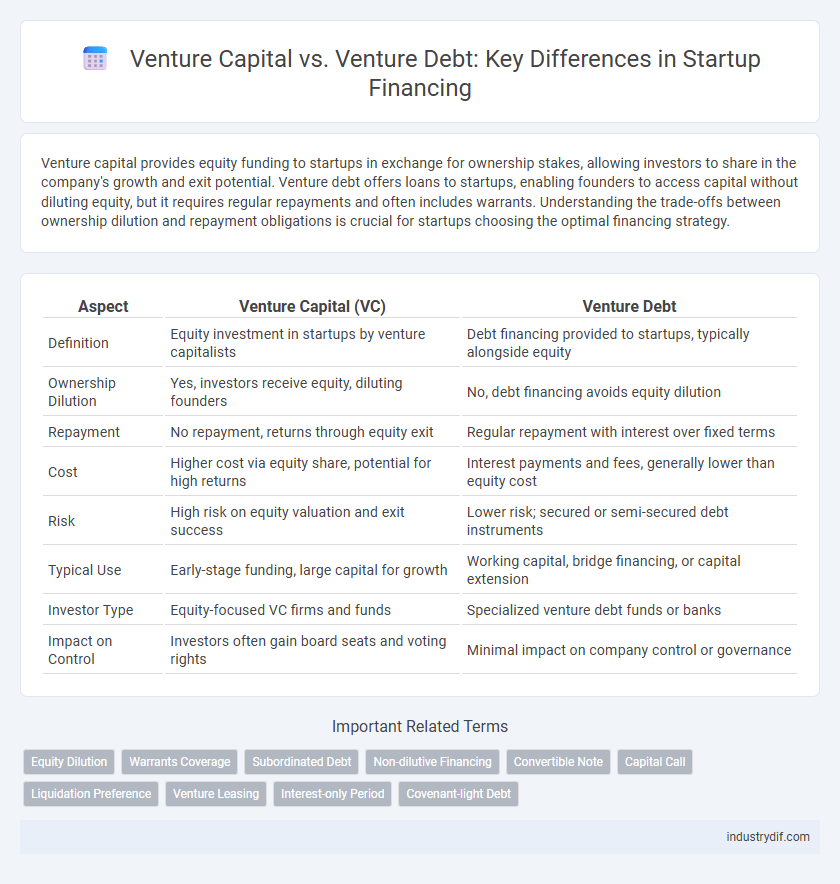

Venture capital provides equity funding to startups in exchange for ownership stakes, allowing investors to share in the company's growth and exit potential. Venture debt offers loans to startups, enabling founders to access capital without diluting equity, but it requires regular repayments and often includes warrants. Understanding the trade-offs between ownership dilution and repayment obligations is crucial for startups choosing the optimal financing strategy.

Table of Comparison

| Aspect | Venture Capital (VC) | Venture Debt |

|---|---|---|

| Definition | Equity investment in startups by venture capitalists | Debt financing provided to startups, typically alongside equity |

| Ownership Dilution | Yes, investors receive equity, diluting founders | No, debt financing avoids equity dilution |

| Repayment | No repayment, returns through equity exit | Regular repayment with interest over fixed terms |

| Cost | Higher cost via equity share, potential for high returns | Interest payments and fees, generally lower than equity cost |

| Risk | High risk on equity valuation and exit success | Lower risk; secured or semi-secured debt instruments |

| Typical Use | Early-stage funding, large capital for growth | Working capital, bridge financing, or capital extension |

| Investor Type | Equity-focused VC firms and funds | Specialized venture debt funds or banks |

| Impact on Control | Investors often gain board seats and voting rights | Minimal impact on company control or governance |

Introduction to Venture Capital and Venture Debt

Venture Capital involves equity financing where investors provide capital to startups in exchange for ownership stakes, aiming for high returns through company growth. Venture Debt offers debt financing to startups, typically complementing venture capital by providing funds without diluting ownership, often secured by future revenue or equity warrants. Both financing methods support early-stage companies but cater to different risk profiles and capital needs.

Key Differences Between Venture Capital and Venture Debt

Venture capital involves equity investment where investors receive ownership stakes in startups, often participating in strategic decision-making and assuming higher risk for potentially greater returns. Venture debt, conversely, is a debt financing option that requires repayment with interest and typically includes warrants, allowing companies to access capital without diluting ownership. Key differences include risk exposure, ownership dilution, repayment obligations, and impact on cash flow management within growing businesses.

How Venture Capital Works

Venture capital involves investors providing equity financing to startups and early-stage companies with high growth potential in exchange for ownership stakes. This funding supports product development, market expansion, and scaling operations while investors often take active roles in strategic decision-making. Returns are typically realized through exit events such as initial public offerings (IPOs) or acquisitions, emphasizing long-term value creation over immediate repayment.

How Venture Debt Works

Venture debt provides startups with non-dilutive capital by offering loans that complement equity financing, typically secured against future revenue or assets. Lenders often include warrants or rights to purchase equity, aligning incentives and mitigating risk while preserving founders' ownership stakes. This flexible financing option helps extend runway and fund growth without immediate equity dilution common in venture capital.

Pros and Cons of Venture Capital

Venture capital provides startups with significant capital infusion and strategic support, enabling rapid growth and access to industry expertise. However, it often involves equity dilution and potential loss of control for founders, alongside high expectations for accelerated returns. The long-term commitment to investors may pressure companies into aggressive scaling strategies that might not align with sustainable business models.

Pros and Cons of Venture Debt

Venture debt offers startups access to non-dilutive capital, preserving equity while providing runway extension without immediate valuation pressure. However, it introduces repayment obligations and interest costs that can strain cash flow, especially if growth targets are not met. Unlike venture capital, venture debt typically requires warrants or covenants, increasing financial risk but maintaining founder control.

When to Choose Venture Capital

Choose venture capital when scaling rapidly requires substantial equity investment and strategic support from experienced industry partners, enabling access to mentorship, networks, and follow-on funding. Venture capital suits startups with high growth potential that can dilute ownership in exchange for significant capital influx and validation. This option is ideal for early-stage companies aiming to disrupt markets and accelerate product development with less immediate pressure on cash flow compared to debt repayments.

When to Opt for Venture Debt

Venture debt is an ideal choice for startups with a proven growth trajectory seeking capital to extend runway without significant equity dilution. Companies typically opt for venture debt when they have upcoming milestones to achieve before their next funding round but need additional working capital. This financing option suits firms with strong revenue streams or backing from reputable venture capital investors, ensuring lower risk and favorable lending terms.

Impact on Startup Ownership and Control

Venture capital typically involves equity financing, resulting in ownership dilution and reduced control for startup founders as investors gain board seats and voting rights. In contrast, venture debt allows startups to raise capital without immediate equity dilution, preserving founder ownership and control but requiring timely repayments and potentially restrictive covenants. Choosing between venture capital and venture debt significantly affects the startup's governance structure and long-term decision-making authority.

Industry Trends in Venture Financing

Venture capital continues to dominate early-stage startup funding, with global investments reaching over $300 billion in 2023, reflecting strong investor appetite for high-growth technology sectors such as AI and fintech. Venture debt is gaining traction as a complementary financing option, providing scalable, non-dilutive capital to venture-backed companies, particularly in later stages where cash flow management is critical. Industry trends show a growing preference for diversified funding strategies, combining equity and debt to optimize capital structure and extend runway amid market volatility.

Related Important Terms

Equity Dilution

Venture capital involves raising funds by exchanging equity, leading to ownership dilution for existing shareholders, while venture debt provides capital through loans, minimizing equity dilution but requiring regular repayments. Startups often choose venture debt to preserve ownership stakes and maintain greater control, especially when equity dilution is a major concern.

Warrants Coverage

Warrants coverage in venture capital typically offers investors equity upside by granting options to purchase shares at a predetermined price, aligning their returns with the company's growth. Venture debt uses warrants as a sweetener to compensate lenders for higher risk, often covering 5-20% of the loan amount, providing potential equity participation without immediate dilution.

Subordinated Debt

Subordinated debt in venture finance ranks below senior debt in repayment priority but offers startups flexible capital without immediate equity dilution, often carrying higher interest rates and warrants to compensate investors. Venture debt as subordinated debt complements venture capital by extending the runway for growth while preserving ownership stakes, crucial for early-stage companies managing cash flow constraints.

Non-dilutive Financing

Venture debt provides non-dilutive financing that enables startups to access capital without sacrificing equity, preserving founders' ownership stakes compared to traditional venture capital. This form of debt financing typically complements equity rounds by offering growth capital that minimizes dilution while supporting runway extension and operational scaling.

Convertible Note

Convertible notes in venture capital provide investors with debt that converts into equity during funding rounds, offering startups capital without immediate valuation pressure. Unlike traditional venture debt, convertible notes align investor returns with company growth by deferring valuation until a qualified financing event.

Capital Call

Venture capital involves investors committing funds upfront with periodic capital calls to deploy capital according to startup milestones, whereas venture debt provides a lump sum loan with scheduled repayments, reducing the need for repeated capital calls. Capital calls in venture capital impact ownership dilution, while venture debt preserves equity but entails interest obligations and covenants.

Liquidation Preference

Venture capital typically includes strong liquidation preferences, ensuring investors recover their investment before common shareholders during exit events, often with a multiple on the original amount. Venture debt generally lacks liquidation preferences, prioritizing seniority in repayment but without participating in equity upside, making it a less dilutive financing option for startups.

Venture Leasing

Venture leasing offers startups an alternative to traditional venture capital and venture debt by providing flexible asset financing without diluting equity or increasing debt on the balance sheet. This financing method enables companies to access essential equipment and technology while preserving cash flow and maintaining financial stability during growth phases.

Interest-only Period

Venture debt typically includes an interest-only period ranging from 6 to 24 months, allowing startups to conserve cash flow and focus on growth before principal repayments begin. In contrast, venture capital funding does not require repayments or interest, as investors gain equity and returns only through future exit events.

Covenant-light Debt

Venture debt often features covenant-light structures, allowing startups greater operational flexibility compared to traditional venture capital equity funding which demands significant ownership dilution. This covenant-light debt reduces restrictive financial covenants, enabling companies to preserve growth momentum while managing cash flow without heavy governance constraints.

Venture Capital vs Venture Debt Infographic

industrydif.com

industrydif.com