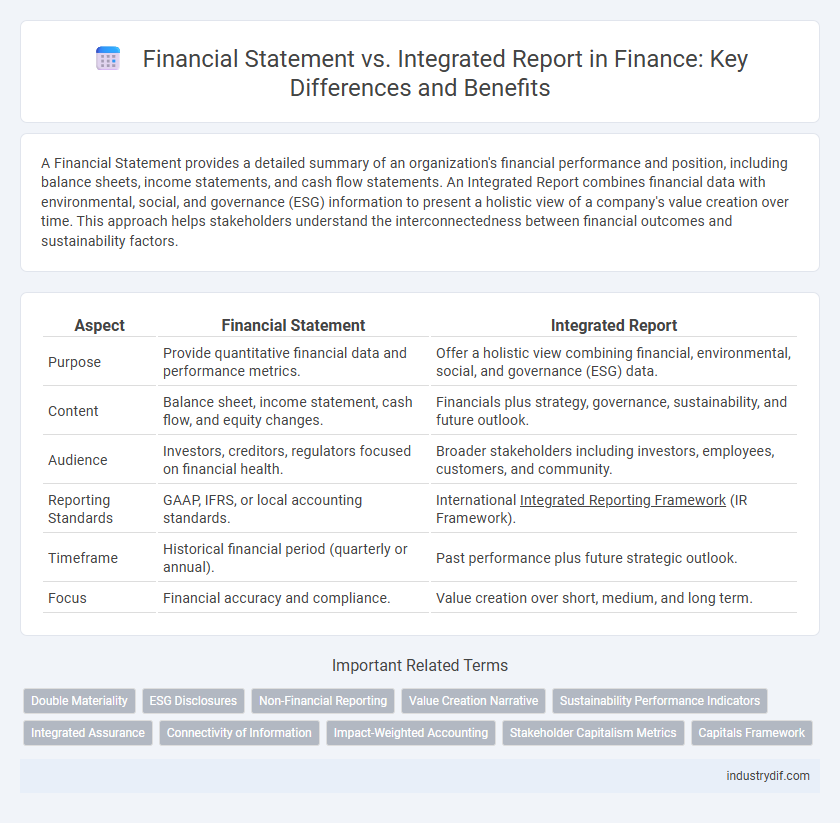

A Financial Statement provides a detailed summary of an organization's financial performance and position, including balance sheets, income statements, and cash flow statements. An Integrated Report combines financial data with environmental, social, and governance (ESG) information to present a holistic view of a company's value creation over time. This approach helps stakeholders understand the interconnectedness between financial outcomes and sustainability factors.

Table of Comparison

| Aspect | Financial Statement | Integrated Report |

|---|---|---|

| Purpose | Provide quantitative financial data and performance metrics. | Offer a holistic view combining financial, environmental, social, and governance (ESG) data. |

| Content | Balance sheet, income statement, cash flow, and equity changes. | Financials plus strategy, governance, sustainability, and future outlook. |

| Audience | Investors, creditors, regulators focused on financial health. | Broader stakeholders including investors, employees, customers, and community. |

| Reporting Standards | GAAP, IFRS, or local accounting standards. | International Integrated Reporting Framework (IR Framework). |

| Timeframe | Historical financial period (quarterly or annual). | Past performance plus future strategic outlook. |

| Focus | Financial accuracy and compliance. | Value creation over short, medium, and long term. |

Understanding Financial Statements: Definition and Purpose

Financial statements are formal records of the financial activities and position of a business, including the balance sheet, income statement, and cash flow statement, designed to provide stakeholders with clear, standardized financial information. Their primary purpose is to offer insights into a company's profitability, liquidity, and solvency, enabling investors, creditors, and management to make informed decisions. Understanding these reports is essential for evaluating financial health and comparing performance across periods and competitors within the financial sector.

What is an Integrated Report? Key Concepts

An Integrated Report combines financial, environmental, social, and governance data into a single document to provide a holistic view of an organization's performance and strategy. It emphasizes value creation over short-term financial gains by addressing how a company's resources and relationships contribute to long-term sustainability. Key concepts include connectivity of information, future orientation, stakeholder inclusiveness, and conciseness to enhance decision-making and accountability.

Core Components: Financial Statements vs Integrated Reports

Financial Statements primarily include core components such as the balance sheet, income statement, cash flow statement, and statement of changes in equity, providing quantitative data on a company's financial performance and position. Integrated Reports combine these financial statements with non-financial information, including governance, strategy, risk management, and sustainability metrics, offering a holistic view of value creation over time. Companies adopting Integrated Reporting communicate how financial, environmental, social, and governance factors interrelate to impact long-term business success.

Regulatory Frameworks and Reporting Standards

Financial statements are prepared following strict regulatory frameworks such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP), ensuring consistency and comparability for investors and regulators. Integrated reports extend beyond financial data by incorporating environmental, social, and governance (ESG) factors, guided by frameworks like the International Integrated Reporting Council (IIRC)

Stakeholder Focus: Investors vs Broader Stakeholders

Financial statements primarily address investors by providing detailed, quantitative data on a company's financial performance and position. Integrated reports expand the focus to a broader range of stakeholders, including employees, customers, suppliers, regulators, and communities, by combining financial data with environmental, social, and governance (ESG) information. This holistic approach enhances transparency and supports more informed decision-making across diverse stakeholder groups.

Value Creation: Short-term vs Long-term Perspectives

Financial statements provide a snapshot of a company's short-term financial performance, focusing on metrics such as profitability, liquidity, and cash flow within a specific accounting period. Integrated reports emphasize long-term value creation by combining financial data with environmental, social, and governance (ESG) factors, enabling stakeholders to assess sustainable business practices and strategic outlook. This approach aligns short-term financial outcomes with broader, future-oriented goals to enhance overall corporate resilience and stakeholder trust.

Transparency and Disclosure Requirements

Financial statements provide standardized quantitative data focused on past financial performance, ensuring transparency through strict regulatory disclosure requirements such as GAAP or IFRS compliance. Integrated reports expand beyond financial metrics to include environmental, social, and governance (ESG) factors, enhancing transparency by disclosing non-financial material information critical for stakeholders' long-term decision-making. The integrated reporting framework mandates a holistic approach to disclosure, combining financial and sustainability data to meet evolving stakeholder demands for comprehensive transparency.

Decision-Making Implications for Businesses

Financial statements provide a quantitative snapshot of a company's fiscal health through balance sheets, income statements, and cash flow statements, aiding stakeholders in evaluating short-term financial performance. Integrated reports combine financial data with environmental, social, and governance (ESG) metrics, offering a holistic view of corporate value creation over time and enhancing strategic decision-making. Businesses leveraging integrated reports can better identify long-term risks and opportunities, thereby improving sustainability-driven investments and stakeholder trust.

Trends Shaping Corporate Reporting

Financial statements remain essential for providing standardized quantitative data on a company's financial health, but integrated reports are increasingly embraced to offer a holistic view that combines financial performance with environmental, social, and governance (ESG) factors. Trends shaping corporate reporting include the rising demand for transparency in sustainability metrics, regulatory shifts promoting non-financial disclosures, and advancements in digital reporting technologies that enhance stakeholder engagement. The convergence of financial and non-financial information in integrated reports supports more informed decision-making and reflects evolving investor priorities towards long-term value creation.

Choosing the Right Reporting Approach for Your Organization

Selecting the appropriate reporting approach hinges on organizational goals, stakeholder needs, and regulatory requirements. Financial statements provide a detailed snapshot of financial performance and position, essential for statutory compliance and investor analysis, while integrated reports combine financial data with environmental, social, and governance (ESG) factors to present a holistic view of value creation. Organizations prioritizing transparency and long-term sustainability benefits will find integrated reporting more effective in communicating strategy and impact.

Related Important Terms

Double Materiality

Financial statements primarily emphasize financial materiality by reporting economic impacts relevant to investors and creditors, while integrated reports adopt a double materiality approach that encompasses both financial and environmental, social, and governance (ESG) factors affecting broader stakeholders. This dual perspective enables organizations to disclose how external sustainability issues influence financial performance and how their operations impact society and the environment.

ESG Disclosures

Financial statements provide a snapshot of a company's financial performance and position, primarily focusing on quantitative data such as revenues, expenses, assets, and liabilities. Integrated reports expand beyond financial metrics by incorporating Environmental, Social, and Governance (ESG) disclosures, highlighting sustainability initiatives, risk management, and long-term value creation to meet stakeholder demands for transparency and accountability.

Non-Financial Reporting

Non-financial reporting in integrated reports encompasses environmental, social, and governance (ESG) factors, providing a holistic view beyond the traditional financial statements that focus primarily on quantitative financial data. Integrated reports enhance transparency by linking financial performance with sustainability metrics and strategic objectives, facilitating better stakeholder decision-making.

Value Creation Narrative

Financial statements provide quantitative data reflecting past financial performance, while integrated reports combine financial metrics with environmental, social, and governance (ESG) information to articulate a comprehensive value creation narrative. This holistic approach enables stakeholders to assess how an organization's strategy, governance, and resource management contribute to sustainable long-term value.

Sustainability Performance Indicators

Financial statements primarily present quantitative financial data, whereas integrated reports combine financial information with sustainability performance indicators such as carbon emissions, water usage, and social impact metrics. Incorporating environmental, social, and governance (ESG) data within integrated reports enables stakeholders to evaluate a company's long-term value creation and sustainable business practices.

Integrated Assurance

Integrated assurance in financial reporting combines traditional financial statement audits with evaluation of non-financial information, enhancing transparency and stakeholder trust. This holistic approach validates both financial data and sustainability metrics, offering a comprehensive assurance framework aligned with corporate governance and regulatory standards.

Connectivity of Information

Financial statements provide standalone quantitative data focused on historical financial performance, while integrated reports emphasize the connectivity of information by combining financial and non-financial data to present a holistic view of organizational value creation over time. This integrated approach enhances stakeholders' understanding by linking financial results with strategy, governance, risks, and sustainability factors in a cohesive narrative.

Impact-Weighted Accounting

Impact-Weighted Accounting enhances traditional Financial Statements by incorporating social and environmental metrics, offering a more comprehensive view of a company's true value and long-term sustainability. Integrated Reports combine financial data with these impact metrics, enabling stakeholders to assess both economic performance and societal impact in a single cohesive document.

Stakeholder Capitalism Metrics

Financial statements primarily emphasize quantitative financial data such as profit, loss, assets, and liabilities, while integrated reports combine financial performance with environmental, social, and governance (ESG) metrics to reflect stakeholder capitalism values. Stakeholder capitalism metrics in integrated reporting include social impact, employee well-being, sustainability initiatives, and corporate governance practices, providing a holistic view of a company's long-term value creation beyond traditional financial results.

Capitals Framework

Financial statements primarily provide quantitative data on financial capital, whereas integrated reports encompass a broader Capitals Framework, integrating financial, manufactured, intellectual, human, social and relationship, and natural capitals to offer a holistic view of value creation. This comprehensive approach aligns with the International Integrated Reporting Council (IIRC) guidelines, enhancing stakeholder insight into an organization's sustainable performance and long-term strategy.

Financial Statement vs Integrated Report Infographic

industrydif.com

industrydif.com