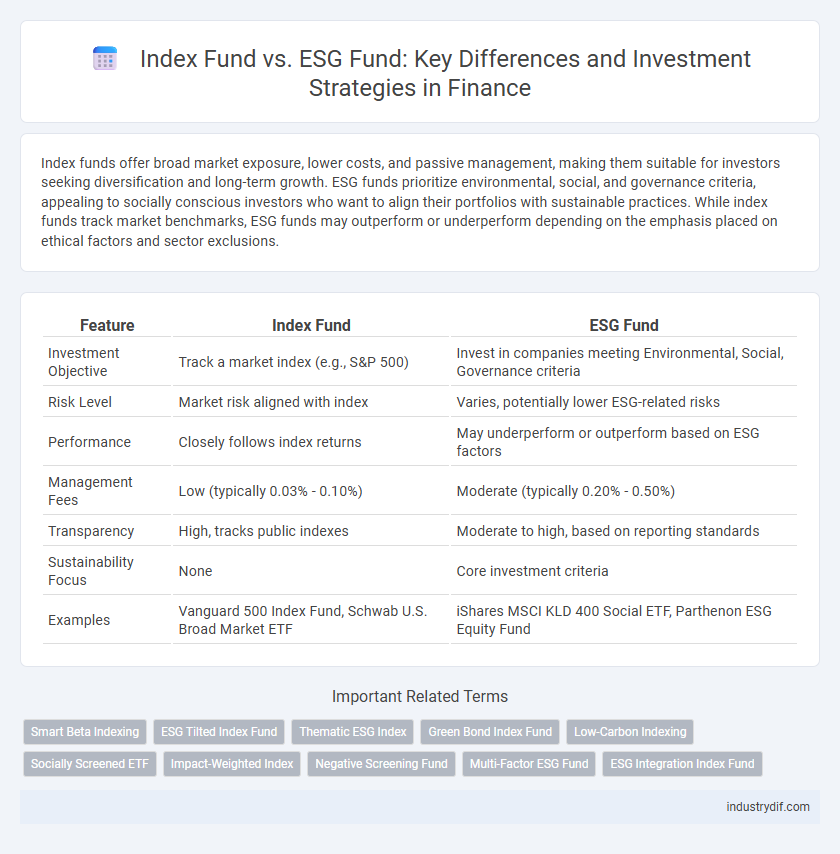

Index funds offer broad market exposure, lower costs, and passive management, making them suitable for investors seeking diversification and long-term growth. ESG funds prioritize environmental, social, and governance criteria, appealing to socially conscious investors who want to align their portfolios with sustainable practices. While index funds track market benchmarks, ESG funds may outperform or underperform depending on the emphasis placed on ethical factors and sector exclusions.

Table of Comparison

| Feature | Index Fund | ESG Fund |

|---|---|---|

| Investment Objective | Track a market index (e.g., S&P 500) | Invest in companies meeting Environmental, Social, Governance criteria |

| Risk Level | Market risk aligned with index | Varies, potentially lower ESG-related risks |

| Performance | Closely follows index returns | May underperform or outperform based on ESG factors |

| Management Fees | Low (typically 0.03% - 0.10%) | Moderate (typically 0.20% - 0.50%) |

| Transparency | High, tracks public indexes | Moderate to high, based on reporting standards |

| Sustainability Focus | None | Core investment criteria |

| Examples | Vanguard 500 Index Fund, Schwab U.S. Broad Market ETF | iShares MSCI KLD 400 Social ETF, Parthenon ESG Equity Fund |

Understanding Index Funds: Definition and Key Features

Index funds are investment vehicles designed to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of the index's constituent stocks. Key features include low management fees, passive management strategy, and broad market exposure that minimizes risk through diversification. Their transparent and rule-based nature makes index funds a popular choice for investors seeking cost-effective growth aligned with overall market trends.

What Are ESG Funds? Principles and Characteristics

ESG funds prioritize investments in companies that meet Environmental, Social, and Governance criteria, promoting sustainability and ethical impact alongside financial returns. These funds integrate qualitative and quantitative analyses of corporate conduct, including carbon footprint, labor practices, and board diversity, to align portfolios with responsible investment principles. By targeting firms with strong ESG ratings, these funds seek to mitigate long-term risks and tap into emerging markets driven by sustainability trends.

Index Fund vs ESG Fund: Core Differences

Index funds track a broad market index, offering diversified exposure with low fees and passive management, while ESG funds prioritize companies meeting specific environmental, social, and governance criteria, potentially affecting sector weightings and risk profiles. The core difference lies in investment strategy: index funds seek to replicate market performance, whereas ESG funds integrate ethical considerations, which may lead to a deviation from traditional market benchmarks. Performance variability and portfolio composition are critical factors investors weigh when choosing between these fund types.

Investment Strategies: Passive vs Responsible Investing

Index funds employ a passive investment strategy, tracking market indexes to replicate their performance with minimal management. ESG funds utilize responsible investing techniques, integrating environmental, social, and governance criteria to select companies demonstrating sustainable practices. Investors seeking market-matching returns prefer index funds, while those prioritizing ethical impact choose ESG funds for values-driven portfolio growth.

Risk and Return Profiles: Comparing Both Fund Types

Index funds typically offer broad market exposure with lower volatility and steady returns, making them suitable for risk-averse investors seeking market-average performance. ESG funds integrate environmental, social, and governance criteria, which can lead to variable risk profiles depending on sector allocations and active management strategies, potentially impacting returns both positively and negatively. Studies indicate ESG funds may underperform or outperform traditional index funds in certain market conditions, reflecting the nuanced balance between ethical considerations and financial goals.

Fees and Cost Structures: Index vs ESG Funds

Index funds generally feature lower fees due to passive management, averaging expense ratios around 0.03% to 0.10%, while ESG funds often incur higher costs ranging from 0.15% to 0.50% because of active screening and engagement practices. The additional costs in ESG funds cover research, monitoring for environmental, social, and governance factors, and shareholder advocacy efforts. Investors should weigh the potential impact of these fees on long-term returns when choosing between cost-efficient index funds and mission-driven ESG investments.

Market Performance: Historical Returns Analysis

Index funds typically track market benchmarks like the S&P 500, delivering returns that reflect broad market performance with average annual returns around 10% historically. ESG funds incorporate environmental, social, and governance criteria, sometimes leading to slight deviations in returns due to sector exclusions, with historical annual returns ranging between 8% and 12%. Research shows ESG funds can outperform or underperform index funds depending on market cycles, with stronger results during periods of heightened focus on sustainability and corporate governance.

Accessibility and Popularity in Financial Markets

Index funds offer broad market exposure with low fees, making them highly accessible to a wide range of investors through major brokerage platforms and retirement accounts. ESG funds, while gaining popularity due to increasing demand for socially responsible investing, often have higher expense ratios and limited availability in some markets, which can restrict accessibility for everyday investors. Market trends indicate a growing shift towards ESG funds, driven by millennial and institutional investor interest, but index funds still dominate overall assets under management and trading volume.

Regulatory Considerations: Compliance and Reporting

Regulatory considerations for index funds typically revolve around broad market compliance, requiring adherence to SEC regulations and transparent periodic reporting of holdings and performance. ESG funds face additional layers of regulatory scrutiny, including verification of environmental, social, and governance criteria, and must comply with evolving sustainability disclosure standards such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the SEC's proposed ESG disclosure rules. Both fund types must ensure accurate, clear reporting to meet investor protection mandates and maintain fiduciary responsibility in a rapidly changing regulatory landscape.

Which Fund is Right for You? Investor Suitability and Goals

Index funds offer broad market exposure with low fees, ideal for investors seeking long-term growth and diversification without focusing on specific ethical criteria. ESG funds prioritize environmental, social, and governance factors, appealing to investors who want to align their investments with personal values while potentially managing risk related to sustainability issues. Choosing between these depends on whether your priority is maximizing returns through market tracking or integrating ethical considerations to reflect social responsibility in your portfolio.

Related Important Terms

Smart Beta Indexing

Smart Beta Indexing offers a strategic advantage over traditional ESG funds by combining rules-based index construction with factor exposure targeting, typically enhancing risk-adjusted returns and reducing volatility. While ESG funds prioritize sustainable, ethical investments, Smart Beta strategies in index funds integrate financial factors such as value, momentum, and quality, providing a more data-driven approach to portfolio optimization.

ESG Tilted Index Fund

ESG Tilted Index Funds integrate environmental, social, and governance criteria into traditional index investment strategies by overweighting companies with higher ESG scores while maintaining broad market exposure, offering a balanced approach between financial returns and sustainable investing. This strategy allows investors to align portfolios with responsible investment principles without sacrificing diversification and risk management inherent in conventional index funds.

Thematic ESG Index

Thematic ESG Index funds integrate environmental, social, and governance criteria with sector-specific or issue-focused themes, offering targeted exposure to sustainable investment opportunities unlike broad index funds that track general market benchmarks. These funds emphasize aligning financial returns with positive social and environmental impact through focused portfolios on climate change, clean energy, or social justice initiatives.

Green Bond Index Fund

A Green Bond Index Fund offers targeted exposure to environmentally sustainable fixed-income securities, aligning investment goals with climate-conscious initiatives while providing diversification and steady returns typical of index funds. Compared to traditional ESG funds, which may include a wider range of asset classes and subjective criteria, Green Bond Index Funds specifically track bonds funding renewable energy, clean transportation, and other green projects, enhancing transparency and impact measurement.

Low-Carbon Indexing

Low-carbon indexing in ESG funds prioritizes investments in companies with reduced carbon footprints, enhancing sustainability-focused portfolio outcomes while mitigating climate risks. Index funds typically track broader market benchmarks without carbon emissions considerations, potentially exposing investors to higher carbon-intensive industries.

Socially Screened ETF

Socially screened ETFs prioritize investments in companies with strong environmental, social, and governance criteria, aligning portfolios with ethical considerations and social responsibility targets. Index funds typically track broader market benchmarks without specific social screens, offering diversified exposure but less focus on ESG principles compared to specialized socially screened ETFs.

Impact-Weighted Index

Impact-weighted index funds integrate environmental, social, and governance (ESG) criteria with traditional index tracking to measure financial returns alongside societal impact. These funds prioritize companies demonstrating positive externalities, enabling investors to align portfolios with sustainability goals without sacrificing market performance.

Negative Screening Fund

Negative screening funds avoid investments in companies that violate environmental, social, and governance (ESG) criteria, focusing primarily on excluding harmful industries such as tobacco, fossil fuels, and weapons manufacturing. Index funds track a broad market or sector benchmark without consideration of ethical or sustainability factors, making negative screening ESG funds a targeted choice for socially responsible investors seeking both financial returns and alignment with their values.

Multi-Factor ESG Fund

Multi-factor ESG funds integrate environmental, social, and governance criteria with traditional financial metrics like value, momentum, and quality to optimize risk-adjusted returns while promoting sustainable investing. These funds often outperform standard index funds by targeting companies with strong ESG scores alongside robust financial performance indicators.

ESG Integration Index Fund

ESG Integration Index Funds systematically incorporate environmental, social, and governance criteria into traditional index investing, enabling investors to align portfolios with sustainability goals without sacrificing market exposure or diversification. These funds utilize quantitative metrics and rigorous screening processes to optimize financial returns while mitigating ESG-related risks across sectors and geographies.

Index Fund vs ESG Fund Infographic

industrydif.com

industrydif.com