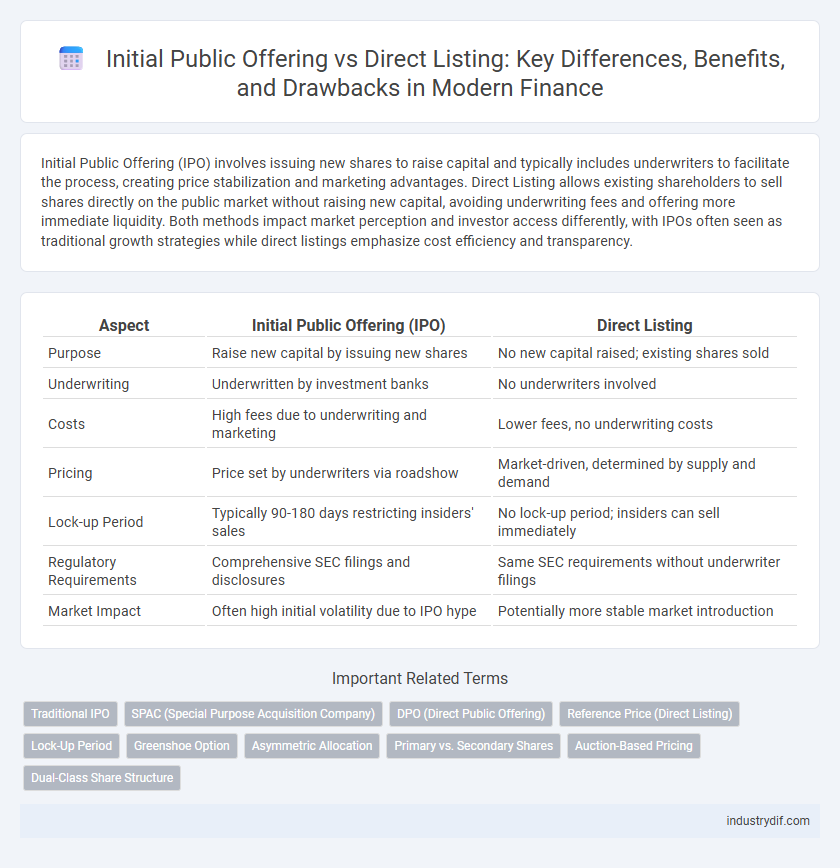

Initial Public Offering (IPO) involves issuing new shares to raise capital and typically includes underwriters to facilitate the process, creating price stabilization and marketing advantages. Direct Listing allows existing shareholders to sell shares directly on the public market without raising new capital, avoiding underwriting fees and offering more immediate liquidity. Both methods impact market perception and investor access differently, with IPOs often seen as traditional growth strategies while direct listings emphasize cost efficiency and transparency.

Table of Comparison

| Aspect | Initial Public Offering (IPO) | Direct Listing |

|---|---|---|

| Purpose | Raise new capital by issuing new shares | No new capital raised; existing shares sold |

| Underwriting | Underwritten by investment banks | No underwriters involved |

| Costs | High fees due to underwriting and marketing | Lower fees, no underwriting costs |

| Pricing | Price set by underwriters via roadshow | Market-driven, determined by supply and demand |

| Lock-up Period | Typically 90-180 days restricting insiders' sales | No lock-up period; insiders can sell immediately |

| Regulatory Requirements | Comprehensive SEC filings and disclosures | Same SEC requirements without underwriter filings |

| Market Impact | Often high initial volatility due to IPO hype | Potentially more stable market introduction |

Overview of Initial Public Offering (IPO)

An Initial Public Offering (IPO) is a process where a private company offers shares to the public for the first time to raise capital and increase market visibility. IPOs typically involve underwriting by investment banks, which help determine the offering price and facilitate the sale of shares. This method allows companies to access a broad investor base, enhance liquidity, and support growth initiatives through newly raised funds.

Overview of Direct Listing

Direct listing is a method for private companies to go public by offering existing shares directly on the stock exchange without issuing new shares or raising capital. This process allows for immediate liquidity and reduces underwriting fees compared to traditional IPOs. Companies benefit from greater price discovery and increased market-driven valuation without dilution of existing ownership.

Key Differences Between IPO and Direct Listing

Initial Public Offering (IPO) involves issuing new shares to raise capital with underwriters facilitating the process, whereas Direct Listing allows existing shareholders to sell shares directly on the exchange without raising new funds or involving underwriters. IPOs typically include price stabilization and investor roadshows, contrasting with the market-driven pricing and no lock-up period found in Direct Listings. Companies choosing IPOs often seek capital infusion and investor base expansion, while Direct Listings focus on liquidity and cost efficiency without diluting ownership.

Advantages of Conducting an IPO

Conducting an Initial Public Offering (IPO) provides companies with significant capital infusion by selling newly issued shares to the public, helping to finance growth and expansion. IPOs also create market visibility and credibility, attracting institutional investors and enhancing stock liquidity. Furthermore, IPOs offer structured pricing through underwriters, reducing price volatility compared to the open market mechanism of direct listings.

Benefits of Opting for a Direct Listing

Direct listing offers cost efficiency by eliminating underwriting fees typically associated with Initial Public Offerings, allowing companies to conserve capital. It provides immediate liquidity for existing shareholders without the dilution of ownership, preserving control for founders and early investors. Increased transparency and market-driven pricing in direct listings often result in a more accurate reflection of true market value.

Costs Associated with IPOs vs Direct Listings

Initial Public Offerings (IPOs) typically involve significant underwriting fees ranging from 5% to 7% of the total capital raised, alongside substantial marketing and regulatory compliance costs. Direct Listings eliminate underwriting fees but may incur expenses related to legal, advisory, and exchange listing requirements, generally resulting in lower overall costs. Companies opting for Direct Listings often save millions in fees, making it a cost-effective alternative to the traditional IPO process.

Regulatory Requirements and Compliance

Initial Public Offerings (IPOs) require extensive regulatory filings, including a detailed prospectus reviewed by the Securities and Exchange Commission (SEC), to ensure full disclosure and investor protection. Direct Listings bypass the traditional underwriter process but still mandate compliance with SEC registration requirements and ongoing disclosure obligations to maintain market transparency. Both methods necessitate adherence to Sarbanes-Oxley Act provisions, but IPOs generally encounter more rigorous pre-market scrutiny due to the involvement of underwriters and roadshows.

Impact on Company Valuation and Share Price

Initial Public Offering (IPO) often sets a fixed share price through underwriters, potentially leading to price surges or drops based on investor demand, directly influencing company valuation. Direct Listing allows existing shares to trade on the market without issuing new shares or underwriters, typically resulting in market-driven share prices reflecting real-time investor sentiment. The valuation impact of IPOs tends to be more controlled and potentially inflated by underwriter pricing, while direct listings offer transparent valuation aligned with genuine market dynamics.

Notable Companies and Case Studies

Notable companies like Spotify and Slack have successfully chosen direct listings, bypassing traditional underwriting fees associated with Initial Public Offerings (IPOs). High-profile IPO case studies include Alibaba and Facebook, which leveraged underwriters to raise substantial capital and generate investor interest. Comparing the two methods reveals trade-offs: IPOs offer price stability and marketing benefits, while direct listings provide cost savings and immediate liquidity.

Choosing the Right Path: IPO or Direct Listing?

Choosing between an Initial Public Offering (IPO) and a direct listing depends on a company's financial goals and liquidity needs; IPOs raise capital through new share issuance, attracting institutional investors but involving underwriter fees and regulatory processes. Direct listings offer existing shareholders immediate liquidity without dilution or underwriting costs, yet do not generate new capital and require strong market demand to ensure price stability. Evaluating factors like capital requirements, market conditions, shareholder structure, and cost considerations guides companies in selecting the optimal path for public market entry.

Related Important Terms

Traditional IPO

A Traditional Initial Public Offering (IPO) involves underwriters who help set the offer price, purchase shares from the company, and sell them to institutional investors, ensuring capital raising and market stabilization. This method contrasts with Direct Listing, where no new shares are issued or underwriters involved, and existing shareholders sell shares directly on the stock exchange, often resulting in different price discovery dynamics.

SPAC (Special Purpose Acquisition Company)

SPACs (Special Purpose Acquisition Companies) offer an alternative to traditional Initial Public Offerings (IPOs) and Direct Listings by enabling private companies to go public through a reverse merger, bypassing the lengthy IPO process and often reducing regulatory scrutiny. Unlike SPACs, Direct Listings do not raise new capital and allow existing shareholders to sell shares immediately, while IPOs involve underwriters and price discovery, positioning SPACs as a hybrid path with faster market access and capital infusion.

DPO (Direct Public Offering)

Direct Public Offering (DPO) enables companies to raise capital by selling shares directly to investors without underwriting, reducing costs compared to traditional Initial Public Offerings (IPO). Unlike IPOs, DPOs provide increased control over share pricing and distribution, often attracting smaller investors and fostering a more transparent market entry.

Reference Price (Direct Listing)

The reference price in a direct listing serves as a benchmark derived from market data and is used to guide opening trades without underwriter involvement or allocating shares at a fixed IPO price. Unlike traditional IPOs, reference prices reflect real-time investor valuation signals, enhancing price discovery and reducing potential price manipulation.

Lock-Up Period

Initial Public Offerings (IPOs) typically include a lock-up period of 90 to 180 days, preventing insiders from selling shares immediately to stabilize stock prices, whereas direct listings generally do not impose such restrictions, allowing immediate trading of all shares. This absence of a lock-up period in direct listings can lead to higher volatility but offers greater liquidity and flexibility for existing shareholders.

Greenshoe Option

The Greenshoe option, commonly used in Initial Public Offerings (IPOs), allows underwriters to sell additional shares up to 15% beyond the original offering to stabilize the stock price, a feature absent in Direct Listings where no new shares are issued. This mechanism provides IPOs with price support and demand management, contrasting with the market-driven price discovery inherent in Direct Listings.

Asymmetric Allocation

Initial Public Offerings (IPOs) involve underwriters allocating shares to select investors, creating asymmetric allocation that may benefit institutional over retail investors. Direct Listings eliminate underwriter allocation, allowing all investors equal access to shares at market-driven prices, reducing allocation asymmetry.

Primary vs. Secondary Shares

Initial Public Offering (IPO) primarily involves the issuance of new, primary shares to raise capital for the company, whereas Direct Listing offers only secondary shares, allowing existing shareholders to sell their holdings without diluting equity. The distinction between primary and secondary shares impacts liquidity, share price discovery, and capital infusion dynamics in the public markets.

Auction-Based Pricing

Auction-based pricing in Initial Public Offerings (IPOs) allows investors to submit bids at different prices, enabling market-driven price discovery and potentially minimizing underpricing. In contrast, Direct Listings bypass traditional underwriting and use a uniform opening price set through a single auction, fostering transparency and immediate market engagement without issuing new shares.

Dual-Class Share Structure

Dual-class share structures often feature prominently in initial public offerings (IPOs), granting founders and insiders enhanced voting power through Class B shares compared to the one-share-one-vote system typical in direct listings. Companies opting for direct listings usually forgo such structures, promoting greater shareholder equality but potentially limiting control retention by original owners.

Initial Public Offering vs Direct Listing Infographic

industrydif.com

industrydif.com