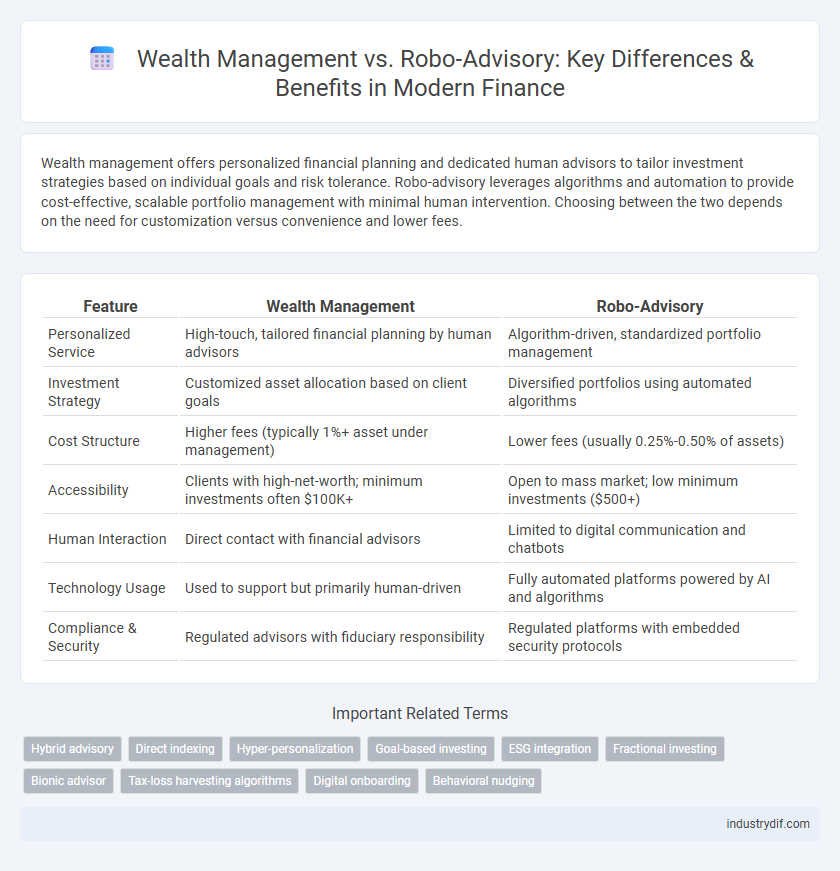

Wealth management offers personalized financial planning and dedicated human advisors to tailor investment strategies based on individual goals and risk tolerance. Robo-advisory leverages algorithms and automation to provide cost-effective, scalable portfolio management with minimal human intervention. Choosing between the two depends on the need for customization versus convenience and lower fees.

Table of Comparison

| Feature | Wealth Management | Robo-Advisory |

|---|---|---|

| Personalized Service | High-touch, tailored financial planning by human advisors | Algorithm-driven, standardized portfolio management |

| Investment Strategy | Customized asset allocation based on client goals | Diversified portfolios using automated algorithms |

| Cost Structure | Higher fees (typically 1%+ asset under management) | Lower fees (usually 0.25%-0.50% of assets) |

| Accessibility | Clients with high-net-worth; minimum investments often $100K+ | Open to mass market; low minimum investments ($500+) |

| Human Interaction | Direct contact with financial advisors | Limited to digital communication and chatbots |

| Technology Usage | Used to support but primarily human-driven | Fully automated platforms powered by AI and algorithms |

| Compliance & Security | Regulated advisors with fiduciary responsibility | Regulated platforms with embedded security protocols |

Defining Wealth Management and Robo-Advisory

Wealth management encompasses personalized financial planning, investment management, and estate planning tailored to high-net-worth individuals, emphasizing customized strategies and human advisory. Robo-advisory utilizes algorithm-driven platforms to provide automated, low-cost investment management services based on client risk profiles and financial goals. Both approaches focus on asset growth and preservation but differ in personalization, cost structure, and level of human involvement.

Key Differences Between Wealth Management and Robo-Advisory

Wealth management offers personalized financial planning and investment strategies through human advisors, catering to high-net-worth individuals with complex portfolios. Robo-advisory relies on algorithm-driven platforms providing automated, low-cost investment management suitable for everyday investors seeking simplicity and convenience. Key differences include the level of human interaction, customization, and cost structures, with wealth management emphasizing tailored expertise and robo-advisory focusing on efficiency and accessibility.

Traditional Wealth Management: Services and Approaches

Traditional wealth management offers personalized financial planning, estate planning, tax optimization, and investment management through dedicated human advisors who tailor strategies based on clients' unique goals and risk tolerance. Services often include portfolio diversification, retirement planning, and regular in-depth reviews to adjust asset allocation in response to market conditions. This hands-on approach emphasizes relationship-building and comprehensive advice, leveraging the advisor's expertise to navigate complex financial situations.

Robo-Advisory Platforms: Technology-Driven Solutions

Robo-advisory platforms leverage advanced algorithms and artificial intelligence to provide personalized investment strategies with lower fees and continuous portfolio monitoring. These technology-driven solutions offer automated rebalancing, tax-loss harvesting, and real-time performance tracking, enhancing efficiency and accessibility for a broad range of investors. By utilizing big data analytics and machine learning, robo-advisors can optimize asset allocation and risk management tailored to individual financial goals.

Cost Comparison: Fees in Wealth Management vs Robo-Advisors

Wealth management services typically charge fees ranging from 1% to 2% of assets under management, reflecting personalized advice and comprehensive financial planning. Robo-advisors offer significantly lower fees, often between 0.25% and 0.50%, leveraging algorithms and automation to reduce costs. This fee disparity makes robo-advisors an attractive option for cost-conscious investors seeking efficient portfolio management.

Personalization and Client Experience

Wealth management offers highly personalized services through dedicated financial advisors who tailor strategies based on in-depth understanding of clients' unique financial goals, risk tolerance, and life situations. Robo-advisory platforms provide algorithm-driven investment solutions with limited customization, emphasizing efficiency and low cost but often lacking the nuanced client experience that human advisors deliver. Enhancing client experience in wealth management depends on building trust and long-term relationships, while robo-advisors focus on accessibility and automation.

Investment Strategies: Human Expertise vs Algorithmic Decisions

Wealth management leverages human expertise to create personalized investment strategies tailored to individual client goals and risk tolerance, incorporating qualitative insights and market experience. Robo-advisory relies on algorithmic decisions driven by data analysis, automation, and quantitative models to optimize portfolio allocation with low fees and efficient rebalancing. While human advisors excel in complex financial planning and behavioral coaching, robo-advisors offer scalable, cost-effective solutions for passive, rule-based investment management.

Accessibility and Minimum Investment Requirements

Wealth management typically requires a high minimum investment, often starting at $100,000 or more, limiting accessibility to affluent clients. Robo-advisory platforms offer low or no minimum investment thresholds, making financial planning accessible to a broader audience with assets as low as $500. These digital services use algorithms to provide affordable, automated portfolio management, democratizing investment opportunities for individuals with varying capital levels.

Regulatory Frameworks Governing Both Models

Wealth management and robo-advisory services both operate under stringent regulatory frameworks designed to protect investors and ensure transparency. Wealth management is subject to comprehensive regulations involving fiduciary duties, suitability assessments, and extensive compliance requirements, managed by entities such as the SEC in the U.S. Robo-advisors must comply with similar regulations but leverage automated algorithms to maintain transparency, limit conflicts of interest, and enhance regulatory compliance efficiency under frameworks like MiFID II in Europe and the Investment Advisers Act.

Choosing Between Wealth Management and Robo-Advisory

Choosing between wealth management and robo-advisory depends on individual financial goals, risk tolerance, and personal preferences for human interaction versus automated services. Wealth management offers personalized, comprehensive advice with a focus on complex financial planning, estate planning, and tax optimization, suitable for high-net-worth individuals. Robo-advisory provides algorithm-driven, cost-effective investment management ideal for investors seeking low fees and easy access to diversified portfolios without requiring direct financial advisor involvement.

Related Important Terms

Hybrid advisory

Hybrid advisory combines the personalized insights of traditional wealth management with the cost-efficiency and algorithm-driven strategies of robo-advisory platforms, offering investors tailored portfolio management and real-time digital analytics. This integration improves asset allocation precision and client engagement while reducing advisory fees, appealing to a broader demographic seeking both human expertise and technological innovation.

Direct indexing

Direct indexing in wealth management offers personalized portfolio construction by directly owning underlying securities, enhancing tax-loss harvesting opportunities and customization beyond traditional robo-advisory models. While robo-advisors rely on algorithm-driven ETFs for low-cost diversification, direct indexing enables precise tax optimization and tailored exposure, appealing to high-net-worth investors seeking greater control over their portfolios.

Hyper-personalization

Wealth management offers hyper-personalization through tailored strategies developed by human advisors who consider clients' unique financial goals, risk tolerance, and life circumstances, ensuring comprehensive, adaptive advice. Robo-advisory platforms use algorithms and AI to deliver scalable hyper-personalized investment portfolios by analyzing vast datasets and client inputs, providing cost-effective, real-time adjustments but often lack the nuanced judgment of human advisors.

Goal-based investing

Wealth management offers personalized, goal-based investing strategies through human advisors who tailor portfolios to individual client objectives and risk tolerance. Robo-advisory uses algorithm-driven platforms to automate goal-based investment decisions, providing a cost-effective alternative with portfolio diversification and real-time rebalancing.

ESG integration

Wealth management firms increasingly integrate Environmental, Social, and Governance (ESG) criteria into portfolio strategies, offering personalized, human-guided advice tailored to individual investor values and long-term goals. Robo-advisory platforms provide scalable ESG investment options through algorithm-driven models, enabling cost-effective, automated portfolio management with predefined ethical screens and impact metrics.

Fractional investing

Fractional investing in wealth management allows investors to buy partial shares of high-value assets, enhancing portfolio diversification with lower capital requirements. Robo-advisory platforms use algorithms to facilitate fractional investing, offering cost-effective, automated portfolio management tailored to individual risk profiles.

Bionic advisor

Bionic advisors combine the personalized expertise of traditional wealth management with advanced algorithm-driven insights from robo-advisory platforms, optimizing portfolio performance and client engagement. This hybrid model leverages AI-powered analytics alongside human financial advisors to deliver tailored investment strategies, risk assessments, and real-time market adjustments.

Tax-loss harvesting algorithms

Tax-loss harvesting algorithms in robo-advisory platforms systematically identify and execute sell orders on underperforming assets to offset realized gains, enhancing after-tax returns with precision and efficiency. In contrast, traditional wealth management relies on human advisors who apply discretionary judgment and tailored strategies, which may lack the quantitative rigor and speed of automated tax-loss harvesting processes.

Digital onboarding

Wealth management offers personalized financial strategies through expert advisors, while robo-advisory platforms streamline digital onboarding with automated, user-friendly processes that enable quick portfolio setup and real-time risk assessments. Digital onboarding in robo-advisory significantly reduces account opening times by leveraging AI-driven KYC verification and intuitive user interfaces, making investment management accessible and efficient for tech-savvy clients.

Behavioral nudging

Wealth management leverages personalized behavioral nudging techniques to influence client decision-making and enhance long-term financial outcomes, integrating human insights with tailored advice. Robo-advisory platforms employ algorithm-driven nudges based on behavioral finance principles to automate investment decisions and promote disciplined saving habits.

Wealth management vs Robo-advisory Infographic

industrydif.com

industrydif.com