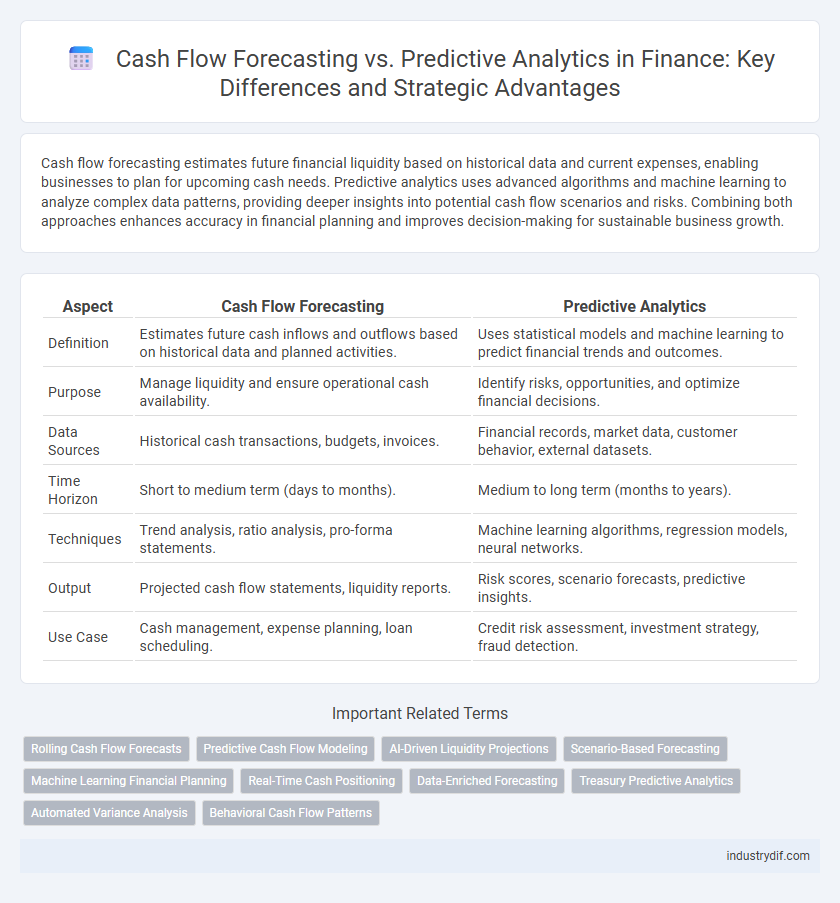

Cash flow forecasting estimates future financial liquidity based on historical data and current expenses, enabling businesses to plan for upcoming cash needs. Predictive analytics uses advanced algorithms and machine learning to analyze complex data patterns, providing deeper insights into potential cash flow scenarios and risks. Combining both approaches enhances accuracy in financial planning and improves decision-making for sustainable business growth.

Table of Comparison

| Aspect | Cash Flow Forecasting | Predictive Analytics |

|---|---|---|

| Definition | Estimates future cash inflows and outflows based on historical data and planned activities. | Uses statistical models and machine learning to predict financial trends and outcomes. |

| Purpose | Manage liquidity and ensure operational cash availability. | Identify risks, opportunities, and optimize financial decisions. |

| Data Sources | Historical cash transactions, budgets, invoices. | Financial records, market data, customer behavior, external datasets. |

| Time Horizon | Short to medium term (days to months). | Medium to long term (months to years). |

| Techniques | Trend analysis, ratio analysis, pro-forma statements. | Machine learning algorithms, regression models, neural networks. |

| Output | Projected cash flow statements, liquidity reports. | Risk scores, scenario forecasts, predictive insights. |

| Use Case | Cash management, expense planning, loan scheduling. | Credit risk assessment, investment strategy, fraud detection. |

Introduction to Cash Flow Forecasting and Predictive Analytics

Cash flow forecasting involves estimating future cash inflows and outflows to ensure liquidity and manage operational needs effectively. Predictive analytics uses historical data, statistical algorithms, and machine learning to identify patterns and predict future financial outcomes with higher accuracy. Combining cash flow forecasting with predictive analytics enhances financial planning by providing deeper insights into cash management and risk mitigation.

Key Differences Between Cash Flow Forecasting and Predictive Analytics

Cash flow forecasting projects future liquidity by analyzing historical financial data and expected inflows and outflows, emphasizing short-term cash management and budget adherence. Predictive analytics utilizes advanced statistical models and machine learning algorithms to identify patterns and trends, enabling proactive decision-making across broader financial scenarios beyond immediate cash flow. The primary difference lies in cash flow forecasting's focus on precise cash availability versus predictive analytics' capability to uncover deeper insights and forecast various financial outcomes.

Core Principles of Cash Flow Forecasting

Cash flow forecasting relies on historical financial data and payment patterns to project future cash inflows and outflows accurately. It centers on liquidity management by estimating timing and amounts of cash movements, allowing businesses to maintain solvency and meet obligations. Core principles include consistency in data input, periodic updates, scenario analysis, and alignment with operational and strategic plans to ensure reliable cash position insights.

Understanding Predictive Analytics in Finance

Predictive analytics in finance leverages historical data, statistical algorithms, and machine learning techniques to forecast future financial performance, enabling more accurate cash flow predictions compared to traditional cash flow forecasting methods. This approach identifies patterns and trends in large datasets, improving risk assessment, budgeting, and investment decisions. Incorporating predictive analytics enhances financial planning by providing dynamic, data-driven insights that adapt to market fluctuations and economic changes.

Data Sources Used in Cash Flow Forecasting vs Predictive Analytics

Cash flow forecasting primarily relies on historical financial statements, accounts receivable and payable data, and cash transaction records to project short-term liquidity needs. Predictive analytics integrates diverse data sources, including macroeconomic indicators, market trends, customer behavior patterns, and external variables like interest rates and commodity prices, to generate more comprehensive and forward-looking financial insights. The combination of structured internal data for cash flow forecasting with unstructured external data in predictive analytics enhances accuracy and strategic financial planning.

Technology Adoption in Cash Flow Management

Cash flow forecasting relies on historical data and trend analysis to project future cash inflows and outflows, while predictive analytics leverages machine learning algorithms and real-time data to provide more accurate and dynamic financial predictions. Advanced technologies like AI-driven software and cloud-based platforms are driving the adoption of predictive analytics in cash flow management, enabling businesses to detect patterns, mitigate risks, and optimize liquidity with greater precision. The integration of predictive analytics tools within enterprise resource planning (ERP) systems enhances decision-making by offering scenario analysis and automated insights, transforming traditional forecasting methods.

Accuracy and Reliability: Forecasting vs Predictive Models

Cash flow forecasting relies on historical financial data and trend analysis to estimate future cash inflows and outflows, offering moderate accuracy but limited adaptability to sudden market changes. Predictive analytics employs advanced machine learning algorithms and real-time data integration, enhancing accuracy and reliability by identifying complex patterns and anticipating unforeseen financial shifts. Consequently, predictive models provide more dynamic and precise cash flow predictions compared to traditional forecasting methods, crucial for strategic financial planning and risk management.

Impact on Financial Decision-Making

Cash flow forecasting provides businesses with projections of future inflows and outflows based on historical data and current trends, enabling short-term liquidity management and operational planning. Predictive analytics leverages advanced algorithms and machine learning to analyze large datasets, uncover patterns, and generate more accurate, dynamic financial predictions that inform strategic decision-making. Integrating predictive analytics with cash flow forecasting enhances financial decision-making by improving risk assessment, optimizing capital allocation, and supporting proactive responses to market fluctuations.

Challenges and Limitations of Each Approach

Cash flow forecasting often struggles with accuracy due to reliance on historical data and static assumptions, which fail to account for sudden market shifts and operational changes. Predictive analytics faces challenges in data quality and integration, requiring extensive real-time data inputs and advanced algorithms that can be resource-intensive and complex to implement. Both approaches are limited by external factors such as economic volatility and regulatory changes, demanding continuous updates and expert interpretation to maintain reliability.

Future Trends in Cash Flow Forecasting and Predictive Analytics

Future trends in cash flow forecasting emphasize the integration of artificial intelligence and machine learning models to enhance accuracy and real-time data analysis. Predictive analytics leverages big data and advanced algorithms to provide deeper insights into cash flow patterns, enabling proactive financial decision-making. The convergence of these technologies supports dynamic scenario planning and automated anomaly detection, optimizing liquidity management for businesses.

Related Important Terms

Rolling Cash Flow Forecasts

Rolling cash flow forecasts continuously update financial projections by incorporating the latest transaction data and trends, enabling businesses to maintain real-time liquidity visibility. Predictive analytics enhances these forecasts by applying machine learning algorithms to identify patterns and anticipate cash flow fluctuations, improving accuracy and decision-making.

Predictive Cash Flow Modeling

Predictive cash flow modeling leverages advanced machine learning algorithms and historical financial data to generate highly accurate forecasts, enabling businesses to anticipate cash inflows and outflows with greater precision. This predictive analytics approach surpasses traditional cash flow forecasting by identifying patterns and anomalies, improving decision-making and optimizing working capital management.

AI-Driven Liquidity Projections

AI-driven liquidity projections leverage machine learning algorithms to enhance cash flow forecasting accuracy by analyzing historical financial data, market trends, and real-time variables. This integration of predictive analytics enables finance teams to anticipate liquidity needs, optimize working capital management, and mitigate cash shortages effectively.

Scenario-Based Forecasting

Scenario-based forecasting enhances cash flow forecasting by incorporating multiple financial outcomes based on varying economic conditions, allowing businesses to anticipate liquidity needs with greater precision. Predictive analytics leverages historical data and machine learning algorithms to identify patterns, but scenario-based models specifically stress-test cash flow against potential market fluctuations for robust financial planning.

Machine Learning Financial Planning

Machine learning enhances cash flow forecasting by analyzing historical financial data, identifying patterns, and generating more accurate predictions of future cash inflows and outflows. Predictive analytics in financial planning leverages advanced algorithms and real-time data to optimize budgeting, allocate resources efficiently, and mitigate potential liquidity risks.

Real-Time Cash Positioning

Cash flow forecasting provides a projection of future cash inflows and outflows based on historical data and expected transactions, whereas predictive analytics uses advanced algorithms and machine learning to analyze real-time financial data for more accurate cash position insights. Real-time cash positioning enables businesses to make immediate liquidity decisions, optimize working capital, and mitigate risks by continuously monitoring actual cash flow dynamics.

Data-Enriched Forecasting

Cash flow forecasting enhanced with predictive analytics leverages historical financial data, market trends, and real-time inputs to generate more accurate and dynamic liquidity predictions. This data-enriched forecasting improves decision-making by identifying potential cash shortfalls and surpluses ahead of time, enabling proactive financial management.

Treasury Predictive Analytics

Treasury predictive analytics leverages advanced algorithms and historical cash flow data to enhance accuracy in cash flow forecasting, enabling proactive liquidity management and risk mitigation. By integrating real-time financial indicators and market trends, predictive analytics offers dynamic insights that surpass traditional forecasting models, optimizing treasury decision-making processes.

Automated Variance Analysis

Automated variance analysis in cash flow forecasting leverages predictive analytics to identify discrepancies between projected and actual cash flows in real time, enabling more accurate financial planning. This integration enhances decision-making by providing early warnings of potential liquidity issues through continuous data-driven adjustments.

Behavioral Cash Flow Patterns

Behavioral cash flow patterns in cash flow forecasting emphasize historical transaction trends and seasonal fluctuations to estimate future liquidity, while predictive analytics leverages machine learning algorithms to identify complex behavioral signals, enabling more accurate and dynamic cash flow predictions. Integrating behavioral data with predictive models enhances financial planning by anticipating cash flow variability driven by customer payment behaviors and market conditions.

Cash Flow Forecasting vs Predictive Analytics Infographic

industrydif.com

industrydif.com