Hedge funds employ diverse strategies including long-short equity, event-driven, and global macro to generate alpha. Quantitative hedge funds utilize advanced algorithms, statistical models, and machine learning techniques to identify market inefficiencies and execute trades at high speed. The data-driven approach of quantitative funds often leads to enhanced risk management and consistent returns compared to traditional hedge fund methods.

Table of Comparison

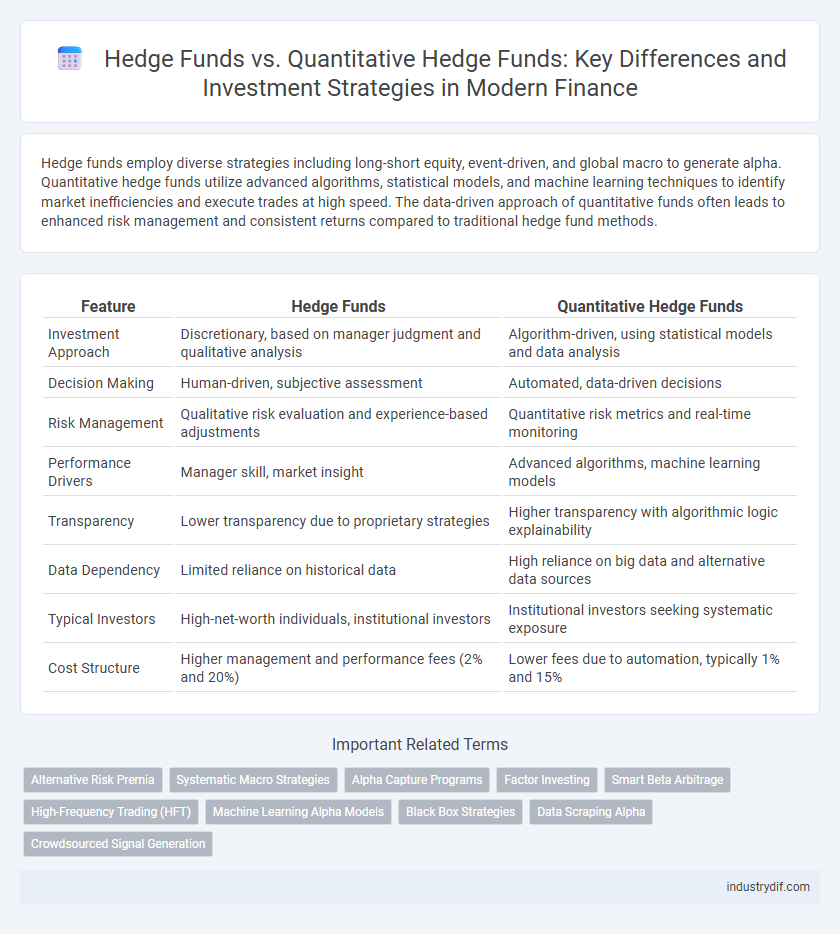

| Feature | Hedge Funds | Quantitative Hedge Funds |

|---|---|---|

| Investment Approach | Discretionary, based on manager judgment and qualitative analysis | Algorithm-driven, using statistical models and data analysis |

| Decision Making | Human-driven, subjective assessment | Automated, data-driven decisions |

| Risk Management | Qualitative risk evaluation and experience-based adjustments | Quantitative risk metrics and real-time monitoring |

| Performance Drivers | Manager skill, market insight | Advanced algorithms, machine learning models |

| Transparency | Lower transparency due to proprietary strategies | Higher transparency with algorithmic logic explainability |

| Data Dependency | Limited reliance on historical data | High reliance on big data and alternative data sources |

| Typical Investors | High-net-worth individuals, institutional investors | Institutional investors seeking systematic exposure |

| Cost Structure | Higher management and performance fees (2% and 20%) | Lower fees due to automation, typically 1% and 15% |

Introduction to Hedge Funds and Quantitative Hedge Funds

Hedge funds are pooled investment vehicles that use diverse strategies to generate high returns, often leveraging long-short equity, derivatives, and arbitrage techniques. Quantitative hedge funds apply advanced mathematical models, statistical analysis, and algorithmic trading to identify market inefficiencies and optimize portfolio performance. Both types aim to deliver alpha but differ fundamentally in their approach, with quantitative funds relying heavily on data-driven, automated decision-making processes.

Core Strategies of Traditional Hedge Funds

Traditional hedge funds primarily employ core strategies such as long/short equity, event-driven, global macro, and fixed income arbitrage, aiming to generate alpha through active management and market insight. These strategies rely heavily on fundamental analysis, discretionary decision-making, and macroeconomic trends to identify undervalued assets or opportunities for arbitrage. Unlike quantitative hedge funds, which utilize algorithmic models and large data sets, traditional hedge funds focus on qualitative assessment and tactical asset allocation to manage risk and optimize returns.

Quantitative Approaches in Hedge Fund Management

Quantitative hedge funds utilize advanced mathematical models, statistical analysis, and algorithmic trading strategies to identify market inefficiencies and optimize portfolio returns. These data-driven approaches enhance decision-making precision, reduce human bias, and enable rapid adaptation to changing market conditions. Leveraging artificial intelligence and machine learning techniques, quantitative hedge fund management increasingly outperforms traditional discretionary methods in risk-adjusted returns.

Differences in Investment Decision-Making Processes

Hedge funds employ discretionary investment strategies driven by qualitative analysis and human judgment, focusing on market trends, macroeconomic factors, and manager expertise to make decisions. Quantitative hedge funds rely on algorithmic models and statistical methods to identify trading opportunities, using vast datasets, machine learning techniques, and real-time data processing to execute systematic trades. The fundamental difference lies in discretionary intuition versus data-driven automation, impacting risk management, adaptiveness, and execution speed.

Risk Management Techniques: Traditional vs Quantitative

Traditional hedge funds primarily rely on discretionary risk management techniques, including qualitative assessments, stop-loss orders, and diversification across asset classes to mitigate potential losses. Quantitative hedge funds employ advanced statistical models, machine learning algorithms, and real-time data analysis to dynamically adjust risk exposure and optimize portfolio performance. These quantitative methods enhance precision in identifying market anomalies and managing volatility compared to traditional strategies.

Role of Technology and Data Analytics

Hedge funds employ diverse strategies to generate alpha, while quantitative hedge funds leverage advanced technology and data analytics to identify complex market patterns and execute algorithm-driven trades. The integration of big data, machine learning, and high-frequency trading platforms allows quantitative hedge funds to process vast datasets with superior speed and precision. This technological edge enhances risk management and portfolio optimization, distinguishing quantitative strategies from traditional discretionary approaches.

Performance Metrics and Evaluation

Hedge funds are traditionally evaluated using performance metrics such as alpha, beta, Sharpe ratio, and maximum drawdown to assess risk-adjusted returns and market exposure. Quantitative hedge funds incorporate advanced algorithmic models and big data analytics to optimize these metrics, often achieving more consistent alpha generation through systematic trading strategies. Performance evaluation for quantitative funds frequently emphasizes predictive accuracy, factor exposure analysis, and robustness across diverse market conditions to ensure model reliability and adaptability.

Regulatory Considerations and Compliance

Hedge funds face complex regulatory frameworks set by bodies like the SEC, requiring comprehensive disclosures and investor protections, while quantitative hedge funds must also address algorithmic trading compliance and data usage audits. Quantitative strategies increase scrutiny on model risk management and cybersecurity protocols, necessitating robust controls to mitigate systemic risks. Both fund types must navigate evolving regulations such as the Dodd-Frank Act and MiFID II, ensuring ongoing adherence to reporting standards and anti-money laundering requirements.

Investor Profiles and Accessibility

Hedge funds typically attract high-net-worth individuals and institutional investors due to their high minimum investment requirements and less transparent strategies. Quantitative hedge funds appeal to investors seeking data-driven, algorithm-based approaches with a focus on scalability and systematic risk management, often offering more accessible entry points through diversified quantitative models. Both investor profiles value risk-adjusted returns but differ in their preference for discretionary management versus automated trading systems.

Future Trends in Hedge Fund Strategies

Future trends in hedge fund strategies indicate a significant shift toward quantitative hedge funds driven by advances in artificial intelligence, machine learning, and big data analytics. Traditional hedge funds are increasingly integrating systematic models to enhance risk management and improve predictive accuracy in volatile markets. Enhanced algorithmic trading platforms and alternative data sources will continue to drive performance differentiation and operational efficiency in the hedge fund industry.

Related Important Terms

Alternative Risk Premia

Hedge funds employ diverse strategies to manage risk and capture returns, while quantitative hedge funds specifically leverage algorithmic models and data-driven techniques to exploit alternative risk premia such as value, momentum, and carry. Alternative risk premia strategies provide systematic, low-correlation sources of alpha by harvesting persistent risk factors beyond traditional market exposures.

Systematic Macro Strategies

Systematic macro strategies in hedge funds utilize algorithm-driven models to analyze global economic indicators and execute trades across asset classes, enhancing predictive accuracy and risk management compared to traditional discretionary hedge funds. Quantitative hedge funds employ advanced statistical techniques and machine learning to systematically capture macroeconomic trends, offering increased transparency and scalability in portfolio allocation.

Alpha Capture Programs

Hedge funds leverage diverse investment strategies to maximize returns, while quantitative hedge funds employ algorithm-driven models to systematically identify market inefficiencies. Alpha capture programs enhance these funds by sourcing actionable trading ideas from a broad network of sell-side analysts and portfolio managers, optimizing alpha generation and risk-adjusted performance.

Factor Investing

Hedge funds utilize diverse strategies, including discretionary decisions, while quantitative hedge funds systematically apply mathematical models and algorithms to exploit factor investing such as value, momentum, and size premia. Factor investing in quantitative hedge funds enhances risk-adjusted returns by identifying and capitalizing on persistent drivers of asset performance through data-driven factor exposures.

Smart Beta Arbitrage

Hedge funds employ various strategies to achieve alpha, while quantitative hedge funds leverage advanced algorithms and data analytics to execute smart beta arbitrage, optimizing risk-adjusted returns through systematic exploitation of market inefficiencies. Smart beta arbitrage in quantitative funds focuses on factor-based investing, using statistical models to identify mispricings across equities and derivatives, enhancing portfolio diversification and reducing exposure to traditional market risks.

High-Frequency Trading (HFT)

Hedge funds employ diverse strategies including long-short equity and global macro, while quantitative hedge funds rely heavily on algorithmic models and data analysis, with high-frequency trading (HFT) as a key component that executes thousands of trades per second to capitalize on minimal price discrepancies. HFT-driven quantitative funds leverage low latency systems and advanced machine learning to optimize trade execution and risk management, differentiating them significantly from traditional hedge funds in speed and strategy precision.

Machine Learning Alpha Models

Hedge funds utilize diverse strategies to generate alpha, while quantitative hedge funds specifically rely on machine learning alpha models to analyze vast datasets and identify predictive patterns for asset price movements. These machine learning models enhance decision-making accuracy by leveraging algorithms such as neural networks, reinforcement learning, and natural language processing to optimize portfolio performance and risk management.

Black Box Strategies

Hedge funds traditionally rely on discretionary investment decisions, while quantitative hedge funds utilize black box strategies driven by complex algorithms and data analysis to identify trading opportunities. These black box models operate with minimal human intervention, leveraging big data, machine learning, and predictive analytics to optimize portfolio performance and risk management.

Data Scraping Alpha

Hedge funds leverage diverse investment strategies to generate alpha, but quantitative hedge funds specifically use advanced data scraping techniques and algorithmic models to identify market inefficiencies and optimize returns. Data scraping alpha involves extracting vast datasets from multiple sources to build predictive models that enhance decision-making and outperform traditional discretionary approaches.

Crowdsourced Signal Generation

Hedge funds typically rely on traditional fundamental analysis and experienced portfolio managers to identify investment opportunities, whereas quantitative hedge funds leverage crowdsourced signal generation, utilizing vast datasets and algorithmic models contributed by a global network of analysts and data scientists to enhance predictive accuracy. Crowdsourced signals in quantitative hedge funds enable diversified, data-driven decision-making by aggregating insights from multiple independent contributors, resulting in improved risk management and alpha generation.

Hedge Funds vs Quantitative Hedge Funds Infographic

industrydif.com

industrydif.com