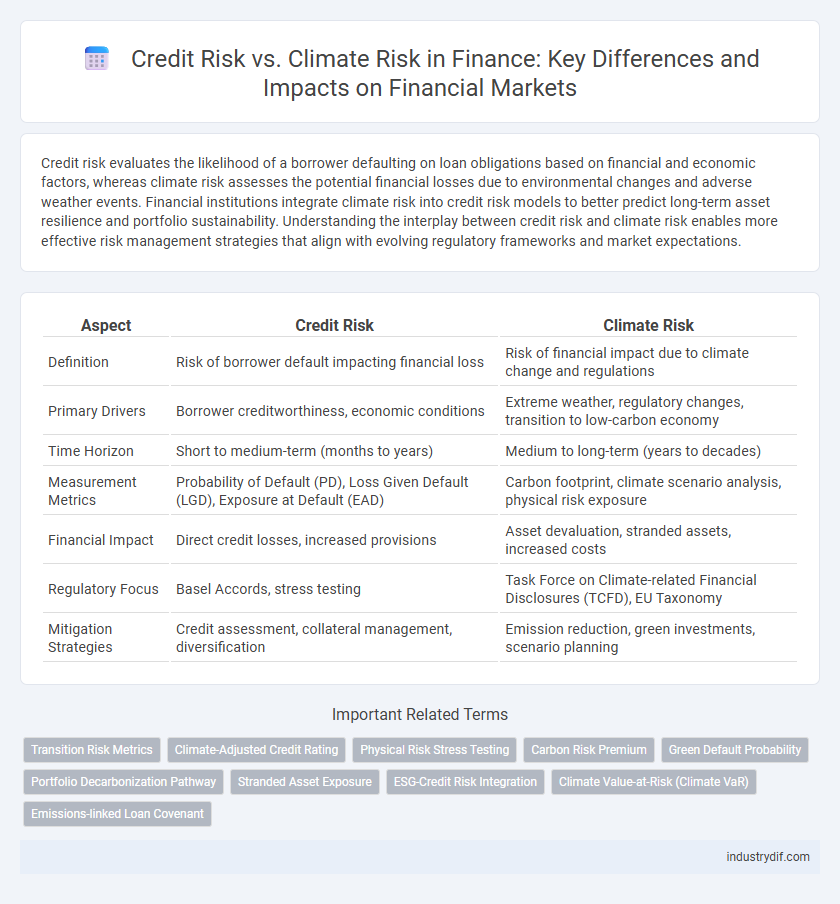

Credit risk evaluates the likelihood of a borrower defaulting on loan obligations based on financial and economic factors, whereas climate risk assesses the potential financial losses due to environmental changes and adverse weather events. Financial institutions integrate climate risk into credit risk models to better predict long-term asset resilience and portfolio sustainability. Understanding the interplay between credit risk and climate risk enables more effective risk management strategies that align with evolving regulatory frameworks and market expectations.

Table of Comparison

| Aspect | Credit Risk | Climate Risk |

|---|---|---|

| Definition | Risk of borrower default impacting financial loss | Risk of financial impact due to climate change and regulations |

| Primary Drivers | Borrower creditworthiness, economic conditions | Extreme weather, regulatory changes, transition to low-carbon economy |

| Time Horizon | Short to medium-term (months to years) | Medium to long-term (years to decades) |

| Measurement Metrics | Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD) | Carbon footprint, climate scenario analysis, physical risk exposure |

| Financial Impact | Direct credit losses, increased provisions | Asset devaluation, stranded assets, increased costs |

| Regulatory Focus | Basel Accords, stress testing | Task Force on Climate-related Financial Disclosures (TCFD), EU Taxonomy |

| Mitigation Strategies | Credit assessment, collateral management, diversification | Emission reduction, green investments, scenario planning |

Introduction to Credit Risk and Climate Risk

Credit risk involves the potential loss a lender faces if a borrower fails to meet debt obligations, assessed through credit scores, debt-to-income ratios, and payment history. Climate risk refers to the financial threats posed by climate change, including physical risks like extreme weather events and transition risks from shifting regulations and market preferences. Both risks require integrated risk management strategies to ensure resilience and regulatory compliance in the evolving financial landscape.

Defining Credit Risk in Finance

Credit risk in finance refers to the potential for loss due to a borrower's failure to repay a loan or meet contractual debt obligations, impacting lenders and investors. It encompasses default risk, downgrade risk, and exposure risk, influencing credit ratings and interest rates. Effective credit risk assessment leverages financial statements, credit scores, and economic indicators to mitigate potential financial losses.

Understanding Climate Risk in the Financial Sector

Climate risk in the financial sector encompasses physical risks from extreme weather events and transition risks related to policy shifts towards a low-carbon economy, both impacting asset valuations and creditworthiness. Unlike traditional credit risk, which focuses on borrower default probabilities, climate risk requires integrating environmental factors into risk models to anticipate long-term financial impacts. Financial institutions increasingly adopt climate scenario analysis and stress testing to quantify exposure and enhance resilience against climate-induced financial disruptions.

Key Differences Between Credit Risk and Climate Risk

Credit risk involves the potential for a borrower to default on loan obligations, directly impacting financial asset valuations and lending decisions. Climate risk pertains to the financial exposure arising from environmental changes, such as physical risks from extreme weather events and transition risks linked to regulatory shifts toward low-carbon economies. Unlike credit risk, which is largely quantitative and borrower-specific, climate risk requires a forward-looking assessment of systemic and long-term environmental factors influencing asset performance.

How Climate Risk Impacts Credit Portfolios

Climate risk introduces significant uncertainty into credit portfolios by increasing the likelihood of borrower default due to physical damages from extreme weather events and regulatory changes linked to the transition to a low-carbon economy. Physical risks, such as floods and hurricanes, directly impair asset values and income streams, while transition risks can affect sectors reliant on fossil fuels or carbon-intensive activities, leading to credit rating downgrades and elevated loan loss provisions. Financial institutions must integrate climate risk metrics into credit risk models to enhance portfolio resilience and comply with emerging regulatory frameworks.

Integrating Climate Risk Into Credit Assessments

Integrating climate risk into credit assessments enhances the accuracy of default predictions by accounting for environmental factors such as regulatory changes, physical asset vulnerabilities, and transition risks affecting borrower creditworthiness. Financial institutions increasingly employ scenario analysis and climate stress testing to quantify potential impacts on loan portfolios, aligning credit risk models with evolving climate realities. This holistic approach supports sustainable lending practices by embedding climate risk metrics within traditional credit evaluation frameworks.

Regulatory Frameworks for Managing Credit and Climate Risks

Regulatory frameworks for managing credit and climate risks have evolved to integrate environmental, social, and governance (ESG) considerations into financial assessments. Central banks and financial regulators, such as the Basel Committee on Banking Supervision, are incorporating climate risk scenarios into credit risk models to enhance resilience and ensure accurate capital allocation. This approach mandates enhanced disclosure, stress testing, and risk management practices tailored to the overlapping impacts of climate-related financial risks on credit portfolios.

Financial Instruments Addressing Both Risks

Financial instruments such as green bonds and sustainability-linked loans are increasingly designed to address both credit risk and climate risk by integrating environmental performance metrics directly into their terms. Credit derivatives tied to climate-related credit events enable investors to hedge against losses stemming from climate-induced defaults or deteriorations in credit quality. Risk assessment models now incorporate climate risk factors alongside traditional credit risk indicators to enhance the accuracy of financial instrument valuations and portfolio resilience.

Best Practices in Risk Mitigation

Implementing robust credit risk and climate risk mitigation strategies involves integrating advanced data analytics and scenario stress testing to assess potential financial impacts accurately. Financial institutions should adopt comprehensive risk frameworks that combine traditional credit risk evaluation with climate-related risk indicators, including transition and physical risks. Enhancing transparency through standardized reporting and engaging in sustainable finance initiatives further strengthens resilience against evolving climate-related financial exposures.

Future Trends in Credit and Climate Risk Management

Future trends in credit and climate risk management emphasize integrating advanced analytics and artificial intelligence to enhance predictive accuracy and resilience. Financial institutions increasingly adopt climate scenario analysis and stress testing to evaluate long-term impacts on credit portfolios and regulatory compliance. Enhanced data transparency and collaboration between stakeholders drive more effective risk mitigation strategies amid evolving environmental and economic challenges.

Related Important Terms

Transition Risk Metrics

Transition risk metrics quantify potential financial impacts arising from the shift to a low-carbon economy, including policy changes, technological advancements, and market shifts influencing credit risk exposure. Integrating transition risk indicators such as carbon pricing scenarios, regulatory compliance costs, and asset stranding probabilities enables more accurate credit risk assessment and portfolio resilience evaluation.

Climate-Adjusted Credit Rating

Climate-adjusted credit ratings integrate environmental factors such as carbon emissions, regulatory climate policies, and physical climate risks into traditional credit risk assessments to provide a more accurate evaluation of an entity's creditworthiness. This approach enhances risk management by incorporating climate-related financial risks, helping investors anticipate potential defaults linked to climate change impacts.

Physical Risk Stress Testing

Physical risk stress testing evaluates the financial impact of climate-related physical events such as hurricanes, floods, and wildfires on credit portfolios, helping institutions quantify potential losses and adjust risk management strategies. Integrating climate scenarios into credit risk models enhances resilience by identifying vulnerabilities linked to asset location, borrower exposure, and recovery timelines under extreme weather conditions.

Carbon Risk Premium

Carbon risk premium reflects the additional expected returns investors demand for exposure to climate-related financial risks, directly impacting credit risk assessments in sectors with high carbon emissions. Incorporating carbon risk premium into credit risk models enhances the accuracy of default probability predictions by quantifying potential losses from regulatory changes, transition costs, and reputational damage linked to climate risk.

Green Default Probability

Green Default Probability integrates environmental factors into traditional credit risk models by assessing the likelihood that borrowers with high carbon footprints or exposure to climate-sensitive sectors will default. Incorporating climate-related metrics such as carbon emissions, regulatory changes, and transition risks enhances the accuracy of credit risk assessments and supports sustainable finance strategies.

Portfolio Decarbonization Pathway

Credit risk evaluation increasingly integrates climate risk factors to assess potential financial losses driven by environmental changes, emphasizing transition risks and physical risks in loan portfolios. Portfolio decarbonization pathways guide asset reallocations toward low-carbon investments, aiming to reduce carbon exposure and enhance resilience against regulatory shifts and climate-induced market volatility.

Stranded Asset Exposure

Stranded asset exposure in credit risk arises when climate-related policies or physical impacts render assets obsolete or non-performing, leading to higher default probabilities in loan portfolios. Financial institutions must integrate climate risk assessments to quantify potential losses from stranded assets, ensuring resilient credit risk management and regulatory compliance.

ESG-Credit Risk Integration

Integrating ESG factors into credit risk assessment enhances the identification of climate-related financial risks by evaluating a borrower's exposure to environmental challenges and sustainability practices. This approach improves portfolio resilience by linking creditworthiness to climate risk metrics, ensuring more informed lending decisions aligned with long-term sustainable finance goals.

Climate Value-at-Risk (Climate VaR)

Climate Value-at-Risk (Climate VaR) quantifies potential financial losses stemming from climate-related factors, such as regulatory changes, physical damages, and transition risks, providing a forward-looking assessment of climate-induced portfolio vulnerabilities. Unlike traditional credit risk models that focus on borrower default likelihood, Climate VaR integrates environmental variables to capture the evolving impact of climate change on asset valuations and creditworthiness.

Emissions-linked Loan Covenant

Emissions-linked loan covenants integrate carbon intensity targets into credit agreements, aligning credit risk assessment with environmental performance metrics. This innovative approach mitigates climate risk by incentivizing borrowers to reduce greenhouse gas emissions, thereby protecting lenders from escalating financial losses related to regulatory penalties and asset devaluation.

Credit Risk vs Climate Risk Infographic

industrydif.com

industrydif.com