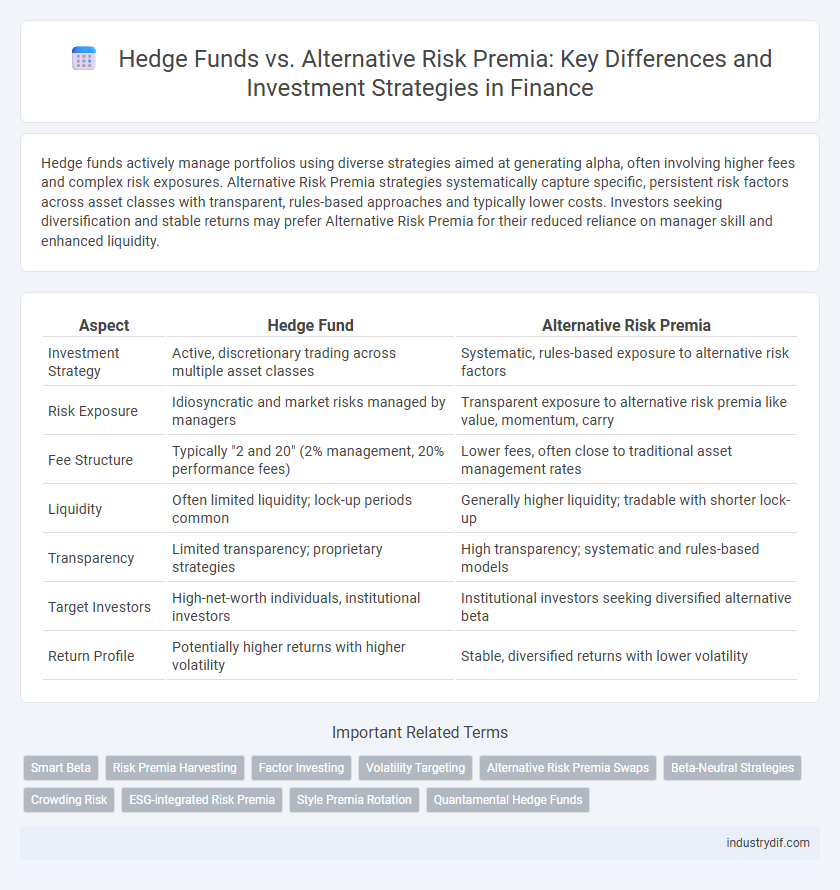

Hedge funds actively manage portfolios using diverse strategies aimed at generating alpha, often involving higher fees and complex risk exposures. Alternative Risk Premia strategies systematically capture specific, persistent risk factors across asset classes with transparent, rules-based approaches and typically lower costs. Investors seeking diversification and stable returns may prefer Alternative Risk Premia for their reduced reliance on manager skill and enhanced liquidity.

Table of Comparison

| Aspect | Hedge Fund | Alternative Risk Premia |

|---|---|---|

| Investment Strategy | Active, discretionary trading across multiple asset classes | Systematic, rules-based exposure to alternative risk factors |

| Risk Exposure | Idiosyncratic and market risks managed by managers | Transparent exposure to alternative risk premia like value, momentum, carry |

| Fee Structure | Typically "2 and 20" (2% management, 20% performance fees) | Lower fees, often close to traditional asset management rates |

| Liquidity | Often limited liquidity; lock-up periods common | Generally higher liquidity; tradable with shorter lock-up |

| Transparency | Limited transparency; proprietary strategies | High transparency; systematic and rules-based models |

| Target Investors | High-net-worth individuals, institutional investors | Institutional investors seeking diversified alternative beta |

| Return Profile | Potentially higher returns with higher volatility | Stable, diversified returns with lower volatility |

Introduction to Hedge Funds and Alternative Risk Premia

Hedge funds are actively managed investment vehicles that employ diverse strategies including long-short equity, event-driven, and global macro to generate alpha and manage risk. Alternative risk premia represent systematic, rule-based exposures to well-documented sources of return such as value, momentum, and volatility, aiming to deliver diversified alpha with enhanced transparency and lower fees. Both approaches seek to enhance portfolio returns but differ in strategy complexity, cost structure, and risk management techniques.

Defining Hedge Funds: Structure and Strategies

Hedge funds are pooled investment vehicles that employ diverse strategies such as long/short equity, global macro, and event-driven to achieve absolute returns regardless of market conditions. Structured as private partnerships, they often use leverage, derivatives, and short-selling to exploit market inefficiencies and manage risk dynamically. These funds typically charge performance-based fees, aligning manager incentives with investor returns while maintaining flexibility across asset classes and geographies.

What is Alternative Risk Premia? Key Concepts

Alternative Risk Premia (ARP) refers to systematic, rule-based investment strategies that seek to capture specific risk factors such as value, momentum, carry, and low volatility across various asset classes. Unlike traditional hedge funds that often employ discretionary and opportunistic approaches, ARP strategies aim to offer diversified, transparent, and cost-efficient exposure to persistent, economically-driven risk premia. These strategies enhance portfolio diversification by targeting sources of return that are less correlated with conventional market risks and aim to generate stable, long-term alpha.

Investment Objectives: Hedge Funds vs. Alternative Risk Premia

Hedge funds aim to achieve absolute returns through active management, leveraging diverse strategies such as long/short equity, event-driven, and global macro to exploit market inefficiencies. Alternative risk premia strategies systematically capture specific risk factors like value, momentum, and carry across asset classes, focusing on transparent, rule-based implementations for consistent risk-adjusted returns. While hedge funds prioritize opportunistic alpha generation, alternative risk premia emphasize harvesting persistent, well-documented risk premiums to enhance portfolio diversification and reduce drawdowns.

Strategy Comparison: Market Exposure and Risk Factors

Hedge funds typically employ active management strategies with dynamic market exposure aiming to generate alpha through security selection and tactical asset allocation, often incorporating leverage and short selling to enhance returns. Alternative Risk Premia strategies systematically harvest risk factors such as value, momentum, carry, and volatility across diversified asset classes, focusing on replicable and transparent sources of risk premia with lower correlation to traditional markets. While hedge funds seek to exploit inefficiencies through discretionary decisions, alternative risk premia emphasize factor-based investment with consistent exposure to intended risk factors, offering distinct risk-return profiles and diversification benefits.

Liquidity and Transparency: A Side-by-Side Analysis

Hedge funds often exhibit lower liquidity due to lock-up periods and complex redemption terms, whereas alternative risk premia strategies typically provide higher liquidity through daily or monthly redemptions. Transparency in hedge funds is restricted because of proprietary strategies and limited public disclosures, while alternative risk premia maintain greater transparency by employing rule-based, systematic investment processes with clearer risk exposures. Investors seeking flexibility and clarity may prefer alternative risk premia, whereas those targeting asymmetric returns might accept hedge funds' reduced liquidity and transparency.

Fee Structures and Cost Implications

Hedge funds typically charge a management fee of 1-2% of assets under management (AUM) plus a 20% performance fee, leading to higher overall costs for investors. Alternative Risk Premia (ARP) strategies often employ a more transparent fee structure, with lower fixed fees around 0.5-1% and reduced or no performance fees, resulting in cost efficiencies. The lower fee burden in ARP can enhance net returns, especially in low-volatility environments where traditional hedge funds may struggle to outperform after fees.

Performance Drivers: Alpha, Beta, and Beyond

Hedge funds generate performance through alpha by exploiting market inefficiencies and employing active management strategies, while alternative risk premia emphasize harvesting systematic risk factors such as value, momentum, and carry across asset classes to capture beta-like returns. The interplay of alpha in hedge funds contrasts with the more transparent, factor-driven beta exposure in alternative risk premia strategies, offering diversified sources of risk and return. Understanding these distinct performance drivers is crucial for portfolio construction, risk management, and achieving uncorrelated returns.

Suitability for Investors: Institutional vs. Individual

Hedge funds typically cater to institutional investors due to high minimum investment requirements and complex strategies requiring sophisticated risk management. Alternative risk premia strategies offer broader accessibility and transparency, making them more suitable for individual investors seeking diversified risk exposures. Institutional investors value hedge funds for active management potential, while individual investors benefit from the lower cost and systematic nature of alternative risk premia.

Trends and Future Outlook in Hedge Funds and Alternative Risk Premia

Hedge funds are increasingly incorporating alternative risk premia strategies to diversify sources of return and enhance risk-adjusted performance amid evolving market volatility. The shift toward transparent, factor-based alternative risk premia reflects investor demand for cost-efficient, liquid, and systematic exposure beyond traditional hedge fund alpha generation. Future trends indicate growth in hybrid models leveraging data analytics and machine learning to optimize hedge fund and alternative risk premia integration, aiming to improve resilience and adaptability in complex financial environments.

Related Important Terms

Smart Beta

Smart Beta strategies in Alternative Risk Premia emphasize systematic, rule-based exposures to specific risk factors such as value, momentum, and volatility, offering more transparent and cost-effective alternatives to traditional hedge funds. Unlike hedge funds, which actively seek alpha through discretionary management, Smart Beta aims to capture persistent sources of risk premia with improved diversification and scalability.

Risk Premia Harvesting

Hedge funds primarily leverage active management strategies aiming for absolute returns, while alternative risk premia focus on systematically capturing diversified factor-based risks to generate steady risk premia harvesting. Risk premia harvesting in alternative strategies involves exploiting persistent return drivers such as value, momentum, and carry, offering scalable and transparent sources of alpha with lower correlation to traditional hedge fund returns.

Factor Investing

Hedge funds typically employ diverse, actively managed strategies aiming for absolute returns, whereas Alternative Risk Premia focus on systematic, factor-based investing that extracts persistent sources of return such as value, momentum, and low volatility. Factor investing within Alternative Risk Premia offers transparent, rules-based exposure to well-documented risk premiums, providing diversification benefits and cost efficiency compared to the discretionary approach of hedge funds.

Volatility Targeting

Hedge funds traditionally employ volatility targeting to dynamically adjust exposure and reduce portfolio drawdowns by scaling positions based on market volatility measures such as VIX or realized volatility. Alternative risk premia strategies utilize volatility targeting frameworks to systematically harvest risk factors like value, momentum, and carry, optimizing risk-adjusted returns while maintaining controlled volatility profiles.

Alternative Risk Premia Swaps

Alternative Risk Premia swaps offer investors systematic exposure to diversified risk factors such as value, momentum, and carry, providing transparency and cost efficiency compared to traditional hedge funds. These swaps enable targeted risk premia allocation with reduced manager risk and enhanced liquidity, making them a compelling solution for portfolio diversification in alternative investments.

Beta-Neutral Strategies

Beta-neutral strategies in hedge funds aim to eliminate market risk by balancing long and short positions, achieving returns through alpha generation independent of market direction. Alternative risk premia focus on harvesting systematic risk factors such as value, momentum, and carry, offering diversified sources of return with typically lower correlation to traditional hedge fund beta exposures.

Crowding Risk

Hedge funds often face significant crowding risk due to concentrated positions in similar strategies, leading to amplified losses during market stress. Alternative risk premia strategies diversify exposures across broader, less correlated risk factors, reducing vulnerability to crowding and improving portfolio resilience.

ESG-integrated Risk Premia

Hedge funds traditionally employ active management strategies with variable ESG integration, while alternative risk premia strategies systematically capture ESG-integrated factors such as climate risk and social impact to enhance portfolio diversification and risk-adjusted returns. Incorporating ESG criteria into alternative risk premia leverages data-driven models to identify sustainable alpha opportunities across equity, credit, and factor premia, aligning financial performance with responsible investment principles.

Style Premia Rotation

Hedge funds primarily leverage discretionary strategies and alpha generation, while alternative risk premia focus on harvesting systematic style premia such as value, momentum, and carry across asset classes; style premia rotation dynamically reallocates exposures to these factors based on changing market regimes to optimize risk-adjusted returns. Empirical evidence shows that integrating style premia rotation within alternative risk premia portfolios enhances diversification and reduces drawdowns compared to traditional hedge fund strategies.

Quantamental Hedge Funds

Quantamental hedge funds combine quantitative models with fundamental analysis to optimize returns by exploiting alternative risk premia such as value, momentum, and carry across asset classes. This approach differentiates them from traditional hedge funds by systematically harvesting diversified, non-correlated sources of alpha while managing risk through data-driven insights and human expertise.

Hedge Fund vs Alternative Risk Premia Infographic

industrydif.com

industrydif.com