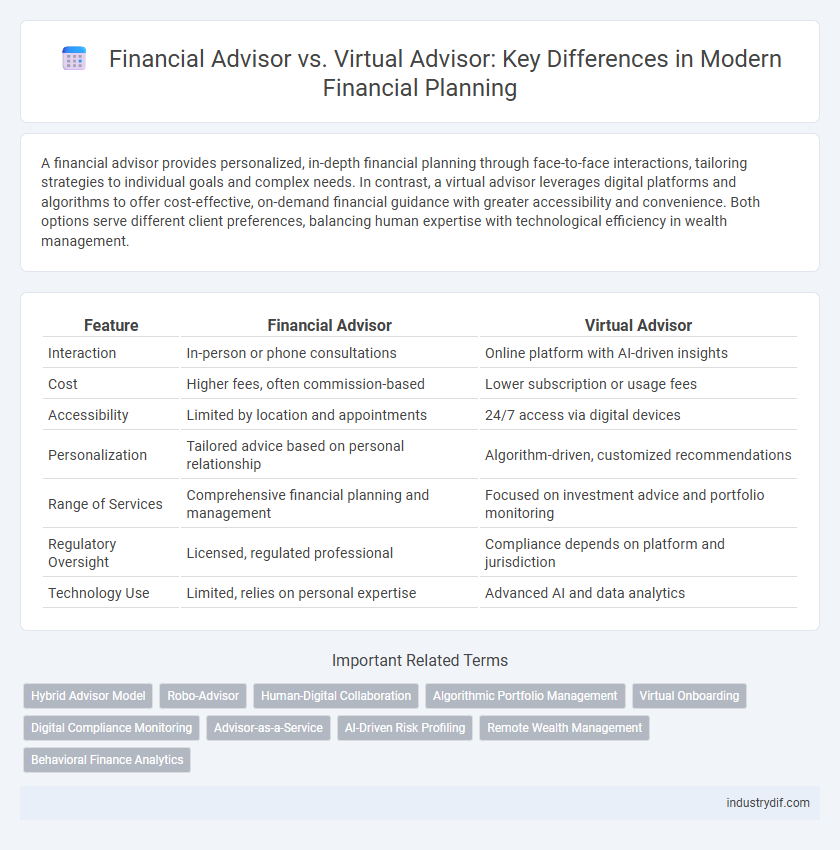

A financial advisor provides personalized, in-depth financial planning through face-to-face interactions, tailoring strategies to individual goals and complex needs. In contrast, a virtual advisor leverages digital platforms and algorithms to offer cost-effective, on-demand financial guidance with greater accessibility and convenience. Both options serve different client preferences, balancing human expertise with technological efficiency in wealth management.

Table of Comparison

| Feature | Financial Advisor | Virtual Advisor |

|---|---|---|

| Interaction | In-person or phone consultations | Online platform with AI-driven insights |

| Cost | Higher fees, often commission-based | Lower subscription or usage fees |

| Accessibility | Limited by location and appointments | 24/7 access via digital devices |

| Personalization | Tailored advice based on personal relationship | Algorithm-driven, customized recommendations |

| Range of Services | Comprehensive financial planning and management | Focused on investment advice and portfolio monitoring |

| Regulatory Oversight | Licensed, regulated professional | Compliance depends on platform and jurisdiction |

| Technology Use | Limited, relies on personal expertise | Advanced AI and data analytics |

Introduction to Financial and Virtual Advisors

Financial advisors offer personalized, face-to-face guidance tailored to individual financial goals, providing comprehensive planning across investments, retirement, tax strategies, and estate management. Virtual advisors leverage technology-driven platforms and algorithms to deliver automated, cost-effective portfolio management and financial recommendations with minimal human intervention. Both types of advisors aim to optimize clients' financial well-being but differ in interaction style, accessibility, and cost structures.

Key Differences Between Financial and Virtual Advisors

Financial advisors offer personalized, in-person guidance tailored to individual goals, leveraging deep expertise in investment strategies, tax planning, and retirement solutions. Virtual advisors deliver automated, algorithm-driven advice through digital platforms, providing cost-effective, accessible financial planning with real-time portfolio management. The key differences lie in human interaction quality, customization depth, and technology integration for client engagement and decision-making.

Roles and Responsibilities Explained

Financial advisors provide personalized investment strategies, retirement planning, and risk management through in-depth client interactions and ongoing portfolio monitoring. Virtual advisors utilize algorithms and artificial intelligence to deliver automated financial guidance and portfolio rebalancing with minimal human intervention. Both roles prioritize optimizing client financial goals but differ in the degree of customization and direct client engagement.

Technology Integration in Advisory Services

Financial advisors increasingly leverage advanced technology integration, such as AI-driven analytics and CRM platforms, to enhance personalized investment strategies and client communication. Virtual advisors utilize machine learning algorithms and robo-advisory tools to deliver cost-effective, automated portfolio management with real-time data analysis. This seamless blend of traditional expertise and innovative digital solutions optimizes advisory efficiency and client experience in modern finance.

Cost Comparison: Fees and Pricing Models

Financial advisors typically charge hourly fees ranging from $150 to $400 or take a percentage of assets under management, usually between 0.5% to 2% annually, which can accumulate significantly over time. Virtual advisors offer lower-cost subscription models or flat fees, with prices often starting as low as $30 per month or a small percentage of assets, usually under 0.5%. The lower overhead of virtual advisors enables more affordable pricing for clients, making them a cost-effective alternative for investors with smaller portfolios.

Regulatory and Compliance Considerations

Financial advisors must adhere to stringent regulatory frameworks such as SEC and FINRA rules, ensuring fiduciary duty, transparent disclosures, and suitability standards for client investments. Virtual advisors, while leveraging automated algorithms, are subject to similar compliance requirements but face unique challenges in maintaining data privacy, cybersecurity, and cross-jurisdictional licensing. Both types require robust compliance management systems to monitor regulatory changes and implement risk mitigation strategies effectively.

Accessibility and Convenience for Clients

Financial advisors offer personalized, face-to-face consultations providing tailored financial strategies, while virtual advisors deliver 24/7 accessibility through digital platforms, enabling clients to manage portfolios anytime from anywhere. Virtual advisors streamline convenience by integrating AI-driven tools and mobile apps that facilitate real-time updates and instant transactions, enhancing client engagement. Accessibility for clients increases with virtual advisors by eliminating geographical barriers and reducing appointment scheduling constraints common in traditional financial advising.

Personalized Service vs Automated Advice

Financial advisors deliver personalized service by analyzing individual financial goals and tailoring strategies with human insight, fostering trust through direct interaction. Virtual advisors leverage automated algorithms and data analytics to provide efficient, cost-effective advice but may lack the nuanced understanding of unique client circumstances. Investors seeking customized financial plans often prioritize the human element, while those valuing accessibility and speed may prefer virtual advisory platforms.

Security, Privacy, and Data Protection

Financial advisors provide personalized financial guidance with strict adherence to confidential client information, ensuring compliance with regulatory standards like GDPR and SEC rules. Virtual advisors utilize advanced encryption technologies and secure cloud platforms to safeguard user data, offering robust protection against cyber threats and unauthorized access. Both options prioritize data privacy, but virtual advisors often implement automated monitoring systems for continuous security enhancements.

Choosing the Right Advisor for Your Needs

Selecting the right advisor depends on your financial goals, preferences, and the level of personalized service required. Financial advisors offer tailored, in-person guidance and comprehensive planning, ideal for complex portfolios or life transitions, while virtual advisors provide automated, cost-effective solutions suitable for tech-savvy investors seeking convenience and lower fees. Evaluating factors such as communication style, technology comfort, fee structures, and the scope of services ensures alignment with your specific financial needs and objectives.

Related Important Terms

Hybrid Advisor Model

The Hybrid Advisor Model combines the personalized expertise of a Financial Advisor with the efficiency and accessibility of a Virtual Advisor, enhancing client engagement through tailored investment strategies supported by advanced digital tools. This integration improves portfolio management and financial planning by leveraging real-time analytics and human insight to optimize asset allocation and risk assessment.

Robo-Advisor

Robo-advisors leverage advanced algorithms and artificial intelligence to provide automated, cost-efficient investment management, reducing the need for human intervention. Unlike traditional financial advisors, robo-advisors offer 24/7 portfolio monitoring, tax-loss harvesting, and personalized asset allocation tailored to individual risk tolerance and financial goals.

Human-Digital Collaboration

Financial advisors combine personalized expertise with emotional intelligence to tailor investment strategies, while virtual advisors use AI algorithms to deliver real-time data analysis and automated portfolio management; integrating both enhances client outcomes through seamless human-digital collaboration. This synergy leverages advanced analytics and human judgment, optimizing decision-making efficiency and ensuring adaptive, client-centered financial planning.

Algorithmic Portfolio Management

Algorithmic portfolio management employed by virtual advisors leverages advanced algorithms and real-time data analysis to optimize investment strategies with high precision and scalability. In contrast, traditional financial advisors rely more on personalized judgment and human expertise but may lack the speed and data-driven consistency inherent in algorithmic approaches.

Virtual Onboarding

Virtual onboarding streamlines the client intake process through secure digital platforms, enabling financial advisors to efficiently gather documentation and verify identities remotely. This automated approach enhances client experience, reduces operational costs, and accelerates account setup compared to traditional financial advisor methods.

Digital Compliance Monitoring

Financial advisors rely on traditional methods for compliance monitoring, which can be time-consuming and prone to human error, whereas virtual advisors leverage advanced AI-driven digital compliance monitoring tools that ensure real-time regulatory adherence and reduce operational risks. Digital compliance monitoring by virtual advisors enhances transparency, automates audit trails, and provides scalable solutions that adapt quickly to evolving financial regulations.

Advisor-as-a-Service

Advisor-as-a-Service platforms combine advanced AI technologies with human expertise to deliver scalable, personalized financial advice, reducing costs and increasing accessibility compared to traditional financial advisors. These virtual advisors leverage real-time data analytics and automated portfolio management to provide continuous, tailored investment strategies, transforming client engagement and operational efficiency in the finance industry.

AI-Driven Risk Profiling

AI-driven risk profiling enhances virtual advisors by leveraging machine learning algorithms to analyze vast datasets, providing highly personalized investment strategies with real-time adjustments. In contrast, traditional financial advisors rely on static questionnaires and periodic reviews, which may lack the dynamic precision and scalability offered by AI technology.

Remote Wealth Management

Financial Advisors provide personalized, in-depth financial planning and portfolio management through direct human interaction, ideal for clients seeking tailored advice and complex wealth strategies. Virtual Advisors leverage AI-driven platforms and remote technology to offer accessible, cost-effective wealth management solutions with 24/7 portfolio monitoring and automated investment rebalancing.

Behavioral Finance Analytics

Behavioral finance analytics enhance decision-making by analyzing clients' psychological biases and emotional responses, which financial advisors use to personalize strategies, while virtual advisors leverage AI-driven behavioral data to deliver scalable, real-time insights. Integrating behavioral finance analytics, virtual advisors optimize portfolio adjustments dynamically, whereas financial advisors provide nuanced human judgment to interpret complex emotional and cognitive factors affecting investment choices.

Financial Advisor vs Virtual Advisor Infographic

industrydif.com

industrydif.com