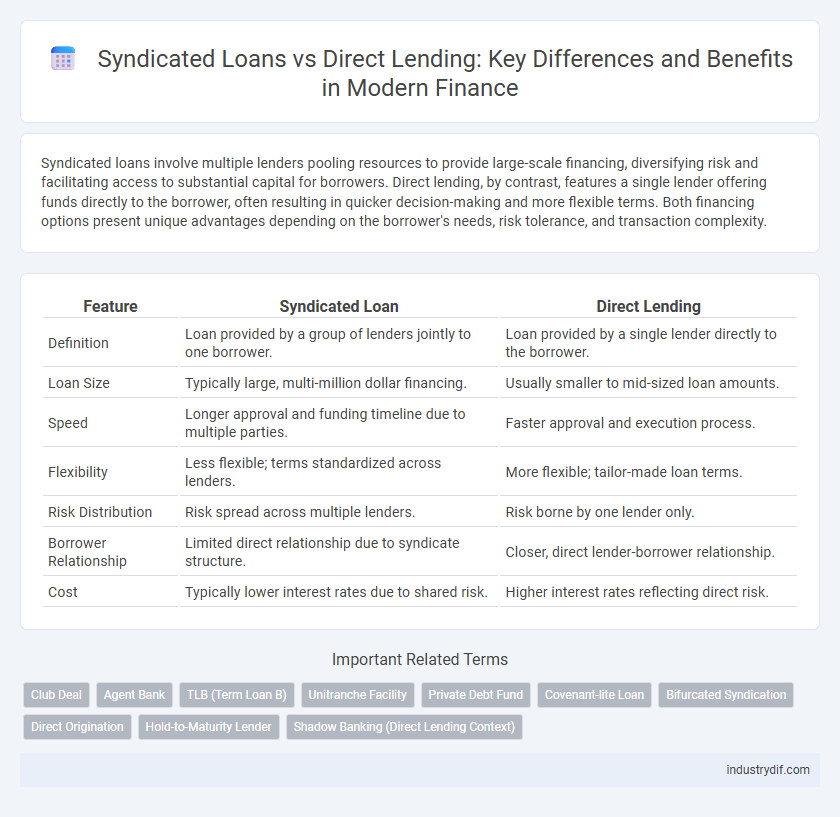

Syndicated loans involve multiple lenders pooling resources to provide large-scale financing, diversifying risk and facilitating access to substantial capital for borrowers. Direct lending, by contrast, features a single lender offering funds directly to the borrower, often resulting in quicker decision-making and more flexible terms. Both financing options present unique advantages depending on the borrower's needs, risk tolerance, and transaction complexity.

Table of Comparison

| Feature | Syndicated Loan | Direct Lending |

|---|---|---|

| Definition | Loan provided by a group of lenders jointly to one borrower. | Loan provided by a single lender directly to the borrower. |

| Loan Size | Typically large, multi-million dollar financing. | Usually smaller to mid-sized loan amounts. |

| Speed | Longer approval and funding timeline due to multiple parties. | Faster approval and execution process. |

| Flexibility | Less flexible; terms standardized across lenders. | More flexible; tailor-made loan terms. |

| Risk Distribution | Risk spread across multiple lenders. | Risk borne by one lender only. |

| Borrower Relationship | Limited direct relationship due to syndicate structure. | Closer, direct lender-borrower relationship. |

| Cost | Typically lower interest rates due to shared risk. | Higher interest rates reflecting direct risk. |

Overview of Syndicated Loans and Direct Lending

Syndicated loans involve multiple lenders pooling resources to provide a large loan to a single borrower, typically facilitated by a lead bank or financial institution, which enhances risk distribution and capital access for large-scale projects. Direct lending refers to non-bank institutions, such as private debt funds, providing loans directly to borrowers, offering faster decision-making and flexible terms tailored to middle-market companies. Both financing methods serve distinct roles in corporate finance, with syndicated loans favoring large corporations and direct lending targeting smaller enterprises with more customized credit solutions.

Key Differences Between Syndicated Loans and Direct Lending

Syndicated loans involve multiple lenders pooling resources to provide a large loan, spreading risk among participants, while direct lending consists of a single lender offering capital directly to the borrower, often allowing for faster decision-making and more customized terms. Syndicated loans typically cater to large corporations or projects requiring substantial funding, whereas direct lending targets small to mid-sized businesses benefiting from increased flexibility and potentially lower costs. The complexity and regulatory oversight are generally higher in syndicated loans compared to the streamlined process and closer lender-borrower relationship found in direct lending.

Structure and Participants in Syndicated Loans

Syndicated loans involve a group of lenders, typically banks and institutional investors, collectively providing funds to a single borrower under a shared credit agreement, which distributes risk and capital among participants. The lead arranger or agent bank coordinates the loan structure, negotiation, and administration, ensuring compliance and communication between the borrower and the syndicate members. Syndicated loan structures often feature multiple tranches with varying interest rates and maturities, accommodating diverse investor risk appetites and regulatory requirements.

Process and Agreements in Direct Lending

Direct lending involves a streamlined process where a single lender provides funds directly to the borrower without intermediaries, enabling faster decision-making and customized loan agreements. The agreements in direct lending are typically more flexible, allowing tailored covenants and repayment terms to suit the borrower's specific financial situation. This contrasts with syndicated loans, which require coordination among multiple lenders, resulting in more standardized contract structures and extended negotiation periods.

Risk Assessment and Mitigation Strategies

Syndicated loans distribute risk across multiple lenders, reducing individual exposure through diversified credit risk and shared due diligence processes. Direct lending involves concentrated risk on a single lender, necessitating rigorous internal credit assessments and stricter collateral requirements for mitigating potential defaults. Effective risk mitigation in syndicated loans includes structured covenants and monitoring mechanisms, while direct lending relies heavily on borrower relationship management and customized risk controls.

Borrower Profiles for Each Lending Type

Syndicated loans typically cater to large corporations and institutions requiring sizable capital that exceeds the capacity of a single lender, making them ideal for complex, multi-layered financing needs. Direct lending primarily targets mid-market companies, offering more flexible, customized loan structures with quicker decision timelines and fewer regulatory hurdles. Borrowers in syndicated loans benefit from the diversified risk among multiple lenders, while direct lending borrowers enjoy closer lender relationships and tailored financial solutions.

Advantages of Syndicated Loans

Syndicated loans offer significant advantages in risk distribution by involving multiple lenders, which reduces individual exposure and enhances credit availability for large-scale projects. The pooled resources from various financial institutions enable borrowers to access larger loan amounts and benefit from diverse expertise and negotiation power. This structure also facilitates flexible loan terms and improved market reputation due to the participation of reputable syndicate members.

Advantages of Direct Lending

Direct lending provides faster access to capital by streamlining the approval process and reducing the layers of intermediaries involved. Borrowers benefit from tailored loan structures and flexible terms, enhancing their ability to meet specific financial needs. This form of financing often results in stronger borrower-lender relationships, fostering better communication and ongoing support.

Market Trends: Syndicated Loans vs Direct Lending

Syndicated loans have traditionally dominated large corporate financing, offering diversification of risk among multiple lenders and access to higher capital volumes. Direct lending has gained momentum as an alternative, characterized by faster execution, tailored loan structures, and increased appeal to middle-market companies underserved by banks. Market trends indicate a growing preference for direct lending due to regulatory pressures on banks and the need for more flexible financing solutions.

Choosing Between Syndicated Loans and Direct Lending

Choosing between syndicated loans and direct lending hinges on factors like borrower size, funding requirements, and risk distribution preferences. Syndicated loans provide access to larger capital pools through multiple lenders, spreading credit risk while potentially involving complex negotiation processes. Direct lending offers quicker decision-making and closer borrower-lender relationships, often appealing to mid-market companies seeking flexible terms and personalized financial solutions.

Related Important Terms

Club Deal

Club deals in syndicated loans involve a small group of lenders collaboratively providing financing to a single borrower, offering streamlined decision-making and shared risk compared to broader syndicated loans. Direct lending bypasses traditional banks, enabling private debt funds to extend credit directly to borrowers, often providing more flexible terms but with less diversification risk management than club deals.

Agent Bank

The agent bank in a syndicated loan coordinates communication between multiple lenders and the borrower, managing the loan administration and ensuring compliance with agreed terms. In direct lending, the lender assumes full responsibility for loan servicing and risk management without an intermediary, offering more streamlined decision-making and tailored financing solutions.

TLB (Term Loan B)

Term Loan B (TLB) is a type of syndicated loan typically used by private equity firms to finance acquisitions, featuring a longer maturity and a floating interest rate tied to LIBOR or SOFR. Unlike direct lending, which involves non-bank lenders offering tailored financing solutions, syndicated loans like TLB distribute risk across multiple institutional investors, enhancing liquidity and enabling larger capital access.

Unitranche Facility

A unitranche facility combines senior and subordinated debt into a single loan with one set of terms, simplifying the borrowing process compared to syndicated loans, which involve multiple lenders with separate tranches and varying priorities. This hybrid structure offers borrowers streamlined documentation and potentially faster execution while providing lenders a blended risk-return profile between traditional senior and mezzanine debt.

Private Debt Fund

Private debt funds primarily favor syndicated loans for their ability to distribute risk among multiple lenders while accessing larger financing amounts, enhancing portfolio diversification. Direct lending offers private debt funds higher control and customized terms, enabling tailored credit solutions and potentially superior returns through closer borrower relationships.

Covenant-lite Loan

Covenant-lite loans, often featured in syndicated loan structures, reduce borrower restrictions by minimizing financial maintenance covenants, appealing to risk-tolerant investors seeking higher returns. In contrast, direct lending typically involves closer lender-borrower relationships with more rigorous covenants, ensuring stronger borrower accountability and risk mitigation.

Bifurcated Syndication

Bifurcated syndication in finance splits a large syndicated loan into distinct tranches to allocate risk and return more effectively among lenders, contrasting with direct lending where a single lender assumes the entire credit exposure. This structure enhances market liquidity while allowing for tailored financing solutions that meet diverse investor risk appetites and borrower needs.

Direct Origination

Direct origination in finance refers to loans provided straight from lenders to borrowers without intermediaries, offering customized terms, faster execution, and closer lender-borrower relationships. Compared to syndicated loans, direct lending provides increased flexibility, more competitive pricing, and enhanced control over loan structure, particularly benefitting mid-market companies seeking tailored financing solutions.

Hold-to-Maturity Lender

Hold-to-maturity lenders in syndicated loans benefit from diversified risk exposure across multiple lenders and borrowers, while direct lending offers more control and potentially higher yields through bilateral agreements. Syndicated loans provide liquidity and risk-sharing, whereas direct lending enhances lender-borrower relationship depth and flexibility in loan terms.

Shadow Banking (Direct Lending Context)

Shadow banking, primarily represented by direct lending, bypasses traditional financial institutions by providing syndicated loans through non-bank entities, enhancing credit access for mid-sized firms. This alternative financing channel leverages private debt funds to offer flexible loan structures and faster approval processes compared to syndicated loans managed by multiple banks.

Syndicated Loan vs Direct Lending Infographic

industrydif.com

industrydif.com