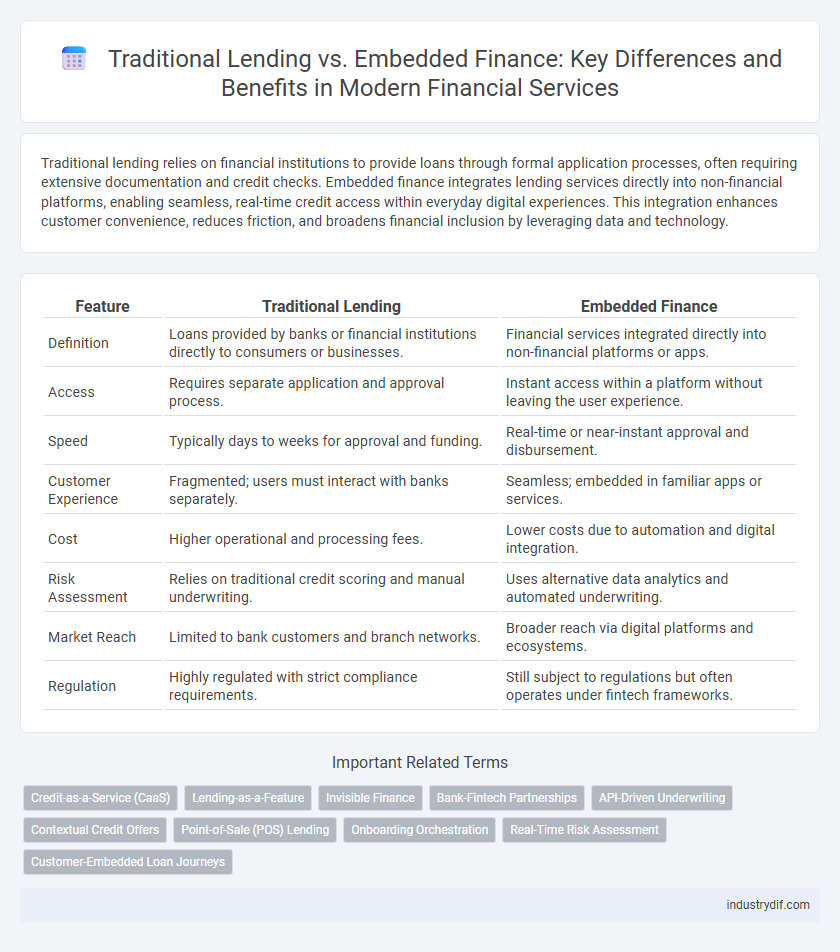

Traditional lending relies on financial institutions to provide loans through formal application processes, often requiring extensive documentation and credit checks. Embedded finance integrates lending services directly into non-financial platforms, enabling seamless, real-time credit access within everyday digital experiences. This integration enhances customer convenience, reduces friction, and broadens financial inclusion by leveraging data and technology.

Table of Comparison

| Feature | Traditional Lending | Embedded Finance |

|---|---|---|

| Definition | Loans provided by banks or financial institutions directly to consumers or businesses. | Financial services integrated directly into non-financial platforms or apps. |

| Access | Requires separate application and approval process. | Instant access within a platform without leaving the user experience. |

| Speed | Typically days to weeks for approval and funding. | Real-time or near-instant approval and disbursement. |

| Customer Experience | Fragmented; users must interact with banks separately. | Seamless; embedded in familiar apps or services. |

| Cost | Higher operational and processing fees. | Lower costs due to automation and digital integration. |

| Risk Assessment | Relies on traditional credit scoring and manual underwriting. | Uses alternative data analytics and automated underwriting. |

| Market Reach | Limited to bank customers and branch networks. | Broader reach via digital platforms and ecosystems. |

| Regulation | Highly regulated with strict compliance requirements. | Still subject to regulations but often operates under fintech frameworks. |

Introduction to Traditional Lending and Embedded Finance

Traditional lending involves financial institutions providing loans through established processes requiring applications, credit assessments, and approvals, often resulting in slower access to funds. Embedded finance integrates financial services directly into non-financial platforms or products, enabling seamless access to credit within the customer's existing digital experience. This transformation enhances user convenience by embedding lending options into e-commerce, SaaS, or mobile applications, streamlining credit delivery.

Key Differences Between Traditional Lending and Embedded Finance

Traditional lending involves banks or financial institutions providing loans directly to consumers or businesses, often requiring lengthy approval processes and credit checks. Embedded finance integrates financial services like lending seamlessly into non-financial platforms, enabling real-time credit access without traditional banking intermediaries. This approach improves user experience by leveraging APIs and data analytics to offer personalized, instant financing options within the user's existing digital environment.

Evolution of Lending Models in Finance

Traditional lending models relied heavily on banks and financial institutions as intermediaries, often involving lengthy approval processes and rigid credit assessments. Embedded finance integrates lending services directly into non-financial platforms, leveraging APIs to offer instant credit without redirecting users to banks. This evolution enhances customer experience by providing seamless access to financing within everyday digital ecosystems like e-commerce, ride-sharing, and software platforms.

Benefits of Embedded Finance Over Traditional Lending

Embedded finance integrates financial services directly within non-financial platforms, offering seamless user experiences and faster access to credit compared to traditional lending. It reduces friction by eliminating the need for separate loan applications, enabling real-time credit decisions through data-driven algorithms. This approach enhances customer convenience, lowers operational costs, and drives higher approval rates by leveraging contextual data from existing platforms.

Challenges Facing Traditional Lending Institutions

Traditional lending institutions face challenges such as lengthy loan approval processes, high operational costs, and limited access to real-time customer data. These factors contribute to customer dissatisfaction and reduced competitiveness in an increasingly digital financial landscape. Additionally, strict regulatory compliance and risk management demands place further strain on traditional banks trying to modernize their loan offerings.

How Embedded Lending Enhances Customer Experience

Embedded lending integrates credit options directly within digital platforms, streamlining the borrowing process and reducing friction for customers. This seamless access enables real-time loan approvals and tailored financing solutions, enhancing convenience and satisfaction. By leveraging data analytics, embedded lending offers personalized terms that traditional lending often cannot match, fostering stronger customer loyalty.

Integration of Financial Services in Non-Financial Platforms

Traditional lending relies on standalone financial institutions offering loans through direct customer engagement, while embedded finance integrates lending services directly into non-financial platforms such as e-commerce, ride-sharing, or SaaS applications. This integration enables seamless access to credit at the point of need, improving user experience and expanding financing opportunities by leveraging platform data for real-time credit assessment. Embedded finance's fusion with non-financial ecosystems accelerates digital transformation, reduces friction in loan acquisition, and fosters innovative financial products tailored to specific platform users.

Regulatory Considerations for Traditional vs Embedded Lending

Traditional lending models are subject to stringent regulatory frameworks including licensing requirements, capital adequacy norms, and consumer protection laws enforced by financial authorities. Embedded finance solutions integrate lending directly within non-financial platforms, often complicating compliance due to jurisdictional overlaps and less-established regulatory guidelines. Regulatory bodies are increasingly adapting policies to address risks associated with data security, transparency, and fair lending practices in embedded finance environments.

Impact of Technology on Lending Ecosystems

Technology transforms lending ecosystems by integrating embedded finance directly into digital platforms, streamlining loan application and approval processes through automation and data analytics. Traditional lending relies heavily on manual underwriting and siloed systems, resulting in slower transaction times and limited personalization. Embedded finance leverages APIs and real-time data, enhancing customer experience and increasing access to credit for underserved markets.

Future Trends in Lending: Embedded Finance and Beyond

Embedded finance is revolutionizing the lending landscape by integrating financial services directly into non-financial platforms, enhancing customer experience and streamlining credit access. Future trends indicate exponential growth in AI-powered credit risk assessment and real-time lending decisions within e-commerce, fintech, and IoT ecosystems. As traditional lending models face disruption, strategic partnerships between banks and embedded finance providers will drive innovation and financial inclusion.

Related Important Terms

Credit-as-a-Service (CaaS)

Credit-as-a-Service (CaaS) revolutionizes traditional lending by integrating seamless, API-driven credit solutions directly into non-financial platforms, enhancing customer experience and accelerating loan approval processes. Embedded finance with CaaS reduces reliance on banks, offering real-time risk assessment, flexible credit options, and scalable infrastructure for businesses to provide tailored credit services efficiently.

Lending-as-a-Feature

Traditional lending relies on standalone financial institutions offering loans through established processes, whereas embedded finance integrates Lending-as-a-Feature directly into non-financial platforms, enabling seamless, real-time credit access within user workflows. This integration leverages APIs, enhancing customer experience and driving higher conversion rates by embedding loan products at the point of need.

Invisible Finance

Invisible finance integrates lending services seamlessly within non-financial platforms, enhancing user experience by eliminating the need for separate credit applications characteristic of traditional lending. This approach leverages APIs and real-time data to offer instant credit decisions, reducing friction and increasing accessibility compared to conventional loan processing methods.

Bank-Fintech Partnerships

Bank-fintech partnerships drive innovation by integrating embedded finance solutions directly into customer platforms, enhancing user experience and expanding access to financial services beyond traditional lending frameworks. This collaboration leverages fintech agility and bank regulatory strength to create seamless, real-time credit and payment options embedded within everyday digital ecosystems.

API-Driven Underwriting

API-driven underwriting in embedded finance accelerates loan approval by integrating real-time data from diverse sources, enhancing risk assessment accuracy compared to traditional lending's manual, siloed processes. This automation reduces operational costs and improves customer experience with faster, personalized credit decisions.

Contextual Credit Offers

Traditional lending relies on separate credit applications and manual approvals, often resulting in delayed access to funds, whereas embedded finance integrates contextual credit offers directly within digital platforms, enabling instant, personalized credit decisions based on real-time data. This shift enhances customer experience by delivering seamless financing options aligned with user context, increasing loan approval rates and optimizing risk assessment through AI-driven analytics.

Point-of-Sale (POS) Lending

Point-of-Sale (POS) lending in embedded finance integrates financing options directly within the purchase journey, enhancing customer convenience and approval speed compared to traditional lending that often involves separate, time-consuming applications. Embedded POS lending leverages real-time data and APIs to offer tailored credit solutions instantly, driving higher conversion rates and improved customer satisfaction in retail environments.

Onboarding Orchestration

Traditional lending relies on manual onboarding processes that often lead to delayed customer verification and increased dropout rates, whereas embedded finance integrates onboarding orchestration within digital platforms, enabling seamless identity verification, instant credit assessments, and real-time decision-making. This streamlined onboarding orchestration in embedded finance boosts customer acquisition, reduces friction, and enhances overall lending efficiency.

Real-Time Risk Assessment

Traditional lending relies on periodic, often delayed risk assessments based on historical credit scores and financial statements, which can slow decision-making and limit loan accessibility. Embedded finance integrates real-time risk assessment using AI-driven data analytics and transaction monitoring, enabling instant credit evaluation and personalized lending solutions for faster, more accurate financial decisions.

Customer-Embedded Loan Journeys

Embedded finance integrates lending solutions directly within customer platforms, streamlining the loan journey by enabling instant credit access without redirecting users to external banks or lenders. Traditional lending requires customers to navigate separate applications and approvals, often causing friction and slowing the borrowing process.

Traditional Lending vs Embedded Finance Infographic

industrydif.com

industrydif.com