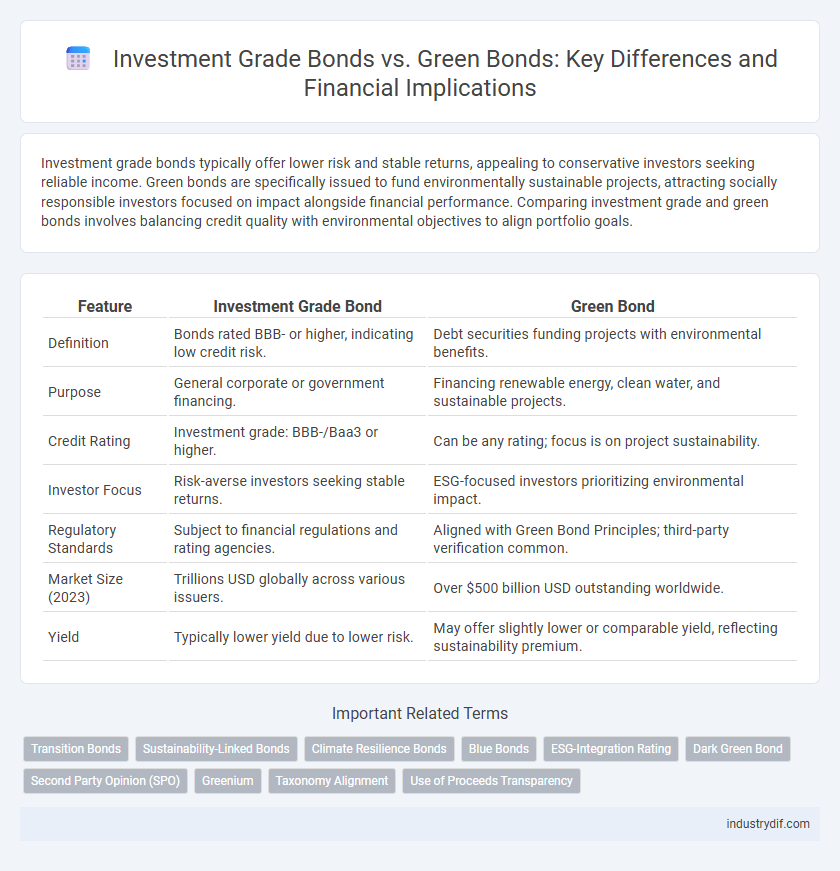

Investment grade bonds typically offer lower risk and stable returns, appealing to conservative investors seeking reliable income. Green bonds are specifically issued to fund environmentally sustainable projects, attracting socially responsible investors focused on impact alongside financial performance. Comparing investment grade and green bonds involves balancing credit quality with environmental objectives to align portfolio goals.

Table of Comparison

| Feature | Investment Grade Bond | Green Bond |

|---|---|---|

| Definition | Bonds rated BBB- or higher, indicating low credit risk. | Debt securities funding projects with environmental benefits. |

| Purpose | General corporate or government financing. | Financing renewable energy, clean water, and sustainable projects. |

| Credit Rating | Investment grade: BBB-/Baa3 or higher. | Can be any rating; focus is on project sustainability. |

| Investor Focus | Risk-averse investors seeking stable returns. | ESG-focused investors prioritizing environmental impact. |

| Regulatory Standards | Subject to financial regulations and rating agencies. | Aligned with Green Bond Principles; third-party verification common. |

| Market Size (2023) | Trillions USD globally across various issuers. | Over $500 billion USD outstanding worldwide. |

| Yield | Typically lower yield due to lower risk. | May offer slightly lower or comparable yield, reflecting sustainability premium. |

Defining Investment Grade Bonds

Investment grade bonds are debt securities issued by entities with strong credit ratings, typically BBB- or higher according to Standard & Poor's, indicating low default risk and high creditworthiness. These bonds attract conservative investors seeking steady income with lower risk compared to high-yield bonds. Unlike green bonds, which finance environmentally sustainable projects, investment grade bonds primarily emphasize credit quality and financial stability.

Understanding Green Bonds

Green bonds are debt securities issued specifically to fund projects with positive environmental or climate benefits, making them a specialized segment within investment-grade bonds. Unlike traditional investment-grade bonds, green bonds are verified by third-party standards to ensure capital is allocated exclusively towards sustainable initiatives such as renewable energy, energy efficiency, or pollution reduction. Investors in green bonds benefit from aligning their portfolios with environmental, social, and governance (ESG) criteria while maintaining credit quality comparable to conventional investment-grade debt.

Credit Ratings: Evaluating Investment Grade

Investment grade bonds possess high credit ratings, typically BBB- or higher from agencies like S&P and Fitch, indicating low default risk and stable returns. Green bonds may receive similar credit ratings but are distinguished by their environmental impact and use of proceeds for sustainable projects. Evaluating investment grade status involves assessing issuer creditworthiness, financial health, and repayment capacity to ensure portfolio stability.

Environmental Impact: The Core of Green Bonds

Green bonds are specifically designed to fund projects with positive environmental impacts, such as renewable energy, clean transportation, and sustainable agriculture, distinguishing them from traditional investment grade bonds that primarily focus on credit quality and risk-return profiles. The environmental impact of green bonds is rigorously monitored and reported, ensuring transparency and accountability, which attracts investors committed to sustainability goals and ESG criteria. Investment grade bonds may include various sectors with strong credit ratings but do not inherently guarantee financing for environmentally beneficial projects like green bonds do.

Key Differences Between Investment Grade and Green Bonds

Investment grade bonds are debt securities with high credit ratings, reflecting low default risk and strong issuer creditworthiness. Green bonds are specifically issued to fund projects with environmental benefits, regardless of credit rating, emphasizing sustainable investment objectives. Key differences include credit risk assessment, purpose of funds, and investor targeting--investment grade bonds appeal to risk-averse investors focused on credit quality, while green bonds attract those prioritizing environmental impact alongside financial returns.

Risk Profiles and Returns Comparison

Investment grade bonds typically offer lower yields and reduced credit risk due to their strong issuer ratings, making them attractive for conservative investors seeking stable income. Green bonds, while often investment grade, may entail sector-specific risks tied to environmental projects but provide the added value of funding sustainable initiatives, sometimes at a slight yield premium. Comparing returns, investment grade bonds prioritize capital preservation with predictable cash flows, whereas green bonds balance moderate risk with the potential for reputational gains and alignment with ESG investment mandates.

Regulatory Frameworks and Standards

Investment grade bonds adhere to stringent credit rating criteria set by regulatory agencies ensuring lower risk and higher investment security. Green bonds must comply with specialized regulatory frameworks, such as the Green Bond Principles and the EU Green Bond Standard, which mandate transparency in the environmental impact and use of proceeds. These standards ensure that green bonds not only meet financial criteria but also support sustainable and climate-friendly projects, differentiating them in the capital markets.

Market Trends in Sustainable Finance

Investment grade bonds maintain steady demand in traditional finance, while green bonds exhibit rapid growth driven by increasing institutional investor interest in sustainability. Market trends show green bond issuance surpassing $500 billion globally in 2023, reflecting a shift towards environmentally responsible investment portfolios. Enhanced regulatory support and ESG integration further accelerate the adoption of green bonds within diversified investment-grade portfolios.

Investor Appetite: Who Buys What?

Institutional investors such as pension funds and insurance companies predominantly favor Investment Grade bonds due to their stable credit ratings and predictable returns. Green Bonds attract a growing segment of ESG-focused investors seeking to align portfolios with sustainability goals while accepting potentially variable returns. Market data reveals increasing crossover as traditional bond investors incorporate Green Bonds to diversify and meet evolving regulatory and investor demand for environmental impact.

Future Outlook: The Role of Green and Investment Grade Bonds in Finance

Investment grade bonds, characterized by their high credit ratings and lower default risk, continue to attract institutional investors seeking stable returns amid market volatility. Green bonds, designed to fund environmentally sustainable projects, are expected to grow significantly as regulatory frameworks and investor demand for climate-conscious assets increase. The future outlook for finance indicates a convergence where investment grade green bonds gain prominence, blending credit quality with environmental impact to support sustainable economic growth.

Related Important Terms

Transition Bonds

Transition bonds serve as a crucial financial instrument bridging the gap between traditional investment grade bonds and green bonds by financing companies in high-carbon sectors undergoing sustainable transformation. These bonds support issuers in meeting environmental targets while maintaining creditworthiness aligned with investment grade standards, facilitating investor confidence in the transition to a low-carbon economy.

Sustainability-Linked Bonds

Sustainability-linked bonds differ from investment grade and green bonds by tying financial performance to the issuer's achievement of predefined environmental, social, or governance (ESG) targets, rather than solely funding environmentally sustainable projects. These bonds incentivize corporate accountability through adjustable coupon rates based on meeting sustainability goals, offering a dynamic approach to financing sustainable development compared to the fixed criteria of green bonds and the credit quality emphasis of investment grade bonds.

Climate Resilience Bonds

Climate resilience bonds, a subset of green bonds, are specifically designed to fund projects that enhance infrastructure durability against climate change impacts, offering investors a stable return with a positive environmental impact. These bonds often carry an investment-grade rating, reflecting low credit risk and attracting risk-averse investors interested in sustainable finance and long-term climate adaptation strategies.

Blue Bonds

Blue bonds, a subset of green bonds, specifically finance ocean and water-related projects, attracting investment-grade ratings due to their lower risk profiles and strong environmental impact. Institutional investors increasingly favor blue bonds for sustainable portfolio diversification, driven by stringent ESG criteria and growing regulatory incentives.

ESG-Integration Rating

Investment grade bonds are evaluated primarily on creditworthiness, ensuring low default risk, while green bonds emphasize environmental, social, and governance (ESG) integration through third-party certifications and impact reporting. ESG-integration ratings for green bonds assess the alignment of funded projects with sustainability criteria, influencing investor decisions beyond traditional financial metrics.

Dark Green Bond

Dark Green Bonds represent a subset of investment-grade green bonds specifically dedicated to financing projects with the highest environmental benefits, such as renewable energy and carbon reduction initiatives. These bonds attract investors seeking stringent sustainability criteria alongside creditworthiness, differentiating them from standard investment-grade bonds by their verified, impactful environmental outcomes.

Second Party Opinion (SPO)

Second Party Opinion (SPO) plays a critical role in differentiating investment grade bonds from green bonds by providing independent verification of environmental credentials and sustainability claims. SPOs enhance investor confidence in green bonds' adherence to established frameworks like the Green Bond Principles, ensuring transparency and credibility beyond traditional credit ratings.

Greenium

Green bonds typically command a "greenium," a premium yield advantage over traditional investment-grade bonds due to their environmental benefits and investor demand for sustainability. This pricing anomaly reflects growing market preference for green assets, often resulting in lower borrowing costs for issuers committed to environmentally friendly projects.

Taxonomy Alignment

Investment grade bonds generally have lower risk and higher credit ratings but may lack specific environmental criteria, while green bonds are designed to fund projects that meet strict taxonomy alignment for sustainability. Taxonomy alignment ensures green bonds comply with environmental objectives, enhancing transparency and credibility in responsible investment frameworks.

Use of Proceeds Transparency

Investment grade bonds prioritize credit quality and risk assessment, with use of proceeds often allocated across general corporate purposes, which can limit transparency on specific project funding. Green bonds mandate clear, detailed disclosure on proceeds dedicated exclusively to environmentally sustainable projects, enhancing transparency for investors focused on ESG criteria.

Investment Grade vs Green Bond Infographic

industrydif.com

industrydif.com