Hedge funds often employ long/short equity strategies to capitalize on stock price movements by holding both long and short positions, aiming to generate alpha regardless of market direction. This approach enhances risk management by hedging exposure and exploiting market inefficiencies to achieve superior returns. Investors favor long/short equity funds for their flexibility in navigating volatile markets while seeking balanced risk-adjusted performance.

Table of Comparison

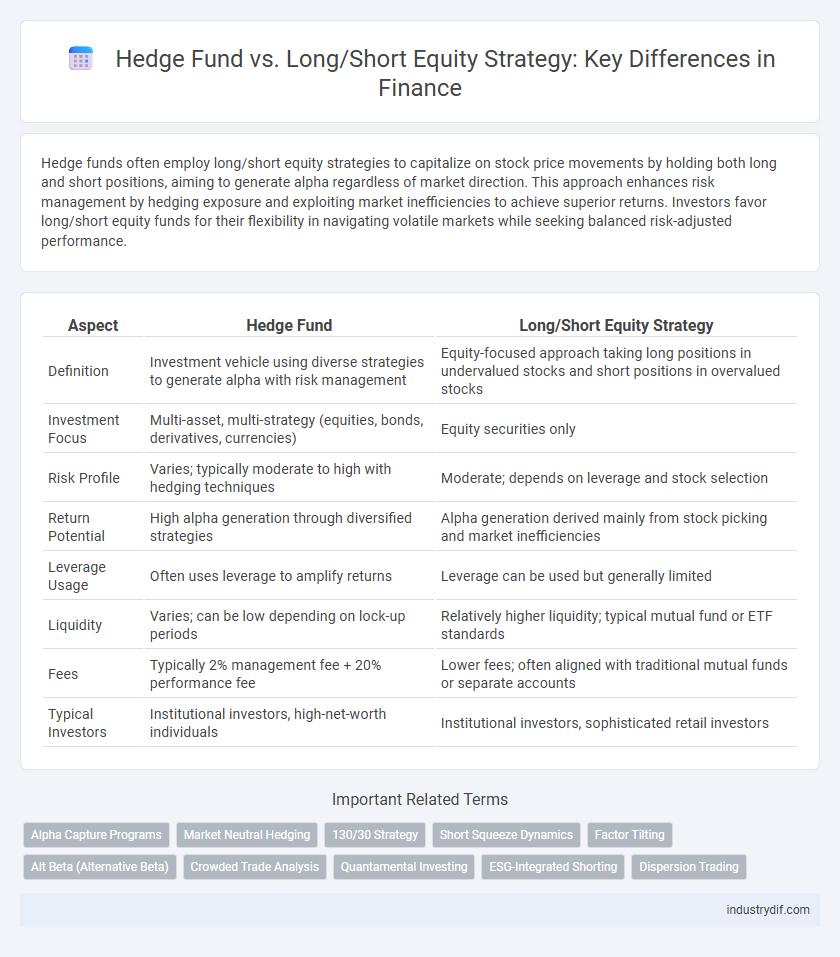

| Aspect | Hedge Fund | Long/Short Equity Strategy |

|---|---|---|

| Definition | Investment vehicle using diverse strategies to generate alpha with risk management | Equity-focused approach taking long positions in undervalued stocks and short positions in overvalued stocks |

| Investment Focus | Multi-asset, multi-strategy (equities, bonds, derivatives, currencies) | Equity securities only |

| Risk Profile | Varies; typically moderate to high with hedging techniques | Moderate; depends on leverage and stock selection |

| Return Potential | High alpha generation through diversified strategies | Alpha generation derived mainly from stock picking and market inefficiencies |

| Leverage Usage | Often uses leverage to amplify returns | Leverage can be used but generally limited |

| Liquidity | Varies; can be low depending on lock-up periods | Relatively higher liquidity; typical mutual fund or ETF standards |

| Fees | Typically 2% management fee + 20% performance fee | Lower fees; often aligned with traditional mutual funds or separate accounts |

| Typical Investors | Institutional investors, high-net-worth individuals | Institutional investors, sophisticated retail investors |

Hedge Fund Overview: Key Characteristics

Hedge funds are private investment vehicles that employ diverse strategies to generate high returns, often using leverage, derivatives, and short selling to manage risk and enhance performance. They typically cater to accredited investors and operate with fewer regulatory constraints compared to mutual funds, allowing for greater flexibility in asset allocation. Key characteristics include active management, performance-based fees, and a focus on absolute returns regardless of market direction.

Long/Short Equity Strategy Defined

Long/Short Equity Strategy involves taking long positions in undervalued stocks while shorting overvalued ones to capitalize on market inefficiencies. This approach aims to generate alpha by exploiting stock selection skills and hedging market exposure, reducing overall portfolio volatility. Unlike traditional hedge funds, long/short equity strategies specifically focus on equity markets through a balanced mix of long and short equity investments.

Core Differences: Hedge Fund vs Long/Short Equity

Hedge funds represent a broad category of pooled investment vehicles employing diverse strategies, including long/short equity, to generate alpha while managing risk. Long/short equity is a specific hedge fund strategy that involves taking long positions in undervalued stocks and short positions in overvalued stocks to capitalize on market inefficiencies. The core difference lies in scope and flexibility: hedge funds may adopt various asset classes and leverage, whereas long/short equity focuses exclusively on equity securities with a balanced approach to directional risk.

Investment Approaches and Techniques

Hedge funds employ a diverse range of investment approaches, including global macro, arbitrage, and long/short equity strategies, aiming to generate absolute returns regardless of market conditions. The long/short equity strategy specifically involves taking long positions in undervalued stocks while shorting overvalued ones, using fundamental analysis and quantitative models to identify mispricings. This technique allows for risk mitigation and enhanced alpha generation by capitalizing on both rising and falling equity markets.

Risk Management in Both Strategies

Hedge funds implement diverse risk management techniques, including derivatives and leverage controls, to mitigate volatility and protect investor capital across various market conditions. Long/short equity strategies specifically balance market exposure by taking simultaneous long positions in undervalued stocks and short positions in overvalued stocks, aiming to reduce systematic risk. Both strategies emphasize dynamic portfolio adjustments and rigorous risk assessment models to optimize returns while minimizing downside risk.

Return Profiles and Performance Metrics

Hedge funds employing long/short equity strategies typically aim to generate alpha by capitalizing on both rising and falling stock prices, resulting in asymmetric return profiles with lower correlation to traditional benchmarks. Key performance metrics such as Sharpe ratio, alpha, beta, and Sortino ratio are critical to evaluating their risk-adjusted returns and downside protection. Unlike pure long-only funds, long/short equity hedge funds often exhibit reduced market volatility exposure and enhanced drawdown control, contributing to more consistent absolute returns over various market cycles.

Typical Investor Profiles

Hedge funds typically attract high-net-worth individuals and institutional investors seeking diversified portfolios with risk-managed exposure to various asset classes. Long/short equity strategies appeal to investors who prefer equity market exposure with the potential for alpha generation through both long and short positions. These profiles often include sophisticated investors with a medium to high-risk tolerance aiming for balanced capital appreciation and downside protection.

Regulatory Considerations

Hedge funds employing long/short equity strategies face evolving regulatory frameworks, including SEC oversight under the Investment Advisers Act and compliance with Dodd-Frank Act provisions. These funds must implement robust risk management and disclosure practices to address concerns related to leverage, liquidity, and market manipulation. Enhanced regulatory scrutiny aims to increase transparency and protect investor interests without stifling the strategic flexibility essential to long/short equity approaches.

Fee Structures and Compensation Models

Hedge funds typically employ a "2 and 20" fee structure, charging a 2% management fee on assets under management and a 20% performance fee on profits generated, aligning compensation with fund performance. Long/short equity strategies within hedge funds may adopt variations of this model, sometimes reducing performance fees or management fees to attract investors seeking lower costs. Compensation models emphasize incentive alignment, often incorporating deferred bonuses and clawback provisions to mitigate risk-taking and ensure sustainable returns.

Industry Trends and Future Outlook

Hedge funds increasingly integrate advanced technologies such as AI and big data analytics to enhance Long/Short Equity strategies, driving alpha generation amid volatile markets. Industry trends show a growing preference for ESG-compliant investments within hedge fund portfolios, reflecting investor demand for sustainability-focused returns. Future outlook suggests continued innovation and regulatory adaptation, positioning Long/Short Equity strategies as flexible tools in dynamic financial landscapes.

Related Important Terms

Alpha Capture Programs

Alpha capture programs in hedge funds systematically collect and evaluate investment ideas from multiple sources to identify alpha-generating opportunities, enhancing the performance of long/short equity strategies by dynamically adjusting positions based on predictive signals. These programs integrate quantitative models and real-time data analytics, enabling hedge funds to exploit market inefficiencies and achieve superior risk-adjusted returns compared to traditional long/short equity approaches without alpha capture integration.

Market Neutral Hedging

Market neutral hedging in hedge funds aims to eliminate market risk by taking equal long and short equity positions, reducing exposure to market volatility while capturing stock-specific alpha. This strategy contrasts with traditional long/short equity approaches by maintaining balanced exposure to minimize beta, enhancing risk-adjusted returns through diversified security selection.

130/30 Strategy

The 130/30 strategy is a variant of long/short equity investing that allows portfolio managers to hold 130% long positions and 30% short positions, aiming to enhance returns while managing market exposure. Unlike traditional hedge funds that may employ diverse asset classes and leverage, the 130/30 approach specifically targets equity markets by systematically extending long positions and shorting overvalued stocks to capture alpha.

Short Squeeze Dynamics

Hedge funds employing long/short equity strategies often face heightened risk during short squeeze events, where rapid price surges force short sellers to cover positions at escalating losses. Understanding short squeeze dynamics is crucial for managing liquidity and volatility, as these spikes can lead to abrupt market distortions and impact fund performance.

Factor Tilting

Hedge funds employing long/short equity strategies leverage factor tilting to systematically overweight factors such as value, momentum, and low volatility, enhancing risk-adjusted returns while managing market exposure. Factor tilting enables these funds to exploit persistent anomalies across equity markets, improving alpha generation compared to traditional long-only approaches.

Alt Beta (Alternative Beta)

Hedge funds employing long/short equity strategies often target alt beta, capturing systematic risk premia beyond traditional market beta by exploiting factors like value, momentum, and size. This approach enhances portfolio diversification and potentially improves risk-adjusted returns by isolating alternative sources of alpha from style and sector exposures.

Crowded Trade Analysis

Hedge funds employing long/short equity strategies often face crowded trade risks, where multiple funds hold similar positions, increasing vulnerability to rapid price reversals and liquidity constraints. Effective crowded trade analysis leverages real-time market data, investor positioning metrics, and liquidity indicators to identify overcrowded exposures and mitigate potential drawdowns.

Quantamental Investing

Quantamental investing in hedge funds combines quantitative models with fundamental analysis to optimize the long/short equity strategy, enhancing stock selection and risk management through data-driven insights alongside traditional financial metrics. This hybrid approach leverages algorithmic screening and deep fundamental research to exploit market inefficiencies and improve alpha generation within hedge fund portfolios.

ESG-Integrated Shorting

Hedge funds employing ESG-integrated shorting in long/short equity strategies capitalize on environmental, social, and governance criteria to identify overvalued or high-risk companies for short positions, enhancing risk-adjusted returns while promoting sustainable investing. This approach leverages advanced ESG data analytics and active portfolio management to align financial performance with responsible investment principles.

Dispersion Trading

Hedge funds employing long/short equity strategies often capitalize on dispersion trading by exploiting the variance between individual stock performances and the overall market index, aiming to generate alpha through relative value arbitrage. Dispersion trading involves taking long positions in undervalued stocks while shorting overvalued counterparts within a sector or index, leveraging statistical measures like implied volatility dispersion to hedge market risk effectively.

Hedge Fund vs Long/Short Equity Strategy Infographic

industrydif.com

industrydif.com