Credit underwriting relies on traditional methods such as manual analysis of financial statements and credit history to assess borrower risk, which can be time-consuming and subjective. Artificial intelligence-driven underwriting leverages machine learning algorithms and big data to enhance accuracy, speed, and scalability in evaluating creditworthiness. This shift enables financial institutions to reduce default rates while expanding access to credit for a broader range of applicants.

Table of Comparison

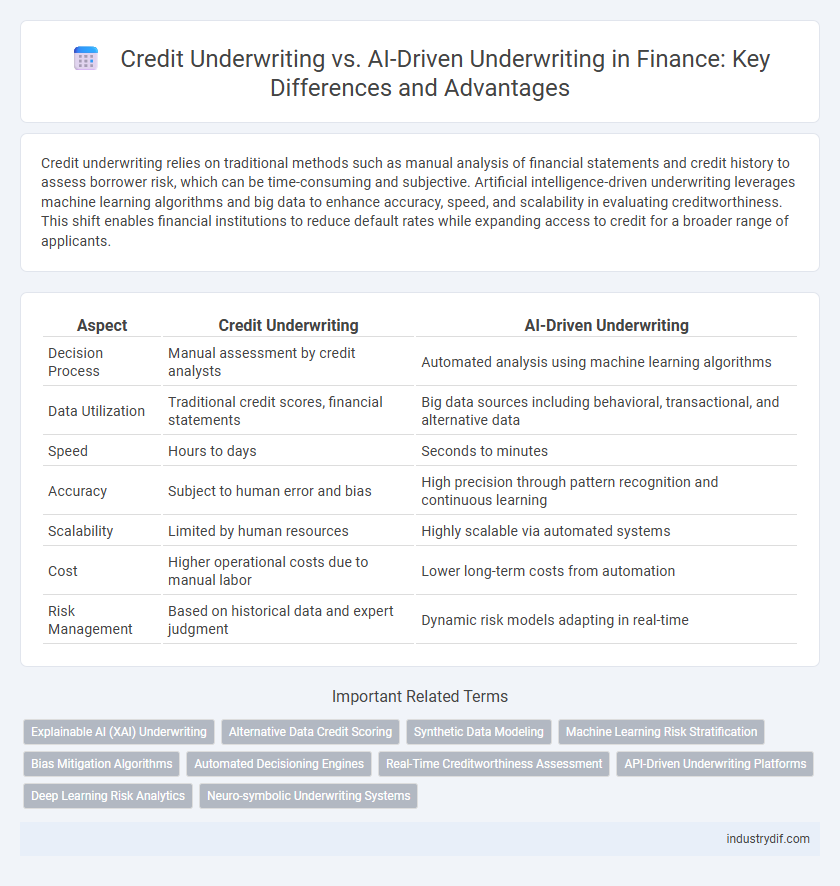

| Aspect | Credit Underwriting | AI-Driven Underwriting |

|---|---|---|

| Decision Process | Manual assessment by credit analysts | Automated analysis using machine learning algorithms |

| Data Utilization | Traditional credit scores, financial statements | Big data sources including behavioral, transactional, and alternative data |

| Speed | Hours to days | Seconds to minutes |

| Accuracy | Subject to human error and bias | High precision through pattern recognition and continuous learning |

| Scalability | Limited by human resources | Highly scalable via automated systems |

| Cost | Higher operational costs due to manual labor | Lower long-term costs from automation |

| Risk Management | Based on historical data and expert judgment | Dynamic risk models adapting in real-time |

Introduction to Credit Underwriting in Finance

Credit underwriting in finance involves assessing the creditworthiness of borrowers by analyzing their financial history, income, and repayment capacity to determine the risk level associated with lending. Traditional credit underwriting relies on manual evaluation and standardized credit scoring models, which can be time-consuming and subjective. Artificial intelligence-driven underwriting enhances this process by employing machine learning algorithms to analyze large datasets rapidly, improving accuracy and enabling more personalized lending decisions.

Traditional Credit Underwriting: Key Processes

Traditional credit underwriting involves a detailed analysis of borrower creditworthiness through financial statements, credit scores, income verification, and debt-to-income ratios. This process relies heavily on human judgment to assess risk, interpret qualitative factors, and ensure regulatory compliance. Underwriters manually evaluate each application, balancing risk with potential return based on historical data and established lending criteria.

The Evolution Toward AI-Driven Underwriting

Credit underwriting has traditionally relied on manual assessment of financial statements and credit histories, often leading to slower decision-making and potential biases. The evolution toward AI-driven underwriting leverages machine learning algorithms and big data analytics to enhance risk evaluation accuracy and processing speed. This transition enables lenders to analyze diverse data sources, optimize credit scoring models, and reduce default rates through predictive insights.

Data Sources: Conventional vs AI-Enhanced Methods

Conventional credit underwriting relies primarily on traditional data sources such as credit scores, income statements, and employment history to assess borrower risk. AI-enhanced underwriting integrates alternative data sets including social media activity, utility payments, and real-time transaction data, enabling more comprehensive risk profiling. Machine learning algorithms analyze these diverse data points to improve predictive accuracy, reduce biases, and accelerate credit decision processes.

Risk Assessment Approaches: Human vs Algorithmic

Credit underwriting traditionally relies on human expertise to evaluate applicant risk by analyzing financial statements, credit history, and qualitative factors such as employment stability and character. Artificial intelligence-driven underwriting leverages machine learning algorithms to process vast datasets, uncover hidden patterns, and predict default probabilities with higher accuracy and speed. This algorithmic approach enhances risk assessment by minimizing human bias and enabling dynamic adjustment to market trends and borrower behavior.

Speed and Efficiency in Underwriting Decisions

Credit underwriting traditionally relies on manual assessment of borrower financials and risk profiles, often resulting in longer decision times and higher operational costs. Artificial intelligence-driven underwriting leverages machine learning algorithms to analyze vast datasets rapidly, enabling real-time risk evaluation and significantly faster loan approvals. This technological advancement enhances efficiency by reducing human error and streamlining workflow processes in financial institutions.

Bias and Fairness in Underwriting Evaluations

Credit underwriting traditionally relies on historical financial data and standardized criteria, which can inadvertently perpetuate biases related to race, gender, or socioeconomic status. Artificial intelligence-driven underwriting leverages machine learning algorithms to analyze diverse data sets, potentially reducing human bias but raising concerns about algorithmic transparency and fairness. Ensuring ethical AI implementation requires continuous monitoring and adjustment to mitigate hidden biases and promote equitable lending decisions.

Regulatory Compliance in AI-Driven Underwriting

AI-driven underwriting enhances regulatory compliance by utilizing advanced algorithms to ensure consistent application of lending criteria and reduce human bias in credit decisions. Machine learning models can be designed to automatically detect anomalies and flag potential anti-discrimination issues, aligning with regulatory requirements such as the Equal Credit Opportunity Act (ECOA). Continuous monitoring and auditing frameworks embedded in AI systems facilitate transparent reporting and adherence to evolving financial regulations.

Integration Challenges: Legacy Systems vs AI Solutions

Credit underwriting traditionally relies on legacy systems that are often rigid and incompatible with modern AI-driven underwriting technologies, creating significant integration challenges. Legacy infrastructures frequently lack the scalability and data processing capabilities required for advanced machine learning models, hindering real-time risk assessment and decision-making. Overcoming these obstacles demands substantial investment in system upgrades and data standardization to seamlessly blend AI solutions with existing credit evaluation processes.

The Future of Underwriting: Merging Human Expertise with AI

Credit underwriting traditionally relies on human expertise to assess borrower risk using financial statements, credit history, and qualitative factors, ensuring nuanced decision-making. Artificial intelligence-driven underwriting leverages machine learning algorithms and big data analytics to enhance accuracy, speed, and scalability in risk evaluation. The future of underwriting envisions a hybrid model combining human judgment with AI-powered insights, optimizing risk assessment and improving lending efficiency.

Related Important Terms

Explainable AI (XAI) Underwriting

Credit underwriting traditionally relies on historical financial data and manual risk assessment, often lacking transparency and consistency. Explainable AI (XAI) underwriting enhances decision-making by providing interpretable models that clarify how risk factors weigh in credit approvals, thereby improving trust, compliance, and accuracy in financial evaluations.

Alternative Data Credit Scoring

Alternative data credit scoring leverages non-traditional information such as utility payments, social media activity, and transaction history to enhance credit underwriting accuracy, providing deeper insights into borrower risk profiles. Artificial intelligence-driven underwriting integrates machine learning algorithms to analyze this alternative data, enabling faster, more precise credit decisions compared to traditional underwriting methods.

Synthetic Data Modeling

Credit underwriting traditionally relies on historical financial data and borrower creditworthiness assessments, whereas artificial intelligence-driven underwriting leverages synthetic data modeling to generate diverse, anonymized datasets that enhance model training and predictive accuracy. Synthetic data modeling improves risk evaluation by enabling AI systems to simulate various credit scenarios and detect complex patterns, reducing biases and increasing the robustness of credit approval decisions.

Machine Learning Risk Stratification

Credit underwriting traditionally relies on fixed criteria and manual analysis to assess borrower risk, often leading to slower decision-making and potential biases. Artificial intelligence-driven underwriting leverages machine learning risk stratification techniques to analyze vast datasets, improving accuracy in predicting defaults and enabling faster, data-driven loan approvals.

Bias Mitigation Algorithms

Credit underwriting traditionally relies on historical financial data and established heuristics, often perpetuating biases against marginalized groups; AI-driven underwriting enhances bias mitigation algorithms by analyzing diverse, non-traditional data sources and applying fairness constraints to improve decision equity. These advanced algorithms dynamically adjust for discriminatory patterns in credit scoring, promoting inclusivity while maintaining predictive accuracy in lending risk assessments.

Automated Decisioning Engines

Credit underwriting traditionally relies on manual evaluation of borrower creditworthiness using financial statements and credit scores, which can be time-consuming and prone to human bias. Artificial intelligence-driven underwriting leverages automated decisioning engines that analyze vast datasets in real-time, enhancing accuracy and efficiency by identifying risk patterns and predicting default probabilities more effectively.

Real-Time Creditworthiness Assessment

Credit underwriting traditionally relies on historical financial data and fixed criteria to evaluate borrower risk, often resulting in delayed decision-making processes. Artificial intelligence-driven underwriting leverages real-time data analytics and machine learning algorithms to provide instantaneous creditworthiness assessments, enhancing accuracy and enabling faster loan approvals.

API-Driven Underwriting Platforms

API-driven underwriting platforms enable seamless integration of credit data sources and AI algorithms to enhance decision accuracy, reduce processing time, and improve risk assessment precision. These platforms leverage artificial intelligence to automate data analysis, enabling credit underwriters to streamline workflows and make data-driven decisions with greater scalability and compliance.

Deep Learning Risk Analytics

Credit underwriting traditionally relies on historical financial data and fixed criteria to assess borrower risk, often leading to conservative lending decisions. Deep learning risk analytics, powered by artificial intelligence, enhances underwriting by analyzing complex patterns in diverse datasets, improving accuracy in risk prediction and enabling more personalized credit decisions.

Neuro-symbolic Underwriting Systems

Neuro-symbolic underwriting systems combine neural networks with symbolic reasoning to enhance credit risk assessment accuracy, integrating vast datasets with expert rules for more transparent and explainable decision-making. This hybrid approach outperforms traditional credit underwriting by reducing bias, improving fraud detection, and enabling dynamic adaptation to evolving borrower profiles.

Credit underwriting vs Artificial intelligence-driven underwriting Infographic

industrydif.com

industrydif.com