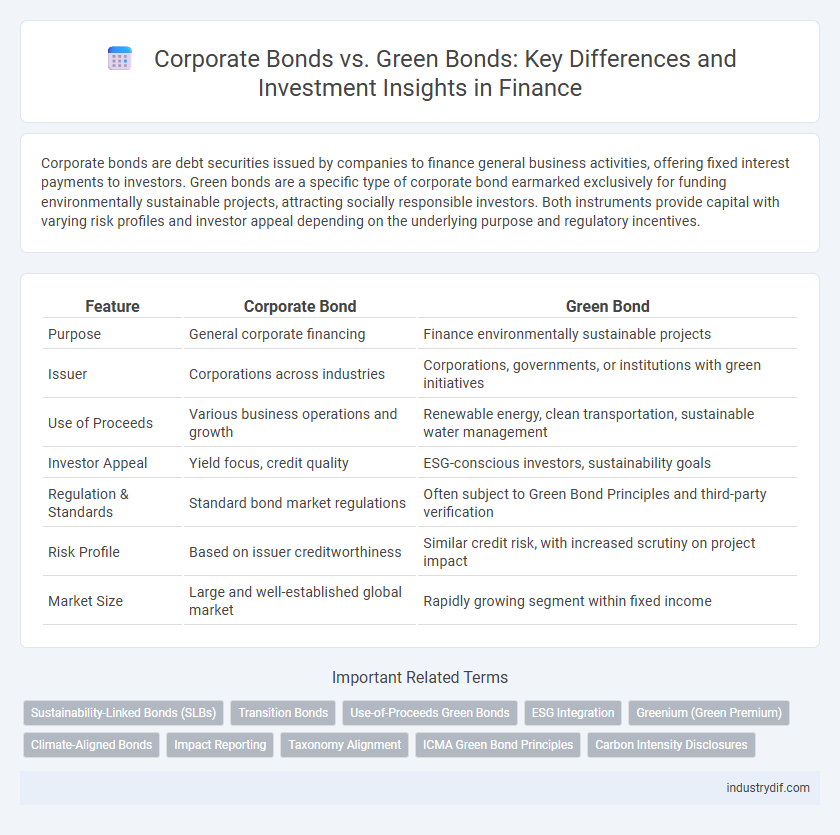

Corporate bonds are debt securities issued by companies to finance general business activities, offering fixed interest payments to investors. Green bonds are a specific type of corporate bond earmarked exclusively for funding environmentally sustainable projects, attracting socially responsible investors. Both instruments provide capital with varying risk profiles and investor appeal depending on the underlying purpose and regulatory incentives.

Table of Comparison

| Feature | Corporate Bond | Green Bond |

|---|---|---|

| Purpose | General corporate financing | Finance environmentally sustainable projects |

| Issuer | Corporations across industries | Corporations, governments, or institutions with green initiatives |

| Use of Proceeds | Various business operations and growth | Renewable energy, clean transportation, sustainable water management |

| Investor Appeal | Yield focus, credit quality | ESG-conscious investors, sustainability goals |

| Regulation & Standards | Standard bond market regulations | Often subject to Green Bond Principles and third-party verification |

| Risk Profile | Based on issuer creditworthiness | Similar credit risk, with increased scrutiny on project impact |

| Market Size | Large and well-established global market | Rapidly growing segment within fixed income |

Introduction to Corporate Bonds and Green Bonds

Corporate bonds are debt securities issued by companies to raise capital, offering fixed interest payments and principal repayment at maturity, appealing to investors seeking stable income. Green bonds function similarly but specifically finance projects with environmental benefits, such as renewable energy or sustainable infrastructure, attracting investors focused on environmental, social, and governance (ESG) criteria. Both instruments provide diversification opportunities in fixed-income portfolios, with green bonds gaining prominence due to increasing demand for sustainable investment options.

Key Features of Corporate Bonds

Corporate bonds are debt securities issued by companies to raise capital, featuring fixed or floating interest rates and set maturity dates that typically range from 1 to 30 years. They offer higher yields compared to government bonds but carry greater credit risk, which depends on the issuer's financial health and credit rating. Unlike green bonds, corporate bonds are not specifically earmarked for environmental projects, providing broader use of proceeds for general corporate purposes.

Key Features of Green Bonds

Green bonds are fixed-income securities designed to finance projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable agriculture. These bonds often require issuers to adhere to specific reporting and transparency standards, like the Green Bond Principles, to ensure funds are used exclusively for eco-friendly initiatives. Compared to traditional corporate bonds, green bonds attract investors seeking impact-driven returns aligned with Environmental, Social, and Governance (ESG) criteria.

Objectives Behind Issuing Corporate and Green Bonds

Corporate bonds are primarily issued to raise capital for business expansion, acquisitions, or debt refinancing, targeting investors seeking steady income with moderate risk. Green bonds specifically finance environmentally sustainable projects, attracting investors focused on social responsibility and long-term ecological impact. Issuers align objectives with capital markets by differentiating risk profiles, return expectations, and strategic commitments to sustainability or corporate growth.

Risk and Return Profile: Corporate vs Green Bonds

Corporate bonds generally offer higher yields to compensate for greater credit risk and economic sensitivity, with returns influenced by issuer creditworthiness and market conditions. Green bonds typically present lower yields but attract investors seeking environmental impact alongside financial return, benefiting from growing demand and often supported by regulatory incentives. Risk profiles differ as corporate bonds face broader default risk, while green bonds carry additional project-specific risks tied to environmental outcomes and regulatory compliance.

Regulatory Framework and Standards

Corporate bonds operate under established securities regulations such as the U.S. Securities Act and EU Prospectus Regulation, ensuring transparency and investor protection without specific environmental mandates. Green bonds must comply not only with general securities laws but also with additional regulatory frameworks like the Climate Bonds Standard and EU Green Bond Standard, which require third-party verification of environmental impact and use of proceeds. These specialized standards promote accountability and ensure funding projects meet strict sustainability criteria, differentiating green bonds within the fixed-income market.

Investor Demographics and Preferences

Corporate bond investors typically include institutional investors such as pension funds, insurance companies, and mutual funds seeking steady income and moderate risk. Green bond investors attract a growing demographic of environmentally conscious individuals and organizations prioritizing sustainable investment goals alongside financial returns. Preference trends show that millennials and ESG-focused funds increasingly favor green bonds due to their positive environmental impact and regulatory incentives.

Environmental, Social, and Governance (ESG) Considerations

Corporate bonds primarily target traditional capital market returns, whereas green bonds are specifically designed to finance projects with positive Environmental, Social, and Governance (ESG) impacts, such as renewable energy and sustainable infrastructure. Investors increasingly prioritize green bonds for their ability to align financial performance with ESG goals, enhancing portfolio sustainability and reducing reputational risks. ESG integration in green bonds is rigorously verified through third-party certifications and impact reporting, offering transparency and accountability not typically emphasized in standard corporate bonds.

Market Trends and Growth Potential

Corporate bonds continue to dominate global debt markets with a robust issuance volume exceeding $5 trillion annually, driven by diverse sector demand and attractive yields. Green bonds, valued at over $500 billion in outstanding volume, exhibit rapid growth fueled by increasing investor preference for sustainable finance and regulatory incentives supporting environmental projects. Market forecasts predict green bond issuance to grow at a compound annual growth rate (CAGR) exceeding 15%, outpacing traditional corporate bonds and signaling significant expansion in ESG-driven capital markets.

Choosing Between Corporate Bonds and Green Bonds

Choosing between corporate bonds and green bonds involves assessing investment goals and risk tolerance, with corporate bonds offering potentially higher yields from diverse industries while green bonds focus on financing environmentally sustainable projects and may appeal to ESG-conscious investors. Green bonds often provide benefits such as tax incentives or enhanced reputational value for investors prioritizing environmental impact. Evaluating factors like credit ratings, maturity, and use of proceeds provides critical insights for making informed decisions aligned with financial objectives and ethical considerations.

Related Important Terms

Sustainability-Linked Bonds (SLBs)

Sustainability-Linked Bonds (SLBs) differ from traditional Corporate Bonds and Green Bonds by tying financial performance to achieving specific environmental, social, and governance (ESG) targets rather than funding predetermined green projects. SLBs incentivize issuers to meet sustainability goals through adjustable interest rates, thereby integrating corporate accountability with investor returns and advancing corporate sustainability efforts.

Transition Bonds

Transition bonds finance companies shifting from high-carbon activities to sustainable practices, bridging the gap between traditional corporate bonds and green bonds by targeting environmentally responsible projects in sectors with significant carbon footprints. These bonds appeal to investors seeking measurable impact during a company's decarbonization process while maintaining financial returns aligned with corporate bond markets.

Use-of-Proceeds Green Bonds

Use-of-Proceeds Green Bonds specifically allocate funds to environmentally sustainable projects such as renewable energy, energy efficiency, and pollution prevention, differentiating them from traditional Corporate Bonds which finance general corporate activities including expansion and acquisitions. Investors prioritize Use-of-Proceeds Green Bonds for their targeted impact reporting and alignment with ESG criteria, supporting corporate sustainability goals while potentially benefiting from similar credit risk profiles as standard Corporate Bonds.

ESG Integration

Corporate bonds typically involve traditional financing methods without specific environmental or social criteria, while green bonds are explicitly designed to fund projects with positive environmental impacts, aligning directly with ESG integration by prioritizing sustainability metrics and transparent reporting standards. ESG integration in green bonds enhances investor confidence through rigorous impact assessments, promoting sustainable investment portfolios and contributing to long-term value creation.

Greenium (Green Premium)

Green bonds often trade at a premium known as the "greenium," reflecting investors' willingness to accept lower yields for environmentally sustainable projects compared to traditional corporate bonds. This greenium highlights the growing demand and positive market sentiment for green finance, influencing capital costs and investment strategies in the fixed-income market.

Climate-Aligned Bonds

Climate-aligned bonds, including green bonds, are debt securities specifically issued to finance projects with positive environmental outcomes, such as renewable energy and sustainable infrastructure, differentiating them from traditional corporate bonds which primarily focus on general corporate financing without explicit environmental criteria. Investors increasingly prefer climate-aligned bonds for their potential to support climate goals while earning competitive returns, as verified by third-party certifications and adherence to frameworks like the Climate Bonds Initiative.

Impact Reporting

Corporate bonds typically emphasize financial performance and credit risk in impact reporting, while green bonds prioritize environmental outcomes such as carbon emission reductions and sustainability project metrics. Investors in green bonds benefit from transparent impact disclosures aligned with internationally recognized frameworks like the Climate Bonds Initiative and the Green Bond Principles.

Taxonomy Alignment

Corporate bonds traditionally finance a wide range of business activities without specific environmental criteria, while green bonds strictly target projects aligned with environmental taxonomy standards established by regulatory frameworks like the EU Taxonomy. Taxonomy alignment in green bonds guarantees that proceeds support sustainable initiatives such as renewable energy or clean transportation, enhancing transparency and investor confidence in environmental impact.

ICMA Green Bond Principles

Corporate bonds provide general financing for a company's operations or expansions, whereas green bonds are specifically issued to fund projects with environmental benefits, adhering closely to the ICMA Green Bond Principles which mandate transparency, project eligibility, and impact reporting. Issuers following the ICMA Green Bond Principles ensure proceeds are allocated to sustainable projects, enhancing investor confidence through clear frameworks on use of proceeds, management of funds, and regular disclosure of environmental impact metrics.

Carbon Intensity Disclosures

Corporate bonds typically offer detailed carbon intensity disclosures reflecting the issuer's total greenhouse gas emissions per unit of revenue, whereas green bonds emphasize transparent reporting specific to the environmental impact and carbon footprint reduction of funded projects. Investors seeking to integrate sustainability metrics prioritize green bonds for their targeted carbon intensity data aligned with climate goals, while corporate bonds provide broader operational emissions insights crucial for comprehensive risk assessment.

Corporate Bond vs Green Bond Infographic

industrydif.com

industrydif.com