Mutual funds offer diversified exposure by pooling investor capital to buy a broad range of securities managed by professionals, while direct indexing allows investors to directly own individual stocks that replicate an index, providing greater tax efficiency and customization. Direct indexing enables tailored portfolio strategies, such as tax-loss harvesting and personalized sector weighting, which mutual funds typically cannot deliver. Investors seeking cost-effective diversification with passive management may prefer mutual funds, whereas those focused on tax optimization and personalized control might opt for direct indexing.

Table of Comparison

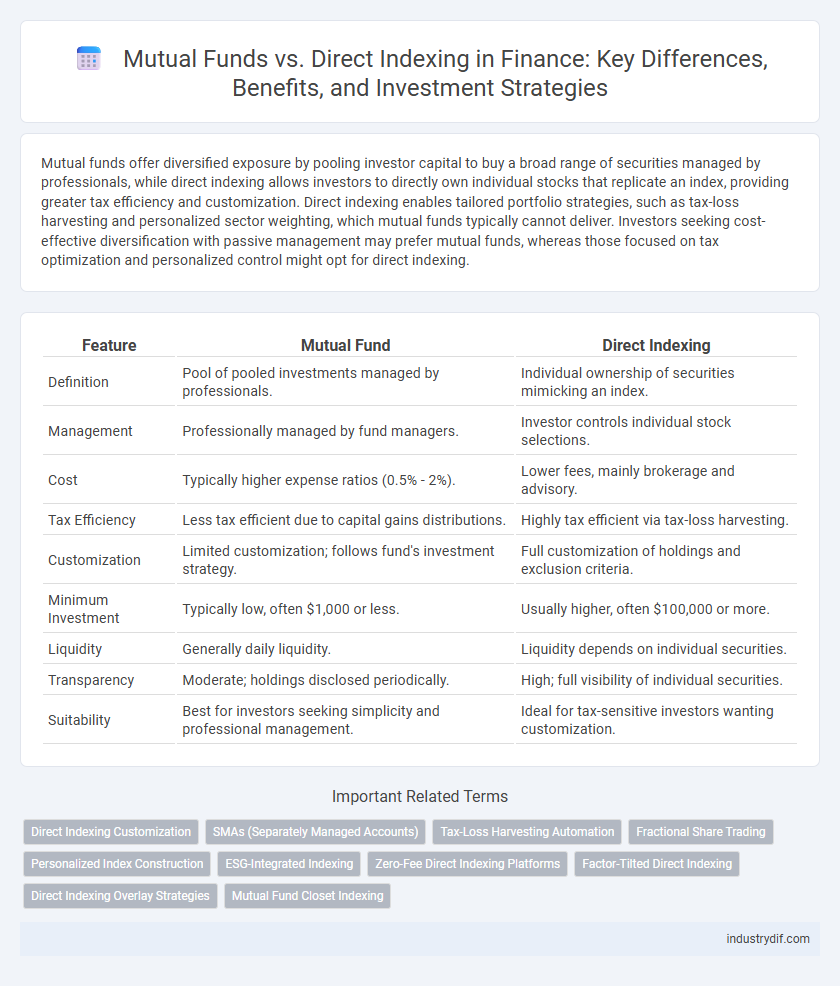

| Feature | Mutual Fund | Direct Indexing |

|---|---|---|

| Definition | Pool of pooled investments managed by professionals. | Individual ownership of securities mimicking an index. |

| Management | Professionally managed by fund managers. | Investor controls individual stock selections. |

| Cost | Typically higher expense ratios (0.5% - 2%). | Lower fees, mainly brokerage and advisory. |

| Tax Efficiency | Less tax efficient due to capital gains distributions. | Highly tax efficient via tax-loss harvesting. |

| Customization | Limited customization; follows fund's investment strategy. | Full customization of holdings and exclusion criteria. |

| Minimum Investment | Typically low, often $1,000 or less. | Usually higher, often $100,000 or more. |

| Liquidity | Generally daily liquidity. | Liquidity depends on individual securities. |

| Transparency | Moderate; holdings disclosed periodically. | High; full visibility of individual securities. |

| Suitability | Best for investors seeking simplicity and professional management. | Ideal for tax-sensitive investors wanting customization. |

Overview of Mutual Funds and Direct Indexing

Mutual funds pool capital from multiple investors to purchase a diversified portfolio managed by professional fund managers, offering ease of access and broad market exposure with varying fee structures. Direct indexing allows investors to buy individual securities that replicate an index, providing customized tax management and potential cost savings through personalized control over the portfolio. Both investment methods aim to achieve market returns but differ in customization, tax efficiency, and fee transparency.

Key Differences Between Mutual Funds and Direct Indexing

Mutual funds pool investor capital to purchase a diversified portfolio managed by professionals, while direct indexing allows individual investors to directly own the underlying securities of an index. Mutual funds typically charge management fees and offer limited customization, whereas direct indexing provides tax-loss harvesting opportunities and personalized portfolio construction. Liquidity is generally higher in mutual funds, whereas direct indexing demands more active management and can have higher transaction costs.

Investment Structure and Management

Mutual funds pool capital from multiple investors to purchase a diversified portfolio managed by professional fund managers, providing simplicity and broad market exposure. Direct indexing allows investors to buy individual securities that replicate an index, enabling customized tax strategies and greater control over asset selection. While mutual funds offer ease of management through active or passive strategies, direct indexing requires more hands-on oversight and often leverages advanced technology platforms for portfolio management.

Cost Comparison: Fees and Expenses

Mutual funds typically charge expense ratios averaging 0.50% to 1.50%, encompassing management fees and administrative costs, which can significantly reduce net returns over time. Direct indexing, while avoiding traditional mutual fund fees, often incurs costs related to trading commissions, custody fees, and tax management expenses, though advances in technology are steadily lowering these charges. Investors seeking cost efficiency should carefully analyze both the visible expense ratios of mutual funds and the often variable transaction costs associated with direct indexing to determine the optimal strategy for minimizing overall investment expenses.

Portfolio Customization and Flexibility

Mutual funds offer limited portfolio customization as investors purchase predefined baskets of securities managed by fund managers, whereas direct indexing allows for granular control by enabling investors to replicate and customize index holdings at the individual stock level. This flexibility in direct indexing facilitates tailored tax management strategies and exclusion of specific sectors or companies, aligning investments with personal values and risk preferences. Consequently, direct indexing provides superior adaptability compared to the one-size-fits-all approach of mutual funds, supporting more precise alignment with investor objectives.

Tax Efficiency and Implications

Mutual funds often generate capital gains distributions that are taxable to investors, reducing overall tax efficiency compared to direct indexing, which allows investors to directly hold individual securities and tailor tax-loss harvesting strategies. Direct indexing provides greater control over realized gains and losses, enabling more effective tax management by offsetting gains with losses on a personalized basis. The ability to customize portfolios in direct indexing may result in lower tax liabilities and enhanced after-tax returns relative to mutual funds.

Performance and Return Potential

Mutual funds offer diversified portfolios managed by professional fund managers, often resulting in steady but sometimes lower returns due to management fees and generalized strategies. Direct indexing allows investors to replicate an index by purchasing individual stocks, providing greater customization and potential tax advantages, which can enhance after-tax returns and overall performance. Studies show that direct indexing can outperform mutual funds in tax efficiency and flexibility, particularly in volatile markets, leading to higher return potential for tailored investment goals.

Accessibility and Minimum Investment Requirements

Mutual funds offer greater accessibility with low minimum investment requirements, often starting as low as $500, making them suitable for beginner investors. Direct indexing typically demands significantly higher initial investments, frequently exceeding $25,000, limiting accessibility to wealthier individuals. This difference in minimum capital can influence the choice between diversified mutual funds and personalized direct indexing portfolios.

Risk Factors and Diversification

Mutual funds offer broad diversification by pooling assets across many securities, which helps mitigate individual stock risk but exposes investors to market and management risks. Direct indexing allows investors to hold a customized basket of individual securities, providing control to reduce specific risk factors and optimize tax efficiency, yet it requires careful selection to avoid concentration risk. Both strategies manage risk differently, with mutual funds relying on professional management and direct indexing focusing on personalized diversification.

Suitability for Different Investor Profiles

Mutual funds suit investors seeking professional management and diversification with less initial capital and lower complexity, typically favored by beginners and those preferring convenience. Direct indexing appeals to experienced investors desiring personalized portfolios, tax-loss harvesting, and greater control over individual securities, often suited for high-net-worth individuals. The choice depends on investor goals, risk tolerance, and desire for customization versus simplicity.

Related Important Terms

Direct Indexing Customization

Direct indexing offers investors unparalleled customization by allowing the selection of individual securities within an index, enabling personalized tax-loss harvesting and alignment with specific financial goals or values. Unlike mutual funds, direct indexing provides greater flexibility in portfolio construction, transparency, and control over capital gains distributions.

SMAs (Separately Managed Accounts)

Separately Managed Accounts (SMAs) offer investors personalized portfolios with direct ownership of securities, unlike mutual funds which pool assets for collective investment. SMAs provide enhanced tax efficiency and transparency compared to mutual funds, while direct indexing allows for customized index replication tailored to individual client preferences within an SMA structure.

Tax-Loss Harvesting Automation

Direct indexing offers automated tax-loss harvesting by systematically identifying and selling depreciated individual securities to offset capital gains, enhancing after-tax returns more effectively than mutual funds, which typically lack personalized tax optimization features. Mutual funds distribute capital gains to investors without the ability to control specific asset sales, limiting opportunities for tailored tax-loss harvesting and potentially resulting in higher tax liabilities.

Fractional Share Trading

Fractional share trading enables investors to purchase partial shares of securities, enhancing accessibility and diversification within direct indexing portfolios compared to traditional mutual funds. This flexibility allows for precise asset allocation and tax efficiency, optimizing investment strategies in personalized index replication.

Personalized Index Construction

Personalized index construction in direct indexing allows investors to tailor portfolios by selecting individual securities that align with their specific financial goals, tax considerations, and ethical preferences, unlike mutual funds which offer generalized, pre-built baskets of securities managed by fund managers. This customization enhances potential tax efficiency and risk management, providing a more precise investment strategy tailored to individual investor profiles.

ESG-Integrated Indexing

Mutual funds with ESG integration offer diversified exposure to environmentally and socially responsible companies but often involve higher management fees and less customization compared to direct indexing. Direct indexing enables investors to tailor ESG criteria at a granular level, optimizing tax efficiency and alignment with personal ethical priorities while directly holding constituent securities.

Zero-Fee Direct Indexing Platforms

Zero-fee direct indexing platforms offer investors personalized portfolios by replicating index performance through individual securities, eliminating management fees commonly found in mutual funds. This approach enhances tax efficiency and customization, providing a cost-effective alternative to traditional mutual fund investments.

Factor-Tilted Direct Indexing

Factor-tilted direct indexing enables investors to customize portfolios by targeting specific risk factors such as value, momentum, or quality, offering greater precision than traditional mutual funds. This approach enhances tax efficiency and cost transparency while providing tailored exposure to factor premiums often diluted in broad mutual fund holdings.

Direct Indexing Overlay Strategies

Direct indexing overlay strategies enable investors to customize portfolios by efficiently replicating index performance while integrating tax-loss harvesting and personalized factor exposures. These strategies offer enhanced control and potential tax efficiency compared to traditional mutual funds by directly owning underlying securities rather than pooled assets.

Mutual Fund Closet Indexing

Mutual funds often engage in closet indexing, where fund managers closely mimic benchmark indices while charging higher fees, reducing potential active management benefits. In contrast, direct indexing allows investors to customize portfolios with tax-loss harvesting and precise factor exposures, offering greater transparency and cost efficiency.

Mutual Fund vs Direct Indexing Infographic

industrydif.com

industrydif.com