Mutual funds offer pooled investment managed by professionals, providing diversification and reduced risk through regulatory oversight. Decentralized finance (DeFi) operates on blockchain technology, enabling peer-to-peer transactions without intermediaries, often with higher transparency and accessibility. Investors seeking traditional stability may prefer mutual funds, while those pursuing innovation and control might explore DeFi platforms.

Table of Comparison

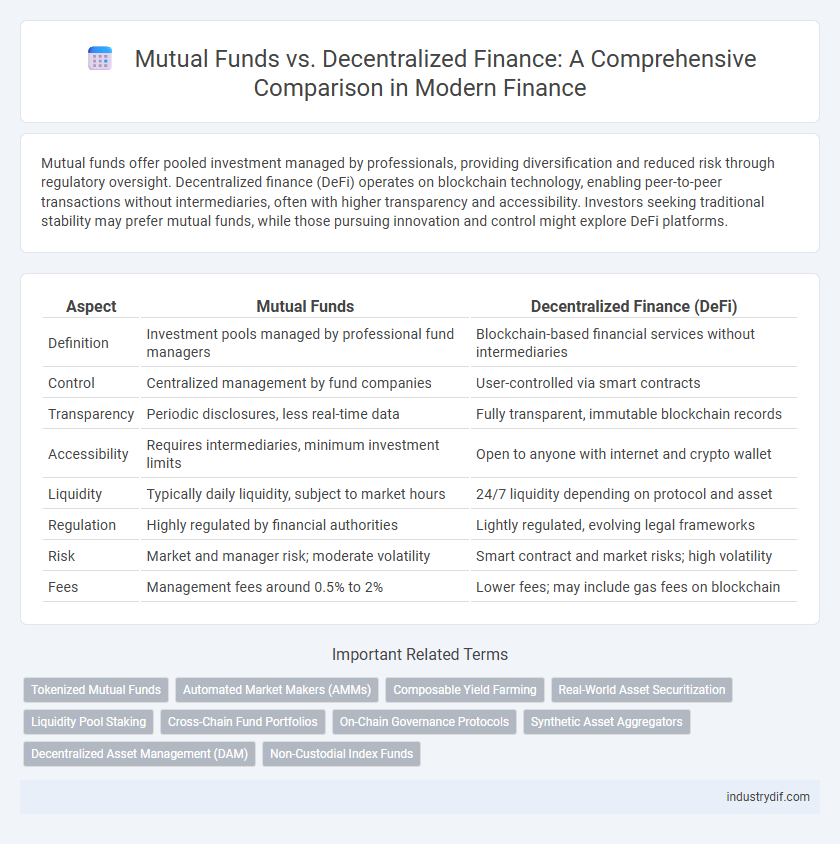

| Aspect | Mutual Funds | Decentralized Finance (DeFi) |

|---|---|---|

| Definition | Investment pools managed by professional fund managers | Blockchain-based financial services without intermediaries |

| Control | Centralized management by fund companies | User-controlled via smart contracts |

| Transparency | Periodic disclosures, less real-time data | Fully transparent, immutable blockchain records |

| Accessibility | Requires intermediaries, minimum investment limits | Open to anyone with internet and crypto wallet |

| Liquidity | Typically daily liquidity, subject to market hours | 24/7 liquidity depending on protocol and asset |

| Regulation | Highly regulated by financial authorities | Lightly regulated, evolving legal frameworks |

| Risk | Market and manager risk; moderate volatility | Smart contract and market risks; high volatility |

| Fees | Management fees around 0.5% to 2% | Lower fees; may include gas fees on blockchain |

Overview of Mutual Funds and Decentralized Finance

Mutual funds pool capital from multiple investors to invest in diversified portfolios managed by professional fund managers, offering regulated and transparent financial products with established risk profiles. Decentralized finance (DeFi) operates on blockchain technology, enabling peer-to-peer financial services without intermediaries, providing increased accessibility and programmable smart contracts but higher volatility and regulatory uncertainty. Comparing both, mutual funds emphasize stability and investor protection, whereas DeFi prioritizes innovation, decentralization, and enhanced liquidity options.

Key Differences: Mutual Funds vs DeFi

Mutual funds pool capital from multiple investors to create a professionally managed portfolio of stocks, bonds, or other securities, providing regulated and transparent investment vehicles with defined fees and governance structures. Decentralized finance (DeFi) operates on blockchain technology, allowing direct peer-to-peer transactions and automated smart contracts without intermediaries, offering increased accessibility, transparency, and often higher risk and volatility. Key differences include custody of assets--mutual funds hold investor assets centrally, whereas DeFi protocols enable users to retain control of their funds through private keys--and regulatory oversight, which is stringent for mutual funds but largely evolving or minimal in DeFi ecosystems.

Investment Structure and Accessibility

Mutual funds operate through a centralized investment structure managed by professional fund managers who pool investor capital to buy a diversified portfolio of assets, typically requiring minimum investment thresholds and offering regulated accessibility. Decentralized finance (DeFi) uses blockchain technology to enable peer-to-peer investments without intermediaries, providing greater accessibility with no minimum investment limits and 24/7 global access via digital wallets. The transparency and liquidity in DeFi contrast with the compliance-driven, periodic redemption process characteristic of traditional mutual fund investments.

Transparency and Security in Mutual Funds and DeFi

Mutual funds offer regulated transparency through periodic disclosures and audits mandated by financial authorities, ensuring investors can access verified performance and risk data. Decentralized finance (DeFi) platforms operate on blockchain technology, providing real-time transparency via immutable public ledgers but face challenges with smart contract vulnerabilities and limited regulatory oversight. Security in mutual funds relies on established legal frameworks and custodian protections, whereas DeFi depends on cryptographic security and community governance, presenting distinct risk profiles for investors.

Cost and Fee Comparison

Mutual funds typically charge management fees ranging from 0.5% to 2% annually, along with potential performance fees, resulting in higher overall costs for investors. Decentralized finance (DeFi) platforms often have lower fees due to the absence of intermediaries, with transaction costs primarily dependent on blockchain network fees, which can fluctuate but usually remain competitive. Investors seeking cost efficiency should weigh the fixed percentage fees of mutual funds against the variable, network-driven expenses in DeFi ecosystems.

Liquidity and Redemption Processes

Mutual funds offer high liquidity with shares typically redeemable at the end of each trading day at the net asset value (NAV), facilitating a structured and regulated redemption process. In contrast, decentralized finance (DeFi) platforms provide near-instant liquidity through blockchain-based tokens, enabling users to trade or withdraw assets without intermediaries. However, DeFi liquidity can be subject to market volatility and smart contract risks, making redemption processes more complex compared to traditional mutual funds.

Regulatory Environment and Compliance

Mutual funds operate under stringent regulatory frameworks enforced by entities like the SEC, ensuring investor protection, transparency, and compliance with fiduciary duties. Decentralized finance (DeFi) platforms function with minimal regulatory oversight, often lacking standardized compliance protocols, which introduces higher risks regarding investor security and legal ambiguity. Understanding these distinct regulatory environments is crucial for investors assessing risk exposure and legal safeguards in traditional versus blockchain-based financial products.

Risk Factors in Mutual Funds and DeFi

Mutual funds expose investors to risks such as market volatility, management errors, and regulatory changes, with diversification partially mitigating these factors. Decentralized finance (DeFi) risks include smart contract vulnerabilities, platform hacks, and liquidity shortages due to the nascent and unregulated nature of blockchain protocols. Understanding these risk profiles is crucial for investors evaluating traditional finance vehicles versus emerging decentralized alternatives.

Performance and Return Potential

Mutual funds typically offer stable, professionally managed portfolios with historical average annual returns ranging from 5% to 10%, depending on market conditions and fund strategy. Decentralized finance (DeFi) platforms can provide significantly higher return potential, sometimes exceeding 20% annually, due to yield farming, staking, and liquidity provision, but they carry elevated risks including smart contract vulnerabilities and market volatility. Investors seeking consistent growth might prefer mutual funds, while those pursuing aggressive returns with tolerance for uncertainty may explore DeFi opportunities.

Future Trends: Mutual Funds and Decentralized Finance

Mutual funds are increasingly integrating artificial intelligence and ESG criteria to optimize portfolio management and align with sustainable investment trends. Decentralized finance (DeFi) leverages blockchain technology and smart contracts, promising greater transparency, reduced fees, and 24/7 accessibility, which appeal to a growing segment of tech-savvy investors. The convergence of traditional mutual funds with DeFi platforms may lead to hybrid models offering enhanced liquidity, diversified assets, and democratized access to financial products in the future.

Related Important Terms

Tokenized Mutual Funds

Tokenized mutual funds combine traditional mutual fund structures with decentralized finance (DeFi) by using blockchain technology to issue digital tokens representing shares, enhancing liquidity and transparency. These funds offer investors fractional ownership with lower barriers to entry and real-time trading capabilities, contrasting with conventional mutual funds' limited liquidity and higher fees.

Automated Market Makers (AMMs)

Mutual funds pool investor money to be professionally managed and diversified across various assets, while Decentralized Finance (DeFi) uses Automated Market Makers (AMMs) like Uniswap and Balancer to enable permissionless, algorithm-driven liquidity provisioning on blockchain networks. AMMs facilitate continuous token swaps through liquidity pools without traditional intermediaries, offering automated price discovery and 24/7 market access, contrasting with the structured and regulated nature of mutual funds.

Composable Yield Farming

Composable yield farming in decentralized finance (DeFi) offers greater flexibility and interoperability compared to traditional mutual funds by enabling users to combine multiple smart contracts and liquidity pools to optimize returns. Unlike mutual funds, which rely on centralized management and fixed strategies, composable yield farming leverages blockchain protocols for dynamic asset allocation and real-time yield optimization.

Real-World Asset Securitization

Mutual funds pool investor capital to invest in diversified portfolios managed by financial professionals, primarily focusing on traditional asset classes, while decentralized finance (DeFi) enables real-world asset securitization by tokenizing tangible assets on blockchain platforms, increasing liquidity and transparency. Real-world asset securitization in DeFi allows fractional ownership and seamless transfer of assets like real estate or commodities, presenting a disruptive alternative to conventional mutual fund structures constrained by regulatory and operational limitations.

Liquidity Pool Staking

Mutual funds pool investor capital to buy a diversified portfolio managed by professionals, providing liquidity through shares that can be redeemed at net asset value. In contrast, decentralized finance (DeFi) liquidity pool staking allows investors to provide tokens to a smart contract liquidity pool, earning rewards and transaction fees while enabling seamless and instant liquidity on blockchain platforms.

Cross-Chain Fund Portfolios

Cross-chain fund portfolios in decentralized finance (DeFi) enable investors to diversify assets across multiple blockchain networks, enhancing liquidity and reducing counterparty risk compared to traditional mutual funds that primarily operate within centralized platforms. This interoperability facilitates seamless asset transfers and automated yield strategies, offering greater transparency and real-time portfolio management.

On-Chain Governance Protocols

On-chain governance protocols in decentralized finance (DeFi) enable transparent and automated decision-making through smart contracts, contrasting with mutual funds where traditional centralized management controls investment choices. These protocols empower token holders to directly vote on key parameters, enhancing security, operational efficiency, and community-driven financial strategies.

Synthetic Asset Aggregators

Synthetic asset aggregators in decentralized finance (DeFi) offer tokenized exposure to traditional assets and derivatives without owning the underlying instruments, providing high liquidity and 24/7 accessibility compared to mutual funds, which are regulated investment vehicles with centralized management and limited trading hours. These aggregators leverage blockchain technology and smart contracts to enable seamless asset replication and fractional ownership, attracting investors seeking diversification beyond the constraints and fees typical of mutual funds.

Decentralized Asset Management (DAM)

Decentralized Asset Management (DAM) leverages blockchain technology to automate and democratize investment decisions, offering transparency and reduced intermediaries compared to traditional mutual funds. DAM platforms enable investors to retain control over assets while participating in diversified portfolios with lower fees and enhanced security.

Non-Custodial Index Funds

Non-custodial index funds in decentralized finance (DeFi) offer investors direct control over their assets without intermediaries, enhancing transparency and reducing counterparty risk compared to traditional mutual funds. These blockchain-based funds provide automated, permissionless investment strategies with lower fees and increased accessibility, revolutionizing portfolio diversification in the finance sector.

Mutual funds vs Decentralized finance Infographic

industrydif.com

industrydif.com