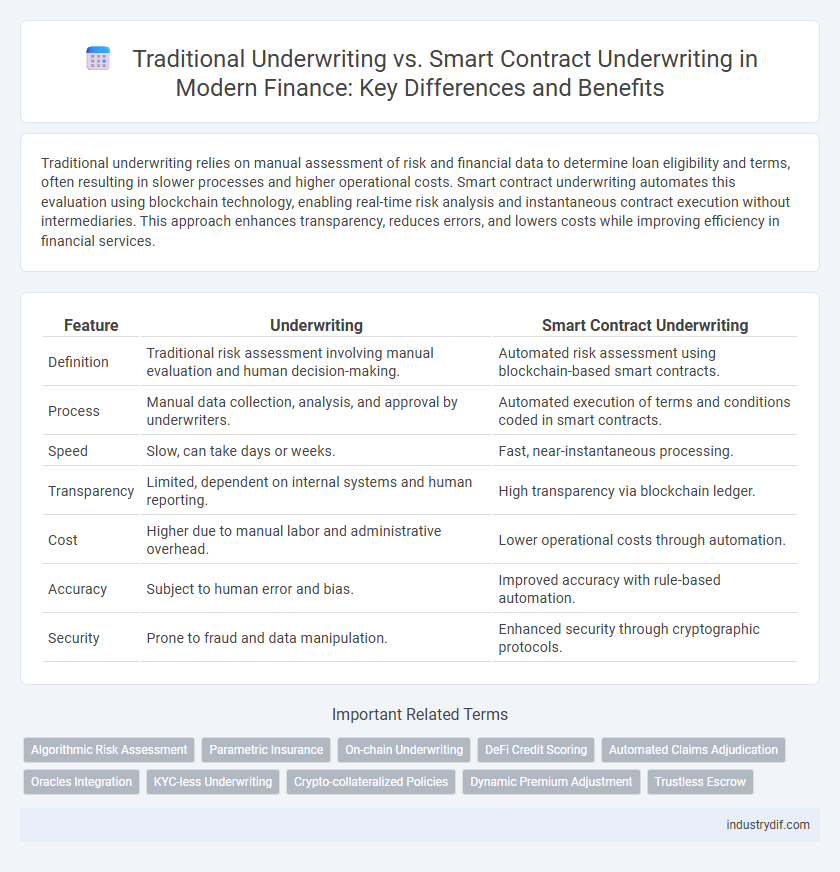

Traditional underwriting relies on manual assessment of risk and financial data to determine loan eligibility and terms, often resulting in slower processes and higher operational costs. Smart contract underwriting automates this evaluation using blockchain technology, enabling real-time risk analysis and instantaneous contract execution without intermediaries. This approach enhances transparency, reduces errors, and lowers costs while improving efficiency in financial services.

Table of Comparison

| Feature | Underwriting | Smart Contract Underwriting |

|---|---|---|

| Definition | Traditional risk assessment involving manual evaluation and human decision-making. | Automated risk assessment using blockchain-based smart contracts. |

| Process | Manual data collection, analysis, and approval by underwriters. | Automated execution of terms and conditions coded in smart contracts. |

| Speed | Slow, can take days or weeks. | Fast, near-instantaneous processing. |

| Transparency | Limited, dependent on internal systems and human reporting. | High transparency via blockchain ledger. |

| Cost | Higher due to manual labor and administrative overhead. | Lower operational costs through automation. |

| Accuracy | Subject to human error and bias. | Improved accuracy with rule-based automation. |

| Security | Prone to fraud and data manipulation. | Enhanced security through cryptographic protocols. |

Understanding Traditional Underwriting in Finance

Traditional underwriting in finance involves a thorough assessment of risk based on borrower credit history, financial statements, and market conditions, performed manually by underwriters. This process relies heavily on expert judgment and compliance with regulatory standards to evaluate loan applications or insurance policies. Although effective, traditional underwriting can be time-consuming and subject to human error, prompting the emergence of automated alternatives like smart contract underwriting.

Introduction to Smart Contract Underwriting

Smart contract underwriting revolutionizes traditional underwriting by automating risk assessment and policy execution using blockchain technology. This innovation enhances transparency, speed, and accuracy by eliminating manual interventions and minimizing human error. By embedding underwriting rules into self-executing contracts, insurers can streamline claims processing and improve operational efficiency.

Key Differences Between Traditional and Smart Contract Underwriting

Traditional underwriting relies on manual risk assessment, extensive documentation, and human judgment to evaluate insurance policies or loans, often leading to longer processing times and higher costs. In contrast, smart contract underwriting automates verification and risk calculation using blockchain technology, ensuring faster execution, greater transparency, and reduced operational errors. The integration of decentralized ledger technology in smart contracts minimizes fraud and enables real-time updates, fundamentally transforming the underwriting landscape.

The Role of Technology in Modern Underwriting

Modern underwriting is increasingly shaped by advanced technology, integrating data analytics, machine learning, and automation to enhance risk assessment accuracy and efficiency. Smart contract underwriting leverages blockchain technology to automate contract execution, ensuring transparency and reducing manual errors in policy issuance and claims processing. This technological evolution streamlines underwriting workflows, decreases operational costs, and fosters faster decision-making in the insurance and finance sectors.

Risk Assessment: Manual vs Automated Approaches

Risk assessment in traditional underwriting relies on manual evaluation of financial data, credit history, and market conditions, often resulting in subjective decisions and slower processing times. Smart contract underwriting utilizes automated algorithms and blockchain technology to analyze real-time data, enforce preset criteria, and minimize human error, leading to faster and more consistent risk assessment. The automation in smart contracts enhances transparency and reduces operational costs by eliminating the need for intermediaries in underwriting processes.

Efficiency and Speed: Comparing Underwriting Methods

Underwriting traditionally involves manual risk assessment processes that can be time-consuming and prone to human error, whereas smart contract underwriting leverages automated blockchain technology to execute risk evaluations and policy issuance instantly. Smart contracts enhance efficiency by eliminating intermediaries and reducing paperwork, resulting in faster transaction settlements and improved accuracy. This automation enables insurers to streamline operations, lower costs, and accelerate decision-making compared to conventional underwriting methods.

Data Security and Transparency in Underwriting Processes

Traditional underwriting relies heavily on manual data processing, creating potential risks to data security and limited transparency in decision-making. In contrast, smart contract underwriting leverages blockchain technology, ensuring encrypted data storage and real-time auditability that enhances both security and transparency. This innovation reduces fraud and errors by providing immutable records and automated contract execution in financial underwriting processes.

Cost Implications of Traditional vs Smart Contract Underwriting

Traditional underwriting involves manual risk assessment processes that incur higher operational costs due to extensive paperwork, human labor, and time-consuming verification steps. In contrast, smart contract underwriting automates risk evaluation and policy issuance on blockchain platforms, significantly reducing administrative expenses and minimizing errors. The cost efficiency of smart contracts enables faster claim settlements and lowers the overall expense ratio for insurers.

Regulatory Compliance in Traditional and Smart Contract Underwriting

Traditional underwriting relies heavily on manual regulatory compliance processes, including thorough documentation reviews and adherence to jurisdiction-specific legal frameworks to mitigate risks. Smart contract underwriting automates compliance through embedded code, enabling real-time verification of regulatory requirements and reducing human error and processing times. This automation enhances transparency, auditability, and consistency, aligning with evolving financial regulations such as AML (Anti-Money Laundering) and KYC (Know Your Customer) standards.

The Future of Underwriting: Trends and Innovations

The future of underwriting is rapidly evolving with the integration of smart contract underwriting, which automates risk assessment and claims processing using blockchain technology. Traditional underwriting relies heavily on manual evaluation and historical data, whereas smart contracts enable real-time, transparent, and frictionless transactions that reduce errors and speed up decision-making. Emerging trends such as artificial intelligence, machine learning, and decentralized finance (DeFi) are driving innovations that enhance predictive analytics and enable more personalized, efficient underwriting models.

Related Important Terms

Algorithmic Risk Assessment

Underwriting relies on traditional actuarial models and human judgment to assess risk, whereas smart contract underwriting employs algorithmic risk assessment using blockchain data automation and real-time analytics for enhanced accuracy. Algorithmic models in smart contract underwriting continuously update risk profiles based on dynamic market conditions and historical data patterns, reducing human error and increasing transparency.

Parametric Insurance

Underwriting in traditional finance involves risk assessment through manual evaluation of policyholder data, while smart contract underwriting automates this process using blockchain technology for real-time, transparent decisions. Parametric insurance leverages smart contracts to trigger automatic payments based on predefined parameters such as weather indexes or seismic activity, minimizing claim processing time and reducing administrative costs.

On-chain Underwriting

On-chain underwriting leverages blockchain technology to automate risk assessment and policy issuance through smart contracts, enhancing transparency and reducing the need for intermediaries compared to traditional underwriting. This decentralized approach allows real-time data verification, improving accuracy in risk evaluation and accelerating claim settlements within the insurance finance sector.

DeFi Credit Scoring

Underwriting in traditional finance relies on manual credit assessments and historical financial data, while Smart Contract Underwriting in DeFi leverages blockchain technology to automate risk evaluation through transparent, real-time credit scoring algorithms. DeFi credit scoring enhances underwriting accuracy by integrating on-chain behavioral data and decentralized identity verification, reducing fraud and enabling instant, trustless loan approval.

Automated Claims Adjudication

Underwriting traditionally relies on manual evaluation of risk and claims, which can delay claims adjudication and increase operational costs. Smart contract underwriting automates claims adjudication using blockchain technology, enabling real-time verification, reducing fraud, and accelerating payment processing with transparent and immutable records.

Oracles Integration

Underwriting in traditional finance relies heavily on manual data verification and risk assessment processes, whereas smart contract underwriting leverages blockchain technology to automate these tasks with greater transparency and efficiency. Oracles integration enhances smart contract underwriting by securely feeding real-world, off-chain data into the blockchain, enabling accurate risk evaluation and real-time contract execution without manual intervention.

KYC-less Underwriting

Underwriting in traditional finance typically requires extensive KYC procedures to verify borrower identity and assess risk, increasing time and compliance costs. Smart contract underwriting automates risk assessment on blockchain platforms, enabling KYC-less underwriting by utilizing decentralized data oracles and cryptographic proofs, reducing friction and enhancing privacy without compromising security.

Crypto-collateralized Policies

Underwriting in traditional finance involves assessing risks and determining premiums based on historical data and manual evaluations, whereas smart contract underwriting automates risk assessment and policy execution using blockchain technology. Crypto-collateralized policies leverage decentralized assets as collateral, enabling transparent, tamper-proof coverage with automated claims processing and real-time premium adjustments.

Dynamic Premium Adjustment

Underwriting traditionally relies on static risk assessments and fixed premium rates, whereas Smart Contract Underwriting utilizes blockchain technology to enable dynamic premium adjustment in real-time based on continuously updated risk data. This approach enhances pricing accuracy and policyholder transparency by automating premium recalculations through decentralized algorithms and smart contracts.

Trustless Escrow

Traditional underwriting relies on intermediary trust and manual risk assessment, often leading to delays and increased costs. In contrast, smart contract underwriting uses blockchain technology to create a trustless escrow system that automates verification, reduces fraud, and ensures transparent, instant settlement.

Underwriting vs Smart Contract Underwriting Infographic

industrydif.com

industrydif.com