Venture capital involves investing in early-stage companies by providing equity funding in exchange for ownership stakes, often requiring extensive due diligence and long-term commitment. Tokenization transforms assets into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and faster transactions without traditional intermediaries. This shift from venture capital to tokenization offers investors greater flexibility and access to a broader range of investment opportunities through decentralized finance platforms.

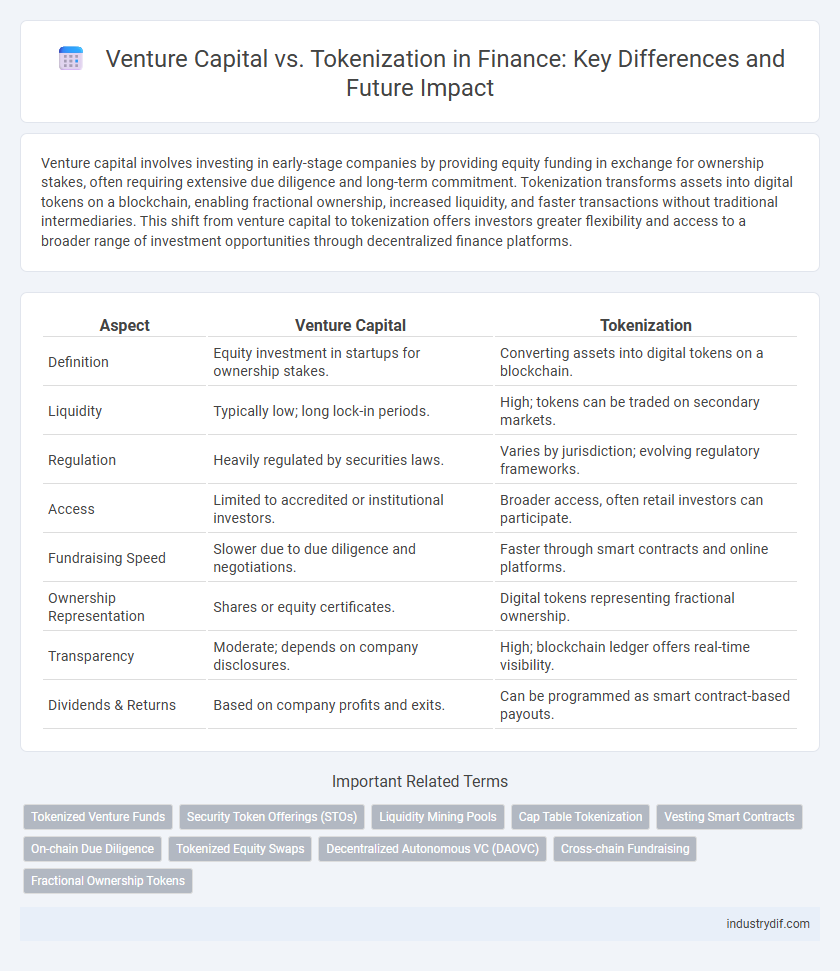

Table of Comparison

| Aspect | Venture Capital | Tokenization |

|---|---|---|

| Definition | Equity investment in startups for ownership stakes. | Converting assets into digital tokens on a blockchain. |

| Liquidity | Typically low; long lock-in periods. | High; tokens can be traded on secondary markets. |

| Regulation | Heavily regulated by securities laws. | Varies by jurisdiction; evolving regulatory frameworks. |

| Access | Limited to accredited or institutional investors. | Broader access, often retail investors can participate. |

| Fundraising Speed | Slower due to due diligence and negotiations. | Faster through smart contracts and online platforms. |

| Ownership Representation | Shares or equity certificates. | Digital tokens representing fractional ownership. |

| Transparency | Moderate; depends on company disclosures. | High; blockchain ledger offers real-time visibility. |

| Dividends & Returns | Based on company profits and exits. | Can be programmed as smart contract-based payouts. |

Introduction to Venture Capital and Tokenization

Venture capital involves funding startups and early-stage companies with high growth potential in exchange for equity stakes, providing both capital and strategic support to accelerate business development. Tokenization converts assets, including equity or real estate, into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and transparent transactions. Both methods offer innovative ways to raise capital but differ fundamentally in structure, accessibility, and regulatory considerations.

Core Principles: How Venture Capital Works

Venture capital operates on the principle of investing equity in early-stage companies with high growth potential in exchange for ownership stakes and influence in management decisions. Investors perform rigorous due diligence to evaluate startup viability, market potential, and scalability before committing funds, aiming for substantial returns upon exits like IPOs or acquisitions. This traditional risk-reward model contrasts with tokenization, which leverages blockchain technology to fractionalize asset ownership, increasing liquidity and accessibility while preserving governance through smart contracts.

Understanding Tokenization in Finance

Tokenization in finance refers to the process of converting ownership rights in real-world assets into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and transparency. Unlike venture capital, which involves direct equity investments in startups or companies, tokenization democratizes access to assets by allowing smaller investors to participate and trade without traditional intermediaries. This innovation reduces barriers to entry and enhances the efficiency of raising capital or trading financial instruments.

Key Differences: Traditional VC vs. Digital Token Investments

Traditional venture capital involves equity funding through shares and ownership stakes within private companies, often requiring long-term lock-ups and significant due diligence. In contrast, digital token investments leverage blockchain technology to offer fractional ownership and increased liquidity through tokenized assets, allowing for quicker transactions and broader market access. Regulatory frameworks and risk profiles differ significantly, with venture capital subject to established securities laws and tokenization navigating emerging, often uncertain, digital asset regulations.

Accessibility and Investor Participation

Venture capital typically requires high entry barriers with significant capital commitments, limiting accessibility to accredited investors and reducing broader participation. Tokenization leverages blockchain technology to fractionalize assets, enabling smaller investments and inclusive participation from a diverse pool of investors globally. This democratization of investment opportunities enhances liquidity and fosters greater market engagement compared to traditional venture capital models.

Funding Mechanisms: Equity vs. Tokens

Venture capital typically involves acquiring equity stakes in startups, providing investors with ownership rights and potential profit sharing based on company valuation. Tokenization leverages blockchain technology to issue digital tokens that represent assets or utility, enabling fractional ownership and increased liquidity compared to traditional equity. While equity funding relies on regulatory frameworks and long-term value creation, token-based funding offers greater accessibility and faster transactions in decentralized markets.

Regulatory Landscape: Compliance in VC and Tokenization

Venture capital operates under well-established regulatory frameworks such as securities laws enforced by the SEC, requiring detailed disclosures and investor accreditation. Tokenization leverages blockchain technology but faces evolving regulations, with jurisdictions varying in classifying tokens as securities or utilities, impacting compliance obligations. Both models demand stringent adherence to anti-money laundering (AML) and know-your-customer (KYC) protocols to mitigate legal and financial risks.

Liquidity and Exit Strategies Compared

Venture capital investments typically involve long lock-up periods with exit strategies relying on IPOs or acquisitions, which can take 5 to 10 years. Tokenization enhances liquidity by allowing fractional ownership and enabling secondary market trading 24/7 on blockchain platforms, significantly shortening exit timelines. This liquidity transformation provides investors with more flexible and immediate exit options compared to traditional venture capital.

Risks and Challenges in Both Approaches

Venture capital involves high financial risk due to illiquidity, long investment horizons, and dependency on startup success, while tokenization risks include regulatory uncertainty, cybersecurity threats, and market volatility affecting digital asset value. Both approaches face challenges in due diligence reliability, valuation accuracy, and investor protection mechanisms. Navigating these risks requires robust legal frameworks, technological security measures, and transparent governance to safeguard investments and ensure sustainable growth.

Future Trends: The Convergence of Venture Capital and Tokenization

The convergence of venture capital and tokenization is reshaping investment landscapes by integrating blockchain technology to enhance liquidity and transparency in startup funding. Tokenization enables fractional ownership of venture assets, allowing broader investor participation and reducing entry barriers traditionally seen in venture capital. This fusion is driving innovation in fundraising models, with decentralized finance (DeFi) platforms increasingly facilitating venture capital deals through digital tokens, signaling a transformative shift in capital markets.

Related Important Terms

Tokenized Venture Funds

Tokenized venture funds leverage blockchain technology to enable fractional ownership and increased liquidity, democratizing access to early-stage investments traditionally dominated by venture capital firms. By issuing digital tokens representing fund shares, these funds enhance transparency, reduce intermediaries, and facilitate global participation, revolutionizing the venture investment landscape.

Security Token Offerings (STOs)

Security Token Offerings (STOs) leverage blockchain technology to issue regulated digital securities, providing enhanced transparency, liquidity, and fractional ownership compared to traditional venture capital funding. STOs offer investors real-time compliance, reduced intermediaries, and global access to capital markets, positioning them as a transformative alternative to conventional equity financing methods.

Liquidity Mining Pools

Venture capital traditionally offers high-risk equity investments with longer lock-up periods, while tokenization leverages blockchain technology to create liquidity mining pools, enabling real-time asset trading and reward distribution. Liquidity mining pools enhance market efficiency by providing continuous access to capital and incentivizing participation through token rewards, bridging the gap between illiquid venture investments and decentralized finance ecosystems.

Cap Table Tokenization

Cap table tokenization transforms traditional equity ownership records into blockchain-based tokens, enhancing liquidity and transparency for venture capital investors. Unlike conventional venture capital structures, tokenized cap tables enable fractional ownership and real-time transferability, streamlining fundraising and secondary market transactions.

Vesting Smart Contracts

Vesting smart contracts in venture capital ensure gradual token release to founders and investors, aligning incentives and reducing risk of premature token liquidation. In tokenization, these automated contracts enhance transparency and security by enforcing predefined schedules for asset or equity token distribution, revolutionizing traditional vesting processes.

On-chain Due Diligence

On-chain due diligence in venture capital leverages blockchain technology to transparently track funding histories and asset provenance, reducing information asymmetry and fraud risks. Tokenization enables automated, real-time verification of investor credentials and asset legitimacy, streamlining the due diligence process and enhancing decision-making accuracy.

Tokenized Equity Swaps

Tokenized equity swaps leverage blockchain technology to enable fractional ownership and seamless trading of equity positions without traditional intermediaries, increasing liquidity and accessibility in venture capital markets. This innovation reduces settlement times, enhances transparency, and allows investors to hedge or gain exposure to startup equity through digital tokens representing swap agreements.

Decentralized Autonomous VC (DAOVC)

Decentralized Autonomous Venture Capital (DAOVC) combines the democratic governance of blockchain-based DAOs with venture capital to enable transparent, community-driven investment decisions and liquidity through tokenization of assets. DAOVCs leverage smart contracts and token economies to reduce intermediaries, increase access to funding, and provide fractional ownership, revolutionizing traditional venture capital models by aligning incentives and expanding investor participation globally.

Cross-chain Fundraising

Cross-chain fundraising leverages tokenization to enable venture capital investments across multiple blockchain platforms, increasing liquidity and broadening investor access beyond traditional VC limitations. This decentralized approach streamlines capital flow, reduces barriers, and enhances transparency in multi-chain ecosystems.

Fractional Ownership Tokens

Venture capital traditionally pools investor funds to acquire equity stakes in startups, while tokenization enables fractional ownership tokens that digitally represent shares of an asset, increasing liquidity and accessibility. Fractional ownership tokens democratize investment opportunities by allowing smaller, divisible investments in ventures or assets, leveraging blockchain technology for transparent and efficient transaction records.

Venture capital vs Tokenization Infographic

industrydif.com

industrydif.com