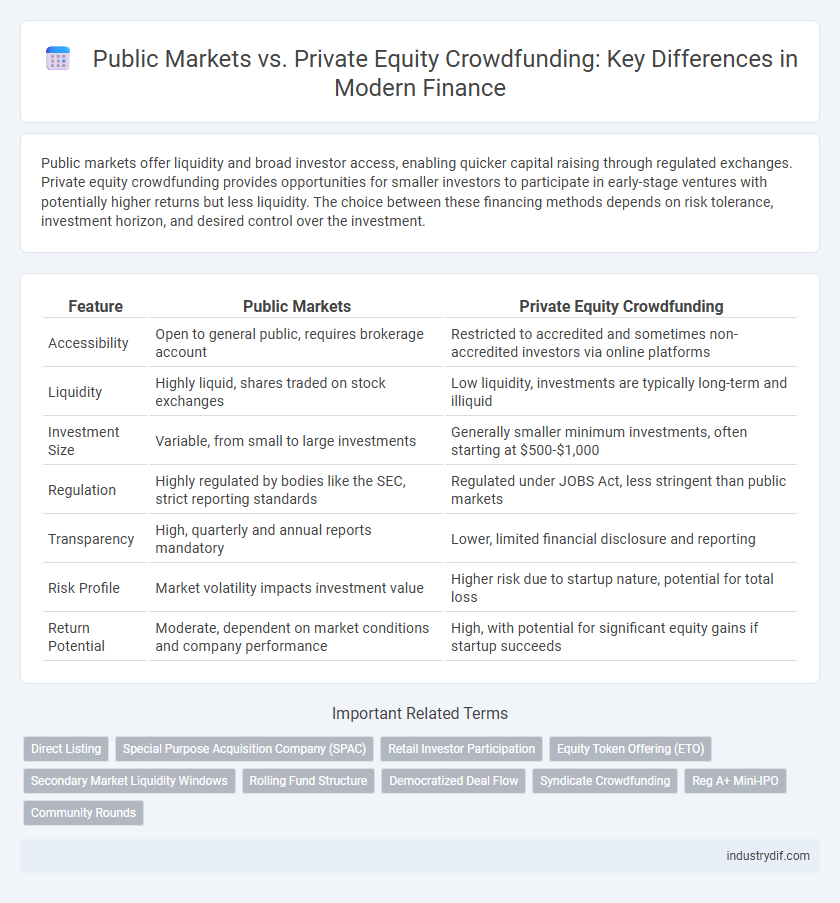

Public markets offer liquidity and broad investor access, enabling quicker capital raising through regulated exchanges. Private equity crowdfunding provides opportunities for smaller investors to participate in early-stage ventures with potentially higher returns but less liquidity. The choice between these financing methods depends on risk tolerance, investment horizon, and desired control over the investment.

Table of Comparison

| Feature | Public Markets | Private Equity Crowdfunding |

|---|---|---|

| Accessibility | Open to general public, requires brokerage account | Restricted to accredited and sometimes non-accredited investors via online platforms |

| Liquidity | Highly liquid, shares traded on stock exchanges | Low liquidity, investments are typically long-term and illiquid |

| Investment Size | Variable, from small to large investments | Generally smaller minimum investments, often starting at $500-$1,000 |

| Regulation | Highly regulated by bodies like the SEC, strict reporting standards | Regulated under JOBS Act, less stringent than public markets |

| Transparency | High, quarterly and annual reports mandatory | Lower, limited financial disclosure and reporting |

| Risk Profile | Market volatility impacts investment value | Higher risk due to startup nature, potential for total loss |

| Return Potential | Moderate, dependent on market conditions and company performance | High, with potential for significant equity gains if startup succeeds |

Overview of Public Markets and Private Equity Crowdfunding

Public markets provide liquidity, transparency, and regulatory oversight, enabling companies to raise capital by issuing shares to a broad base of investors on stock exchanges such as NYSE and NASDAQ. Private equity crowdfunding allows startups and small businesses to access capital from accredited and retail investors through online platforms, offering less stringent regulatory requirements but limited liquidity. Both financing methods deliver distinct advantages in capital accessibility, risk exposure, and investor engagement depending on company size and growth stage.

Key Differences in Investment Structures

Public markets feature highly regulated investment structures with liquidity through stock exchanges, enabling investors to buy and sell shares quickly. Private equity crowdfunding involves pooled capital from individual investors to fund private companies, often with limited liquidity and longer investment horizons. Unlike public markets, private equity crowdfunding securities are typically exempt from registration, resulting in fewer disclosure requirements and higher risk profiles.

Access and Participation Requirements

Public markets offer broad access to investors with relatively low participation requirements, including standard brokerage accounts and regulatory compliance such as SEC registration for equity shares. Private equity crowdfunding typically requires investors to meet specific accreditation criteria or minimum investment thresholds, often limiting participation to accredited or qualified investors. The accessibility of public markets ensures liquidity and diversification, whereas private equity crowdfunding provides opportunities for early-stage investments but with restricted entry and higher risk exposure.

Liquidity and Exit Strategies Comparison

Public markets offer higher liquidity as shares can be quickly bought or sold on stock exchanges, enabling investors to exit positions with relative ease and speed. Private equity crowdfunding typically involves longer lock-up periods and less frequent transaction opportunities, resulting in limited liquidity and more complex exit strategies often dependent on company buyouts or secondary market sales. Investors in private equity crowdfunding must plan for extended investment horizons and potentially delayed returns compared to the more immediate liquidity of public markets.

Regulatory Oversight and Compliance

Public markets are subject to stringent regulatory oversight by entities such as the U.S. Securities and Exchange Commission (SEC), ensuring transparency, investor protection, and comprehensive reporting requirements. Private equity crowdfunding operates under more flexible regulatory frameworks, often governed by exemptions like Regulation CF, which mandates limits on fundraising amounts and investor eligibility but imposes less rigorous disclosure standards. Compliance in public markets demands adherence to ongoing financial reporting and corporate governance rules, whereas private equity crowdfunding emphasizes initial disclosure and investor education to balance accessibility with risk mitigation.

Risk Profiles and Investor Protections

Public markets offer higher liquidity and regulatory oversight, providing investors with greater transparency and standardized reporting, which reduces risk. Private equity crowdfunding involves higher risk due to less stringent regulations, limited liquidity, and lower disclosure requirements, increasing exposure to valuation uncertainties and potential fraud. Investor protections in public markets include securities laws and institutional safeguards, whereas private equity crowdfunding often relies on platform due diligence and individual investor risk tolerance.

Transparency and Disclosure Standards

Public markets are governed by stringent transparency and disclosure standards mandated by regulatory bodies like the SEC, requiring companies to regularly file detailed financial reports accessible to all investors. Private equity crowdfunding operates under comparatively relaxed disclosure requirements, which can limit investor access to comprehensive financial data and increase informational asymmetry. The contrast in transparency significantly affects risk assessment and investor confidence between the two financing platforms.

Valuation Methods and Pricing Mechanisms

Public markets rely heavily on transparent valuation methods such as market capitalization, price-to-earnings ratios, and real-time trading data to determine pricing mechanisms, enabling efficient price discovery through supply and demand dynamics. Private equity crowdfunding employs valuation approaches like discounted cash flow (DCF), comparable company analysis, and negotiation between investors and startups, reflecting the illiquidity and higher risk of private investments. Pricing in public markets is generally more liquid and volatile, whereas private equity crowdfunding prices are less frequent, more subjective, and influenced by investor sentiment and strategic considerations.

Impact on Capital Formation and Innovation

Public markets facilitate large-scale capital formation through broad investor access, enabling rapid funding and liquidity for established companies, which drives innovation by supporting scalable projects. Private equity crowdfunding allows emerging ventures to secure financing from diverse, often retail investors, fostering innovation in early-stage startups with niche or disruptive technologies. The complementary roles of public markets and private equity crowdfunding enhance overall ecosystem dynamism by balancing liquidity with access to capital for innovation across different growth phases.

Future Trends in Equity Financing

Public markets are evolving with increased integration of blockchain technology to enhance transparency and liquidity, while private equity crowdfunding platforms are leveraging AI-driven analytics to match investors with high-growth startups more efficiently. Regulatory shifts are expected to further democratize access to private equity crowdfunding, enabling broader participation from retail investors and fostering greater capital flow into innovation sectors. The convergence of digital finance tools and evolving investor demand is set to blur traditional boundaries between public and private equity markets, accelerating hybrid financing models.

Related Important Terms

Direct Listing

Direct listings enable companies to access public markets without traditional underwriters, offering greater liquidity and transparency compared to private equity crowdfunding, which typically limits investment access to accredited investors and involves longer capital lock-up periods. Public markets through direct listings provide immediate price discovery and broader market participation, contrasting with the often less liquid and higher-risk nature of private equity crowdfunding investments.

Special Purpose Acquisition Company (SPAC)

Special Purpose Acquisition Companies (SPACs) offer a streamlined path for private equity crowdfunding investors to access public markets by merging with private companies, facilitating faster capital infusion and liquidity compared to traditional IPOs. SPACs enable efficient capital deployment and reduced regulatory hurdles, providing a compelling alternative to conventional public offerings within the finance sector.

Retail Investor Participation

Retail investor participation in public markets remains high due to liquidity and regulatory protections, enabling broad portfolio diversification through accessible stock exchanges. In contrast, private equity crowdfunding offers retail investors opportunities for early-stage investments with potentially higher returns but carries increased risk, lower liquidity, and limited regulatory oversight.

Equity Token Offering (ETO)

Equity Token Offering (ETO) represents a transformative approach in private equity crowdfunding by digitizing ownership stakes via blockchain technology, enabling fractional investment and enhanced liquidity compared to traditional public markets. This innovation reduces entry barriers for retail investors while providing issuers with greater access to global capital, blending the transparency of public markets with the flexibility of private investment.

Secondary Market Liquidity Windows

Secondary market liquidity windows provide public markets with continuous, real-time trading opportunities, enabling investors to quickly buy or sell assets at transparent prices. In contrast, private equity crowdfunding typically offers limited secondary market access, resulting in lower liquidity and longer holding periods for investors seeking to exit their positions.

Rolling Fund Structure

Rolling fund structure in public markets offers continuous capital deployment and investor liquidity compared to traditional private equity crowdfunding, which relies on discrete funding rounds and limited secondary market options. This model enhances capital efficiency by enabling fund managers to raise, invest, and scale portfolios dynamically while providing investors with regular access opportunities and transparency.

Democratized Deal Flow

Public markets offer broad access to investment opportunities with high liquidity and regulatory transparency, enabling widespread participation in established companies. Private equity crowdfunding democratizes deal flow by allowing individual investors to directly fund early-stage startups and private ventures, bypassing traditional gatekeepers and fostering diverse investment portfolios.

Syndicate Crowdfunding

Syndicate crowdfunding in private equity enables smaller investors to pool capital under lead investors, offering access to curated startup opportunities typically unavailable in public markets. Unlike public markets with liquid securities and regulatory hurdles, private equity syndicates provide concentrated, high-growth potential investments through collaborative funding structures.

Reg A+ Mini-IPO

Reg A+ Mini-IPOs offer a streamlined alternative to traditional public markets by allowing private companies to raise up to $75 million from both accredited and non-accredited investors with reduced regulatory burdens compared to full IPOs. This method enhances liquidity and investor access while maintaining compliance with SEC regulations, positioning it as a flexible funding option within private equity crowdfunding.

Community Rounds

Community rounds in private equity crowdfunding enable individual investors to directly participate in funding early-stage companies, leveraging social networks and collective support to drive capital formation. Public markets, by contrast, offer liquidity and regulatory transparency but limit retail investor access to pre-IPO growth opportunities available through these community-driven private funding rounds.

Public Markets vs Private Equity Crowdfunding Infographic

industrydif.com

industrydif.com