Stock markets facilitate the buying and selling of shares in publicly traded companies, providing liquidity and regulatory oversight. Tokenized securities represent ownership rights through blockchain technology, enabling fractional ownership and 24/7 trading with reduced intermediaries. Both systems offer investment opportunities, but tokenized securities enhance accessibility and transparency in financial markets.

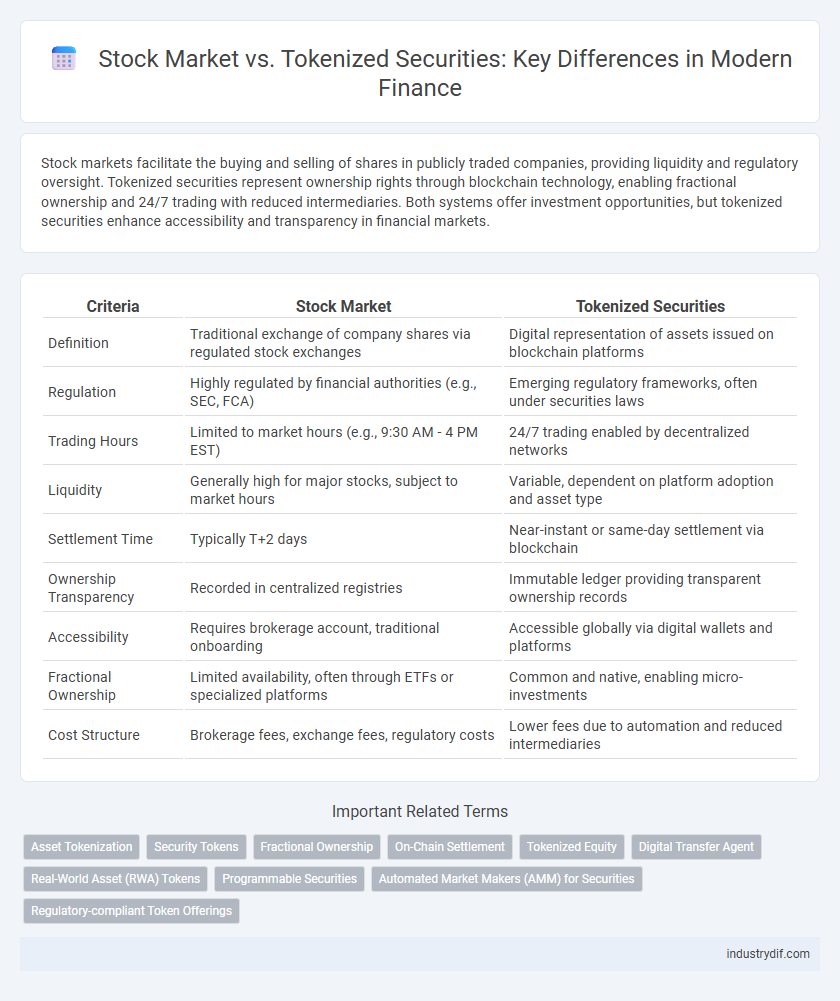

Table of Comparison

| Criteria | Stock Market | Tokenized Securities |

|---|---|---|

| Definition | Traditional exchange of company shares via regulated stock exchanges | Digital representation of assets issued on blockchain platforms |

| Regulation | Highly regulated by financial authorities (e.g., SEC, FCA) | Emerging regulatory frameworks, often under securities laws |

| Trading Hours | Limited to market hours (e.g., 9:30 AM - 4 PM EST) | 24/7 trading enabled by decentralized networks |

| Liquidity | Generally high for major stocks, subject to market hours | Variable, dependent on platform adoption and asset type |

| Settlement Time | Typically T+2 days | Near-instant or same-day settlement via blockchain |

| Ownership Transparency | Recorded in centralized registries | Immutable ledger providing transparent ownership records |

| Accessibility | Requires brokerage account, traditional onboarding | Accessible globally via digital wallets and platforms |

| Fractional Ownership | Limited availability, often through ETFs or specialized platforms | Common and native, enabling micro-investments |

| Cost Structure | Brokerage fees, exchange fees, regulatory costs | Lower fees due to automation and reduced intermediaries |

Introduction to Stock Market and Tokenized Securities

The stock market serves as a centralized platform where investors buy and sell shares of publicly traded companies, providing liquidity and price discovery through regulated exchanges like the NYSE and NASDAQ. Tokenized securities represent traditional assets converted into digital tokens on a blockchain, enabling fractional ownership, increased accessibility, and faster settlement times. This innovation bridges conventional finance with decentralized technology, offering enhanced transparency and potentially lower transaction costs compared to traditional stock markets.

Key Definitions: Stocks vs Tokenized Securities

Stocks represent ownership shares in a publicly traded company, granting shareholders voting rights and potential dividends, while tokenized securities are digital representations of traditional financial assets, such as stocks or bonds, issued on blockchain platforms. Tokenized securities enable fractional ownership, increased liquidity, and faster settlement processes compared to conventional stock trading. Both offer investment opportunities, but tokenized securities leverage blockchain technology to enhance transparency, security, and accessibility in financial markets.

Historical Development and Evolution

The stock market originated in the 17th century with the establishment of the Amsterdam Stock Exchange, evolving through centuries to include electronic trading platforms and global exchanges. Tokenized securities emerged in the 21st century, leveraging blockchain technology to digitize traditional assets, enabling fractional ownership and enhanced liquidity. This evolution reflects a shift from centralized, paper-based markets to decentralized, digital ecosystems that streamline asset trading and settlement processes.

How Traditional Stocks Work

Traditional stocks represent ownership shares in a corporation, granting shareholders voting rights and entitlement to dividends based on company performance. Stocks are traded on regulated exchanges like the NYSE or NASDAQ, where prices fluctuate according to supply, demand, and market sentiment driven by economic indicators and corporate earnings reports. Investors rely on brokerage accounts to buy and sell stocks, benefiting from historical liquidity, established valuation models, and regulatory protections provided by entities such as the SEC.

Fundamentals of Tokenized Securities

Tokenized securities represent digital ownership of traditional financial assets such as stocks or bonds, leveraging blockchain technology to enhance transparency and liquidity. These digital tokens are programmable, allowing for automated compliance and fractional ownership, which lowers entry barriers for investors. Unlike conventional stock markets, tokenized securities operate on decentralized platforms, enabling faster settlement times and global accessibility.

Regulatory Landscape: Compliance and Governance

The regulatory landscape for stock markets is well-established, with stringent compliance requirements governed by agencies such as the SEC in the United States and ESMA in Europe, ensuring investor protection and market transparency. Tokenized securities operate within emerging frameworks that combine traditional securities laws with blockchain-specific regulations, requiring adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) standards alongside smart contract audits. Governance in tokenized securities often involves decentralized protocols, creating novel compliance challenges and necessitating collaboration between regulators and tech innovators to balance innovation with investor safeguards.

Accessibility and Market Participation

Stock market investing traditionally requires intermediaries and often involves high entry barriers, limiting accessibility for retail investors. Tokenized securities leverage blockchain technology to lower these barriers by enabling fractional ownership and 24/7 trading, increasing market participation across global audiences. This democratization enhances liquidity and provides inclusive investment opportunities beyond conventional stock exchanges.

Liquidity and Trading Mechanisms

Stock markets provide high liquidity through centralized exchanges with standardized trading hours and regulatory oversight, enabling efficient price discovery and market depth. Tokenized securities leverage blockchain technology to facilitate continuous, peer-to-peer trading without intermediaries, potentially increasing liquidity by enabling fractional ownership and 24/7 market access. The decentralized nature of tokenized securities introduces new trading mechanisms such as smart contracts and automated settlement, which reduce transaction costs and enhance transparency compared to traditional stock markets.

Security, Transparency, and Risk Management

Tokenized securities offer enhanced transparency by leveraging blockchain technology, enabling real-time tracking and immutable records compared to traditional stock markets. Security is bolstered through cryptographic protocols, reducing fraud and unauthorized access risks inherent in centralized stock exchanges. Risk management benefits from increased liquidity and fractional ownership in tokenized assets, allowing investors to diversify portfolios more efficiently while maintaining regulatory compliance.

Future Trends: Convergence or Divergence?

The future of Finance hinges on the dynamic interplay between traditional Stock Markets and emerging Tokenized Securities, as blockchain adoption intensifies. Tokenized Securities offer enhanced liquidity, fractional ownership, and 24/7 market access, challenging the conventional trading hours and regulatory structures of Stock Markets. Market analysts predict either a convergence where regulatory frameworks adapt to integrate tokenization or a divergence driven by distinct investor preferences and technological innovations.

Related Important Terms

Asset Tokenization

Asset tokenization transforms traditional stocks into digital tokens on blockchain platforms, enhancing liquidity, transparency, and fractional ownership. Unlike conventional stock markets, tokenized securities enable 24/7 trading, reduced settlement times, and broadened access to global investors through decentralized finance mechanisms.

Security Tokens

Security tokens represent ownership in traditional assets through blockchain technology, offering enhanced transparency, faster settlement, and increased liquidity compared to conventional stocks. Unlike traditional stock market shares, security tokens enable fractional ownership and global access while complying with regulatory standards, bridging the gap between traditional finance and decentralized finance ecosystems.

Fractional Ownership

Fractional ownership in tokenized securities enables investors to buy and sell smaller shares of assets, increasing liquidity and accessibility compared to traditional stock markets where shares are typically traded in whole units. This innovation democratizes investment opportunities, allowing broader participation and efficient portfolio diversification through blockchain technology.

On-Chain Settlement

On-chain settlement in tokenized securities offers near-instantaneous transaction finality by leveraging blockchain technology, reducing settlement risk compared to traditional stock market clearing processes that typically require multiple days. This streamlined approach enhances transparency and operational efficiency, enabling seamless ownership transfers and real-time reconciliation on decentralized ledgers.

Tokenized Equity

Tokenized equity represents ownership shares digitized on a blockchain, enabling faster settlement, increased transparency, and fractional ownership compared to traditional stock market equities. This innovation reduces intermediaries, lowers transaction costs, and enhances liquidity by allowing global access to a broader range of investors.

Digital Transfer Agent

Digital Transfer Agents streamline the recordkeeping and ownership transfer processes for both stock market equities and tokenized securities, enhancing transaction speed and transparency. By leveraging blockchain technology, these agents reduce settlement times and minimize errors compared to traditional transfer agents in conventional stock markets.

Real-World Asset (RWA) Tokens

Stock market investments involve traditional shares traded on regulated exchanges, while tokenized securities represent real-world asset (RWA) tokens that digitize ownership of physical or financial assets on blockchain platforms. RWA tokens enhance liquidity, enable fractional ownership, and provide 24/7 trading opportunities, bridging the gap between conventional finance and decentralized markets.

Programmable Securities

Programmable securities leverage blockchain technology to enable automated compliance, real-time settlement, and customizable smart contract functionalities, differentiating them from traditional stock market instruments. These tokenized assets enhance liquidity and transparency while reducing intermediaries, fundamentally transforming capital markets with programmable, automated features.

Automated Market Makers (AMM) for Securities

Automated Market Makers (AMMs) in tokenized securities provide continuous liquidity by algorithmically pricing assets without relying on traditional order books, offering greater efficiency and accessibility compared to conventional stock market trading. This innovation enhances market depth and reduces transaction costs, making securities trading more transparent and decentralized.

Regulatory-compliant Token Offerings

Regulatory-compliant token offerings in tokenized securities adhere to existing financial regulations, ensuring investor protection and market transparency unlike many traditional stock market instruments. These offerings leverage blockchain technology to facilitate efficient trading, reduced settlement times, and fractional ownership while meeting stringent compliance standards set by authorities such as the SEC.

Stock Market vs Tokenized Securities Infographic

industrydif.com

industrydif.com