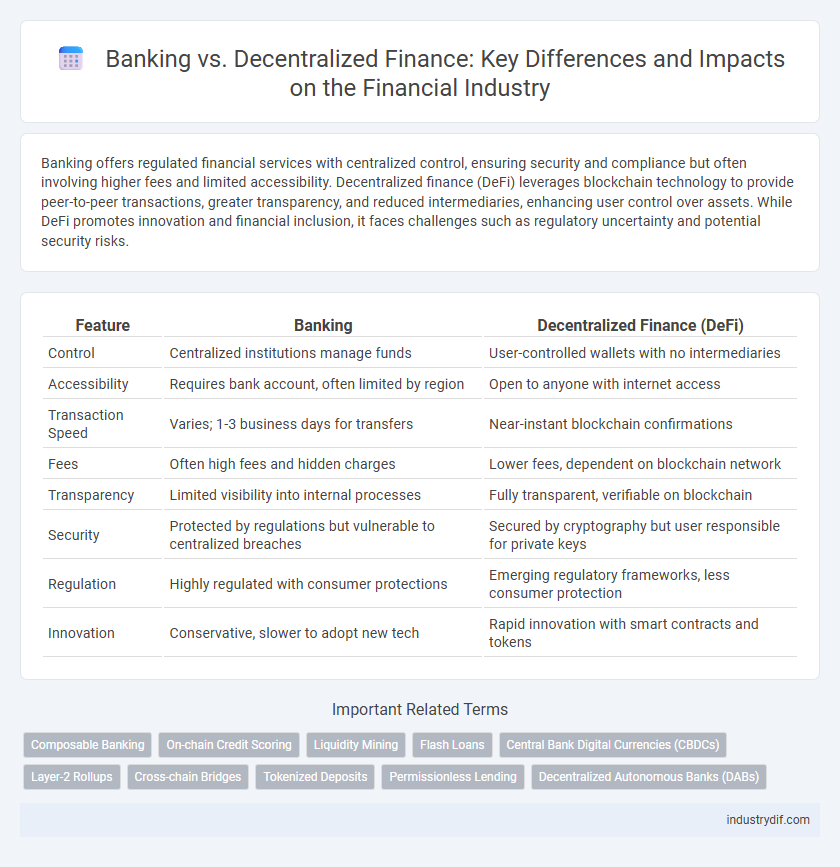

Banking offers regulated financial services with centralized control, ensuring security and compliance but often involving higher fees and limited accessibility. Decentralized finance (DeFi) leverages blockchain technology to provide peer-to-peer transactions, greater transparency, and reduced intermediaries, enhancing user control over assets. While DeFi promotes innovation and financial inclusion, it faces challenges such as regulatory uncertainty and potential security risks.

Table of Comparison

| Feature | Banking | Decentralized Finance (DeFi) |

|---|---|---|

| Control | Centralized institutions manage funds | User-controlled wallets with no intermediaries |

| Accessibility | Requires bank account, often limited by region | Open to anyone with internet access |

| Transaction Speed | Varies; 1-3 business days for transfers | Near-instant blockchain confirmations |

| Fees | Often high fees and hidden charges | Lower fees, dependent on blockchain network |

| Transparency | Limited visibility into internal processes | Fully transparent, verifiable on blockchain |

| Security | Protected by regulations but vulnerable to centralized breaches | Secured by cryptography but user responsible for private keys |

| Regulation | Highly regulated with consumer protections | Emerging regulatory frameworks, less consumer protection |

| Innovation | Conservative, slower to adopt new tech | Rapid innovation with smart contracts and tokens |

Overview of Traditional Banking Systems

Traditional banking systems rely on centralized institutions such as commercial banks, credit unions, and savings institutions that manage deposits, loans, and financial transactions through regulated frameworks. These systems depend on intermediaries to facilitate trust, ensure compliance with regulatory standards, and provide services including interest-bearing accounts, credit issuance, and payment processing. Central banks play a critical role in monetary policy implementation, liquidity management, and financial stability within traditional banking infrastructures.

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a blockchain-based financial system that operates without traditional intermediaries like banks, using smart contracts to automate transactions. It enables peer-to-peer lending, borrowing, trading, and earning interest on cryptocurrencies through decentralized applications (dApps). DeFi offers increased transparency, accessibility, and control over assets compared to conventional banking systems.

Core Principles: Centralization vs Decentralization

Traditional banking operates on a centralized model where financial institutions control transactions, maintain trust, and enforce regulations, ensuring security and regulatory compliance. Decentralized finance (DeFi) leverages blockchain technology to enable peer-to-peer transactions without intermediaries, promoting transparency, accessibility, and reduced costs. This core distinction between centralization and decentralization fundamentally reshapes control, risk distribution, and user empowerment in financial ecosystems.

Key Services: Banking Products vs DeFi Solutions

Traditional banking offers key services such as savings and checking accounts, loans, credit cards, and wealth management facilitated by centralized institutions subject to regulatory oversight. In contrast, decentralized finance (DeFi) solutions provide blockchain-based alternatives including peer-to-peer lending, automated market making, yield farming, and decentralized exchanges without intermediaries. While banking products emphasize security and customer protection, DeFi solutions prioritize transparency, accessibility, and programmable financial contracts through smart contracts.

Accessibility and Financial Inclusion

Traditional banking systems often require extensive documentation and credit history, limiting access for underbanked populations, whereas decentralized finance (DeFi) platforms leverage blockchain technology to provide borderless, permissionless financial services accessible via smartphones. DeFi eliminates intermediaries, reducing costs and entry barriers, enabling individuals without formal identification or credit scores to participate in lending, borrowing, and asset management. Consequently, decentralized finance promotes greater financial inclusion by extending services to unbanked and underprivileged communities worldwide.

Security Models: Risks and Safeguards

Traditional banking relies on centralized security protocols, including regulatory oversight, insured deposits, and robust fraud detection systems, which mitigate risks such as unauthorized access and financial misconduct. Decentralized finance (DeFi) operates on blockchain technology with transparency and immutability but exposes users to risks like smart contract vulnerabilities, rug pulls, and lack of formal regulatory protections. Security safeguards in DeFi include multi-signature wallets, decentralized governance, and third-party audits, yet the absence of centralized control necessitates heightened user vigilance and education to manage potential risks effectively.

Regulatory Compliance in Banking and DeFi

Banking institutions operate under stringent regulatory frameworks enforced by government authorities, ensuring compliance with anti-money laundering (AML), know your customer (KYC), and consumer protection laws. Decentralized Finance (DeFi) platforms, while innovative and borderless, often face regulatory uncertainty due to the absence of centralized control and varying jurisdictional laws. Enhanced regulatory compliance in DeFi is critical to fostering trust, legal clarity, and wider adoption in the financial ecosystem.

Transaction Speed and Costs Comparison

Traditional banking systems often involve intermediaries, resulting in slower transaction speeds and higher fees, especially for cross-border payments that can take several days and incur significant costs. Decentralized finance (DeFi) platforms leverage blockchain technology to enable near-instantaneous transactions with minimal fees, significantly reducing both time and expense. This efficiency arises from the elimination of middlemen and automation through smart contracts, offering a more cost-effective and faster alternative to conventional banking transactions.

Impact on Global Financial Ecosystem

Banking institutions traditionally centralize control over financial transactions, ensuring regulatory compliance and stability within global markets. Decentralized Finance (DeFi) leverages blockchain technology to enable peer-to-peer transactions, enhancing transparency, reducing intermediaries, and increasing accessibility across borders. The shift towards DeFi challenges conventional banking by promoting financial inclusion, lowering costs, and fostering innovation, ultimately transforming the global financial ecosystem's structure and efficiency.

Future Outlook: Banking and DeFi Integration

The future outlook for banking and DeFi integration involves the convergence of traditional financial institutions with blockchain-based decentralized platforms to enhance transparency, security, and accessibility. Innovations such as hybrid financial products, interoperable protocols, and regulatory frameworks are driving collaboration between banks and DeFi ecosystems. This integration aims to create a more inclusive financial system by leveraging the scalability of banking infrastructure alongside the trustless, automated capabilities of decentralized finance.

Related Important Terms

Composable Banking

Composable banking leverages modular financial services within decentralized finance (DeFi) to create flexible and customizable banking solutions, enabling seamless integration of traditional banking features with blockchain technology. This approach enhances interoperability, reduces costs, and accelerates innovation by allowing banks and fintechs to assemble tailored financial products from interoperable components.

On-chain Credit Scoring

On-chain credit scoring leverages blockchain data to assess borrower reliability transparently, contrasting traditional banking's reliance on centralized credit bureaus and opaque criteria. This decentralized approach provides real-time, immutable credit histories that enhance lending efficiency and financial inclusion within decentralized finance ecosystems.

Liquidity Mining

Liquidity mining in decentralized finance (DeFi) provides users with high yield opportunities by incentivizing token holders to supply liquidity through automated market makers, contrasting traditional banking where liquidity is managed by centralized institutions with lower interest returns. DeFi's liquidity mining enhances capital efficiency and transparency, leveraging smart contracts, while banking relies on intermediaries and regulatory frameworks that limit user control and accessibility.

Flash Loans

Flash loans in decentralized finance (DeFi) offer instant, uncollateralized borrowing by smart contracts, enabling rapid arbitrage and liquidation opportunities without traditional credit checks, contrasting sharply with conventional banking's reliance on credit assessments and collateral. This innovation disrupts traditional finance by providing seamless access to liquidity within a single blockchain transaction, enhancing market efficiency and democratizing lending access.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) offer a regulated digital alternative to traditional banking by enabling instant, secure transactions directly through central banks, reducing reliance on intermediaries. Unlike decentralized finance (DeFi) platforms, CBDCs maintain state-backed stability and monetary policy control, bridging digital innovation with conventional financial systems.

Layer-2 Rollups

Layer-2 rollups enhance decentralized finance (DeFi) by processing transactions off-chain, significantly increasing scalability and reducing fees compared to traditional banking systems. These solutions enable faster settlement and greater accessibility, challenging centralized banking by offering transparent, trustless financial services on blockchain networks.

Cross-chain Bridges

Cross-chain bridges enable seamless asset transfers between traditional banking infrastructures and decentralized finance (DeFi) networks, enhancing liquidity and interoperability. These bridges facilitate secure, real-time transactions across multiple blockchain protocols, reducing reliance on centralized intermediaries and expanding global financial access.

Tokenized Deposits

Tokenized deposits in decentralized finance (DeFi) offer increased transparency and faster settlement compared to traditional banking systems, leveraging blockchain technology to enable programmable and interoperable digital assets. While conventional banks rely on centralized ledgers and regulatory frameworks, DeFi platforms utilize smart contracts to facilitate peer-to-peer tokenized deposits that reduce intermediaries and operational costs.

Permissionless Lending

Permissionless lending in decentralized finance (DeFi) eliminates intermediaries, enabling direct peer-to-peer loans secured by smart contracts on blockchain platforms like Ethereum. Unlike traditional banking, which requires credit approval and regulatory compliance, DeFi lending offers greater accessibility, transparency, and faster settlement through automated protocols.

Decentralized Autonomous Banks (DABs)

Decentralized Autonomous Banks (DABs) leverage blockchain technology and smart contracts to provide transparent, permissionless financial services without traditional intermediaries, significantly reducing operational costs and enhancing security. Unlike conventional banks, DABs enable users to maintain control over their assets while accessing lending, borrowing, and liquidity functions governed by automated protocols within decentralized finance ecosystems.

Banking vs Decentralized Finance Infographic

industrydif.com

industrydif.com