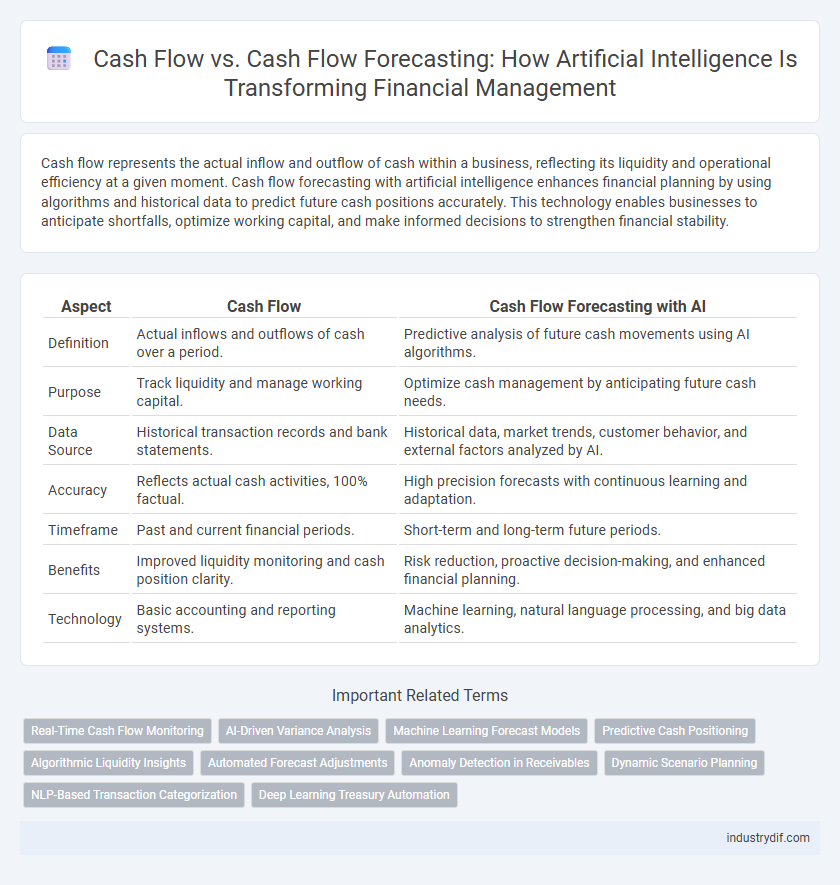

Cash flow represents the actual inflow and outflow of cash within a business, reflecting its liquidity and operational efficiency at a given moment. Cash flow forecasting with artificial intelligence enhances financial planning by using algorithms and historical data to predict future cash positions accurately. This technology enables businesses to anticipate shortfalls, optimize working capital, and make informed decisions to strengthen financial stability.

Table of Comparison

| Aspect | Cash Flow | Cash Flow Forecasting with AI |

|---|---|---|

| Definition | Actual inflows and outflows of cash over a period. | Predictive analysis of future cash movements using AI algorithms. |

| Purpose | Track liquidity and manage working capital. | Optimize cash management by anticipating future cash needs. |

| Data Source | Historical transaction records and bank statements. | Historical data, market trends, customer behavior, and external factors analyzed by AI. |

| Accuracy | Reflects actual cash activities, 100% factual. | High precision forecasts with continuous learning and adaptation. |

| Timeframe | Past and current financial periods. | Short-term and long-term future periods. |

| Benefits | Improved liquidity monitoring and cash position clarity. | Risk reduction, proactive decision-making, and enhanced financial planning. |

| Technology | Basic accounting and reporting systems. | Machine learning, natural language processing, and big data analytics. |

Understanding Cash Flow in Finance

Cash flow represents the actual inflow and outflow of cash within a business, providing a real-time snapshot of liquidity and operational efficiency. Accurate cash flow forecasting, enhanced by Artificial Intelligence algorithms, leverages historical data and predictive analytics to anticipate future cash positions, reducing uncertainty and optimizing financial planning. Integrating AI-driven cash flow forecasting enables companies to proactively manage working capital, mitigate risks of cash shortages, and improve strategic decision-making in finance.

Introduction to Cash Flow Forecasting

Cash flow forecasting leverages artificial intelligence to predict future cash inflows and outflows, enabling businesses to maintain optimal liquidity and avoid financial shortfalls. By analyzing historical transaction data, payment patterns, and market trends, AI-driven models provide accurate, real-time forecasts that enhance decision-making and financial planning. Integrating AI in cash flow forecasting reduces uncertainty and supports proactive management of working capital.

Traditional Methods for Cash Flow Forecasting

Traditional methods for cash flow forecasting often rely on historical financial data, manual data entry, and basic spreadsheet models, which can introduce inaccuracies and inefficiencies. These conventional approaches struggle to adapt dynamically to market fluctuations and complex cash flow patterns, limiting predictive reliability. As a result, organizations using traditional forecasting face challenges in real-time decision-making and optimizing liquidity management.

Challenges in Manual Cash Flow Management

Manual cash flow management faces challenges such as data inaccuracies, delayed updates, and limited forecasting precision, which hinder effective liquidity analysis. Human errors in compiling transactions and reconciling accounts often lead to inconsistent cash flow statements, affecting decision-making. Integrating artificial intelligence in cash flow forecasting enhances accuracy by automating data processing and providing real-time predictive insights, addressing limitations of manual methods.

The Role of Artificial Intelligence in Finance

Artificial intelligence enhances cash flow management by providing accurate, real-time cash flow forecasting, reducing financial risks and improving liquidity planning. Machine learning algorithms analyze historical data and market trends to predict future cash inflows and outflows with higher precision. Integrating AI-driven cash flow forecasting tools helps finance teams optimize working capital, automate decision-making, and increase operational efficiency.

AI-Powered Cash Flow Forecasting Explained

AI-powered cash flow forecasting leverages machine learning algorithms to analyze historical financial data, customer payment behavior, and market trends, providing highly accurate predictions of future cash inflows and outflows. This advanced forecasting enables finance teams to identify potential liquidity shortfalls, optimize working capital, and make informed investment decisions with enhanced confidence. Integrating AI-driven cash flow analytics into financial planning helps businesses reduce uncertainty and improve their overall cash management strategies.

Key Benefits of Using AI for Cash Flow Predictions

AI-driven cash flow forecasting enhances accuracy by analyzing vast datasets and identifying patterns that traditional methods often miss. It enables real-time monitoring and adaptive predictions, allowing businesses to anticipate liquidity needs and optimize financial planning. Automation reduces manual errors and accelerates decision-making, promoting more efficient cash management and strategic investment.

Comparing Historical Cash Flow to Forecasted Values

Analyzing historical cash flow provides a concrete foundation for understanding past financial performance and liquidity patterns, essential for accurate cash flow forecasting models. Artificial intelligence enhances this process by identifying subtle trends and anomalies in historical data that traditional methods might miss, improving the precision of forecasted cash flow values. Comparing historical cash flow to AI-driven forecasts enables finance professionals to validate model accuracy, detect deviations early, and optimize working capital management.

Real-World Applications of AI in Cash Flow Management

Artificial intelligence enhances cash flow management by analyzing historical data and market trends to generate accurate cash flow forecasts, enabling businesses to optimize liquidity and reduce financial risks. Real-world applications include automated invoice processing, predictive analytics for cash inflows and outflows, and dynamic scenario planning that adapts to changing economic conditions. AI-powered tools also improve working capital management by identifying payment patterns and flagging potential cash shortages before they occur.

Future Trends: AI and Financial Forecasting Evolution

Artificial Intelligence is revolutionizing cash flow forecasting by incorporating real-time data analytics and machine learning algorithms to predict financial trends with greater accuracy and speed. Future trends indicate increased adoption of AI-driven forecasting tools that enable businesses to optimize liquidity management and reduce financial risks. Enhanced AI capabilities will facilitate dynamic scenario analysis, helping finance professionals make proactive, data-driven decisions for improved cash flow strategies.

Related Important Terms

Real-Time Cash Flow Monitoring

Real-time cash flow monitoring powered by artificial intelligence enables businesses to track inflows and outflows instantaneously, enhancing accuracy and responsiveness in financial management. AI-driven cash flow forecasting leverages historical data and predictive analytics to optimize liquidity planning and mitigate risks.

AI-Driven Variance Analysis

AI-driven variance analysis enhances cash flow management by accurately comparing actual cash inflows and outflows against predictive cash flow forecasts, enabling real-time identification of discrepancies. Machine learning algorithms process historical financial data and market trends to refine forecast accuracy, optimize liquidity planning, and reduce financial risk.

Machine Learning Forecast Models

Machine learning forecast models enhance cash flow forecasting by analyzing historical financial data and identifying complex patterns to predict future cash inflows and outflows with higher accuracy. Integrating AI-driven algorithms improves liquidity management, reduces forecasting errors, and supports proactive financial decision-making in dynamic market conditions.

Predictive Cash Positioning

Predictive cash positioning leverages artificial intelligence to analyze historical cash flow data, enabling businesses to accurately forecast future liquidity and optimize working capital management. This AI-driven approach enhances decision-making by identifying cash surplus or deficits in advance, reducing financial risks and improving operational efficiency.

Algorithmic Liquidity Insights

Algorithmic liquidity insights leverage artificial intelligence to analyze historical cash flow data and predict future liquidity patterns with high accuracy, enabling businesses to optimize their working capital management. Advanced AI models integrate real-time financial transactions, market trends, and external economic indicators to produce dynamic cash flow forecasts that improve decision-making and risk mitigation.

Automated Forecast Adjustments

Cash flow forecasting enhanced by artificial intelligence enables automated forecast adjustments by continuously analyzing real-time financial data and identifying patterns that traditional models may miss. This automation improves accuracy in predicting liquidity needs, reduces human error, and allows businesses to make proactive decisions for optimized cash management.

Anomaly Detection in Receivables

Cash flow forecasting with artificial intelligence enhances anomaly detection in receivables by identifying irregular payment patterns and potential fraud in real time, improving accuracy beyond traditional cash flow analysis. Advanced AI algorithms analyze historical transaction data, enabling early detection of discrepancies that can impact liquidity management and optimize working capital strategies.

Dynamic Scenario Planning

Cash flow forecasting with artificial intelligence leverages dynamic scenario planning to enhance accuracy by analyzing multiple financial variables and market conditions in real time. This approach enables finance professionals to predict cash inflows and outflows more precisely, adapting strategies swiftly to optimize liquidity and mitigate risks.

NLP-Based Transaction Categorization

NLP-based transaction categorization enhances cash flow forecasting by automatically classifying financial transactions with high accuracy, enabling real-time visibility into cash inflows and outflows. This AI-driven approach reduces manual errors and improves predictive models, resulting in more precise liquidity management and strategic financial planning.

Deep Learning Treasury Automation

Deep learning in treasury automation enhances cash flow forecasting accuracy by analyzing vast datasets and identifying complex financial patterns in real-time, enabling proactive liquidity management. Integrating AI-driven models with cash flow improves decision-making efficiency, reduces forecasting errors, and optimizes working capital allocation.

Cash Flow vs Cash Flow Forecasting with Artificial Intelligence Infographic

industrydif.com

industrydif.com