Credit scores traditionally rely on financial history, payment patterns, and credit utilization to evaluate creditworthiness, whereas alternative data scoring incorporates non-traditional information such as utility payments, rental history, and social behavior. Alternative data scoring improves access to credit for individuals with limited or no credit history by providing a broader view of financial reliability. Financial institutions use these complementary methods to enhance risk assessment and expand lending opportunities.

Table of Comparison

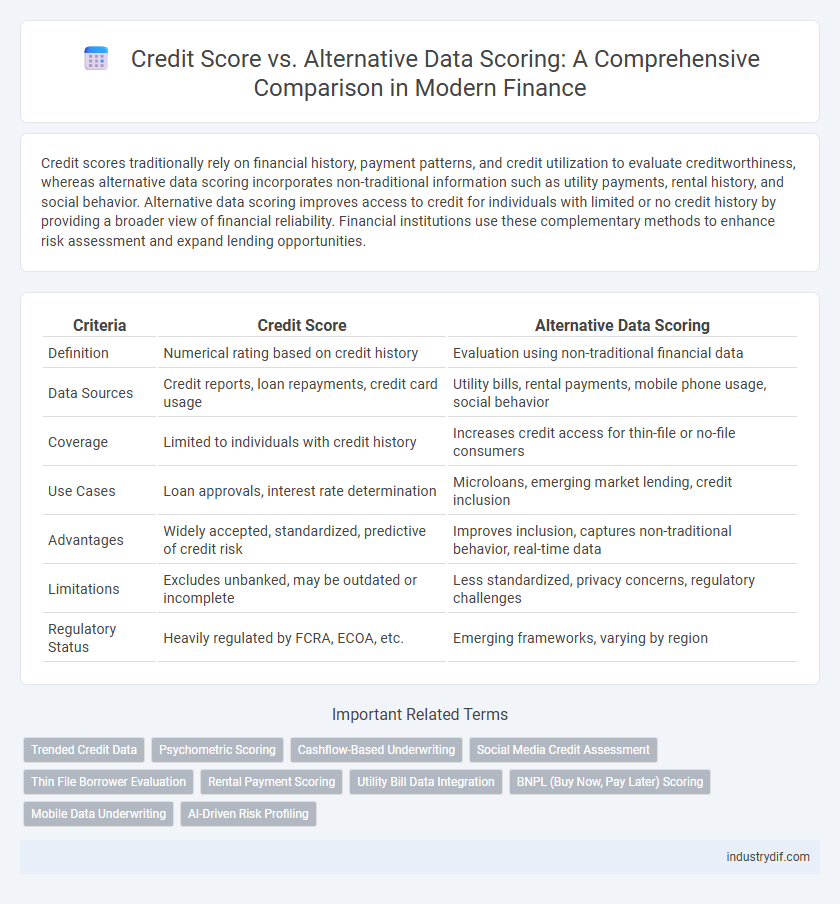

| Criteria | Credit Score | Alternative Data Scoring |

|---|---|---|

| Definition | Numerical rating based on credit history | Evaluation using non-traditional financial data |

| Data Sources | Credit reports, loan repayments, credit card usage | Utility bills, rental payments, mobile phone usage, social behavior |

| Coverage | Limited to individuals with credit history | Increases credit access for thin-file or no-file consumers |

| Use Cases | Loan approvals, interest rate determination | Microloans, emerging market lending, credit inclusion |

| Advantages | Widely accepted, standardized, predictive of credit risk | Improves inclusion, captures non-traditional behavior, real-time data |

| Limitations | Excludes unbanked, may be outdated or incomplete | Less standardized, privacy concerns, regulatory challenges |

| Regulatory Status | Heavily regulated by FCRA, ECOA, etc. | Emerging frameworks, varying by region |

Introduction to Credit Score and Alternative Data Scoring

Credit scores are numerical representations based on traditional financial data such as payment history, credit utilization, and length of credit history, used by lenders to evaluate creditworthiness. Alternative data scoring incorporates non-traditional information including utility payments, rental history, and social behavior to assess credit risk, especially for individuals with limited credit history. By integrating alternative data, financial institutions can expand credit access and enhance predictive accuracy for underserved populations.

Traditional Credit Scoring: Methods and Limitations

Traditional credit scoring primarily relies on credit history data, such as payment records, outstanding debt, length of credit history, types of credit accounts, and recent credit inquiries obtained from credit bureaus. This method faces limitations in accurately assessing creditworthiness for thin-file or no-file consumers, often excluding individuals without extensive credit histories. Consequently, traditional scoring models may lead to higher default risks and financial exclusion for underserved populations.

Understanding Alternative Data in Credit Assessment

Alternative data in credit assessment leverages non-traditional sources such as utility payments, rental history, and social media activity to provide a more comprehensive view of an individual's creditworthiness. This approach enhances the accuracy of credit scoring models by incorporating real-time behavioral and financial patterns that traditional credit scores may overlook. Integrating alternative data helps lenders better assess risk, especially for underbanked or thin-file borrowers, leading to more inclusive and precise credit evaluations.

Key Differences: Credit Score vs. Alternative Data Scoring

Traditional credit scores rely primarily on historical credit data such as payment history, outstanding debt, and credit utilization ratios, while alternative data scoring incorporates non-traditional information including utility payments, rental history, and social media activity. Credit scores provide a standardized numerical value used by lenders to assess creditworthiness, whereas alternative data scoring offers a more comprehensive view of an individual's financial behavior, especially for those with limited or no credit history. The integration of alternative data scoring can increase access to credit for underserved populations by supplementing or enhancing traditional credit evaluations.

Data Sources: Conventional vs. Alternative Approaches

Conventional credit scoring relies heavily on traditional data sources such as payment history, credit card utilization, loan repayment records, and public financial information to determine creditworthiness. In contrast, alternative data scoring incorporates non-traditional data, including utility payments, rental history, social media activity, and even mobile phone usage patterns, providing a more comprehensive view of an individual's financial behavior. This innovative approach enables lenders to assess credit risk for individuals with limited or no conventional credit history, expanding access to credit for underbanked populations.

Impact on Financial Inclusion and Accessibility

Credit scores have traditionally been the primary metric for assessing creditworthiness, but alternative data scoring leverages non-traditional information such as utility payments, rental history, and social data to enhance financial inclusion. This approach enables underserved populations, including the unbanked and underbanked, to access credit by providing a more comprehensive credit profile. By incorporating alternative data, lenders can make more accurate risk assessments and expand financial accessibility to millions excluded by conventional credit scoring models.

Regulatory Landscape for Credit and Alternative Data Scoring

Regulatory frameworks for traditional credit scoring are governed by established laws like the Fair Credit Reporting Act (FCRA) in the United States, ensuring consumer protection and data accuracy. Emerging regulations on alternative data scoring focus on transparency, fairness, and preventing discrimination, with agencies like the Consumer Financial Protection Bureau (CFPB) actively evaluating these models. Compliance challenges arise as lenders integrate non-traditional data sources, requiring ongoing alignment with evolving standards to maintain ethical and legal credit assessment practices.

Risks and Challenges in Alternative Data Usage

Alternative data scoring in finance introduces risks such as data privacy concerns, potential biases, and lack of standardized validation methods, which may affect the accuracy and fairness of credit assessments. The integration of non-traditional data sources like social media activity or utility payments poses challenges in ensuring data quality and compliance with regulatory frameworks. Financial institutions must address these issues to mitigate risks of misclassification and maintain consumer trust while leveraging alternative data for credit evaluation.

Industry Adoption: Trends and Case Studies

Financial institutions increasingly integrate alternative data scoring alongside traditional credit scores to enhance risk assessment accuracy. Major lenders such as Upstart and Zest AI report improved loan approval rates by using non-traditional data points like utility payments and social behavior analytics. Case studies from emerging markets reveal that alternative scoring models significantly expand credit access for underserved populations, driving wider industry adoption.

Future Outlook: Evolving Credit Assessment Models

Future credit assessment models will increasingly integrate alternative data scoring alongside traditional credit scores, leveraging machine learning algorithms to analyze diverse datasets such as utility payments, rental history, and social behavior. These advanced models aim to enhance accuracy, reduce bias, and expand credit access for underbanked populations by providing a more holistic financial profile. The finance industry anticipates regulatory frameworks evolving to support transparency and ethical use of alternative data in credit decision-making.

Related Important Terms

Trended Credit Data

Trended credit data enhances traditional credit scoring models by analyzing monthly patterns in credit usage, such as payment trends and balance fluctuations, providing a more dynamic and predictive view of borrower behavior. This approach outperforms static credit scores by incorporating time-series data that reflect financial resilience and risk more accurately, enabling lenders to make better-informed lending decisions.

Psychometric Scoring

Psychometric scoring evaluates borrower behavior and personality traits through questionnaires to predict creditworthiness, providing insights beyond traditional credit scores that rely on financial history. This alternative data scoring method enhances risk assessment for individuals with limited or no credit history by analyzing cognitive and emotional attributes linked to repayment reliability.

Cashflow-Based Underwriting

Cashflow-based underwriting leverages alternative data such as transaction history, bill payments, and real-time income streams to provide a more dynamic and inclusive credit assessment compared to traditional credit scores, which primarily rely on past credit behavior and debt repayment records. This approach enhances risk evaluation accuracy by capturing borrowers' actual financial health and liquidity, enabling lenders to extend credit to underserved individuals with limited or no credit history.

Social Media Credit Assessment

Social media credit assessment leverages alternative data sources such as online behavior, social interactions, and digital footprints to provide a more comprehensive evaluation of creditworthiness beyond traditional credit scores. This method enhances risk prediction accuracy by incorporating real-time, context-rich information often unavailable in conventional credit reports.

Thin File Borrower Evaluation

Traditional credit scores often fail to accurately assess thin file borrowers due to limited credit history, whereas alternative data scoring incorporates utility payments, rental history, and social behavior to provide a more comprehensive evaluation. This approach leverages machine learning algorithms to enhance predictive accuracy and increase lending opportunities for underserved populations.

Rental Payment Scoring

Rental payment scoring leverages consistent monthly rent payments to enhance credit assessments, especially for individuals with limited traditional credit history. By incorporating alternative data such as rent payment records, lenders gain a more comprehensive view of financial responsibility, improving credit access and reducing default risk.

Utility Bill Data Integration

In finance, integrating utility bill data into alternative data scoring models enhances credit assessment accuracy by capturing consistent payment behavior often missed by traditional credit scores. This approach improves financial inclusion for individuals with limited credit history by providing a more comprehensive view of their creditworthiness.

BNPL (Buy Now, Pay Later) Scoring

Credit score models primarily rely on traditional financial data such as credit card history and loan repayments, whereas alternative data scoring for BNPL leverages non-traditional metrics like utility payments, mobile phone usage, and online transaction behavior to assess consumer creditworthiness. BNPL scoring that incorporates alternative data enhances risk prediction accuracy, enabling lenders to extend credit responsibly to consumers with limited credit history or thin credit files.

Mobile Data Underwriting

Mobile data underwriting leverages alternative data sources such as call logs, app usage, and payment history to enhance credit scoring models, particularly for individuals with limited traditional credit history. Incorporating mobile data into credit assessments increases accuracy in risk evaluation and broadens financial inclusion by enabling lenders to make informed decisions beyond conventional credit scores.

AI-Driven Risk Profiling

AI-driven risk profiling leverages alternative data scoring by analyzing non-traditional data sources such as transaction history, social media behavior, and utility payments to enhance credit risk assessment beyond conventional credit scores. This approach enables more accurate and inclusive credit evaluations, particularly for individuals with limited credit histories, thereby transforming financial decision-making processes in lending and risk management.

Credit Score vs Alternative Data Scoring Infographic

industrydif.com

industrydif.com