenization is improving, fostering broader adoption but still presenting challenges compared to the more established governance around crowdfunding.

Traditional Crowdfunding Models Explained

Traditional crowdfunding models enable businesses or individuals to raise capital by collecting small amounts of money from many investors through online platforms like Kickstarter or Indiegogo. These models typically offer backers rewards or pre-sales instead of equity, limiting direct financial returns but fostering community support and product validation. Unlike tokenized assets, traditional crowdfunding lacks blockchain-based ownership rights, making it simpler but less flexible for secondary trading or fractional investment.

The Rise of Tokenized Assets in Financial Markets

Tokenized assets are revolutionizing financial markets by enabling fractional ownership and increased liquidity for traditionally illiquid investments like real estate and art. Unlike crowdfunding, which pools resources without offering tradable ownership stakes, tokenization leverages blockchain technology to provide transparent, secure, and easily transferable digital shares. This shift is attracting institutional investors and boosting market accessibility, driving rapid growth in decentralized finance (DeFi) platforms.

Investor Access and Participation: A Comparative Analysis

Crowdfunding enables widespread investor access through low minimum contributions, democratizing participation in early-stage projects often unavailable via traditional finance. Tokenized assets utilize blockchain technology to fractionalize ownership, offering liquidity and borderless trading that enhances investor flexibility and market entry. Both models expand opportunities but differ in regulatory frameworks and secondary market access, influencing investor engagement and portfolio diversification strategies.

Risks and Security Considerations

Crowdfunding platforms often face risks related to lack of regulatory oversight, potential fraud, and limited investor protections, increasing the likelihood of financial loss for participants. Tokenized assets, while offering enhanced transparency through blockchain technology, present security challenges such as smart contract vulnerabilities and the risk of token theft or hacking. Investors should carefully evaluate security protocols, regulatory compliance, and the risk management frameworks inherent in both crowdfunding and tokenized asset offerings.

Liquidity and Secondary Market Opportunities

Crowdfunding typically offers limited liquidity as investors often wait until project completion or exit events to realize returns, whereas tokenized assets enable fractional ownership with enhanced liquidity through blockchain-based secondary markets. Tokenized assets can be traded 24/7 on digital exchanges, providing continuous price discovery and immediate transaction settlement compared to the slower, infrequent secondary market opportunities in traditional crowdfunding. This increased liquidity and seamless transferability of tokenized assets diversify investor access and reduce barriers to entry, making them more attractive for dynamic portfolio management.

Future Trends in Crowdfunding and Tokenized Assets

Future trends in crowdfunding highlight increased integration with blockchain technology, enabling greater transparency, security, and fractional ownership through tokenized assets. Tokenized assets facilitate seamless liquidity and global access, transforming traditional crowdfunding models by allowing investors to trade digital shares of real-world assets on secondary markets. Emerging regulatory frameworks aim to balance investor protection with innovation, fostering wider adoption and scalability of crowdfunding platforms powered by tokenization.

Choosing the Right Model for Your Investment Strategy

Crowdfunding offers direct equity or rewards-based participation, ideal for investors seeking straightforward, early-stage funding opportunities with tangible business involvement. Tokenized assets provide fractional ownership on blockchain platforms, enhancing liquidity and enabling access to diversified portfolios with transparent, programmable transactions. Selecting the right model depends on investment goals, risk tolerance, and preference for liquidity versus control within emerging financial technologies.

Related Important Terms

Initial Coin Offering (ICO)

Initial Coin Offerings (ICOs) enable startups to raise capital by issuing digital tokens on blockchain platforms, offering investors fractional ownership or utility, contrasting traditional crowdfunding that relies on direct contributions without tokenized equity. Tokenized assets in ICOs provide enhanced liquidity, transparency, and global reach, revolutionizing fundraising methods beyond conventional crowdfunding limitations.

Security Token Offering (STO)

Security Token Offerings (STOs) provide regulatory compliance and investor protection by issuing tokenized assets that represent ownership stakes, contrasting with traditional crowdfunding models which often lack fractional ownership and liquidity. STOs leverage blockchain technology to enhance transparency, enable secondary market trading, and reduce settlement times, making them a more secure and efficient alternative for raising capital.

Equity Crowdfunding

Equity crowdfunding allows investors to acquire shares in startups or private companies through online platforms, providing direct ownership and potential dividends. Tokenized assets represent traditional equity on a blockchain, offering enhanced liquidity and fractional ownership but may involve regulatory complexities compared to conventional equity crowdfunding.

Decentralized Autonomous Organization (DAO)

Decentralized Autonomous Organizations (DAOs) leverage tokenized assets to enable transparent, democratic governance and fractional ownership in crowdfunding campaigns, enhancing investor rights and liquidity compared to traditional crowdfunding. Tokenized assets within DAOs create programmable financial instruments on blockchain networks, streamlining fundraising while reducing intermediaries and regulatory friction.

Fractional Ownership Tokens

Fractional ownership tokens enable investors to purchase and trade portions of high-value assets through blockchain technology, offering increased liquidity and transparency compared to traditional crowdfunding methods. Unlike conventional crowdfunding, tokenized assets provide programmable rights and automatic dividend distributions, enhancing investor control and engagement in financial markets.

Non-Fungible Tokens (NFT) for Assets

Crowdfunding enables collective investment in projects through pooled funds, while tokenized assets, particularly Non-Fungible Tokens (NFTs), represent unique digital ownership of physical or intangible assets on a blockchain, enhancing liquidity and provenance verification. NFTs provide asset holders with immutable proof of authenticity and scarcity, facilitating fractional ownership and secondary market trading in finance.

Regulated Token Offerings

Regulated Token Offerings (RTOs) provide a compliant framework for tokenized assets, enabling businesses to raise capital while adhering to securities laws, reducing investor risk compared to traditional crowdfunding. By leveraging blockchain technology, RTOs enhance transparency, liquidity, and fractional ownership, positioning them as a superior alternative to unregulated crowdfunding platforms in the finance sector.

Real-World Asset (RWA) Tokenization

Tokenized assets leverage blockchain technology to fractionalize real-world assets (RWA), enabling increased liquidity and broader investor access compared to traditional crowdfunding methods that rely on direct investment pools. RWA tokenization enhances transparency, reduces intermediaries, and facilitates compliance through smart contracts, offering a scalable solution for the democratization of finance.

Community Governance Tokens

Community governance tokens empower investors to participate directly in decision-making processes, enhancing transparency and alignment of interests in crowdfunding projects. Tokenized assets facilitate fractional ownership and liquidity, but governance tokens uniquely enable collective control and strategic input within decentralized finance ecosystems.

Smart Contract Fundraising

Smart contract fundraising streamlines crowdfunding by automating investment agreements, reducing intermediaries, and enhancing transparency through blockchain technology. Tokenized assets enable fractional ownership and liquidity, expanding investor access and creating new opportunities for capital raising in decentralized finance.

Crowdfunding vs Tokenized assets Infographic

industrydif.com

industrydif.com