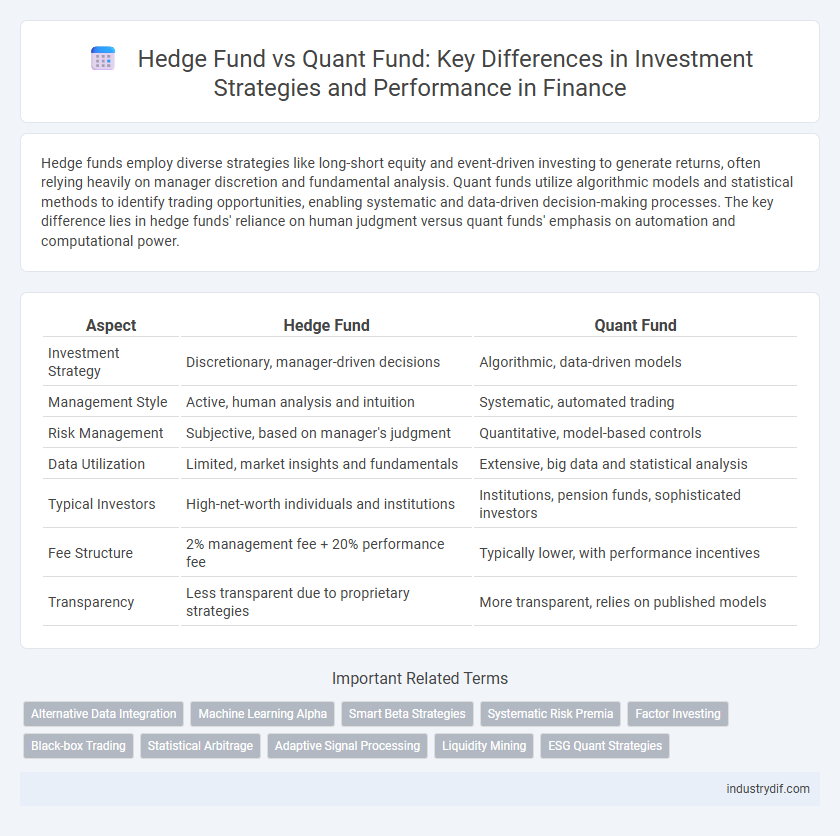

Hedge funds employ diverse strategies like long-short equity and event-driven investing to generate returns, often relying heavily on manager discretion and fundamental analysis. Quant funds utilize algorithmic models and statistical methods to identify trading opportunities, enabling systematic and data-driven decision-making processes. The key difference lies in hedge funds' reliance on human judgment versus quant funds' emphasis on automation and computational power.

Table of Comparison

| Aspect | Hedge Fund | Quant Fund |

|---|---|---|

| Investment Strategy | Discretionary, manager-driven decisions | Algorithmic, data-driven models |

| Management Style | Active, human analysis and intuition | Systematic, automated trading |

| Risk Management | Subjective, based on manager's judgment | Quantitative, model-based controls |

| Data Utilization | Limited, market insights and fundamentals | Extensive, big data and statistical analysis |

| Typical Investors | High-net-worth individuals and institutions | Institutions, pension funds, sophisticated investors |

| Fee Structure | 2% management fee + 20% performance fee | Typically lower, with performance incentives |

| Transparency | Less transparent due to proprietary strategies | More transparent, relies on published models |

Definition of Hedge Funds

Hedge funds are pooled investment vehicles that employ diverse strategies to maximize returns while managing risk, often utilizing leverage, derivatives, and short selling. They cater primarily to accredited investors and institutional clients, offering flexible investment mandates across asset classes such as equities, fixed income, commodities, and currencies. Hedge funds differ from quant funds by emphasizing discretionary decision-making and fundamental analysis rather than reliance on algorithmic or systematic trading models.

Definition of Quant Funds

Quant funds utilize advanced mathematical models, algorithms, and statistical techniques to identify investment opportunities and manage portfolio risk systematically. Unlike traditional hedge funds that rely heavily on manager discretion and qualitative analysis, quant funds process vast datasets to execute trades with high precision and speed. These funds leverage machine learning and big data analytics to optimize returns and minimize human bias in decision-making.

Investment Strategies: Hedge Fund vs Quant Fund

Hedge funds employ diverse investment strategies including long/short equity, arbitrage, and event-driven approaches, relying heavily on manager discretion and fundamental analysis. Quant funds utilize algorithmic models and statistical techniques to execute high-frequency trades or systematic portfolio rebalancing, minimizing human bias. The strategic divergence lies in hedge funds' adaptive, qualitative decision-making versus quant funds' data-driven, rule-based investment processes.

Risk Management Approaches

Hedge funds employ diverse risk management strategies including dynamic hedging, stop-loss orders, and exposure limits to mitigate market volatility and protect capital. Quant funds utilize algorithmic models and statistical analysis to identify and manage risks, leveraging data-driven insights for portfolio optimization and predictive risk assessment. Both fund types prioritize risk-adjusted returns but apply distinct methodologies reflecting their investment philosophies and operational frameworks.

Performance Metrics and Benchmarks

Hedge funds typically measure performance using absolute return metrics such as net alpha and Sharpe ratio, benchmarking against risk-free rates or specific indices like the S&P 500 to evaluate risk-adjusted returns. Quant funds rely heavily on statistical performance indicators including Information Ratio and Sortino ratio, using factor-based benchmarks or custom quantitative models to assess strategy effectiveness. Both fund types emphasize maintaining consistent alpha generation while managing volatility relative to their chosen benchmarks.

Technology and Data Usage

Hedge funds primarily leverage discretionary strategies augmented by data analysis tools, while quant funds rely heavily on advanced algorithms, machine learning, and big data to drive automated trading decisions. Quant funds utilize extensive datasets from market feeds, alternative data sources, and historical price information processed through high-frequency computing infrastructure to identify statistical arbitrage opportunities. This contrast highlights quant funds' dependence on cutting-edge technology and data science for systematic investment models, whereas hedge funds often blend qualitative insights with quantitative data.

Regulatory Environment

Hedge funds operate under less stringent regulatory oversight, often registering with the SEC but benefiting from exemptions under the Investment Advisers Act, allowing flexible investment strategies and less frequent reporting requirements. Quant funds, as a subset of hedge funds utilizing algorithmic trading and complex mathematical models, must navigate specific regulations regarding data usage, algorithm transparency, and risk disclosures to comply with both Securities and Exchange Commission (SEC) guidelines and market conduct rules. Regulatory frameworks emphasize risk management and transparency, compelling quant funds to implement robust compliance systems to meet heightened scrutiny compared to traditional hedge funds.

Fee Structures and Costs

Hedge funds typically charge a 2% management fee and a 20% performance fee based on profits, aligning costs with fund success but resulting in higher overall expenses. Quant funds may offer lower management fees, around 1%, due to their reliance on algorithm-driven strategies and reduced discretionary input, while still applying performance fees that range from 10% to 20%. Investors should consider these fee structures carefully, as the higher costs in hedge funds can impact net returns compared to the often more cost-efficient quant funds.

Typical Investors and Capital Sources

Hedge funds typically attract high-net-worth individuals, family offices, and institutional investors seeking diversified, actively managed portfolios with flexible strategies, relying on capital sourced from accredited investors and large institutional commitments. Quant funds primarily draw sophisticated investors such as pension funds, endowments, and proprietary trading firms that prioritize algorithm-driven, data-intensive investment approaches, with capital frequently raised through structured products and institutional partnerships. Both fund types emphasize risk-adjusted returns but differ markedly in their investor base and capital acquisition methods.

Future Trends in Hedge and Quant Funds

Hedge funds and quant funds are rapidly evolving with increased adoption of artificial intelligence, machine learning, and alternative data sources to enhance predictive accuracy and risk management. The integration of blockchain technology and decentralized finance (DeFi) platforms is expected to disrupt traditional fund structures, providing greater transparency and liquidity. Environmental, social, and governance (ESG) criteria are becoming crucial investment factors, driving funds to incorporate sustainable strategies for long-term value creation.

Related Important Terms

Alternative Data Integration

Hedge funds traditionally rely on fundamental analysis and discretionary strategies, while quant funds leverage algorithmic models to process vast alternative data sets such as satellite imagery, social media sentiment, and transaction records for predictive insight. The integration of alternative data in quant funds enhances alpha generation by uncovering non-traditional market signals often overlooked by conventional hedge fund approaches.

Machine Learning Alpha

Hedge funds leverage machine learning alpha by applying advanced algorithms to exploit market inefficiencies through diverse, discretionary strategies, while quant funds rely heavily on systematic, data-driven models to generate alpha from large-scale pattern recognition and predictive analytics. Machine learning enhances alpha generation in both fund types by enabling adaptive, real-time decision-making that improves risk-adjusted returns and uncovers novel investment signals.

Smart Beta Strategies

Smart Beta strategies blend elements of passive and active management by systematically weighting portfolios based on factors like value, momentum, or volatility, offering a transparent and cost-effective alternative to traditional hedge funds. Quant funds leverage complex algorithms and big data analytics to exploit market inefficiencies, whereas hedge funds often employ discretionary tactics, but both may incorporate Smart Beta to enhance risk-adjusted returns.

Systematic Risk Premia

Hedge funds typically pursue alpha through active management strategies, while quant funds exploit systematic risk premia by using algorithmic models to identify persistent market inefficiencies and factor exposures. Systematic risk premia strategies in quant funds provide diversified, rule-based returns that are less reliant on discretionary decisions and can capture compensation for bearing specific market risks such as value, momentum, or carry.

Factor Investing

Hedge funds often employ discretionary strategies leveraging market insights and macroeconomic trends, whereas quant funds utilize algorithmic models and factor investing to systematically exploit anomalies such as value, momentum, and quality factors across diversified asset classes. Factor investing in quant funds enhances risk-adjusted returns by targeting specific drivers of performance identified through statistical analysis and machine learning techniques.

Black-box Trading

Hedge funds often utilize black-box trading strategies, relying on proprietary algorithms and complex models to execute trades without disclosing the underlying methodologies, which contrasts with quant funds that systematically apply quantitative analysis and data-driven models with greater transparency in their trading logic. Black-box trading in both fund types emphasizes automation and speed, but hedge funds may integrate discretionary insights, while quant funds prioritize statistically validated signals and risk management frameworks.

Statistical Arbitrage

Hedge funds employ diverse strategies including long-short equities and macroeconomic trends, while quant funds rely heavily on algorithmic trading and statistical arbitrage, utilizing quantitative models to identify and exploit price inefficiencies. Statistical arbitrage in quant funds leverages high-frequency data and machine learning to execute rapid, low-risk trades across correlated assets, aiming for consistent alpha generation.

Adaptive Signal Processing

Hedge funds leverage adaptive signal processing through dynamic market analysis to optimize risk-adjusted returns, whereas quant funds predominantly utilize algorithmic strategies grounded in statistical models and machine learning to identify predictive signals. Adaptive signal processing in hedge funds enhances real-time portfolio adjustments, improving responsiveness to market volatility compared to the more static quantitative approaches.

Liquidity Mining

Hedge funds typically engage in liquidity mining through traditional asset classes, leveraging active management and proprietary strategies to optimize yield and risk. Quant funds employ algorithm-driven models to exploit liquidity mining opportunities across decentralized finance (DeFi) platforms, enhancing portfolio efficiency through data-driven decision-making and automated execution.

ESG Quant Strategies

Hedge funds deploying ESG quant strategies utilize advanced algorithms and big data analytics to identify sustainable investment opportunities while managing risks related to environmental, social, and governance factors. Quant funds specialize in systematic, data-driven approaches that enhance ESG integration by optimizing portfolio construction based on ESG scores, carbon footprint metrics, and social impact indicators.

Hedge Fund vs Quant Fund Infographic

industrydif.com

industrydif.com