Wealth management leverages hyper-personalization to tailor investment strategies and financial plans uniquely to each client's goals, risk tolerance, and life events. By integrating data analytics and AI, hyper-personalization enhances decision-making precision and client engagement, creating value beyond traditional portfolio management. This approach drives superior client satisfaction and optimizes asset growth in an increasingly competitive financial landscape.

Table of Comparison

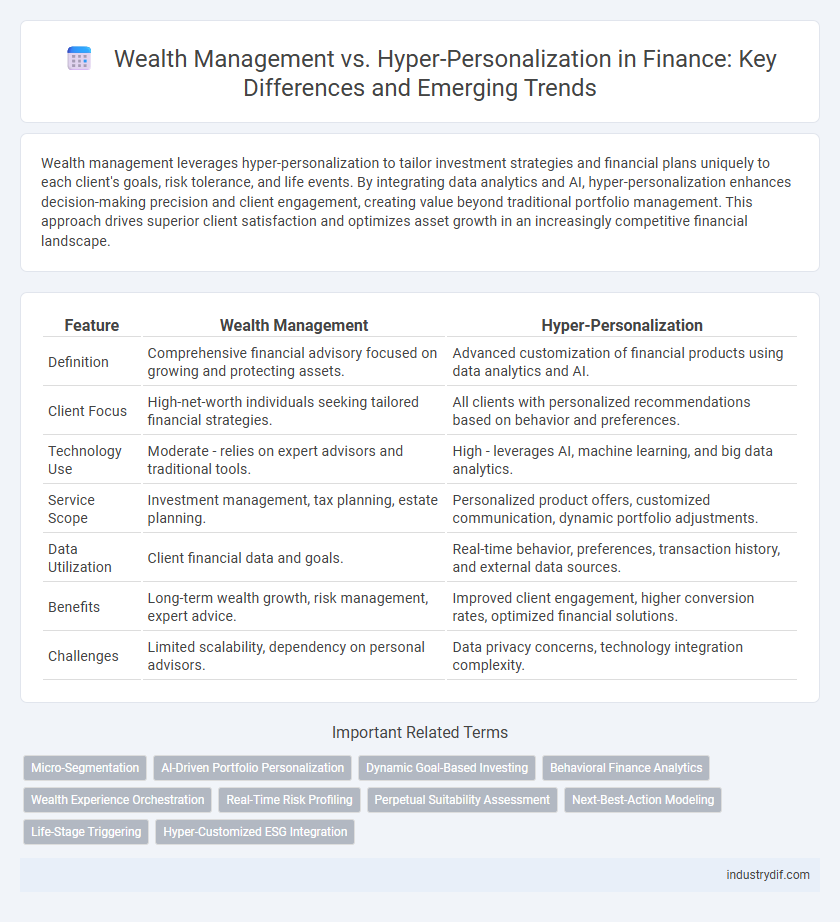

| Feature | Wealth Management | Hyper-Personalization |

|---|---|---|

| Definition | Comprehensive financial advisory focused on growing and protecting assets. | Advanced customization of financial products using data analytics and AI. |

| Client Focus | High-net-worth individuals seeking tailored financial strategies. | All clients with personalized recommendations based on behavior and preferences. |

| Technology Use | Moderate - relies on expert advisors and traditional tools. | High - leverages AI, machine learning, and big data analytics. |

| Service Scope | Investment management, tax planning, estate planning. | Personalized product offers, customized communication, dynamic portfolio adjustments. |

| Data Utilization | Client financial data and goals. | Real-time behavior, preferences, transaction history, and external data sources. |

| Benefits | Long-term wealth growth, risk management, expert advice. | Improved client engagement, higher conversion rates, optimized financial solutions. |

| Challenges | Limited scalability, dependency on personal advisors. | Data privacy concerns, technology integration complexity. |

Defining Wealth Management in Modern Finance

Wealth management in modern finance integrates investment advice, estate planning, tax strategies, and personalized financial services to optimize client assets and long-term growth. It emphasizes a holistic approach, combining traditional portfolio management with cutting-edge technologies and hyper-personalization to tailor solutions to individual goals. By leveraging data analytics and client-specific insights, wealth management firms enhance decision-making and deliver customized financial plans in a competitive market.

What is Hyper-Personalization in Financial Services?

Hyper-personalization in financial services leverages advanced data analytics, artificial intelligence, and machine learning to deliver tailored financial advice and product recommendations based on real-time customer behavior and preferences. It enhances wealth management by creating customized investment strategies, risk assessments, and financial planning aligned precisely with individual client goals and market conditions. By integrating hyper-personalization, financial institutions improve client engagement, satisfaction, and long-term portfolio performance.

Key Differences Between Wealth Management and Hyper-Personalization

Wealth management focuses on comprehensive financial planning, investment advice, and asset allocation tailored to high-net-worth individuals, emphasizing risk management and long-term growth. Hyper-personalization leverages advanced data analytics and AI to deliver customized financial solutions and real-time insights based on individual behaviors, preferences, and financial goals. The key difference lies in wealth management's broad, strategic approach versus hyper-personalization's precise, data-driven customization at the micro level.

The Evolution of Client Expectations in Finance

Client expectations in finance have evolved significantly with advancements in wealth management, now demanding hyper-personalization through data-driven insights and tailored investment strategies. Wealth management firms leverage artificial intelligence and machine learning to analyze comprehensive client data, enabling customized portfolio management that aligns with individual goals and risk tolerance. This evolution emphasizes proactive communication and adaptive financial planning, transforming traditional wealth advisory into a dynamic, client-centric experience.

Technology’s Role in Wealth Management and Hyper-Personalization

Technology in wealth management drives hyper-personalization by leveraging artificial intelligence, big data analytics, and machine learning to offer tailored investment strategies and real-time financial insights. Advanced algorithms analyze client-specific financial goals, risk tolerance, and market trends to create dynamic portfolios that adapt to changing circumstances. Integrating digital platforms enhances client engagement, providing seamless access to customized advice, automated rebalancing, and predictive financial planning tools.

Data-Driven Strategies for Personalized Financial Solutions

Wealth management leverages data-driven strategies to deliver hyper-personalized financial solutions, utilizing advanced analytics and artificial intelligence to tailor investment portfolios according to individual risk profiles, goals, and market conditions. By integrating real-time data from various sources such as transaction histories, spending behavior, and economic indicators, advisors create highly customized plans that optimize asset allocation and wealth growth. This approach enhances client satisfaction and retention by aligning financial strategies with evolving personal circumstances and market dynamics.

Benefits of Hyper-Personalization in Wealth Management

Hyper-personalization in wealth management leverages advanced data analytics and AI to deliver customized investment strategies, enhancing client satisfaction and portfolio performance. By analyzing real-time financial behavior and market trends, advisors provide highly relevant advice that aligns with individual goals and risk tolerance. This approach reduces client churn and improves long-term asset growth through precise, tailored financial planning.

Challenges Facing Traditional Wealth Management Models

Traditional wealth management models face challenges such as limited scalability, reliance on generic client segmentation, and inefficiencies in delivering truly personalized advice. Hyper-personalization leverages big data analytics, AI, and real-time insights to provide tailored financial strategies that adapt dynamically to individual client needs. Overcoming legacy system constraints and integrating advanced technology platforms remain critical hurdles for wealth managers aiming to enhance client experience and retention.

Future Trends: Integrating Hyper-Personalization into Wealth Advisory

Future trends in wealth management emphasize integrating hyper-personalization by leveraging artificial intelligence and big data analytics to deliver tailored investment strategies aligned with individual client goals and risk profiles. Cutting-edge platforms utilize real-time behavioral insights and predictive modeling to optimize portfolio performance and enhance client engagement. The convergence of technology and financial expertise drives a shift towards highly customized wealth advisory services, improving decision-making and client satisfaction.

Choosing the Right Approach: Wealth Management or Hyper-Personalization?

Choosing between wealth management and hyper-personalization depends on client priorities and financial goals; wealth management offers comprehensive portfolio strategies and risk management, while hyper-personalization leverages AI and data analytics to tailor financial advice to individual behaviors and preferences. Firms investing in hyper-personalization enhance client engagement through customized product recommendations, real-time insights, and adaptive financial planning tools. Balancing traditional wealth management expertise with cutting-edge personalization technology ensures optimized client outcomes and competitive advantage in the financial services industry.

Related Important Terms

Micro-Segmentation

Micro-segmentation in wealth management enables hyper-personalization by analyzing granular client data to tailor investment strategies, risk profiles, and financial products at an individual level. Leveraging advanced analytics and AI, firms can deliver precise wealth solutions that enhance client engagement and optimize portfolio performance.

AI-Driven Portfolio Personalization

AI-driven portfolio personalization in wealth management enables precise asset allocation tailored to individual risk tolerance, financial goals, and market conditions, enhancing investment performance and client satisfaction. Leveraging machine learning algorithms, hyper-personalization analyzes vast datasets to dynamically adjust portfolios, optimizing returns while mitigating risks in real-time.

Dynamic Goal-Based Investing

Dynamic goal-based investing in wealth management leverages hyper-personalization by continuously adapting portfolios to evolving client objectives and market conditions, enhancing risk-adjusted returns. This approach integrates real-time data analytics and behavioral insights to deliver tailored strategies that align investments with individual financial goals and life changes.

Behavioral Finance Analytics

Behavioral finance analytics drives hyper-personalization in wealth management by analyzing clients' psychological patterns, risk tolerance, and decision-making processes to tailor investment strategies precisely. This data-driven approach enhances portfolio optimization and client engagement, surpassing traditional wealth management models by integrating cognitive biases and emotional factors into personalized financial advice.

Wealth Experience Orchestration

Wealth Experience Orchestration integrates hyper-personalization techniques to tailor financial strategies and investment portfolios, enhancing client satisfaction and optimizing asset growth. Leveraging real-time data analytics, this approach transforms traditional wealth management by delivering customized, seamless experiences that align with individual financial goals and risk profiles.

Real-Time Risk Profiling

Real-time risk profiling in wealth management leverages hyper-personalization techniques to continuously analyze clients' financial behaviors, market conditions, and portfolio dynamics for tailored investment strategies. This dynamic approach enhances decision-making accuracy by using AI-driven analytics to adapt risk tolerance and asset allocation instantly, improving client satisfaction and portfolio resilience.

Perpetual Suitability Assessment

Wealth management increasingly relies on hyper-personalization through perpetual suitability assessments, enabling continuous alignment of investment strategies with clients' evolving financial goals and risk profiles. This dynamic approach leverages real-time data and advanced analytics to enhance decision-making accuracy and client satisfaction in portfolio management.

Next-Best-Action Modeling

Next-Best-Action Modeling in wealth management leverages hyper-personalization by analyzing client data and behavioral patterns to deliver tailored financial advice and investment strategies. This approach enhances client engagement and optimizes portfolio performance by predicting the most relevant actions for individual investor goals.

Life-Stage Triggering

Wealth management strategies increasingly leverage hyper-personalization by utilizing life-stage triggering to tailor financial advice and product offerings according to individual milestones such as marriage, retirement, or asset acquisition. This dynamic approach enhances client engagement and optimizes portfolio adjustments by aligning investment decisions directly with evolving personal circumstances and goals.

Hyper-Customized ESG Integration

Hyper-personalization in wealth management enables precise ESG integration by tailoring investment portfolios to individual values and sustainability goals, leveraging advanced data analytics and AI-driven insights. This hyper-customized approach enhances client satisfaction and drives responsible investing, aligning financial performance with personalized environmental, social, and governance criteria.

Wealth Management vs Hyper-Personalization Infographic

industrydif.com

industrydif.com