Traditional underwriting relies on detailed risk assessments and individual policy evaluations, which can be time-consuming and costly. Parametric insurance offers a streamlined alternative by triggering payouts based on predefined events or parameters, such as natural disaster indices, enabling faster claims processing. This model reduces administrative expenses and provides greater transparency, benefiting both insurers and policyholders.

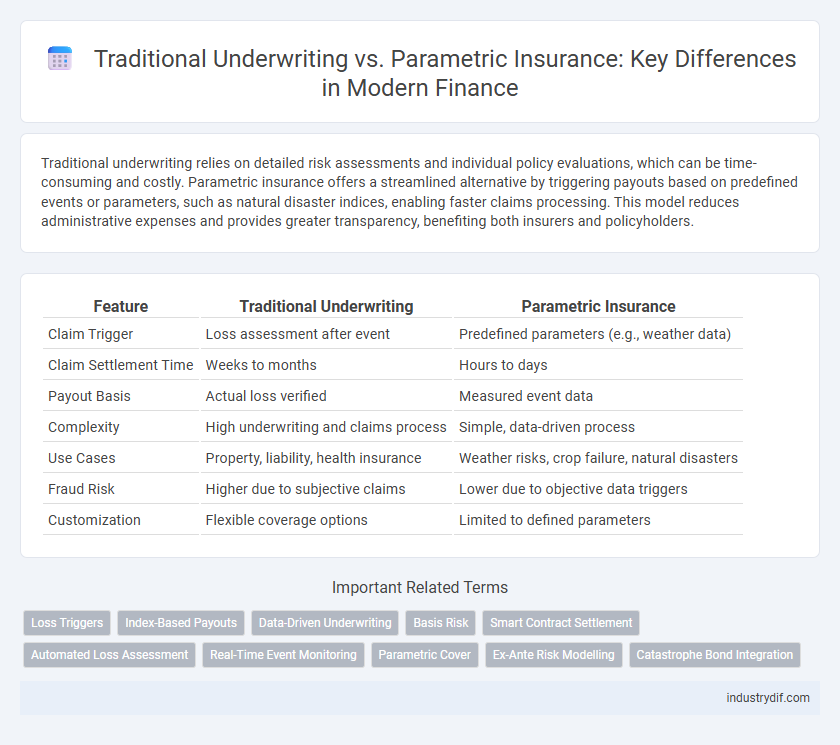

Table of Comparison

| Feature | Traditional Underwriting | Parametric Insurance |

|---|---|---|

| Claim Trigger | Loss assessment after event | Predefined parameters (e.g., weather data) |

| Claim Settlement Time | Weeks to months | Hours to days |

| Payout Basis | Actual loss verified | Measured event data |

| Complexity | High underwriting and claims process | Simple, data-driven process |

| Use Cases | Property, liability, health insurance | Weather risks, crop failure, natural disasters |

| Fraud Risk | Higher due to subjective claims | Lower due to objective data triggers |

| Customization | Flexible coverage options | Limited to defined parameters |

Introduction to Insurance Underwriting Models

Traditional underwriting relies on detailed risk assessment using historical data, individual policy evaluations, and personalized risk factors to determine premiums and coverage terms. Parametric insurance utilizes predefined triggers based on measurable parameters, such as natural disaster indices or weather data, enabling faster claims processing without complex loss adjustment. Comparing these models highlights the trade-off between accuracy and efficiency in risk transfer mechanisms within financial insurance frameworks.

Defining Traditional Underwriting in Finance

Traditional underwriting in finance involves the comprehensive assessment of risk by analyzing an individual or entity's detailed financial history, creditworthiness, and other relevant factors to determine insurance eligibility and premium rates. This process relies heavily on historical data evaluation, detailed paperwork, and expert judgment to evaluate potential losses. It contrasts with parametric insurance by focusing on subjective risk evaluation rather than predefined triggers or indices.

Understanding Parametric Insurance Explained

Parametric insurance is a modern risk transfer solution that pays out predefined amounts based on objective, measurable triggers such as weather data or seismic activity, rather than traditional claims assessments. Unlike traditional underwriting, which involves time-consuming loss evaluations and documentation, parametric insurance delivers faster, more transparent payouts, reducing administrative costs and improving liquidity for policyholders. This approach is particularly effective for managing risks like natural disasters, where rapid financial response is critical.

Key Differences: Traditional vs Parametric Insurance

Traditional underwriting involves evaluating individual risk factors through detailed assessments and historical data to determine insurance premiums, while parametric insurance relies on predefined triggers such as weather events or natural disasters to automatically pay out fixed claims. Parametric insurance offers faster claim settlements and reduced administrative costs compared to the often lengthy and subjective traditional underwriting process. This shift enhances transparency and predictability for policyholders by tying payouts directly to measurable parameters rather than subjective loss evaluations.

Risk Assessment: Methods and Implications

Traditional underwriting relies on detailed individual assessments, using historical data and credit scores to evaluate risk, ensuring tailored policy pricing but often resulting in longer processing times. Parametric insurance utilizes predefined triggers based on measurable parameters, such as weather events or financial indices, enabling quicker payouts but may lead to basis risk where the payout does not perfectly match the actual loss. The choice between these methods impacts risk transfer efficiency, premium accuracy, and claims handling in financial services.

Policy Structure and Claims Processes

Traditional underwriting relies on individualized risk assessment and detailed policy terms, resulting in customized coverage and a claims process that involves thorough loss verification and adjustment. Parametric insurance offers preset coverage triggered by predefined parameters such as weather data or seismic readings, enabling rapid, automatic claim payouts without the need for damage assessment. This streamlined policy structure and efficient claim process reduce administrative costs and accelerate indemnity, especially useful for natural disaster coverage.

Advantages and Limitations of Traditional Underwriting

Traditional underwriting offers precise risk assessment by evaluating individual client data and historical loss experience, enabling tailored premium pricing and risk mitigation strategies. It provides comprehensive coverage with detailed policy terms and conditions that address specific risks, but the process is often time-consuming, costly, and reliant on complex paperwork and manual review. Limitations include slower claims settlements due to damage verification and potential biases in risk evaluation, reducing scalability compared to parametric insurance solutions.

Benefits and Challenges of Parametric Insurance

Parametric insurance offers swift claim settlements by triggering payouts based on predefined event parameters, reducing administrative costs and minimizing disputes compared to traditional underwriting processes that rely on loss assessments. Challenges include basis risk, where the payout may not fully cover actual losses, and the need for accurate, transparent data sources to determine triggering events. Despite these hurdles, parametric insurance enhances financial resilience by providing transparent, predictable coverage and facilitating faster liquidity in response to catastrophic events.

Industry Use Cases: When Each Model Excels

Traditional underwriting excels in sectors requiring detailed risk assessment such as commercial real estate, healthcare, and automotive insurance, where historical data and individual risk profiles drive premium calculations. Parametric insurance is highly effective in industries vulnerable to quantifiable events like agriculture, energy, and natural disaster coverage, offering rapid payouts based on predefined triggers such as weather conditions or seismic activity. Both models enhance risk management but serve distinct use cases: traditional underwriting provides customized risk evaluation while parametric insurance ensures swift, objective claim settlements.

Future Trends in Insurance Underwriting

Future trends in insurance underwriting emphasize the integration of parametric insurance models, leveraging real-time data and IoT technology to enable rapid, objective claim settlements that reduce administrative costs. Traditional underwriting continues to evolve with advanced machine learning algorithms and predictive analytics, enhancing risk assessment accuracy and personalized policy pricing. The convergence of these approaches anticipates a hybrid model where automated, data-driven processes coexist with expert judgment, driving efficiency and customer-centric innovation in the insurance industry.

Related Important Terms

Loss Triggers

Traditional underwriting relies on detailed individual risk assessments and loss history to determine coverage, while parametric insurance uses predefined, objective loss triggers such as specific weather conditions or seismic measurements. Parametric insurance enables faster claims payouts by activating payments based on the occurrence of these quantifiable events, bypassing the need for claims adjustment and loss verification.

Index-Based Payouts

Index-based payouts in parametric insurance offer swift, transparent settlements by triggering payments based on predefined indices like weather data or catastrophe parameters, eliminating the need for loss assessment inherent in traditional underwriting. This approach reduces administrative costs and claim disputes, enhancing efficiency compared to conventional indemnity insurance where payouts depend on actual loss verification.

Data-Driven Underwriting

Traditional underwriting relies heavily on historical loss data and subjective risk assessments to evaluate potential policyholders, often causing delays and increased costs. Parametric insurance employs real-time data and predefined triggers, enabling faster claims processing and more accurate risk pricing through advanced analytics and automated evaluations.

Basis Risk

Traditional underwriting assesses individual risk factors and policy conditions, often resulting in basis risk due to delays and claim disputes when actual losses vary from expected outcomes. Parametric insurance minimizes basis risk by using predefined, objective triggers like weather indices or seismic activity data, enabling faster payouts and greater transparency in financial risk management.

Smart Contract Settlement

Smart contract settlement in parametric insurance automates claims processing by triggering payouts based on predefined data parameters, reducing human error and speeding up transactions compared to traditional underwriting methods reliant on manual assessment and documentation. This blockchain-enabled approach enhances transparency and efficiency, enabling faster risk transfer and lower operational costs in financial insurance services.

Automated Loss Assessment

Traditional underwriting relies on manual assessment of claims resulting in slower loss verification, whereas parametric insurance uses automated, data-driven triggers like weather sensors or financial indices to expedite loss assessment and payouts. Automated loss assessment in parametric insurance reduces operational costs and accelerates claim settlements, enhancing efficiency and customer satisfaction in financial risk management.

Real-Time Event Monitoring

Traditional underwriting relies on historical data and manual risk assessment methods, resulting in slower response times and delayed claim settlements. Parametric insurance leverages real-time event monitoring and predefined triggers, enabling instant payouts and enhanced efficiency in managing financial risks.

Parametric Cover

Parametric insurance provides rapid payouts based on predefined triggers such as weather data or natural disaster metrics, eliminating the need for lengthy claims assessments common in traditional underwriting. By leveraging real-time data and automated processes, parametric cover enhances financial resilience and liquidity for businesses exposed to specific risks.

Ex-Ante Risk Modelling

Traditional underwriting relies heavily on historical loss data and detailed individual assessments to predict risk, which can result in lengthy approval times and subjective estimations. Parametric insurance uses pre-defined triggers based on measurable indices such as weather data or economic indicators, enabling faster payouts and more transparent ex-ante risk modeling.

Catastrophe Bond Integration

Traditional underwriting relies on detailed risk assessment and loss estimation, while parametric insurance uses predefined triggers based on measurable parameters, enabling faster payouts. Catastrophe bond integration enhances parametric insurance by transferring extreme event risks to capital markets, improving liquidity and risk diversification for insurers and investors.

Traditional Underwriting vs Parametric Insurance Infographic

industrydif.com

industrydif.com