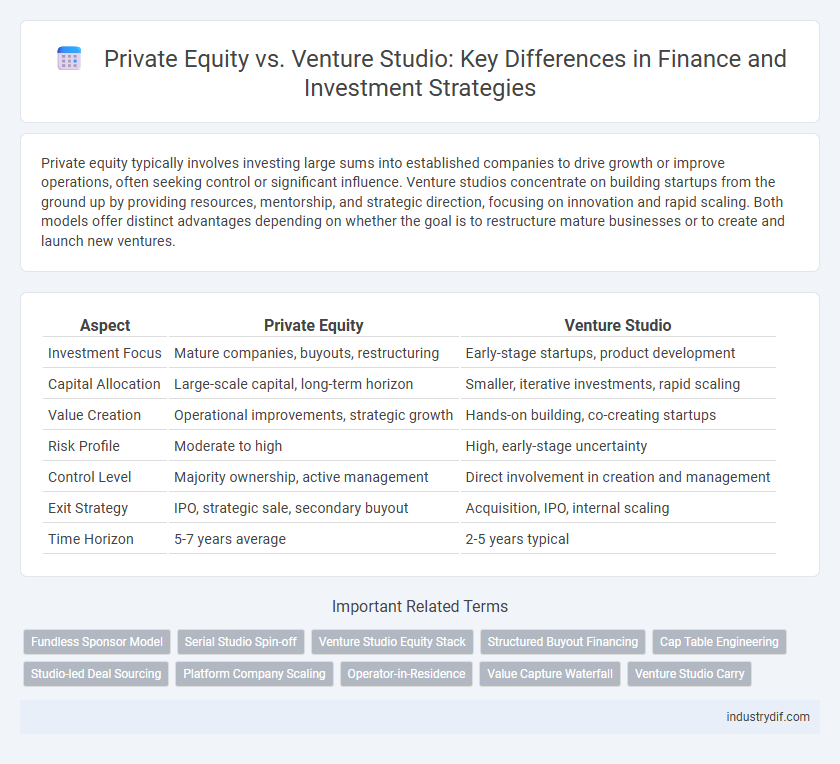

Private equity typically involves investing large sums into established companies to drive growth or improve operations, often seeking control or significant influence. Venture studios concentrate on building startups from the ground up by providing resources, mentorship, and strategic direction, focusing on innovation and rapid scaling. Both models offer distinct advantages depending on whether the goal is to restructure mature businesses or to create and launch new ventures.

Table of Comparison

| Aspect | Private Equity | Venture Studio |

|---|---|---|

| Investment Focus | Mature companies, buyouts, restructuring | Early-stage startups, product development |

| Capital Allocation | Large-scale capital, long-term horizon | Smaller, iterative investments, rapid scaling |

| Value Creation | Operational improvements, strategic growth | Hands-on building, co-creating startups |

| Risk Profile | Moderate to high | High, early-stage uncertainty |

| Control Level | Majority ownership, active management | Direct involvement in creation and management |

| Exit Strategy | IPO, strategic sale, secondary buyout | Acquisition, IPO, internal scaling |

| Time Horizon | 5-7 years average | 2-5 years typical |

Definition of Private Equity and Venture Studios

Private equity refers to investment funds that acquire equity ownership in established companies, often aiming to improve operations and increase value before exiting through a sale or IPO. Venture studios, also known as startup studios or company builders, create and launch multiple startups by providing initial capital, operational support, and strategic direction from inception. While private equity focuses on scaling existing businesses, venture studios concentrate on incubating early-stage ventures to accelerate innovation and market entry.

Key Differences Between Private Equity and Venture Studios

Private equity firms primarily invest in established companies by acquiring significant equity stakes to drive operational improvements and generate high returns. Venture studios, on the other hand, build startups from the ground up by providing capital, talent, and strategic resources throughout the company-building process. The key differences lie in the investment stage, with private equity targeting mature businesses, while venture studios focus on early-stage innovation and startup creation.

Investment Strategies: Private Equity vs Venture Studios

Private equity firms primarily invest in mature companies with established cash flows, aiming to improve operational efficiency and drive long-term value through strategic management and financial restructuring. Venture studios focus on early-stage startup creation, leveraging internal resources to rapidly test, refine, and scale new business ideas, prioritizing innovation and market disruption. While private equity emphasizes controlling stakes and gradual growth, venture studios invest in multiple ventures with higher risk and potential for exponential returns.

Stages of Business Targeted by Each Model

Private equity firms typically target mature businesses in later stages, such as growth, expansion, or pre-IPO phases, aiming to optimize operational efficiencies and maximize returns through restructuring or scaling. Venture studios focus on early-stage startups, often in the ideation or product development phases, providing hands-on support to accelerate innovation and market entry. The distinct targeting of business stages influences investment strategies, risk profiles, and value creation approaches unique to each model.

Value Creation: Approaches in Private Equity and Venture Studios

Private equity firms create value by optimizing established companies through financial restructuring, operational improvements, and strategic management to drive growth and profitability. Venture studios generate value by incubating early-stage startups, providing hands-on support, resources, and iterative product development to rapidly scale innovative business models. The private equity approach emphasizes maximizing returns through mature asset enhancement, while venture studios focus on early validation, market fit, and agility in emerging markets.

Risk Profiles and Return Expectations

Private equity investments typically involve lower risk profiles with steady returns by acquiring mature companies, whereas venture studios engage in high-risk early-stage startups aiming for exponential returns. Private equity investors expect consistent cash flows and capital preservation, while venture studios focus on innovation potential and scalability with uncertain outcomes. Understanding these distinctions helps allocate capital according to risk tolerance and desired return horizons.

Involvement and Control in Portfolio Companies

Private equity firms typically acquire majority stakes in portfolio companies, enabling direct control over strategic decisions and operational restructuring to maximize returns. Venture studios invest primarily at the inception stage, co-founding startups and maintaining hands-on involvement throughout the product development and market entry phases. The degree of control in private equity centers on financial and governance mechanisms, while venture studios emphasize active participation in innovation and team building.

Fund Structure and Capital Sources

Private equity funds typically raise capital from institutional investors and high-net-worth individuals, structuring their funds as limited partnerships where general partners manage investments and limited partners provide capital. Venture studios finance projects internally, reinvesting operational revenue or securing seed capital from strategic partners, often maintaining full equity ownership rather than external fundraising. Fund structures in private equity emphasize long-term capital commitments with defined investment periods, whereas venture studios operate with flexible capital allocation tailored to iterative startup development.

Exit Strategies and Liquidity Events

Private equity firms primarily pursue exit strategies through leveraged buyouts, secondary sales, or initial public offerings (IPOs), aiming for liquidity events that maximize investor returns within a 4-7 year horizon. Venture studios focus on building multiple startups in-house and typically seek exits via acquisitions or strategic partnerships, often facilitating earlier liquidity events through mergers or buyouts. Both models prioritize value creation but differ in timelines and mechanisms to achieve optimal capital realization for stakeholders.

Choosing Between Private Equity and Venture Studios for Entrepreneurs

Entrepreneurs seeking growth capital must weigh Private Equity's focus on established businesses with proven cash flows against Venture Studios' hands-on approach in building early-stage startups from the ground up. Private Equity offers significant funding and strategic guidance for scaling mature companies, while Venture Studios provide operational support, mentorship, and co-creation for novel ideas in exchange for equity stakes. Selecting between these options depends on the entrepreneur's stage of business, need for operational involvement, and appetite for risk versus control.

Related Important Terms

Fundless Sponsor Model

The fundless sponsor model in private equity allows investment professionals to source deals and raise capital on a deal-by-deal basis, reducing the need for a committed fund and increasing flexibility compared to traditional private equity firms. Venture studios, by contrast, focus on systematically building startups in-house but typically rely on their own capital or external investors rather than operating under a fundless sponsor structure.

Serial Studio Spin-off

Serial studio spin-offs leverage venture studios' structured innovation processes to rapidly develop and commercialize startups with proven market potential, contrasting with private equity's typical focus on mature companies and long-term value creation. Venture studios provide hands-on operational support and strategic resources during early-stage growth, whereas private equity firms primarily invest capital to optimize performance and scale existing businesses.

Venture Studio Equity Stack

The venture studio equity stack typically includes founder shares, employee stock options, and investor equity, structured to align incentives across all stakeholders while retaining operational control within the studio. Compared to private equity, venture studio investments often emphasize earlier-stage company building with higher risk and potentially greater long-term equity value creation.

Structured Buyout Financing

Structured buyout financing in private equity involves tailored debt and equity packages designed to optimize capital structure and minimize risk, often incorporating mezzanine financing and earnouts to enhance returns. Venture studios typically rely less on structured buyouts, focusing instead on initial equity stakes and operational support during early-stage venture building, which limits traditional buyout financing applications.

Cap Table Engineering

Private equity firms focus on optimizing cap table engineering by acquiring significant equity stakes in mature companies, structuring ownership to maximize control and value extraction. In contrast, venture studios engineer cap tables through iterative equity distributions among founders, early employees, and strategic partners to balance risk and incentivize innovation at the startup phase.

Studio-led Deal Sourcing

Studio-led deal sourcing in private equity uniquely combines in-house innovation with capital deployment, enabling venture studios to identify and develop startups from inception rather than relying solely on external opportunities. This approach accelerates value creation by integrating operational expertise and strategic resources early, differentiating it from traditional private equity models focused on later-stage investments.

Platform Company Scaling

Private Equity firms focus on scaling platform companies by leveraging operational improvements, strategic acquisitions, and financial restructuring to enhance value and drive long-term growth. Venture Studios accelerate platform scaling through hands-on support, co-building startups, and integrating innovative technologies to rapidly validate business models and expand market presence.

Operator-in-Residence

An Operator-in-Residence in private equity typically focuses on optimizing portfolio company operations to drive growth and improve financial performance, leveraging seasoned management expertise. In contrast, an Operator-in-Residence at a venture studio plays an active role in building new startups from inception, combining hands-on operational leadership with strategic investment to accelerate early-stage innovation.

Value Capture Waterfall

Private equity firms optimize value capture waterfalls by structuring returns through multiple tiers, prioritizing capital recovery and preferred returns before profit-sharing, thereby maximizing investor payouts. Venture studios, by contrast, focus on iterative value creation through operational involvement in startups, with value capture often realized via equity stakes that escalate as portfolio companies mature and exit.

Venture Studio Carry

Venture Studio carry typically involves a profit-sharing arrangement where founders and key contributors receive equity stakes in portfolio companies created and scaled within the studio, aligning incentives for long-term growth. Unlike traditional private equity carry structures, which are based on limited partner profit distributions from investment exits, venture studio carry emphasizes ongoing operational involvement and value creation during the early-stage development and scaling phases.

Private Equity vs Venture Studio Infographic

industrydif.com

industrydif.com