A bear market is characterized by widespread declining prices across traditional financial assets, typically driven by economic downturns or shifts in investor sentiment. In contrast, a crypto winter refers specifically to prolonged periods of falling cryptocurrency prices, often accompanied by reduced market activity and innovation slowdowns. While both represent market downturns, crypto winters are influenced by unique factors such as regulatory changes and technology development cycles.

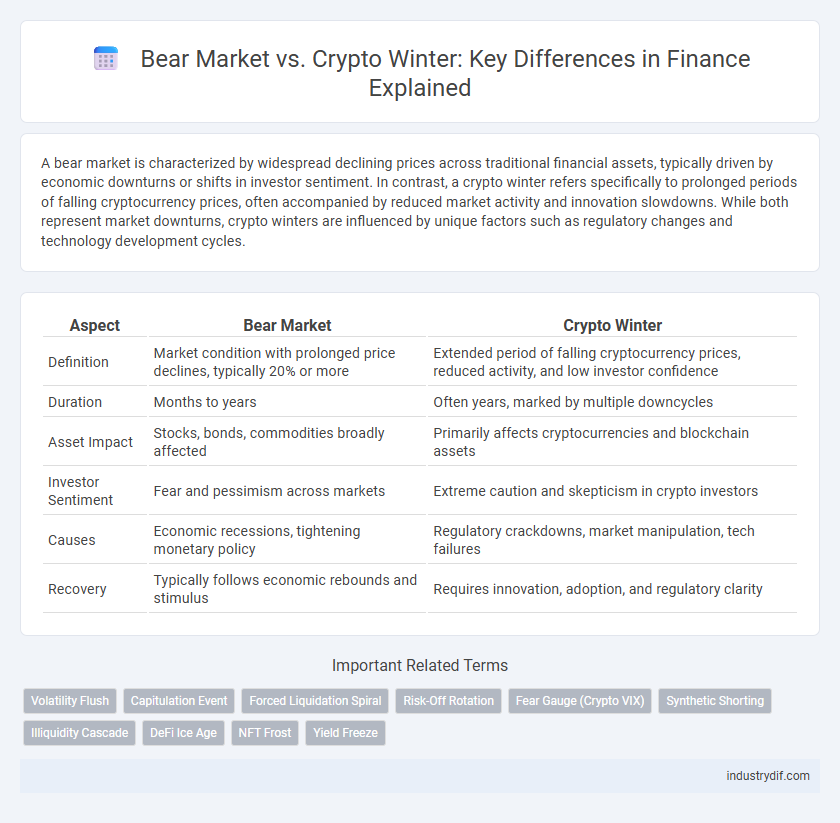

Table of Comparison

| Aspect | Bear Market | Crypto Winter |

|---|---|---|

| Definition | Market condition with prolonged price declines, typically 20% or more | Extended period of falling cryptocurrency prices, reduced activity, and low investor confidence |

| Duration | Months to years | Often years, marked by multiple downcycles |

| Asset Impact | Stocks, bonds, commodities broadly affected | Primarily affects cryptocurrencies and blockchain assets |

| Investor Sentiment | Fear and pessimism across markets | Extreme caution and skepticism in crypto investors |

| Causes | Economic recessions, tightening monetary policy | Regulatory crackdowns, market manipulation, tech failures |

| Recovery | Typically follows economic rebounds and stimulus | Requires innovation, adoption, and regulatory clarity |

Understanding Bear Market in Traditional Finance

A bear market in traditional finance is characterized by a sustained decline of 20% or more in major stock indices, reflecting widespread investor pessimism and reduced market confidence. It typically results from economic downturns, declining corporate earnings, or geopolitical events, leading to increased selling pressure and lower asset prices. Understanding these fundamental drivers helps investors differentiate bear markets from crypto winters, where factors such as regulatory uncertainty and technological shifts play a significant role.

Defining Crypto Winter in the Digital Asset Space

Crypto Winter refers to a prolonged period of declining prices and reduced market activity in the digital asset space, often characterized by significant drops in Bitcoin and other cryptocurrency valuations. Unlike a traditional bear market, Crypto Winter involves extended investor pessimism, diminished liquidity, and widespread project failures or stagnation in blockchain innovation. This phase impacts market sentiment and capital flow, influencing long-term adoption trends and regulatory scrutiny within the cryptocurrency ecosystem.

Key Differences: Bear Market vs Crypto Winter

A bear market is characterized by a prolonged decline of 20% or more in traditional stock markets, driven by economic downturns, reduced investor confidence, and broader financial instability. A crypto winter specifically refers to an extended period of depressed prices and low trading volume within cryptocurrency markets, often influenced by regulatory changes, technological developments, and market sentiment unique to digital assets. While both involve significant market contractions, a crypto winter typically includes heightened volatility and innovation challenges exclusive to blockchain technology and decentralized finance.

Historical Examples of Bear Markets

Historical bear markets, such as the 2008 financial crisis and the 2000 dot-com bubble burst, demonstrate prolonged periods of declining asset prices and investor pessimism. The crypto winter, notably the 2018-2019 phase following Bitcoin's 2017 peak, shares similarities with traditional bear markets in sharp value drops and slow recovery times. Both scenarios emphasize investor caution and market volatility but differ in regulatory frameworks and asset class maturity.

Notable Crypto Winters Since 2011

Notable crypto winters since 2011 include the 2013-2015 downturn triggered by the Mt. Gox exchange collapse and regulatory pressures, and the 2018 bear market following the 2017 ICO boom, which saw Bitcoin prices plummet from nearly $20,000 to below $4,000. The 2022 crypto winter, catalyzed by high-profile liquidations like the FTX bankruptcy and tightening monetary policies, caused widespread asset devaluation across digital currencies. These periods contrast with traditional bear markets by featuring heightened volatility, significant technological challenges, and evolving regulatory scrutiny within the cryptocurrency ecosystem.

Market Triggers: What Causes Bear Markets and Crypto Winters?

Bear markets are typically triggered by economic downturns, rising interest rates, or geopolitical tensions that erode investor confidence and lead to widespread selling in traditional assets like stocks and bonds. Crypto winters result from factors such as regulatory crackdowns, large-scale hacks, and significant declines in network activity or adoption, which create prolonged bearish conditions in cryptocurrency markets. Both market downturns are intensified by negative sentiment and liquidity shortages, but crypto winters often involve unique technological and speculative dynamics absent in traditional bear markets.

Impact on Investor Behavior and Market Sentiment

Bear markets typically trigger widespread investor pessimism, leading to increased asset sell-offs and risk aversion across traditional financial markets. In contrast, crypto winters intensify market volatility and uncertainty, often causing heightened fear and speculative withdrawal within the cryptocurrency community. Both conditions significantly dampen market sentiment, but crypto winters uniquely exacerbate mistrust due to the sector's nascent regulatory environment and frequent technological disruptions.

Recovery Patterns: Stocks vs Cryptocurrencies

Bear markets in stocks typically exhibit gradual recovery patterns driven by economic fundamentals and corporate earnings growth, often spanning months to years. In contrast, crypto winters show more volatile and unpredictable recoveries, influenced heavily by market sentiment, regulatory changes, and technological innovations. While stock markets benefit from historical performance data to gauge rebounds, cryptocurrency markets require adaptive strategies due to rapid shifts in investor behavior and ecosystem developments.

Strategies for Navigating Bear Markets and Crypto Winters

Effective strategies for navigating bear markets and crypto winters involve diversifying investment portfolios to mitigate risk and maintaining liquidity for potential buying opportunities. Utilizing dollar-cost averaging helps investors avoid market timing and reduces the impact of volatility in both traditional stocks and cryptocurrencies. Staying informed through reliable financial analysis and adhering to long-term investment goals can enhance resilience during prolonged market downturns.

Long-term Implications for Financial Markets and Crypto Ecosystems

Bear markets in traditional finance typically signal prolonged economic downturns with decreased investor confidence and reduced liquidity, often lasting months or years and impacting equities, bonds, and commodities globally. Crypto winters drastically lower token valuations and investor activity, stalling innovation but encouraging ecosystem resilience through project consolidation and enhanced regulatory frameworks. Long-term implications for both include heightened risk awareness, structural market adjustments, and the potential emergence of stronger, more sustainable investment landscapes in equities and blockchain technologies.

Related Important Terms

Volatility Flush

A Bear Market typically features prolonged declines in traditional asset prices triggered by economic downturns, while a Crypto Winter represents an extended phase of declining cryptocurrency valuations driven by market sentiment and regulatory pressures. Both scenarios involve a volatility flush, where sharp price corrections and heightened sell-offs purge speculative excess, resetting market dynamics for sustainable growth.

Capitulation Event

A capitulation event in both bear markets and crypto winters signals widespread panic selling, where investors drastically liquidate assets, leading to sharp price declines and market bottoms. This phase often marks the transition from sustained negative sentiment to eventual recovery, driven by exhausted sellers and renewed accumulation opportunities.

Forced Liquidation Spiral

A forced liquidation spiral in a bear market typically involves widespread selling pressure as investors liquidate traditional assets to cover losses, exacerbating price declines and deepening the downturn. In contrast, a crypto winter's forced liquidation spiral often accelerates due to leveraged positions on decentralized platforms, causing rapid collapses in token values and triggering cascading margin calls across the blockchain ecosystem.

Risk-Off Rotation

Risk-off rotation during a bear market typically leads to a sell-off in traditional equities and bonds as investors seek safer assets, while a crypto winter amplifies this risk aversion within digital assets, causing significant declines in cryptocurrencies and related tokens. The heightened risk-off sentiment drives capital away from volatile investments, exacerbating price drops and reducing market liquidity across both traditional and crypto markets.

Fear Gauge (Crypto VIX)

The Crypto VIX, a volatility index measuring market fear in digital assets, spikes sharply during both bear markets and crypto winters, reflecting heightened investor uncertainty and risk aversion. While traditional bear markets signify prolonged downturns in stock prices, crypto winters are characterized by extended periods of decline and stagnation in cryptocurrency values, with the Crypto VIX serving as a critical barometer for timing entry and exit points in these volatile conditions.

Synthetic Shorting

Synthetic shorting enables investors to profit during bear markets or crypto winters by replicating short positions through derivatives without directly short-selling the underlying assets. This strategy leverages options or futures contracts to hedge portfolios and mitigate risks amid prolonged market downturns and decreased asset valuations.

Illiquidity Cascade

Bear markets trigger illiquidity cascades as declining asset values prompt widespread selling, exacerbating market drops and liquidity shortages. Crypto winters intensify illiquidity with reduced trading volumes, concentrated token holdings, and network-specific vulnerabilities, leading to prolonged capital freezes and decreased market confidence.

DeFi Ice Age

DeFi Ice Age refers to a prolonged downturn in decentralized finance projects marked by declining liquidity, reduced yields, and widespread project failures that parallel but extend beyond traditional bear markets or crypto winters. This phenomenon is characterized by systemic risks in DeFi protocols, including smart contract vulnerabilities and governance challenges, exacerbating investor losses amid broader market contractions.

NFT Frost

Bear markets generally indicate prolonged declines in traditional financial assets, while crypto winters specifically reference extended downtrends in cryptocurrency markets. NFT Frost describes the sharp decrease in NFT trading volumes and valuations during crypto winters, reflecting reduced market enthusiasm and liquidity within the digital collectibles sector.

Yield Freeze

A yield freeze in both bear markets and crypto winters significantly hampers investor returns by locking capital in low or negative-yielding assets, stalling portfolio growth. This phenomenon exacerbates market liquidity issues, as traders avoid riskier ventures, deepening the downturn's impact on asset prices and financial stability.

Bear Market vs Crypto Winter Infographic

industrydif.com

industrydif.com