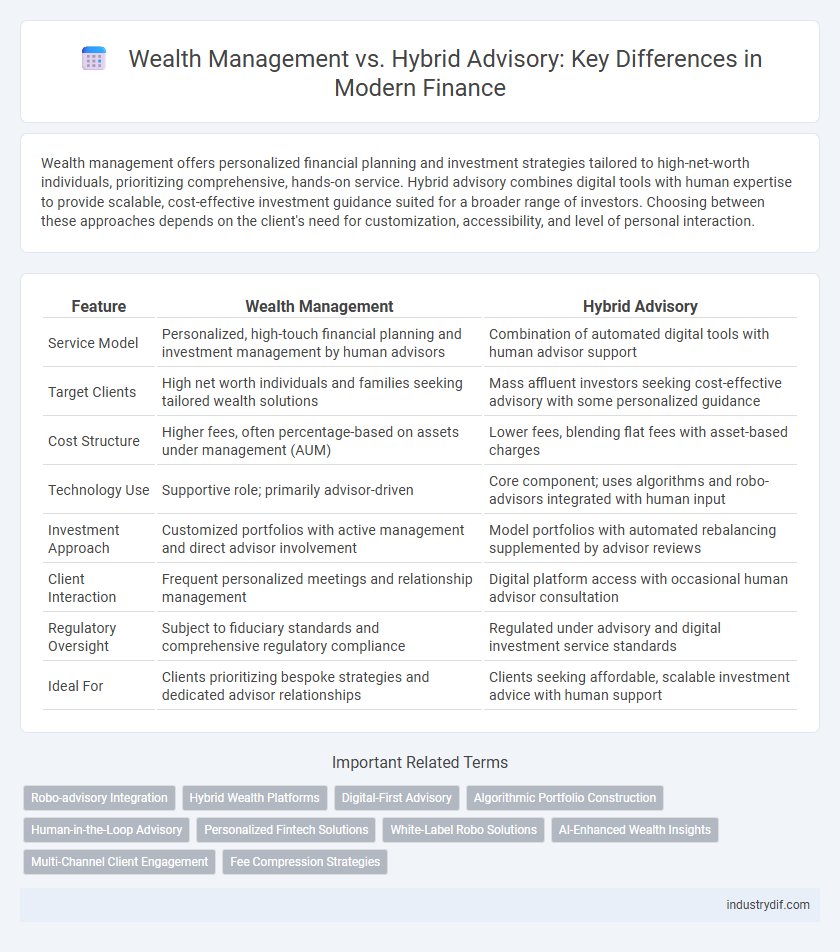

Wealth management offers personalized financial planning and investment strategies tailored to high-net-worth individuals, prioritizing comprehensive, hands-on service. Hybrid advisory combines digital tools with human expertise to provide scalable, cost-effective investment guidance suited for a broader range of investors. Choosing between these approaches depends on the client's need for customization, accessibility, and level of personal interaction.

Table of Comparison

| Feature | Wealth Management | Hybrid Advisory |

|---|---|---|

| Service Model | Personalized, high-touch financial planning and investment management by human advisors | Combination of automated digital tools with human advisor support |

| Target Clients | High net worth individuals and families seeking tailored wealth solutions | Mass affluent investors seeking cost-effective advisory with some personalized guidance |

| Cost Structure | Higher fees, often percentage-based on assets under management (AUM) | Lower fees, blending flat fees with asset-based charges |

| Technology Use | Supportive role; primarily advisor-driven | Core component; uses algorithms and robo-advisors integrated with human input |

| Investment Approach | Customized portfolios with active management and direct advisor involvement | Model portfolios with automated rebalancing supplemented by advisor reviews |

| Client Interaction | Frequent personalized meetings and relationship management | Digital platform access with occasional human advisor consultation |

| Regulatory Oversight | Subject to fiduciary standards and comprehensive regulatory compliance | Regulated under advisory and digital investment service standards |

| Ideal For | Clients prioritizing bespoke strategies and dedicated advisor relationships | Clients seeking affordable, scalable investment advice with human support |

Defining Wealth Management

Wealth management encompasses a comprehensive suite of financial services tailored to high-net-worth individuals, including investment management, tax planning, estate planning, and retirement strategies. It integrates personalized financial advice with strategic goal-setting to preserve and grow assets over time. Unlike hybrid advisory models that combine automated portfolio management with human support, wealth management offers fully customized solutions driven by dedicated financial advisors.

What Is Hybrid Advisory?

Hybrid advisory combines traditional wealth management with digital investment platforms, offering clients personalized financial planning alongside technology-driven portfolio management. This approach integrates human advisors' expertise with algorithm-based tools to optimize asset allocation, risk assessment, and cost efficiency. Hybrid advisory services enhance client engagement by providing real-time data analytics, automated rebalancing, and tailored advice calibrated to individual financial goals.

Key Differences Between Wealth Management and Hybrid Advisory

Wealth management offers comprehensive, personalized financial planning and investment services typically led by dedicated human advisors, focusing on high-net-worth clients. Hybrid advisory combines digital platforms with human guidance, providing automated investment management alongside access to financial advisors, catering to a broader client base. Key differences include the level of personalization, cost structure, and the balance between technology and human interaction.

Services Offered: Wealth Management vs Hybrid Advisory

Wealth management services include comprehensive financial planning, investment portfolio management, tax optimization, estate planning, and personalized advisory tailored to high-net-worth individuals. Hybrid advisory combines automated digital investment platforms with access to human financial advisors, offering scalable portfolio management, algorithm-driven asset allocation, and on-demand expert consultations. The hybrid model provides cost-effective solutions with personalized insights, while traditional wealth management emphasizes deep customization and broader financial services.

Technology’s Role in Hybrid Advisory

Hybrid advisory leverages advanced technology platforms that integrate artificial intelligence and data analytics to deliver personalized wealth management solutions. This technology enables real-time portfolio monitoring and dynamic asset allocation, enhancing client engagement and decision-making accuracy. By combining human expertise with automated processes, hybrid advisory optimizes efficiency and scalability in wealth management services.

Human Expertise in Traditional Wealth Management

Human expertise in traditional wealth management delivers personalized financial planning, leveraging seasoned advisors' deep market insights and client-specific strategies. This hands-on approach ensures adaptive decision-making and builds trusted, long-term relationships tailored to complex financial goals. Hybrid advisory, while integrating technology, often lacks the nuanced judgment and emotional intelligence inherent in experienced wealth managers.

Cost Comparison: Fees and Pricing Models

Wealth management services typically charge a percentage of assets under management (AUM), averaging around 1% annually, which can increase with portfolio complexity. Hybrid advisory platforms combine automated investment algorithms with human advisor support, often featuring lower fees ranging from 0.25% to 0.50%, plus fixed service charges or subscription models. Cost comparisons reveal that hybrid advisory models offer more affordable options for investors seeking personalized advice without the higher expense of traditional wealth management.

Client Experience: Personalization and Engagement

Wealth management offers highly personalized financial strategies through dedicated advisors, ensuring tailored solutions that adapt to clients' evolving goals and risk profiles. Hybrid advisory combines digital tools with human oversight, enhancing client engagement by providing real-time portfolio insights alongside expert guidance. Both models prioritize client experience, balancing customization with accessibility to optimize financial outcomes.

Suitability for Different Client Profiles

Wealth management offers personalized strategies tailored to high-net-worth individuals seeking comprehensive financial planning and investment oversight, emphasizing long-term growth and risk management. Hybrid advisory blends automated digital tools with human advisor insights, making it ideal for clients desiring cost-effective solutions and moderate guidance, often appealing to younger investors or those with less complex portfolios. Suitability depends on client profiles, where wealth management suits sophisticated investors requiring multifaceted services, while hybrid advisory caters to tech-savvy clients preferring flexible, scalable advice.

Future Trends in Wealth Management and Hybrid Advisory

Future trends in wealth management emphasize the integration of advanced AI-driven analytics and personalized client experiences to optimize portfolio performance and risk management. Hybrid advisory models increasingly leverage technology to combine human expertise with automated investment strategies, enhancing scalability and cost efficiency. The convergence of digital innovation and regulatory compliance is driving a shift toward more adaptive, client-centric wealth management solutions.

Related Important Terms

Robo-advisory Integration

Wealth management integrates personalized financial planning with human advisors, while hybrid advisory combines automated robo-advisory algorithms with professional guidance to optimize portfolio management. Robo-advisory integration enhances hybrid advisory by leveraging AI-driven asset allocation, real-time data analysis, and cost efficiency, enabling more tailored investment strategies and improved client engagement.

Hybrid Wealth Platforms

Hybrid wealth platforms combine personalized financial advisory with automated investment tools, offering a scalable solution that enhances client engagement and portfolio diversification. These platforms integrate advanced algorithms with human expertise, enabling wealth management firms to deliver tailored strategies while reducing operational costs and improving efficiency.

Digital-First Advisory

Digital-first advisory platforms leverage advanced algorithms and AI to deliver personalized wealth management solutions with lower fees and greater accessibility. Hybrid advisory blends human financial advisors with digital tools, offering clients tailored guidance while maintaining the efficiency and scalability of technology-driven investment strategies.

Algorithmic Portfolio Construction

Algorithmic portfolio construction in wealth management leverages sophisticated quantitative models to tailor investment strategies based on client risk profiles and market conditions, ensuring personalized asset allocation and dynamic rebalancing. Hybrid advisory integrates human expertise with algorithm-driven insights, combining algorithmic precision and personalized financial advice for optimal portfolio management outcomes.

Human-in-the-Loop Advisory

Wealth management integrates personalized financial planning with direct human advisor expertise, ensuring tailored strategies for complex investor needs, while hybrid advisory combines algorithm-driven recommendations with human-in-the-loop advisory to enhance efficiency and maintain personalized oversight. This human-in-the-loop approach balances automated portfolio management with advisor intervention, optimizing decision-making and improving client trust and satisfaction in wealth management services.

Personalized Fintech Solutions

Wealth management leverages comprehensive financial planning and personalized portfolio strategies through dedicated advisors, while hybrid advisory combines digital platforms with human expertise to offer tailored, scalable investment solutions. Personalized fintech solutions in hybrid advisory enhance client experience by using AI-driven analytics and real-time data to optimize financial decisions and asset allocation.

White-Label Robo Solutions

White-label robo solutions offer scalable, cost-effective wealth management platforms enabling firms to provide personalized portfolio management and automated financial advice under their own brand. Hybrid advisory combines human expertise with algorithm-driven insights, enhancing client engagement and delivering tailored investment strategies through these customizable digital solutions.

AI-Enhanced Wealth Insights

AI-enhanced wealth insights in hybrid advisory models leverage advanced machine learning algorithms to analyze vast datasets, providing personalized investment strategies that surpass traditional wealth management in precision and adaptability. These AI-driven tools enable real-time portfolio optimization, risk assessment, and predictive analytics, transforming client engagement and decision-making processes for superior financial outcomes.

Multi-Channel Client Engagement

Wealth management leverages personalized financial planning and dedicated advisors to foster deep client relationships, while hybrid advisory combines digital platforms with human expertise to offer scalable, multi-channel client engagement. Integrating face-to-face meetings, mobile apps, and AI-driven insights enhances client experience and optimizes portfolio management across diverse communication channels.

Fee Compression Strategies

Wealth management firms implement fee compression strategies by leveraging technology and scalable solutions to reduce advisory costs while maintaining personalized service. Hybrid advisory models blend automated investment algorithms with human advisors, optimizing operational efficiency and enabling competitive, transparent fee structures that attract cost-conscious clients.

Wealth management vs Hybrid advisory Infographic

industrydif.com

industrydif.com