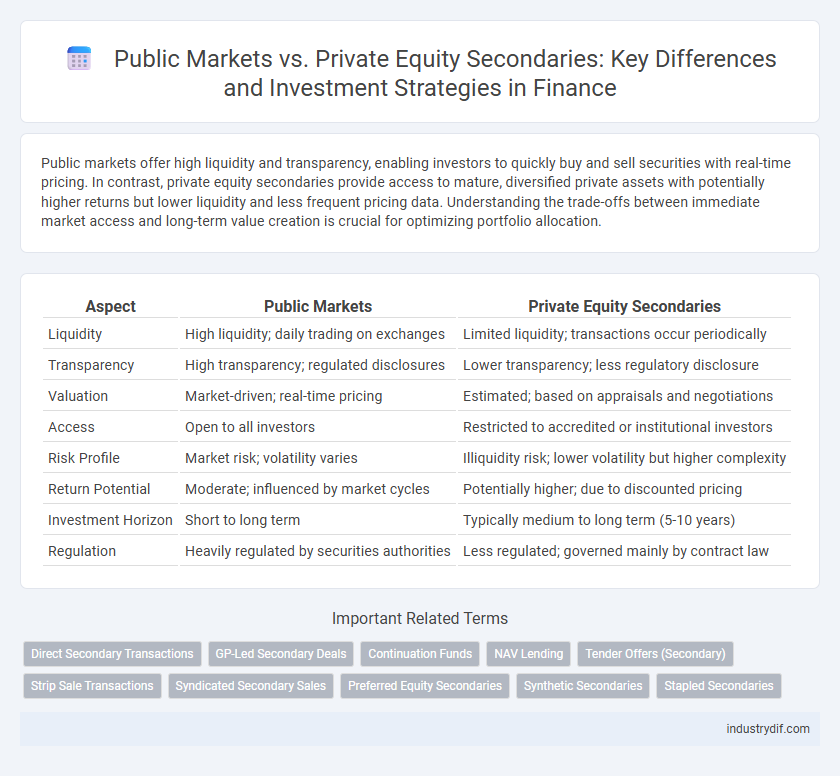

Public markets offer high liquidity and transparency, enabling investors to quickly buy and sell securities with real-time pricing. In contrast, private equity secondaries provide access to mature, diversified private assets with potentially higher returns but lower liquidity and less frequent pricing data. Understanding the trade-offs between immediate market access and long-term value creation is crucial for optimizing portfolio allocation.

Table of Comparison

| Aspect | Public Markets | Private Equity Secondaries |

|---|---|---|

| Liquidity | High liquidity; daily trading on exchanges | Limited liquidity; transactions occur periodically |

| Transparency | High transparency; regulated disclosures | Lower transparency; less regulatory disclosure |

| Valuation | Market-driven; real-time pricing | Estimated; based on appraisals and negotiations |

| Access | Open to all investors | Restricted to accredited or institutional investors |

| Risk Profile | Market risk; volatility varies | Illiquidity risk; lower volatility but higher complexity |

| Return Potential | Moderate; influenced by market cycles | Potentially higher; due to discounted pricing |

| Investment Horizon | Short to long term | Typically medium to long term (5-10 years) |

| Regulation | Heavily regulated by securities authorities | Less regulated; governed mainly by contract law |

Overview of Public Markets and Private Equity Secondaries

Public markets offer high liquidity and transparency with assets traded on regulated exchanges, enabling real-time pricing and access to a wide investor base. Private equity secondaries involve the buying and selling of pre-existing investor commitments to private equity funds, providing liquidity in inherently illiquid assets while often trading at a discount or premium to net asset value (NAV). Both markets serve distinct investor needs, with public markets prioritizing immediate liquidity and private equity secondaries focusing on portfolio diversification and access to private assets without the typical long lock-up periods.

Key Differences Between Public Markets and Private Equity Secondaries

Public markets offer high liquidity and immediate price transparency, enabling investors to buy and sell shares rapidly with real-time valuation. Private equity secondaries involve trading pre-existing investor stakes in private companies, characterized by lower liquidity and longer holding periods due to the illiquid nature of private assets. Pricing in private equity secondaries often includes discounts to net asset value (NAV) reflecting valuation uncertainty, whereas public markets use market-driven prices reflecting aggregated supply and demand dynamics.

Liquidity and Accessibility in Public vs Private Markets

Public markets offer high liquidity with shares traded on exchanges, enabling investors to quickly buy or sell assets at transparent prices. Private equity secondaries provide limited liquidity, as transactions occur less frequently and often involve negotiated prices, restricting immediate access to capital. Accessibility in public markets is broad, allowing a diverse range of investors to participate, whereas private equity secondaries typically require accredited investors and larger minimum commitments.

Valuation Methods: Public Markets vs Secondary Private Equity

Valuation methods in public markets primarily rely on real-time pricing derived from transparent market transactions and widely recognized financial metrics such as price-to-earnings (P/E) ratios and market capitalization. In contrast, secondary private equity valuations depend on less frequent deal-based assessments, often using discounted cash flow (DCF) analysis, net asset value (NAV), and peer comparisons adjusted for illiquidity and market inefficiencies. The difference in transparency, liquidity, and frequency of valuation updates leads to distinct pricing dynamics and risk premiums between public equities and private equity secondaries.

Investor Profiles and Participation

Institutional investors such as pension funds and endowments predominantly dominate private equity secondaries, seeking long-term, illiquid assets with risk diversification benefits. Public markets attract a broader range of participants, including retail investors and active traders, due to higher liquidity and transparency. Differences in investor profiles result in varying strategies and risk appetites, with private equity secondaries favoring patient capital while public markets enable rapid entry and exit.

Risk and Return Characteristics

Public markets offer high liquidity and transparency, enabling investors to swiftly adjust portfolios with relatively lower risk due to regulatory oversight. Private equity secondaries provide access to mature assets with historical performance data, typically generating higher risk-adjusted returns through illiquidity premiums and reduced J-curve effects. The risk-return tradeoff in public markets favors volatility sensitivity, whereas private equity secondaries emphasize capital preservation coupled with yield enhancement over longer holding periods.

Regulatory Environments

Public markets operate under stringent regulatory frameworks established by agencies like the SEC, ensuring transparency, market liquidity, and investor protection through mandatory disclosures and periodic reporting requirements. In contrast, private equity secondaries face less rigid regulatory oversight but must navigate complex compliance with securities laws, including exemptions under Regulation D and the JOBS Act, which govern private placements and investor eligibility. The divergent regulatory environments influence liquidity, valuation transparency, and access to capital, driving distinct risk profiles and strategic considerations for investors in each market.

Common Strategies in Public Markets and PE Secondaries

Public markets often employ strategies such as index investing, growth and value investing, and quantitative trading, leveraging liquidity and transparency to optimize portfolio performance. In private equity secondaries, strategies focus on acquiring existing stakes in private funds or direct investments at a discount, aiming for risk mitigation and enhanced returns through diversification and decreased holding periods. Both markets utilize fundamental and market-driven analyses, but secondaries emphasize due diligence on underlying asset quality and fund manager reputation.

Recent Trends in Public and Private Equity Secondaries

Recent trends in public and private equity secondaries reveal increased liquidity and market depth driven by rising institutional investor participation and technological advancements in transaction platforms. A growing preference for private equity secondaries is noted due to their potential for higher yields and portfolio diversification compared to traditional public markets. Data from 2023 indicates a surge in secondary deal volumes, with private equity secondaries reaching over $100 billion globally, reflecting robust investor demand and evolving capital recycling strategies.

Future Outlook for Public and Private Equity Secondaries

Public markets are expected to benefit from increased liquidity and regulatory transparency, attracting more institutional investors seeking real-time pricing and flexibility. Private equity secondaries will likely see continued growth driven by aging portfolios and the rising demand for diversification, with innovations such as increased GP-led transactions enhancing market efficiency. Both markets are poised to integrate advanced data analytics and AI to optimize asset valuation and improve risk management in evolving financial landscapes.

Related Important Terms

Direct Secondary Transactions

Direct secondary transactions in private equity involve the sale of ownership interests in existing private equity funds or portfolios, providing liquidity options that differ significantly from public market trading of equity securities. These transactions often offer discounted valuations and complex negotiations, contrasting with the high liquidity and transparent pricing typically found in public markets.

GP-Led Secondary Deals

GP-led secondary deals in private equity enable general partners to restructure or recapitalize funds, offering liquidity solutions that are less accessible in public markets due to regulatory constraints and market volatility. These transactions often provide institutional investors with tailored investment opportunities, enhanced portfolio diversification, and potentially attractive risk-adjusted returns compared to traditional public market securities.

Continuation Funds

Continuation funds in private equity secondaries provide investors with extended liquidity by allowing stakes in mature portfolios to be sold, contrasting public markets where securities are traded continuously and valuations fluctuate daily. These funds offer strategic advantages such as enhanced asset management and tailored exit timing, which are less accessible in the public equity landscape.

NAV Lending

NAV lending in private equity secondaries offers tailored financing solutions by using the net asset value of private equity funds as collateral, enabling investors to access liquidity without liquidating positions. Public markets typically lack such structured NAV-based credit facilities, leading to greater reliance on market volatility and less efficient capital deployment.

Tender Offers (Secondary)

Tender offers in public markets provide liquidity through transparent price discovery and regulatory oversight, enabling investors to sell shares at market-driven valuations. In contrast, private equity secondaries via tender offers offer limited liquidity by facilitating transactions in illiquid assets, often at negotiated discounts reflecting private market complexities and less frequent pricing transparency.

Strip Sale Transactions

Strip sale transactions in public markets involve selling a diversified portfolio of securities, enabling investors to adjust exposure quickly with enhanced liquidity, while private equity secondaries focus on purchasing interests in private funds at negotiated discounts, offering access to illiquid assets with potential value appreciation. Public markets prioritize transparency and regulatory oversight, whereas private equity secondaries emphasize bespoke deal structures and portfolio diversification within restricted market environments.

Syndicated Secondary Sales

Syndicated secondary sales in private equity provide liquidity by pooling investor interests, allowing broader participation compared to the more transparent and liquid public markets. These transactions optimize portfolio diversification and pricing efficiency while catering to institutional investors seeking access to mature, less volatile assets outside traditional public equity exchanges.

Preferred Equity Secondaries

Preferred equity secondaries in private equity offer tailored liquidity solutions and structured risk-return profiles, distinguishing them from the more liquid but volatile public markets. These instruments provide investors with priority claims on cash flows and downside protection, making them a strategic component in diversified alternative investment portfolios.

Synthetic Secondaries

Synthetic secondaries in private equity provide liquidity by allowing investors to gain exposure to existing portfolios without directly buying underlying assets, contrasting with public markets where shares of companies trade openly. These transactions often involve structured financial instruments such as derivatives or funded structures, offering tailored risk-return profiles and access to illiquid assets not available in public markets.

Stapled Secondaries

Stapled secondaries in private equity combine a traditional secondary transaction with a commitment to a new fund, offering liquidity and immediate reinvestment opportunities that are less accessible in public markets. This strategy enhances portfolio diversification and aligns limited partners' interests by bridging mature assets with fresh capital deployment.

Public Markets vs Private Equity Secondaries Infographic

industrydif.com

industrydif.com