Private equity involves acquiring significant or controlling stakes in established companies to drive growth and increase value through strategic management. Venture debt provides startups and early-stage companies with non-dilutive capital, typically alongside equity financing, allowing them to extend their runway without giving up ownership. Both financing options cater to different risk profiles and growth stages, making them suitable for distinct investment strategies in the financial landscape.

Table of Comparison

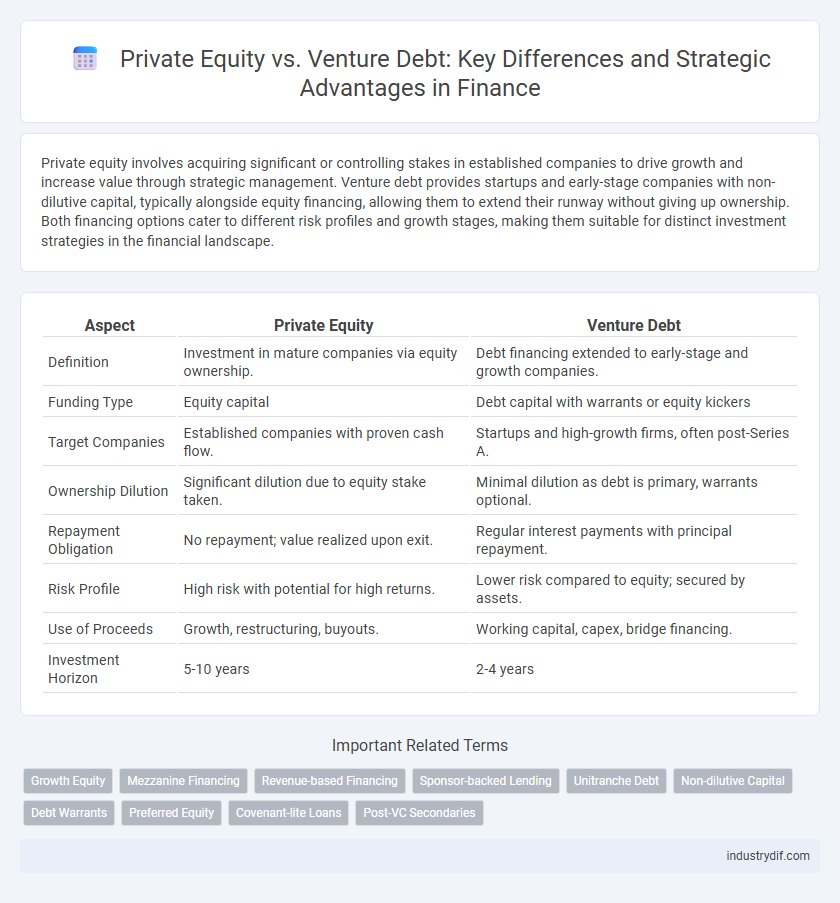

| Aspect | Private Equity | Venture Debt |

|---|---|---|

| Definition | Investment in mature companies via equity ownership. | Debt financing extended to early-stage and growth companies. |

| Funding Type | Equity capital | Debt capital with warrants or equity kickers |

| Target Companies | Established companies with proven cash flow. | Startups and high-growth firms, often post-Series A. |

| Ownership Dilution | Significant dilution due to equity stake taken. | Minimal dilution as debt is primary, warrants optional. |

| Repayment Obligation | No repayment; value realized upon exit. | Regular interest payments with principal repayment. |

| Risk Profile | High risk with potential for high returns. | Lower risk compared to equity; secured by assets. |

| Use of Proceeds | Growth, restructuring, buyouts. | Working capital, capex, bridge financing. |

| Investment Horizon | 5-10 years | 2-4 years |

Overview of Private Equity and Venture Debt

Private equity involves investing in private companies through equity stakes, often targeting mature businesses seeking growth, expansion, or restructuring. Venture debt provides loan financing to early-stage or growth-stage companies, supplementing equity funding without diluting ownership. Both financing options serve distinct roles in corporate capital structures, with private equity emphasizing ownership and control, while venture debt focuses on debt repayment with interest.

Key Differences Between Private Equity and Venture Debt

Private equity involves acquiring significant ownership stakes in mature companies, often aiming for control and long-term growth, while venture debt provides non-dilutive capital to early-stage startups, complementing equity financing. Private equity typically requires substantial equity commitments and targets profitable firms with stable cash flows, whereas venture debt offers flexible loans with warrants, focusing on high-growth, pre-revenue companies. The risk profile differs as private equity investors assume operational and market risks through ownership, whereas venture debt lenders primarily face credit risk with defined repayment terms.

Investment Structures and Terms

Private equity investments typically involve acquiring significant equity stakes with control rights and longer lock-in periods, often structured through preferred shares or limited partnerships. Venture debt, in contrast, provides non-dilutive capital through debt instruments like warrants or convertible notes, featuring shorter maturities and covenant-based agreements. The distinct investment terms reflect differing risk profiles, with private equity emphasizing ownership and governance, while venture debt prioritizes downside protection and repayment schedules.

Typical Investors and Borrowers

Private equity investors typically include institutional investors, pension funds, and high-net-worth individuals seeking substantial equity stakes in established companies with growth potential. Venture debt lenders primarily consist of specialized venture banks and debt funds targeting early-stage startups that have already secured venture capital funding. Borrowers in private equity often look for long-term capital infusion to scale operations, while venture debt borrowers seek flexible, non-dilutive financing to extend their runway between equity rounds.

Risk and Return Profiles

Private equity investments typically exhibit higher risk due to substantial capital commitments in established companies, but they offer significant return potential through equity appreciation and operational improvements. Venture debt presents a lower risk profile by providing secured loans to startups, yet it yields more modest returns primarily via interest payments and warrants. Understanding these differing risk-return dynamics helps investors balance portfolio diversification and capital allocation strategies effectively.

Impact on Company Ownership and Control

Private equity investments typically result in significant ownership dilution and grant investors substantial control rights, including board seats and veto powers, directly influencing company decisions. Venture debt allows companies to raise capital without substantial equity dilution, preserving existing ownership structures and control for founders and early investors. This financing approach offers growth capital while minimizing interference in strategic management, aligning with companies seeking to maintain autonomy.

Use Cases: When to Choose Private Equity vs Venture Debt

Private equity is ideal for established companies seeking significant capital infusion to drive expansion, acquisitions, or restructuring, often in exchange for equity and control. Venture debt suits early-stage startups requiring growth capital without immediate equity dilution, typically supplementing venture capital rounds for operational expenses or working capital. Choosing between the two depends on the company's lifecycle, funding needs, and willingness to dilute ownership or assume debt obligations.

Due Diligence and Underwriting Processes

Due diligence in private equity involves comprehensive financial, legal, and operational assessments to evaluate risk and value, often requiring detailed scrutiny of historical performance and management quality. Venture debt underwriting emphasizes assessing the startup's growth potential, cash flow projections, and the likelihood of future equity rounds, focusing on risk mitigation through covenant structures and collateral. Both processes rely on rigorous data analysis, but private equity conducts deeper asset valuation while venture debt prioritizes liquidity and exit strategies.

Exit Strategies and Timelines

Private equity investments typically pursue exit strategies such as initial public offerings (IPOs) or strategic sales within a 5 to 7-year timeline, aiming for significant control and value creation. Venture debt, often used by startups alongside equity, usually expects repayment or exit within 2 to 4 years through refinancing events or acquisitions without diluting ownership. The timing and nature of exits in private equity and venture debt directly impact returns and risk profiles for investors and entrepreneurs.

Recent Trends in Private Equity and Venture Debt

Recent trends in private equity highlight increased fundraising activities and a focus on technology and healthcare sectors, with dry powder reaching record highs globally. Venture debt is gaining traction as startups seek non-dilutive capital, supported by low interest rates and flexible terms, especially in late-stage funding rounds. Data from 2023 shows venture debt deals growing at a 15% annual rate, reflecting its rising role as a complement to traditional venture capital financing.

Related Important Terms

Growth Equity

Growth equity bridges the gap between venture capital and private equity by providing minority capital to mature startups with proven revenue models, enabling accelerated expansion without relinquishing control. Unlike venture debt, which involves loans secured against future revenues or assets, growth equity offers equity stakes, aligning investor returns with company valuation growth and minimizing repayment burdens.

Mezzanine Financing

Mezzanine financing serves as a hybrid instrument blending private equity and debt features, typically subordinated and positioned between senior debt and equity in the capital structure, providing growth capital with less dilution than pure equity. Unlike venture debt, mezzanine financing often includes equity kickers or warrants, facilitating higher returns for investors and is commonly used in leveraged buyouts and expansion stages rather than early-stage startups.

Revenue-based Financing

Revenue-based financing offers a flexible alternative to traditional private equity and venture debt by allowing startups to repay capital through a fixed percentage of ongoing gross revenues. This model aligns investor returns with company performance, reducing dilution and providing founders with growth capital without surrendering significant equity or incurring fixed debt obligations.

Sponsor-backed Lending

Sponsor-backed lending in private equity involves loans secured by established portfolio companies with predictable cash flows, offering lower risk and often larger deal sizes compared to venture debt, which targets early-stage startups with higher growth potential but increased risk and limited collateral. Private equity sponsors leverage sponsor-backed lending to optimize capital structure and maintain equity upside, while venture debt acts as a complement to equity financing in venture-backed companies, enabling extended runway without immediate dilution.

Unitranche Debt

Unitranche debt combines senior and subordinated debt into a single loan facility, offering private equity firms a streamlined financing solution with faster execution and fewer covenants compared to traditional debt structures. Venture debt, typically used by startups, complements equity financing without diluting ownership, whereas unitranche debt provides private equity-backed companies with flexible capital that blends the benefits of both senior and mezzanine financing.

Non-dilutive Capital

Private equity typically involves equity ownership and can dilute existing shareholders' stakes, whereas venture debt provides non-dilutive capital, allowing startups to raise funds without giving up equity. Venture debt is often favored by companies seeking growth capital while preserving ownership control and minimizing shareholder dilution.

Debt Warrants

Debt warrants in private equity often provide investors with equity upside by allowing the purchase of shares at a predetermined price, enhancing returns alongside debt repayment. Venture debt typically includes warrants as sweeteners to compensate for higher risk, giving lenders potential participation in the startup's equity growth without immediate dilution.

Preferred Equity

Preferred equity in private equity typically offers investors priority in dividend payments and liquidation proceeds, providing a more secure position compared to venture debt, which involves fixed interest payments and eventual repayment of principal. Unlike venture debt that adds debt to a company's balance sheet, preferred equity enhances capital structure without increasing leverage, aligning investor returns with company growth while mitigating risk.

Covenant-lite Loans

Covenant-lite loans in private equity offer fewer restrictions, providing borrowers greater operational flexibility compared to venture debt, which typically includes more stringent covenants to protect lenders. This difference affects risk profiles, with covenant-lite loans often favored in buyouts while venture debt remains critical for early-stage company growth with tighter monitoring.

Post-VC Secondaries

Post-VC secondaries provide liquidity options by enabling private equity investors to buy stakes in later-stage startups, contrasting with venture debt that offers non-dilutive capital as a bridge between funding rounds. This secondary market facilitates portfolio diversification and risk mitigation for private equity firms while supporting growth without immediate equity dilution for startups.

Private equity vs Venture debt Infographic

industrydif.com

industrydif.com