Fund managers leverage their expertise to make strategic investment decisions driven by market trends and client objectives, focusing on portfolio management and risk assessment. Quantitative analysts utilize advanced mathematical models and algorithms to analyze financial data, aiming to identify investment opportunities and optimize trading strategies. Both roles are critical in finance but differ in approach; fund managers emphasize human judgment and experience, while quantitative analysts prioritize data-driven insights and automation.

Table of Comparison

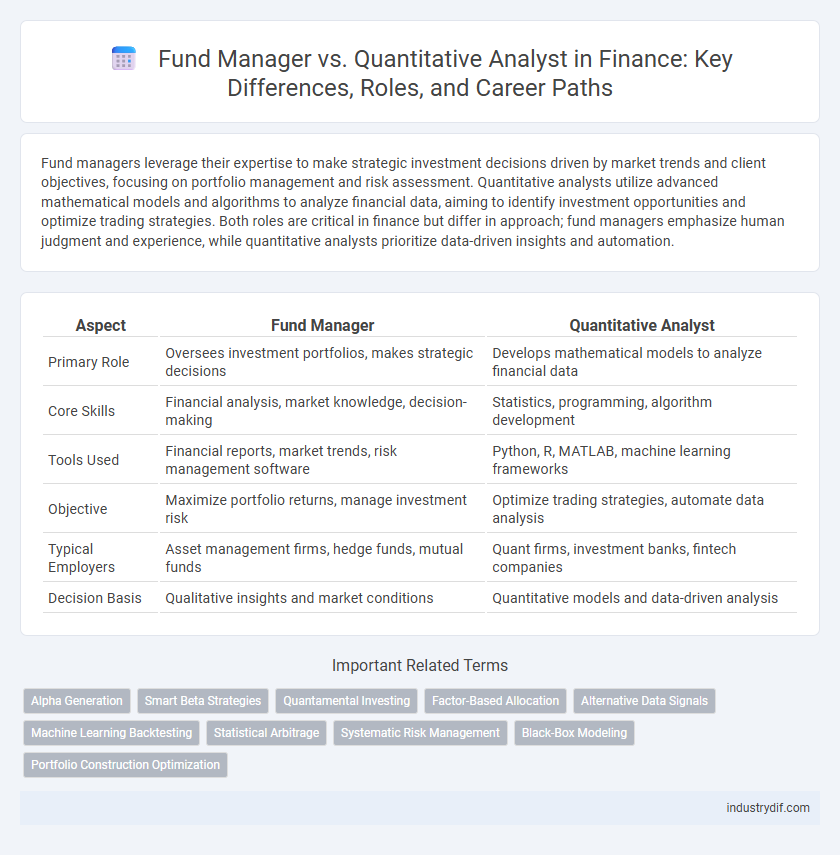

| Aspect | Fund Manager | Quantitative Analyst |

|---|---|---|

| Primary Role | Oversees investment portfolios, makes strategic decisions | Develops mathematical models to analyze financial data |

| Core Skills | Financial analysis, market knowledge, decision-making | Statistics, programming, algorithm development |

| Tools Used | Financial reports, market trends, risk management software | Python, R, MATLAB, machine learning frameworks |

| Objective | Maximize portfolio returns, manage investment risk | Optimize trading strategies, automate data analysis |

| Typical Employers | Asset management firms, hedge funds, mutual funds | Quant firms, investment banks, fintech companies |

| Decision Basis | Qualitative insights and market conditions | Quantitative models and data-driven analysis |

Role Overview: Fund Manager vs Quantitative Analyst

Fund managers oversee investment portfolios by making strategic decisions based on market trends, economic data, and company performance to maximize returns for clients. Quantitative analysts use mathematical models, statistical techniques, and algorithmic strategies to identify investment opportunities and manage risk through data-driven insights. While fund managers prioritize qualitative judgment and client relations, quantitative analysts focus on developing and implementing complex computational methods to support trading and portfolio management.

Key Responsibilities and Daily Tasks

Fund managers oversee investment portfolios, making strategic decisions to achieve clients' financial goals while managing risk and asset allocation. Quantitative analysts develop mathematical models and algorithms to analyze market trends, optimize trading strategies, and support data-driven investment decisions. Both roles involve data analysis, but fund managers prioritize portfolio management and client relations, whereas quantitative analysts focus on quantitative research and algorithm development.

Core Skills and Qualifications Required

Fund managers require strong decision-making skills, deep market knowledge, and expertise in portfolio management with qualifications such as a CFA charter or MBA in finance. Quantitative analysts demand advanced proficiency in programming languages like Python or R, statistical modeling, and mathematics, often holding degrees in quantitative fields such as applied mathematics, statistics, or computer science. Both roles emphasize analytical skills and financial acumen, but fund managers focus more on strategic investment decisions, while quantitative analysts prioritize data-driven financial modeling.

Investment Strategies: Human Judgment vs Data-Driven Models

Fund managers rely on human judgment, market experience, and qualitative analysis to shape investment strategies, leveraging intuition and macroeconomic insights to make discretionary decisions. Quantitative analysts develop data-driven models using algorithms, statistical techniques, and machine learning to identify patterns and optimize portfolio performance objectively. While fund managers prioritize flexibility and adaptive thinking, quantitative analysts emphasize systematic approaches and data accuracy for consistent results.

Decision-Making Processes Compared

Fund managers rely on qualitative insights, market experience, and macroeconomic analysis to make investment decisions, balancing risk and return with a broader strategic outlook. Quantitative analysts apply mathematical models, statistical techniques, and algorithmic trading strategies to analyze large datasets and identify patterns for optimized decision-making. The fund manager integrates human judgment and market sentiment, whereas the quantitative analyst emphasizes data-driven precision and systematic approaches in portfolio management.

Impact on Portfolio Performance

Fund managers leverage experience and market insights to make strategic investment decisions, often emphasizing qualitative factors that influence portfolio performance. Quantitative analysts utilize advanced mathematical models and data-driven algorithms to optimize asset allocation and identify trading opportunities, enhancing risk-adjusted returns. The integration of both roles can lead to improved portfolio diversification, risk management, and consistent alpha generation.

Technology and Tools Utilized

Fund managers leverage portfolio management software and financial modeling tools to analyze market trends and make strategic investment decisions. Quantitative analysts utilize advanced programming languages like Python and R, alongside machine learning algorithms and large datasets, to develop predictive models and automate trading strategies. Both professionals depend heavily on high-performance computing and data analytics platforms to enhance accuracy and efficiency in financial analysis.

Career Pathways and Advancement

Fund managers typically advance through roles that emphasize investment decision-making, portfolio management, and client relationship building, often progressing to senior or chief investment officer positions. Quantitative analysts develop expertise in mathematical modeling, programming, and data analysis, with career growth leading to senior quant roles, quant research director, or heads of quantitative strategies. Both paths require continuous skill development but diverge, with fund managers focusing more on macroeconomic insights and client management, while quants specialize in algorithm development and statistical techniques for financial markets.

Compensation and Industry Demand

Fund managers typically earn higher base salaries combined with substantial performance-based bonuses due to their direct impact on investment decisions and portfolio returns. Quantitative analysts receive competitive compensation packages driven by strong demand for expertise in data modeling, algorithmic trading, and risk assessment, with salaries rising sharply in hedge funds and investment banks. Industry demand for fund managers remains robust in asset management firms, while quantitative analysts see growing opportunities in fintech and proprietary trading firms due to advancements in AI and machine learning.

Choosing the Right Role: Which is Best for You?

Choosing between a Fund Manager and a Quantitative Analyst depends on your strengths and career goals within finance. Fund Managers focus on portfolio strategy, client communication, and market trend analysis, requiring strong leadership and decision-making skills. Quantitative Analysts emphasize data modeling, algorithm development, and statistical analysis, ideal for those who excel in mathematics and programming.

Related Important Terms

Alpha Generation

Fund managers leverage fundamental analysis and market intuition to generate alpha by actively selecting securities and timing market movements, while quantitative analysts employ statistical models and algorithmic strategies to identify inefficiencies and optimize portfolio returns. Both roles contribute to alpha generation, with fund managers emphasizing discretionary decision-making and quantitative analysts focusing on data-driven, systematic approaches.

Smart Beta Strategies

Fund managers leverage qualitative insights and market experience to select and adjust Smart Beta strategies, emphasizing risk management and portfolio diversification. Quantitative analysts develop algorithm-driven models that systematically capture factor premiums and optimize Smart Beta indices using statistical and mathematical methods.

Quantamental Investing

Quantamental investing integrates the qualitative insights of fund managers with the quantitative rigor of quantitative analysts, leveraging data-driven models to enhance stock selection and portfolio management. This hybrid approach combines human expertise in market trends and company fundamentals with algorithmic precision, aiming to optimize returns while managing risks effectively.

Factor-Based Allocation

Fund Managers leverage qualitative insights and market experience to adjust factor-based allocation strategies dynamically, optimizing portfolio performance under varying market conditions. Quantitative Analysts employ statistical models and algorithmic techniques to systematically identify and weight factors, enhancing the precision and scalability of factor-based investment approaches.

Alternative Data Signals

Fund Managers leverage alternative data signals to enhance portfolio diversification and identify unique investment opportunities beyond traditional financial metrics. Quantitative Analysts develop advanced algorithms that process alternative data sets like satellite imagery and social media trends to generate predictive models for market behavior and risk assessment.

Machine Learning Backtesting

Fund managers rely on qualitative judgment and market experience to make investment decisions, while quantitative analysts develop algorithmic models using machine learning techniques to perform rigorous backtesting and optimize portfolio strategies. Machine learning backtesting enables quantitative analysts to evaluate predictive accuracy and risk metrics over extensive historical data, enhancing systematic investment approaches beyond traditional fund management methods.

Statistical Arbitrage

Fund managers leverage qualitative insights and market experience to guide investment decisions, while quantitative analysts develop algorithmic models based on statistical arbitrage to exploit pricing inefficiencies using large datasets and advanced mathematical techniques. Statistical arbitrage strategies rely on mean-reversion and co-integration to identify transient mispricings, with quantitative analysts optimizing portfolios through rigorous backtesting and risk management to achieve alpha in complex financial markets.

Systematic Risk Management

Fund managers leverage qualitative insights and market experience to make discretionary investment decisions aimed at optimizing portfolio returns while mitigating systematic risk through strategic asset allocation. Quantitative analysts employ advanced statistical models and algorithms to identify, measure, and manage systematic risk factors, enhancing risk-adjusted performance by systematically adjusting exposures to market-wide risk drivers.

Black-Box Modeling

Fund managers typically rely on qualitative insights and market experience to make investment decisions, while quantitative analysts specialize in developing black-box models that use complex algorithms and data-driven techniques to predict market movements. Black-box modeling in finance involves creating proprietary, algorithmic systems where the internal mechanics are hidden, enabling faster, unbiased decision-making but often sacrificing transparency and interpretability.

Portfolio Construction Optimization

Fund managers leverage qualitative insights and market experience to construct diversified portfolios targeting risk-adjusted returns, while quantitative analysts utilize advanced algorithms and statistical models to optimize asset allocation and minimize portfolio risk. Combining the strategic judgment of fund managers with the computational precision of quantitative analysts enhances portfolio construction by aligning investment objectives with data-driven risk management techniques.

Fund Manager vs Quantitative Analyst Infographic

industrydif.com

industrydif.com