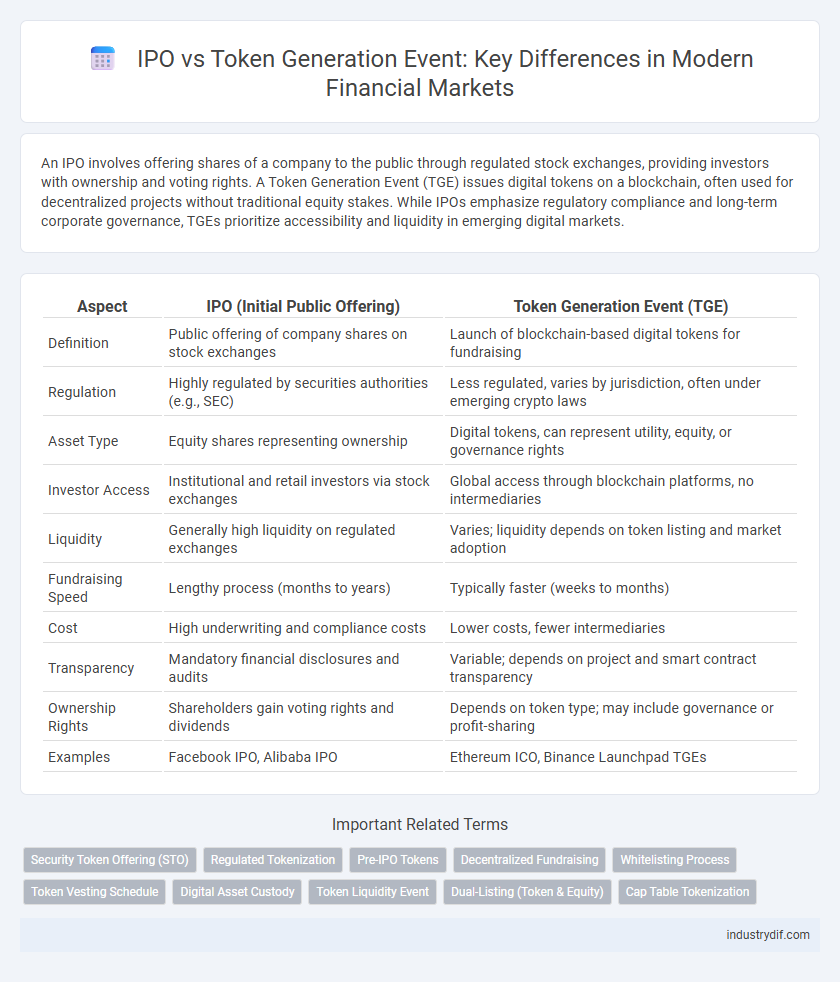

An IPO involves offering shares of a company to the public through regulated stock exchanges, providing investors with ownership and voting rights. A Token Generation Event (TGE) issues digital tokens on a blockchain, often used for decentralized projects without traditional equity stakes. While IPOs emphasize regulatory compliance and long-term corporate governance, TGEs prioritize accessibility and liquidity in emerging digital markets.

Table of Comparison

| Aspect | IPO (Initial Public Offering) | Token Generation Event (TGE) |

|---|---|---|

| Definition | Public offering of company shares on stock exchanges | Launch of blockchain-based digital tokens for fundraising |

| Regulation | Highly regulated by securities authorities (e.g., SEC) | Less regulated, varies by jurisdiction, often under emerging crypto laws |

| Asset Type | Equity shares representing ownership | Digital tokens, can represent utility, equity, or governance rights |

| Investor Access | Institutional and retail investors via stock exchanges | Global access through blockchain platforms, no intermediaries |

| Liquidity | Generally high liquidity on regulated exchanges | Varies; liquidity depends on token listing and market adoption |

| Fundraising Speed | Lengthy process (months to years) | Typically faster (weeks to months) |

| Cost | High underwriting and compliance costs | Lower costs, fewer intermediaries |

| Transparency | Mandatory financial disclosures and audits | Variable; depends on project and smart contract transparency |

| Ownership Rights | Shareholders gain voting rights and dividends | Depends on token type; may include governance or profit-sharing |

| Examples | Facebook IPO, Alibaba IPO | Ethereum ICO, Binance Launchpad TGEs |

Definition of IPO and Token Generation Event

An Initial Public Offering (IPO) refers to the process through which a private company offers its shares to the public on a stock exchange, enabling public investment and ownership. A Token Generation Event (TGE) is a crowdfunding mechanism in the blockchain space where digital tokens are created and sold to investors, often representing utility or governance rights rather than equity. While IPOs involve regulatory compliance and equity issuance, TGEs focus on decentralized funding through cryptographic assets.

Key Differences Between IPOs and TGEs

Initial Public Offerings (IPOs) and Token Generation Events (TGEs) differ primarily in regulatory frameworks, asset types, and investor access. IPOs involve selling equity shares in a company under strict securities regulations, providing investors ownership and voting rights, while TGEs offer blockchain-based tokens often representing utility or access in decentralized networks with less regulatory oversight. Furthermore, IPOs typically require substantial financial disclosures and longer timelines, whereas TGEs can be executed quickly, enabling broader global participation and liquidity through cryptocurrency markets.

Regulatory Oversight: IPOs vs Token Generation Events

IPOs operate under stringent regulatory oversight from bodies such as the SEC, requiring detailed disclosures, investor protections, and compliance with securities laws. In contrast, Token Generation Events (TGEs) often face a fragmented regulatory landscape, with varying degrees of scrutiny depending on jurisdiction and the classification of the token as a security or utility. This disparity in regulatory oversight impacts investor confidence, legal risks, and the overall market acceptance of these fundraising mechanisms.

Fundraising Mechanisms: Shares vs Tokens

IPO fundraising involves the sale of company shares to public investors, granting equity ownership and voting rights, whereas Token Generation Events (TGEs) raise capital by issuing digital tokens that may represent assets, utility, or governance within a blockchain ecosystem without conferring traditional equity. Shares in an IPO are regulated securities traded on stock exchanges, providing legal protections and valuation transparency, while tokens from TGEs often operate under varied regulatory frameworks and can fluctuate widely in utility and liquidity. Companies leveraging TGEs benefit from rapid capital access and global investor reach, whereas IPOs emphasize long-term investor confidence and regulatory compliance.

Investor Rights and Protections

Investors in an Initial Public Offering (IPO) receive regulated shareholder rights, including voting power, dividends, and protections under securities laws enforced by authorities like the SEC. In contrast, Token Generation Events (TGEs) often provide limited legal rights, with tokens typically classified as utility or security tokens lacking standardized investor protections. This disparity raises significant considerations regarding transparency, regulatory oversight, and enforceability of investor claims in TGEs compared to traditional IPO investments.

Market Accessibility and Participant Requirements

IPO market accessibility is often limited to institutional investors and accredited individuals due to stringent regulatory requirements, while Token Generation Events leverage blockchain technology to enable global participation with minimal entry barriers. IPOs typically impose higher capital requirements and extensive compliance procedures, whereas Token Generation Events allow smaller investments and offer broader democratization of market access. This fundamental difference drives diverse participant profiles and liquidity dynamics between traditional equity offerings and digital token sales.

Transparency and Disclosure Standards

IPO processes typically involve stringent transparency and disclosure standards regulated by government agencies like the SEC, requiring detailed financial statements and risk factors to protect investors. Token Generation Events (TGEs) often operate in less regulated environments, resulting in varied levels of transparency, with some projects providing limited or inconsistent disclosures compared to traditional IPOs. The disparity in regulatory oversight between IPOs and TGEs significantly impacts investor confidence and the perceived credibility of the offerings.

Valuation Methods in IPOs and TGEs

Valuation methods in IPOs primarily rely on fundamental analysis, including discounted cash flow (DCF), price-to-earnings (P/E) ratios, and comparable company analysis to determine fair market value based on historical financial performance and future earnings potential. Token Generation Events (TGEs) use market-driven metrics such as token utility, network adoption rates, and algorithmic models like venture capital valuation and token velocity to estimate value in highly speculative and volatile markets. While IPO valuations emphasize regulatory compliance and audited financials, TGE valuations often depend on community sentiment, tokenomics, and blockchain project fundamentals.

Risks and Challenges for Investors

Investors face significant risks in IPOs due to regulatory scrutiny, market volatility, and potential overvaluation, which can lead to price fluctuations post-listing. Token Generation Events (TGEs) present challenges such as lack of regulatory clarity, higher susceptibility to fraud, and limited investor protections compared to traditional securities. Evaluating the credibility, underlying assets, and compliance status is critical for mitigating risks in both financing methods.

Future Trends in Capital Raising: IPOs vs TGEs

Future trends in capital raising highlight a growing shift from traditional Initial Public Offerings (IPOs) to Token Generation Events (TGEs), driven by blockchain technology and increased investor accessibility. TGEs offer faster fundraising, fractional ownership, and global reach, contrasting with the regulatory complexity and longer timelines of IPOs. As decentralized finance (DeFi) evolves, the integration of tokenized assets is expected to redefine liquidity and market participation in capital markets.

Related Important Terms

Security Token Offering (STO)

Security Token Offerings (STOs) combine regulatory compliance with blockchain technology, offering tradable digital securities that provide investors with ownership rights and transparent asset-backed value, unlike traditional Initial Public Offerings (IPOs). STOs enhance liquidity and reduce intermediaries by leveraging smart contracts, making them a viable alternative to IPOs for raising capital within secure and regulated frameworks.

Regulated Tokenization

Regulated tokenization in Token Generation Events (TGEs) offers enhanced compliance with securities laws compared to traditional Initial Public Offerings (IPOs), enabling digital asset issuance on blockchain platforms with transparency and investor protection. Unlike IPOs, which require extensive regulatory approvals and centralized intermediaries, regulated TGEs facilitate decentralized fundraising while maintaining stringent AML/KYC protocols and smart contract-enforced governance.

Pre-IPO Tokens

Pre-IPO tokens offer early investors blockchain-based digital assets representing equity or utility rights before a company's formal public listing, enabling liquidity and fractional ownership unlike traditional IPO shares. These tokens can provide enhanced transparency, faster settlement, and access to a broader investor base, distinguishing them from conventional pre-IPO equity investments.

Decentralized Fundraising

Initial Public Offerings (IPOs) enable companies to raise capital by offering equity through regulated stock exchanges, ensuring investor protections but often involving lengthy compliance procedures. Token Generation Events (TGEs) leverage blockchain technology to facilitate decentralized fundraising by issuing digital tokens directly to investors, enabling faster liquidity and broader access while operating in a less regulated environment.

Whitelisting Process

The whitelisting process in an IPO involves stringent KYC and accreditation verification to ensure compliance with securities regulations and investor eligibility. In contrast, token generation events use blockchain-enabled whitelisting to automate identity verification and restrict participation to approved investors, enhancing transparency and security.

Token Vesting Schedule

Token Generation Events (TGEs) often include a structured token vesting schedule that gradually releases tokens to investors to prevent market flooding and align long-term incentives, while IPOs typically implement lock-up periods where shares cannot be sold for a fixed time post-listing. Vesting schedules in TGEs can range from cliff periods of several months to multi-year linear releases, whereas IPO lock-ups usually last 90 to 180 days, directly impacting liquidity and investor confidence in the emerging asset class.

Digital Asset Custody

Digital asset custody in IPOs involves traditional financial infrastructure and regulatory oversight to secure shares, while Token Generation Events (TGEs) leverage blockchain technology allowing decentralized custody solutions with enhanced transparency and real-time auditability. Institutional investors prioritize regulated custody providers for IPOs, whereas TGEs attract users favoring non-custodial wallets and smart contract-based asset management.

Token Liquidity Event

A Token Liquidity Event (TLE) offers immediate market access and trading opportunities for digital assets, contrasting traditional IPOs where liquidity is often delayed until after lock-up periods expire. TLEs enable decentralized trading and continuous price discovery, enhancing token holder flexibility and market responsiveness compared to conventional equity offerings.

Dual-Listing (Token & Equity)

Dual-listing through an IPO and Token Generation Event enables companies to access both traditional equity markets and blockchain-based token markets, enhancing capital-raising opportunities and investor access. This hybrid approach leverages regulatory frameworks for shares while utilizing blockchain for token liquidity and global reach, optimizing valuation and market depth in the evolving financial ecosystem.

Cap Table Tokenization

Cap table tokenization through a Token Generation Event (TGE) offers enhanced liquidity and fractional ownership compared to traditional IPOs, enabling real-time transfer and transparency of equity stakes on blockchain platforms. Unlike conventional IPO processes that rely on centralized intermediaries, tokenized cap tables streamline shareholder management and reduce administrative costs by automating governance and dividend distributions via smart contracts.

IPO vs Token Generation Event Infographic

industrydif.com

industrydif.com