Forex trading involves buying and selling currency pairs on global markets, relying on analysis of economic indicators and geopolitical events to predict price movements. Crypto arbitrage exploits price discrepancies of the same cryptocurrency across different exchanges, enabling traders to profit from rapid market inefficiencies. While forex markets offer higher liquidity and stability, crypto arbitrage presents opportunities for quick gains amid volatile asset prices.

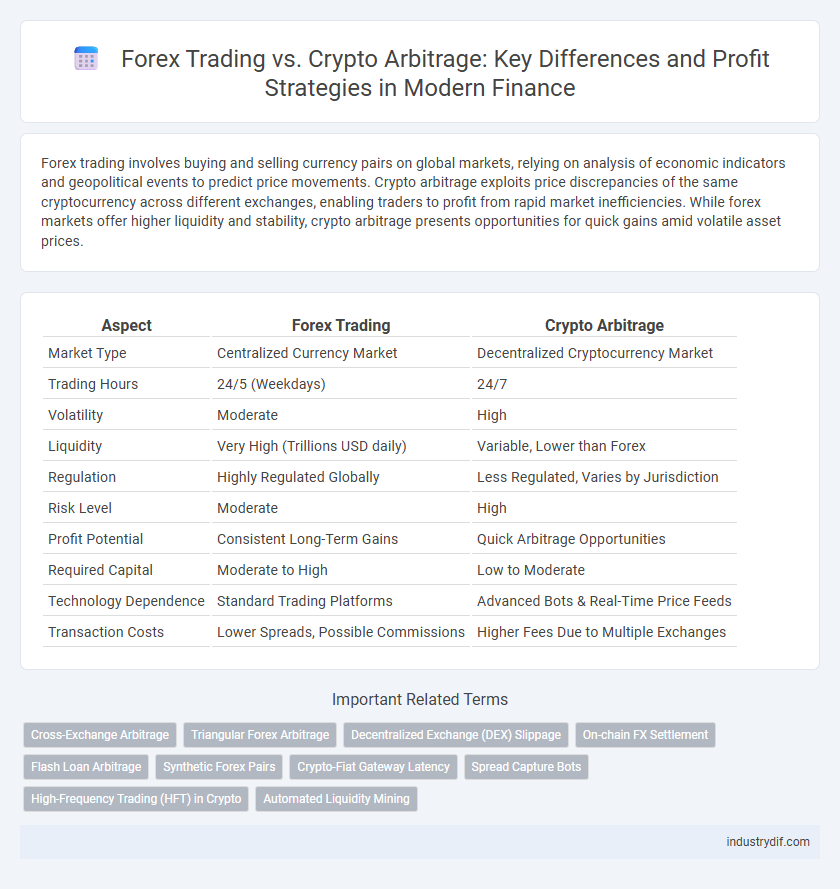

Table of Comparison

| Aspect | Forex Trading | Crypto Arbitrage |

|---|---|---|

| Market Type | Centralized Currency Market | Decentralized Cryptocurrency Market |

| Trading Hours | 24/5 (Weekdays) | 24/7 |

| Volatility | Moderate | High |

| Liquidity | Very High (Trillions USD daily) | Variable, Lower than Forex |

| Regulation | Highly Regulated Globally | Less Regulated, Varies by Jurisdiction |

| Risk Level | Moderate | High |

| Profit Potential | Consistent Long-Term Gains | Quick Arbitrage Opportunities |

| Required Capital | Moderate to High | Low to Moderate |

| Technology Dependence | Standard Trading Platforms | Advanced Bots & Real-Time Price Feeds |

| Transaction Costs | Lower Spreads, Possible Commissions | Higher Fees Due to Multiple Exchanges |

Introduction to Forex Trading and Crypto Arbitrage

Forex trading involves the exchange of global currencies on decentralized markets, with daily volumes exceeding $6 trillion, making it the largest financial market worldwide. Crypto arbitrage exploits price discrepancies of cryptocurrencies across different exchanges, capitalizing on the 24/7 nature of digital asset trading and high volatility. Both strategies require an understanding of market dynamics, liquidity, and risk management to optimize profitability.

Key Differences Between Forex and Crypto Markets

Forex trading operates within highly regulated markets dominated by established currencies like the USD and EUR, offering deep liquidity and lower volatility. Crypto arbitrage exploits price discrepancies across decentralized exchanges with high volatility and less regulatory oversight, creating opportunities for quick, high-risk profits. The forex market's stability contrasts sharply with the crypto market's rapid price swings and fragmented exchange ecosystem.

Liquidity and Volatility Comparison

Forex trading generally offers higher liquidity due to established global markets with daily volumes exceeding $6 trillion, enabling rapid transaction execution and minimal slippage. Crypto arbitrage experiences heightened volatility as digital asset prices can fluctuate dramatically within minutes, creating both risks and profit opportunities unavailable in the forex market. The distinct liquidity profiles influence trading strategies, with forex suited for steady, high-volume trades, while crypto arbitrage capitalizes on price inefficiencies in less liquid, more volatile markets.

Trading Platforms and Technology

Forex trading primarily relies on established platforms like MetaTrader 4 and 5, known for their robust charting tools, algorithmic trading support, and integration with global liquidity providers. Crypto arbitrage leverages decentralized exchanges (DEXs) and centralized exchanges (CEXs) with advanced APIs, smart contract automation, and cross-platform bots to exploit price discrepancies efficiently. Technology for crypto arbitrage often incorporates real-time blockchain data analytics and faster transaction validation, offering distinct advantages over traditional forex trading systems.

Regulatory Environment: Forex vs Crypto

Forex trading is regulated by established financial authorities such as the SEC, FCA, and CFTC, enforcing strict compliance and investor protection standards. Crypto arbitrage faces a fragmented regulatory landscape with differing rules across countries, often lacking clear guidelines or consistent oversight. The evolving regulatory environment in crypto markets increases risk exposure and challenges for arbitrageurs compared to the more structured Forex market.

Risk Management Strategies

Forex trading risk management relies on stop-loss orders, position sizing, and leverage control to mitigate market volatility and limit potential losses. Crypto arbitrage risk management emphasizes monitoring transaction fees, price slippage, and execution speed to ensure profitability amid rapid price fluctuations between exchanges. Both strategies require continuous market analysis and strict discipline to prevent significant capital erosion.

Profit Potential and Returns

Forex trading offers consistent profit potential with high liquidity and regulated markets, allowing traders to leverage economic data and geopolitical events for predictable returns. Crypto arbitrage exploits price discrepancies across decentralized exchanges, presenting opportunities for rapid, high-yield returns amid volatile markets but with increased risk and lower regulatory oversight. While Forex trading provides stable, long-term growth, crypto arbitrage can yield significant short-term profits, contingent on market inefficiencies and execution speed.

Market Accessibility and Trading Hours

Forex trading offers high market accessibility with 24-hour trading across major global financial centers, accommodating traders in various time zones. Crypto arbitrage operates continuously as cryptocurrency markets never close, providing round-the-clock opportunities even during traditional market off-hours. The nonstop trading environment of crypto arbitrage can present unique advantages for investors seeking liquidity and price discrepancies outside standard forex sessions.

Capital Requirements and Leverage

Forex trading typically demands higher capital requirements due to larger position sizes and margin regulations set by brokers and regulators, often requiring a minimum of $1,000 to $5,000 to start effectively. Crypto arbitrage usually involves lower initial capital because of the smaller trade sizes and the ability to leverage various decentralized platforms, with some exchanges offering leverage up to 100x. Leverage in Forex is generally capped at 30:1 for retail traders in major jurisdictions, while crypto arbitrage can exploit higher leverage ratios, although this comes with increased risk and volatility.

Choosing the Right Strategy for Your Portfolio

Forex trading offers high liquidity and established market regulations, making it suitable for investors seeking stability and predictable returns in their portfolios. Crypto arbitrage exploits price inefficiencies across exchanges, providing opportunities for rapid gains but with increased risk due to market volatility and regulatory uncertainty. Balancing these strategies depends on risk tolerance, investment goals, and the desired diversification within your financial portfolio.

Related Important Terms

Cross-Exchange Arbitrage

Cross-Exchange Arbitrage in Forex Trading involves exploiting price discrepancies of the same currency pairs across different forex brokers or platforms, leveraging high liquidity and tight spreads for efficient execution. In contrast, Crypto Arbitrage targets price inefficiencies across multiple cryptocurrency exchanges, capitalizing on volatile digital assets and varying exchange fees to generate rapid profits.

Triangular Forex Arbitrage

Triangular Forex Arbitrage exploits price discrepancies among three currency pairs in the foreign exchange market to generate risk-free profits through simultaneous trades. In contrast, crypto arbitrage involves capitalizing on price differences across various cryptocurrency exchanges, but it lacks the structured triangular framework and often encounters higher volatility and liquidity risks.

Decentralized Exchange (DEX) Slippage

Forex trading on centralized platforms typically experiences lower slippage due to higher liquidity and regulated order execution, whereas crypto arbitrage on decentralized exchanges (DEX) often faces significant slippage caused by limited liquidity pools and rapid price fluctuations within automated market maker (AMM) models. Understanding the impact of slippage on trade execution cost is essential for optimizing arbitrage strategies in volatile DEX environments.

On-chain FX Settlement

On-chain FX settlement leverages blockchain technology to provide transparent, real-time confirmation of forex trades, significantly reducing counterparty risk and settlement delays typical in traditional Forex trading. Crypto arbitrage exploits price discrepancies across decentralized exchanges, enabling rapid, automated profit opportunities without the need for intermediaries, contrasting with the conventional FX market's reliance on centralized clearinghouses.

Flash Loan Arbitrage

Flash loan arbitrage leverages decentralized finance (DeFi) protocols to access uncollateralized loans instantly, enabling traders to exploit price discrepancies across multiple crypto exchanges without upfront capital. Unlike traditional forex trading that relies on currency pair fluctuations over time, flash loan arbitrage in crypto offers near-instantaneous, risk-minimized profit opportunities by automating complex transactions within a single blockchain block.

Synthetic Forex Pairs

Synthetic Forex pairs combine two different currencies from separate Forex markets to create a new trading instrument, offering arbitrage opportunities distinct from traditional Forex or crypto markets. These pairs leverage price inefficiencies between correlated assets, enabling traders to exploit volatility and spread differences more efficiently than in direct Forex or crypto arbitrage.

Crypto-Fiat Gateway Latency

Crypto-fiat gateway latency significantly impacts execution speed in crypto arbitrage, where milliseconds can determine profitability, unlike forex trading which typically features lower latency due to established banking infrastructure. This latency difference influences risk exposure and strategy efficiency, making arbitrage in crypto markets more sensitive to delays in converting digital assets to fiat currencies.

Spread Capture Bots

Spread capture bots in forex trading exploit small price differentials by executing high-frequency trades across currency pairs, benefiting from market liquidity and tight spreads. In crypto arbitrage, these bots capitalize on price discrepancies between exchanges, but face higher volatility and wider spreads, making risk management and rapid execution crucial for profitability.

High-Frequency Trading (HFT) in Crypto

High-frequency trading (HFT) in crypto arbitrage leverages algorithmic strategies to exploit price discrepancies across multiple cryptocurrency exchanges within milliseconds, offering faster execution and higher profitability compared to traditional Forex trading. The decentralized nature and extreme volatility of crypto markets create unique arbitrage opportunities that HFT systems efficiently capitalize on, outperforming Forex's more regulated and slower-moving environment.

Automated Liquidity Mining

Automated liquidity mining in crypto arbitrage leverages smart contracts to optimize capital allocation across decentralized exchanges, offering real-time arbitrage opportunities and higher yield potential compared to traditional Forex trading, which relies heavily on centralized platforms and slower manual execution. This automation reduces slippage and latency, enhancing profitability through continuous rebalancing of liquidity pools in volatile cryptocurrency markets.

Forex Trading vs Crypto Arbitrage Infographic

industrydif.com

industrydif.com