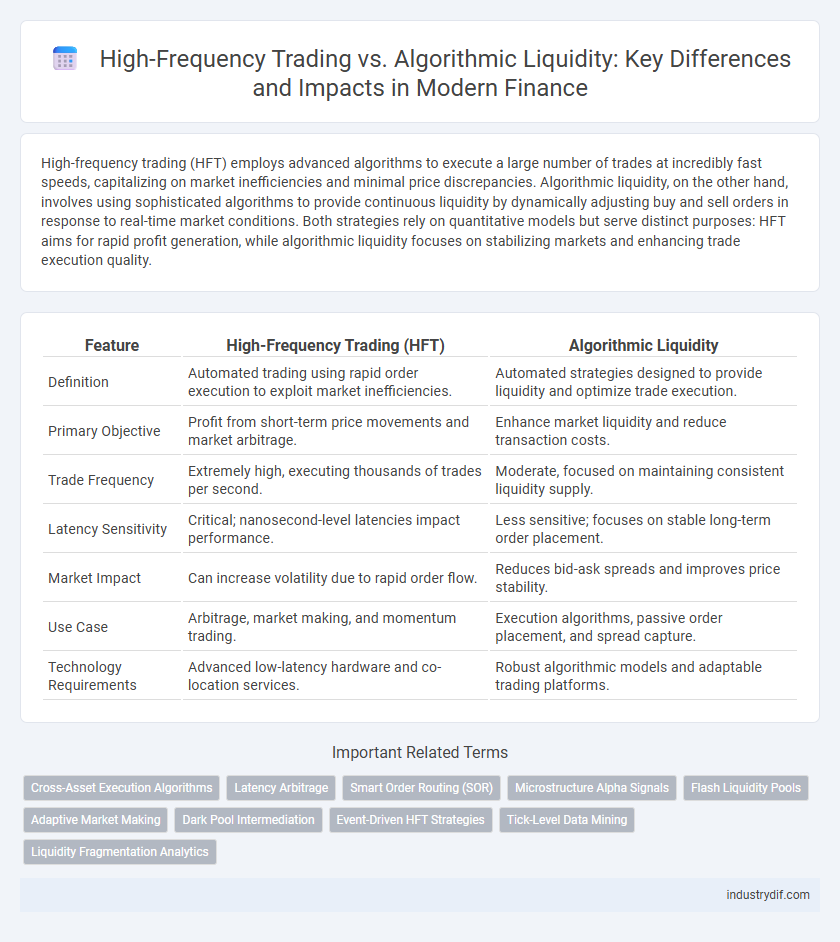

High-frequency trading (HFT) employs advanced algorithms to execute a large number of trades at incredibly fast speeds, capitalizing on market inefficiencies and minimal price discrepancies. Algorithmic liquidity, on the other hand, involves using sophisticated algorithms to provide continuous liquidity by dynamically adjusting buy and sell orders in response to real-time market conditions. Both strategies rely on quantitative models but serve distinct purposes: HFT aims for rapid profit generation, while algorithmic liquidity focuses on stabilizing markets and enhancing trade execution quality.

Table of Comparison

| Feature | High-Frequency Trading (HFT) | Algorithmic Liquidity |

|---|---|---|

| Definition | Automated trading using rapid order execution to exploit market inefficiencies. | Automated strategies designed to provide liquidity and optimize trade execution. |

| Primary Objective | Profit from short-term price movements and market arbitrage. | Enhance market liquidity and reduce transaction costs. |

| Trade Frequency | Extremely high, executing thousands of trades per second. | Moderate, focused on maintaining consistent liquidity supply. |

| Latency Sensitivity | Critical; nanosecond-level latencies impact performance. | Less sensitive; focuses on stable long-term order placement. |

| Market Impact | Can increase volatility due to rapid order flow. | Reduces bid-ask spreads and improves price stability. |

| Use Case | Arbitrage, market making, and momentum trading. | Execution algorithms, passive order placement, and spread capture. |

| Technology Requirements | Advanced low-latency hardware and co-location services. | Robust algorithmic models and adaptable trading platforms. |

Understanding High-Frequency Trading: Key Characteristics

High-frequency trading (HFT) utilizes advanced algorithms and ultra-low latency systems to execute thousands of trades per second, capitalizing on minute price discrepancies. Its key characteristics include rapid order execution, co-location near exchange servers, and the exploitation of short-term market inefficiencies. This distinct approach contrasts with algorithmic liquidity provision, which focuses more on sustained market-making and minimizing market impact over time.

Core Principles of Algorithmic Liquidity Strategies

Algorithmic liquidity strategies prioritize optimizing trade execution through real-time market data analysis and adaptive order placement, minimizing market impact and slippage. These strategies rely on smart order routing and dynamic adjustment of order types based on liquidity availability and volatility patterns. Core principles include speed, precision, and risk management, ensuring efficient liquidity provision while maintaining compliance with regulatory frameworks.

Comparing Speed: HFT Versus Liquidity Algorithms

High-Frequency Trading (HFT) executes orders within microseconds, leveraging ultra-low latency connections to capitalize on fleeting market opportunities. Liquidity algorithms prioritize optimizing trade execution over milliseconds to seconds, balancing speed with market impact and order book dynamics. The stark contrast in execution speed highlights HFT's advantage in rapid order placement, while liquidity algorithms excel in strategic trade placement for enhanced market depth and reduced slippage.

Execution Models: Market Making vs. Liquidity Seeking

High-Frequency Trading (HFT) execution models often revolve around market making strategies, where firms provide continuous bid and ask quotes to capture the spread and profit from rapid price movements. In contrast, algorithmic liquidity seeking models prioritize sourcing liquidity by dynamically routing orders across multiple venues to minimize market impact and execution costs. Market making models emphasize inventory management and order book control, while liquidity seeking algorithms focus on adapting to real-time market conditions to efficiently fulfill large volume trades.

Regulatory Frameworks Impacting HFT and Algorithmic Liquidity

Regulatory frameworks such as the SEC's Regulation National Market System (Reg NMS) and MiFID II in Europe significantly shape high-frequency trading (HFT) and algorithmic liquidity by enforcing transparency and market fairness standards. These regulations impose stringent requirements on order handling, latency, and market access, thereby influencing the strategies and technologies employed by HFT firms and liquidity providers. Compliance with these rules ensures reduced market manipulation risks and promotes equitable access to liquidity across trading venues.

Data Latency and Infrastructure Requirements

High-frequency trading (HFT) relies on ultra-low data latency and advanced infrastructure such as co-location servers and high-speed fiber optics to execute trades in microseconds. Algorithmic liquidity provision, while also dependent on efficient data processing, prioritizes adaptive algorithms to manage order flow and market impact over extreme speed, requiring robust but less latency-sensitive infrastructure. The investment in specialized hardware and real-time data feeds differentiates HFT's emphasis on minimizing latency from algorithmic liquidity strategies focused on dynamic market-making efficiency.

Risk Management in High-Frequency Trading and Liquidity Algorithms

Risk management in high-frequency trading (HFT) emphasizes real-time monitoring of market conditions, execution speed, and rapid response to price fluctuations to mitigate adverse selection and slippage risks. Liquidity algorithms prioritize optimizing order placement to enhance market depth while minimizing market impact and adverse price movements, thereby ensuring stable liquidity provision. Advanced risk controls, including dynamic position limits and automated circuit breakers, are essential to safeguard portfolios against flash crashes and extreme volatility inherent in HFT environments.

Impact on Market Microstructure and Price Discovery

High-Frequency Trading (HFT) and Algorithmic Liquidity provision significantly influence market microstructure by enhancing order book dynamics and narrowing bid-ask spreads. HFT strategies exploit ultra-fast execution to capitalize on short-term price discrepancies, contributing to increased market efficiency but also raising concerns about volatility and market fairness. Algorithmic Liquidity, through smart order routing and adaptive algorithms, improves price discovery by ensuring deeper market depth and reducing information asymmetry among participants.

Technology Innovations Driving HFT and Algorithmic Liquidity

Technology innovations such as advanced machine learning algorithms, ultra-low latency networking, and high-performance computing infrastructures significantly enhance high-frequency trading (HFT) strategies by enabling rapid execution and real-time data analysis. Algorithmic liquidity benefits from these advancements through sophisticated order routing algorithms and dynamic pricing models that optimize market making and minimize information asymmetry. The integration of artificial intelligence and cloud-based platforms further drives scalability and adaptability in both HFT and algorithmic liquidity provision.

Future Trends: The Evolution of Automated Financial Markets

High-frequency trading (HFT) and algorithmic liquidity provision are driving forces in the future evolution of automated financial markets by leveraging advanced machine learning models and enhanced data processing speeds to execute trades with unparalleled precision. Emerging trends indicate increased integration of artificial intelligence and quantum computing, enabling predictive analytics that optimize order flow and reduce market impact. Regulatory frameworks are evolving to address the complexities of these technologies, emphasizing transparency and systemic risk mitigation in increasingly fragmented global exchanges.

Related Important Terms

Cross-Asset Execution Algorithms

Cross-Asset Execution Algorithms integrate High-Frequency Trading strategies to optimize liquidity provision across multiple financial instruments simultaneously, enhancing execution efficiency by dynamically adjusting orders based on real-time market data. These algorithms leverage advanced statistical models and machine learning techniques to minimize market impact and transaction costs while maximizing trade speed and accuracy.

Latency Arbitrage

High-frequency trading (HFT) leverages ultra-low latency connections to execute latency arbitrage strategies, exploiting small time delays between markets to generate profits by rapidly buying and selling securities. Algorithmic liquidity providers counteract latency arbitrage by using advanced algorithms to dynamically adjust order flows and enhance market efficiency, reducing the impact of latency discrepancies on trading spreads.

Smart Order Routing (SOR)

Smart Order Routing (SOR) enhances both High-Frequency Trading (HFT) and Algorithmic Liquidity by dynamically directing orders to multiple trading venues based on real-time liquidity, price, and latency data. This technology optimizes execution speed and price improvement, leveraging algorithms that analyze market fragmentation to reduce transaction costs and increase market efficiency.

Microstructure Alpha Signals

High-frequency trading exploits microstructure alpha signals by executing rapid, short-term strategies that capitalize on minimal price discrepancies and market inefficiencies within milliseconds. Algorithmic liquidity mechanisms leverage these signals to optimize order placement and execution, enhancing market depth while minimizing adverse selection and transaction costs.

Flash Liquidity Pools

Flash liquidity pools enable high-frequency trading firms to access ultra-fast, temporary liquidity by leveraging advanced algorithms that execute millions of trades within microseconds. These pools create a competitive edge by providing immediate market depth and minimizing slippage, enhancing overall algorithmic liquidity efficiency in financial markets.

Adaptive Market Making

Adaptive market making in high-frequency trading leverages sophisticated algorithms to dynamically adjust bid-ask spreads based on real-time market conditions, optimizing liquidity provision and minimizing risk. This approach enhances algorithmic liquidity by continuously learning and adapting to price volatility, order flow, and competitor behavior, thus improving execution efficiency in fast-paced financial markets.

Dark Pool Intermediation

High-frequency trading (HFT) leverages ultra-fast algorithms to capitalize on market inefficiencies, while algorithmic liquidity provision in dark pools facilitates anonymous large block trades, reducing market impact and signaling risks. Dark pool intermediation integrates sophisticated algorithms to optimize order execution by matching liquidity providers and demand without exposing trade intentions to public markets, enhancing price discovery efficiency.

Event-Driven HFT Strategies

Event-driven high-frequency trading (HFT) strategies leverage real-time news, earnings reports, and geopolitical events to execute rapid trades, capitalizing on sudden market inefficiencies. These strategies outperform traditional algorithmic liquidity provision by dynamically adjusting to market-moving events, thereby enhancing trade execution speed and profitability.

Tick-Level Data Mining

High-frequency trading leverages tick-level data mining to execute rapid, algorithm-driven trades by analyzing granular market fluctuations and order book dynamics in real-time. Algorithmic liquidity models optimize market making and inventory management by extracting actionable insights from tick-level data, enhancing trade execution efficiency and minimizing market impact.

Liquidity Fragmentation Analytics

Liquidity Fragmentation Analytics plays a crucial role in distinguishing the impacts of High-Frequency Trading (HFT) versus Algorithmic Liquidity by analyzing market liquidity dispersion across multiple venues and order books. This analytical approach helps quantify the degree of liquidity fragmentation, enabling traders and institutions to optimize execution strategies by identifying the most favorable trading venues that minimize transaction costs and slippage.

High-Frequency Trading vs Algorithmic Liquidity Infographic

industrydif.com

industrydif.com