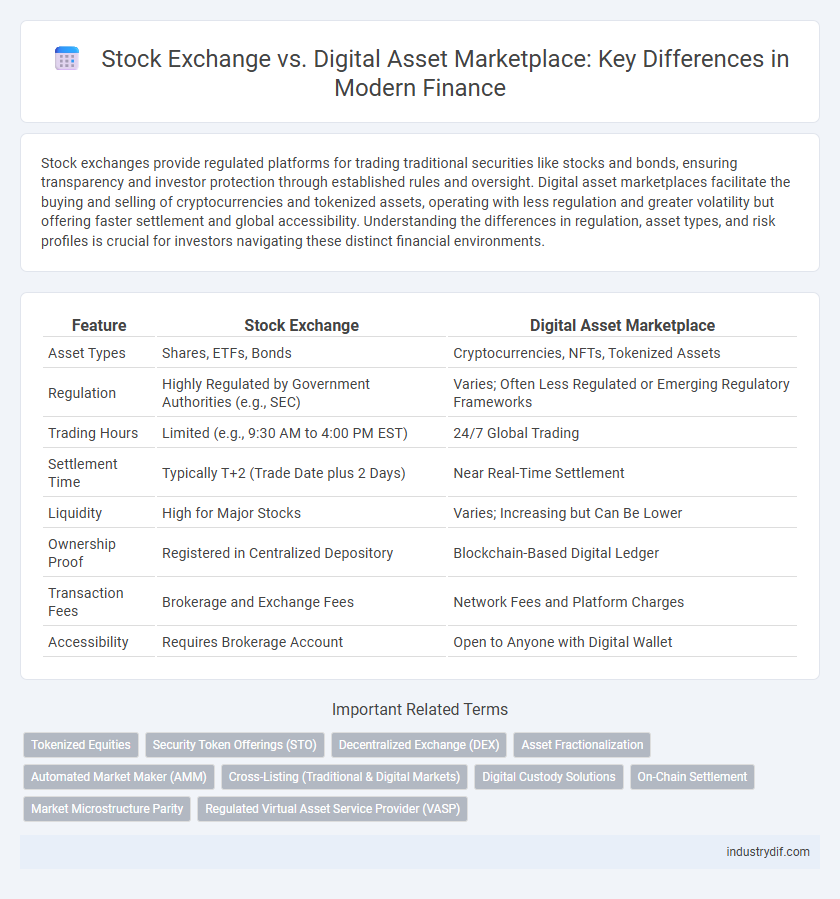

Stock exchanges provide regulated platforms for trading traditional securities like stocks and bonds, ensuring transparency and investor protection through established rules and oversight. Digital asset marketplaces facilitate the buying and selling of cryptocurrencies and tokenized assets, operating with less regulation and greater volatility but offering faster settlement and global accessibility. Understanding the differences in regulation, asset types, and risk profiles is crucial for investors navigating these distinct financial environments.

Table of Comparison

| Feature | Stock Exchange | Digital Asset Marketplace |

|---|---|---|

| Asset Types | Shares, ETFs, Bonds | Cryptocurrencies, NFTs, Tokenized Assets |

| Regulation | Highly Regulated by Government Authorities (e.g., SEC) | Varies; Often Less Regulated or Emerging Regulatory Frameworks |

| Trading Hours | Limited (e.g., 9:30 AM to 4:00 PM EST) | 24/7 Global Trading |

| Settlement Time | Typically T+2 (Trade Date plus 2 Days) | Near Real-Time Settlement |

| Liquidity | High for Major Stocks | Varies; Increasing but Can Be Lower |

| Ownership Proof | Registered in Centralized Depository | Blockchain-Based Digital Ledger |

| Transaction Fees | Brokerage and Exchange Fees | Network Fees and Platform Charges |

| Accessibility | Requires Brokerage Account | Open to Anyone with Digital Wallet |

Overview of Stock Exchanges and Digital Asset Marketplaces

Stock exchanges are centralized platforms where publicly traded company shares are bought and sold under government regulations, providing liquidity and price discovery. Digital asset marketplaces facilitate peer-to-peer trading of cryptocurrencies and tokenized assets using blockchain technology, often operating with less regulatory oversight. Both serve as essential venues for asset exchange but differ significantly in structure, asset types, and regulatory frameworks.

Historical Evolution: From Stock Markets to Digital Platforms

Stock exchanges originated in the 17th century with organized venues like the Amsterdam Stock Exchange, evolving over centuries from physical trading floors to electronic trading systems by the late 20th century. Digital asset marketplaces emerged in the early 21st century, driven by blockchain technology and cryptocurrencies, enabling decentralized and global trading of digital assets beyond traditional equities and bonds. This historical evolution reflects a shift from centralized, regulated stock markets to diversified digital platforms fostering increased accessibility and innovation in asset trading.

Key Structural Differences

Stock exchanges operate as centralized platforms regulated by financial authorities, facilitating the trading of stocks and securities through well-established mechanisms such as order books and market makers. In contrast, digital asset marketplaces typically use decentralized technology like blockchain, enabling peer-to-peer trading of cryptocurrencies and tokens without intermediaries. The structural distinction lies in regulatory oversight, the nature of assets traded, and the underlying technology supporting transaction validation and settlement processes.

Regulatory Framework Comparison

Stock exchanges operate under stringent regulatory frameworks established by national securities authorities like the SEC in the United States, ensuring rigorous compliance with disclosure, trading, and investor protection rules. Digital asset marketplaces often function under evolving regulations, with frameworks such as the EU's MiCA (Markets in Crypto-Assets) proposal aiming to standardize oversight, yet many jurisdictions still lack comprehensive rules for cryptocurrencies and tokens. The regulatory disparity affects market stability, investor confidence, and legal enforcement mechanisms between traditional stock markets and emerging digital asset platforms.

Asset Types Traded

Stock exchanges primarily facilitate the trading of traditional financial instruments such as equities, bonds, and derivatives, offering regulated environments for securities. Digital asset marketplaces focus on cryptocurrencies, tokens, and other blockchain-based assets, often operating with decentralized frameworks. The distinction in asset types affects liquidity, regulatory oversight, and investor risk profiles within each platform.

Trading Hours and Accessibility

Stock exchanges operate within fixed trading hours, typically aligned with regular business days and hours, limiting access to those specific time frames. Digital asset marketplaces provide 24/7 trading availability, offering continuous market access without restrictions on time. This extended accessibility attracts global participants and supports higher trading frequency in digital asset markets.

Security and Custody Solutions

Stock exchanges implement robust regulatory frameworks and centralized custody solutions to ensure asset security and investor protection, often relying on insured and audited third-party custodians. Digital asset marketplaces utilize blockchain technology for decentralized custody with cryptographic security measures but face challenges in regulatory compliance and custodial risk management. Institutional-grade digital asset custody providers increasingly offer multi-signature wallets, cold storage, and insurance coverage to bridge security gaps compared to traditional stock exchange custodianship.

Fee Structures and Costs

Stock exchanges typically charge transaction fees, listing fees, and annual fees, with costs varying based on trade volume and asset type, while digital asset marketplaces often impose trading fees, withdrawal fees, and sometimes network fees tied to blockchain activity. Stock exchange fees tend to be more standardized and regulated, reflecting traditional financial oversight, whereas digital asset marketplaces offer more dynamic fee models influenced by real-time market demand and blockchain transaction costs. Investors should analyze fee transparency and underlying cost structures, as these directly impact net returns in both environments.

Liquidity and Market Participants

Stock exchanges offer high liquidity due to established regulatory frameworks and the participation of institutional investors, market makers, and retail traders, ensuring continuous asset trading. Digital asset marketplaces often exhibit variable liquidity driven by decentralized participation, including individual crypto holders, decentralized finance (DeFi) protocols, and automated market makers (AMMs). The presence of diverse market participants in digital asset marketplaces can lead to more volatile price movements compared to the relatively stable liquidity pools found in traditional stock exchanges.

Future Trends in Financial Marketplaces

Stock exchanges are evolving by integrating blockchain technology to enhance transparency and reduce settlement times, while digital asset marketplaces continue expanding with tokenized securities and decentralized finance (DeFi) products. The rise of central bank digital currencies (CBDCs) and regulatory advancements are accelerating the convergence of traditional finance with digital asset platforms. Future financial marketplaces will likely prioritize interoperability, increased automation through smart contracts, and enhanced investor accessibility across asset classes.

Related Important Terms

Tokenized Equities

Tokenized equities on digital asset marketplaces enable fractional ownership and 24/7 trading, offering increased liquidity and accessibility compared to traditional stock exchanges. These platforms leverage blockchain technology to enhance transparency, reduce settlement times, and lower transaction costs in equity trading.

Security Token Offerings (STO)

Security Token Offerings (STOs) blend traditional stock exchange regulations with blockchain technology, offering digital assets that represent ownership while providing compliance and investor protection. Unlike conventional stock exchanges, digital asset marketplaces facilitate real-time trading of STOs with enhanced transparency, reduced settlement times, and programmable rights embedded into the tokens.

Decentralized Exchange (DEX)

Decentralized exchanges (DEX) operate on blockchain technology, enabling peer-to-peer cryptocurrency trading without intermediaries, contrasting with traditional stock exchanges that rely on centralized authorities and regulatory frameworks. DEX platforms enhance transparency, reduce counterparty risk, and provide users with greater control over their assets through smart contracts and decentralized liquidity pools.

Asset Fractionalization

Stock exchanges primarily trade whole shares of listed securities, while digital asset marketplaces enable asset fractionalization, allowing investors to buy and sell portions of digital tokens representing fractions of real-world assets. This fractional ownership increases liquidity, lowers investment barriers, and expands access to diverse asset classes such as real estate, art, and collectibles through blockchain technology.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) revolutionize digital asset marketplaces by enabling decentralized trading through algorithmic liquidity pools, eliminating traditional order books found on stock exchanges. Unlike stock exchanges that rely on centralized intermediaries, AMMs facilitate continuous market liquidity and 24/7 trading for cryptocurrencies and tokens, enhancing accessibility and efficiency in digital finance.

Cross-Listing (Traditional & Digital Markets)

Cross-listing enables companies to simultaneously list their shares on traditional stock exchanges and digital asset marketplaces, enhancing liquidity and broadening investor access across conventional equities and tokenized assets. This dual presence facilitates price discovery and regulatory arbitrage, leveraging the established infrastructure of stock exchanges alongside the innovative capabilities of blockchain-based platforms.

Digital Custody Solutions

Digital custody solutions in digital asset marketplaces provide enhanced security through multi-signature wallets and decentralized key management, reducing risks of theft and fraud compared to traditional stock exchange custodians. These solutions enable real-time asset tracking and instant settlement, offering greater transparency and efficiency for institutional investors handling cryptocurrencies and tokenized securities.

On-Chain Settlement

Stock exchanges traditionally rely on centralized clearinghouses for trade settlement, often resulting in delayed transaction finality, whereas digital asset marketplaces utilize on-chain settlement protocols that enable real-time, immutable recording of trades on a blockchain. On-chain settlement enhances transparency, reduces counterparty risk, and streamlines liquidity management by eliminating the need for intermediaries and manual reconciliation processes.

Market Microstructure Parity

Market microstructure parity in finance highlights how both stock exchanges and digital asset marketplaces facilitate price discovery, liquidity provision, and order execution through similar protocols despite differing asset classes and trading technologies. Analyzing bid-ask spreads, order book dynamics, and transaction costs reveals converging mechanisms ensuring efficient market functioning across traditional securities and blockchain-based tokens.

Regulated Virtual Asset Service Provider (VASP)

Regulated Virtual Asset Service Providers (VASPs) operate with stringent compliance standards, ensuring secure and transparent transactions within digital asset marketplaces, contrasting with traditional stock exchanges that primarily facilitate trading of equities under established financial regulations. VASPs integrate blockchain technology and anti-money laundering (AML) protocols to provide legitimacy and investor protection in the rapidly evolving digital finance landscape.

Stock Exchange vs Digital Asset Marketplace Infographic

industrydif.com

industrydif.com