The stock market offers centralized trading with high transparency and regulation, providing investors with price discovery and liquidity. Alternative Trading Systems (ATS) operate as private platforms, allowing for more flexible, often anonymous transactions that can reduce market impact for large orders. Both serve critical roles, with the stock market ensuring standardized exchanges and ATS facilitating tailored trading strategies.

Table of Comparison

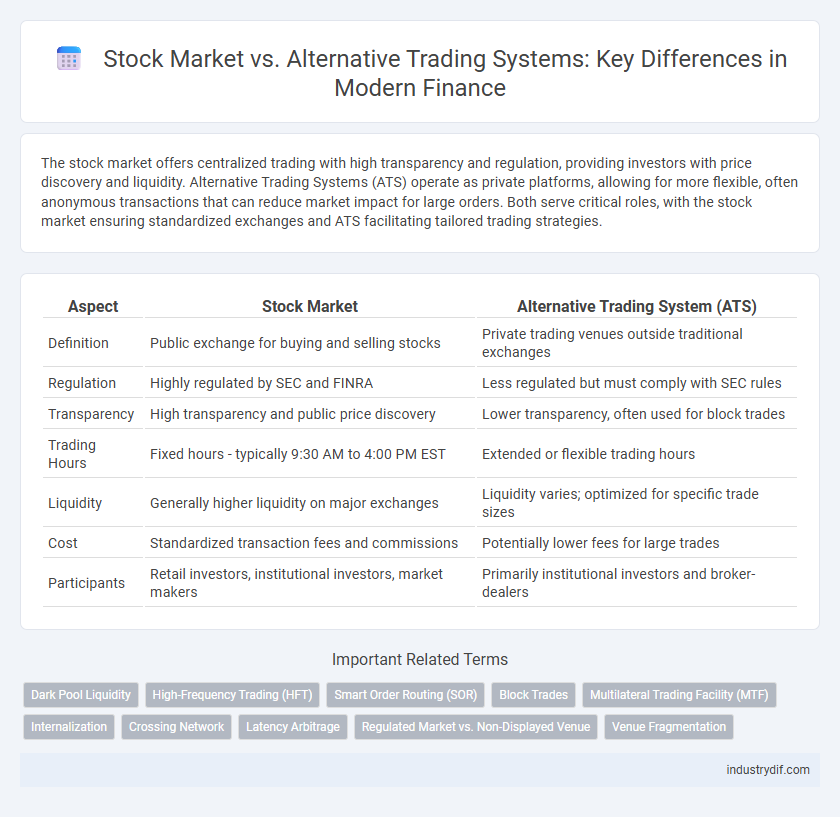

| Aspect | Stock Market | Alternative Trading System (ATS) |

|---|---|---|

| Definition | Public exchange for buying and selling stocks | Private trading venues outside traditional exchanges |

| Regulation | Highly regulated by SEC and FINRA | Less regulated but must comply with SEC rules |

| Transparency | High transparency and public price discovery | Lower transparency, often used for block trades |

| Trading Hours | Fixed hours - typically 9:30 AM to 4:00 PM EST | Extended or flexible trading hours |

| Liquidity | Generally higher liquidity on major exchanges | Liquidity varies; optimized for specific trade sizes |

| Cost | Standardized transaction fees and commissions | Potentially lower fees for large trades |

| Participants | Retail investors, institutional investors, market makers | Primarily institutional investors and broker-dealers |

Overview of Stock Markets and Alternative Trading Systems

Stock markets serve as centralized platforms where stocks and securities are publicly traded, regulated by financial authorities to ensure transparency and investor protection. Alternative Trading Systems (ATS) operate as non-exchange trading venues that facilitate matching buyers and sellers, often providing increased liquidity and reduced transaction costs for institutional investors. Both systems play crucial roles in financial markets, but stock markets emphasize regulated public trading while ATS offer flexible, private trading alternatives.

Regulatory Frameworks: Stock Markets vs Alternative Trading Systems

Stock markets operate under stringent regulatory frameworks established by entities like the SEC, ensuring transparency, investor protection, and standardized trading practices. Alternative Trading Systems (ATS) are regulated under Regulation ATS, offering more flexible rules but still maintaining oversight to prevent market abuse and promote fair access. The key difference lies in disclosure requirements and operational scope, with stock markets subject to more rigorous reporting and ATS focusing on niche or off-exchange liquidity pools.

Trading Mechanisms in Stock Markets and ATS

Stock markets operate as centralized exchanges where matching buy and sell orders follow a transparent price discovery mechanism, ensuring liquidity and regulatory oversight. Alternative Trading Systems (ATS) utilize electronic platforms that facilitate off-exchange trading, often providing greater flexibility and reduced transaction costs through dark pools or electronic communication networks (ECNs). The key trading mechanism difference lies in stock markets' public order books versus ATS's private, often anonymous order handling processes.

Market Participants: Who Trades Where

Institutional investors such as mutual funds and pension funds primarily trade on stock markets due to their high liquidity and regulatory transparency. Conversely, hedge funds and high-frequency traders often prefer Alternative Trading Systems (ATS) for their ability to execute large block trades anonymously and with reduced market impact. Retail investors predominantly use traditional stock exchanges, benefiting from regulated environments and extensive market data access.

Liquidity Comparison: Stock Markets vs ATS

Stock markets typically offer higher liquidity due to greater accessibility and a larger pool of buyers and sellers, enabling faster execution of trades at transparent prices. Alternative Trading Systems (ATS) often provide lower liquidity but can facilitate sizable block trades and customized executions, benefiting institutional investors seeking anonymity. Liquidity in stock markets tends to support price discovery more efficiently compared to ATS, where trading volumes and frequency are generally lower.

Transparency and Reporting Standards

Stock markets operate under stringent transparency and reporting standards mandated by regulatory bodies like the SEC, ensuring real-time public access to trade data and comprehensive disclosure from listed companies. Alternative Trading Systems (ATS), while regulated, often have more limited transparency, with less frequent public reporting and private trade executions that reduce market visibility. Enhanced reporting on ATS activities is critical for investors seeking equal access to information and fair price discovery.

Access and Membership Criteria

Stock Market access generally requires brokerage accounts regulated under national financial authorities, ensuring broad participation for retail and institutional investors. Alternative Trading Systems (ATS) impose stricter membership criteria, often limited to institutional clients or professionally accredited investors due to regulatory frameworks and market transparency standards. These differences influence liquidity, trading volumes, and the types of securities available for transaction within each platform.

Costs and Fees Structure

Stock Market transactions typically incur brokerage commissions, exchange fees, and regulatory charges, which vary by volume and traded securities. Alternative Trading Systems (ATS) often offer lower overall fees with reduced exchange costs and may provide volume-based discounts, appealing to high-frequency traders. Understanding the cost structures of both platforms is essential for investors seeking to optimize trading expenses and maximize returns.

Risks and Challenges in Both Systems

Stock market trading involves higher regulatory oversight, reducing counterparty risk but exposing investors to market volatility and systemic shocks, whereas Alternative Trading Systems (ATS) face less stringent regulations, increasing risks of transparency issues and liquidity constraints. Stock markets often experience challenges related to high-frequency trading and market manipulation, while ATS platforms struggle with potential conflicts of interest and limited investor protections. Both systems confront operational risks, technological failures, and cybersecurity threats, requiring robust risk management frameworks to safeguard investors and maintain market integrity.

Future Trends in Stock Markets and Alternative Trading Systems

Future trends in stock markets and Alternative Trading Systems (ATS) highlight increased integration of blockchain technology and artificial intelligence for enhanced transparency and efficiency. Market participants expect a rise in algorithmic trading and decentralized finance (DeFi) platforms, driving competition between traditional exchanges and ATS. Regulatory developments will shape the dynamic landscape, promoting innovation while ensuring investor protection and market stability.

Related Important Terms

Dark Pool Liquidity

Dark pool liquidity offers institutional investors the ability to execute large block trades anonymously, reducing market impact compared to traditional stock market exchanges. Alternative Trading Systems (ATS) provide this private trading environment, enhancing price discovery efficiency while limiting public order book exposure.

High-Frequency Trading (HFT)

High-Frequency Trading (HFT) leverages advanced algorithms and ultra-low latency connections primarily within Alternative Trading Systems (ATS) to execute rapid, high-volume trades outside traditional stock markets. ATS platforms offer greater flexibility and reduced regulatory constraints, enabling HFT firms to exploit microsecond price discrepancies and enhance market liquidity.

Smart Order Routing (SOR)

Smart Order Routing (SOR) technology optimizes trade execution by dynamically directing orders between the stock market and Alternative Trading Systems (ATS) to secure best pricing and liquidity. By analyzing real-time market data, SOR systems enhance transaction speed and reduce market impact, providing investors with efficient access to fragmented liquidity pools.

Block Trades

Block trades executed through Alternative Trading Systems (ATS) offer greater anonymity and reduced market impact compared to traditional stock market transactions, facilitating the efficient transfer of large share volumes. These non-exchange venues provide institutional investors with flexible trade execution options, often at lower costs and enhanced price discovery, crucial for managing substantial equity portfolios.

Multilateral Trading Facility (MTF)

Multilateral Trading Facilities (MTFs) operate as alternative trading systems that facilitate the matching of buy and sell orders for financial instruments, providing greater transparency and competition compared to traditional stock exchanges. MTFs enable faster execution, lower transaction costs, and increased liquidity, making them a popular choice for institutional investors seeking efficient market access beyond conventional stock markets.

Internalization

Internalization in the stock market occurs when brokers execute client orders within their own firms rather than routing them to public exchanges, enabling faster execution and reduced market impact. Alternative Trading Systems (ATS) often facilitate internalization by matching buyers and sellers privately, offering enhanced liquidity and potential price improvement compared to traditional stock exchanges.

Crossing Network

A crossing network in finance is an alternative trading system (ATS) that matches buy and sell orders internally without routing them to public stock exchanges, reducing market impact and trading costs. Unlike traditional stock markets, crossing networks provide greater anonymity and price improvement by executing trades at midpoint prices based on existing bids and offers.

Latency Arbitrage

Latency arbitrage exploits time delays between stock market exchanges and Alternative Trading Systems (ATS) by rapidly executing trades on faster venues before prices update on slower platforms, creating opportunities for profit. High-frequency traders leverage this speed advantage in ATS and dark pools to capture gains from latency discrepancies, challenging traditional market fairness and transparency.

Regulated Market vs. Non-Displayed Venue

Regulated markets offer transparent price discovery and strict oversight, ensuring investor protection and real-time data dissemination, while Alternative Trading Systems (ATS) operate as non-displayed venues with limited transparency, often facilitating large block trades off-exchange to minimize market impact. The distinction influences liquidity, execution speed, and regulatory compliance, making regulated markets more suitable for retail investors and ATS attractive for institutional trading strategies.

Venue Fragmentation

Venue fragmentation in the stock market increases market complexity by dispersing liquidity across multiple platforms, including traditional exchanges and Alternative Trading Systems (ATSs). This dispersion can lead to price discrepancies and challenges in achieving best execution for investors due to the varied transparency and regulatory frameworks.

Stock Market vs Alternative Trading System Infographic

industrydif.com

industrydif.com