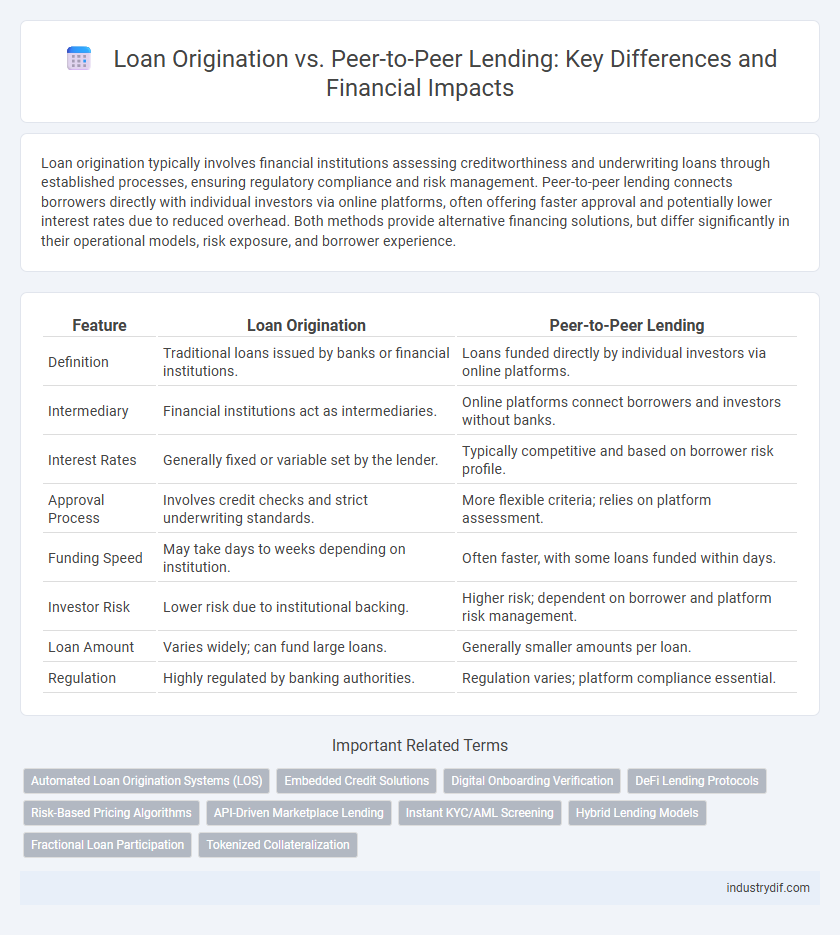

Loan origination typically involves financial institutions assessing creditworthiness and underwriting loans through established processes, ensuring regulatory compliance and risk management. Peer-to-peer lending connects borrowers directly with individual investors via online platforms, often offering faster approval and potentially lower interest rates due to reduced overhead. Both methods provide alternative financing solutions, but differ significantly in their operational models, risk exposure, and borrower experience.

Table of Comparison

| Feature | Loan Origination | Peer-to-Peer Lending |

|---|---|---|

| Definition | Traditional loans issued by banks or financial institutions. | Loans funded directly by individual investors via online platforms. |

| Intermediary | Financial institutions act as intermediaries. | Online platforms connect borrowers and investors without banks. |

| Interest Rates | Generally fixed or variable set by the lender. | Typically competitive and based on borrower risk profile. |

| Approval Process | Involves credit checks and strict underwriting standards. | More flexible criteria; relies on platform assessment. |

| Funding Speed | May take days to weeks depending on institution. | Often faster, with some loans funded within days. |

| Investor Risk | Lower risk due to institutional backing. | Higher risk; dependent on borrower and platform risk management. |

| Loan Amount | Varies widely; can fund large loans. | Generally smaller amounts per loan. |

| Regulation | Highly regulated by banking authorities. | Regulation varies; platform compliance essential. |

Understanding Loan Origination: Key Concepts

Loan origination involves the complete process of a borrower applying for a new loan, including application, underwriting, approval, and disbursement, typically managed by banks or financial institutions. It requires evaluating creditworthiness, income verification, and risk assessment to determine loan terms and interest rates. Efficient loan origination systems leverage automated technologies to streamline approvals and reduce operational costs.

What is Peer-to-Peer Lending?

Peer-to-peer lending is a financial practice where individuals can borrow and lend money directly without traditional banks acting as intermediaries. This model leverages online platforms to connect borrowers seeking loans with investors looking to fund them, often resulting in lower interest rates and faster approval times compared to conventional loan origination. It democratizes access to credit by enabling peer investors to diversify their portfolios and borrowers to obtain funds based on personal creditworthiness.

Traditional Loan Origination Process Steps

The traditional loan origination process involves customer application, credit analysis, loan underwriting, and approval before disbursement. This structured sequence ensures risk assessment and regulatory compliance through thorough documentation and verification. Unlike peer-to-peer lending, traditional origination relies heavily on financial institutions as intermediaries managing the entire loan lifecycle.

Peer-to-Peer Lending Workflow Explained

Peer-to-peer lending workflow involves connecting borrowers directly with individual investors through an online platform, eliminating traditional banks as intermediaries. The process begins with borrower application and credit assessment, followed by loan listing, where investors review and fund portions of the requested amount. Once fully funded, the platform manages loan disbursement and repayment tracking, ensuring transparent communication and automated payment collections between parties.

Key Differences Between Loan Origination and P2P Lending

Loan origination involves traditional financial institutions processing and approving loans through a structured underwriting process, while peer-to-peer (P2P) lending connects individual borrowers directly with investors via online platforms, bypassing banks. Key differences include risk assessment methods, with loan origination relying on credit scores and institutional evaluation, whereas P2P lending often integrates social and behavioral data for borrower assessment. Transaction speed and funding sources also differ, as loan origination typically requires longer processing times and centralized capital, contrasting with the faster, decentralized funding from multiple individual lenders in P2P lending.

Risk Assessment in Loan Origination vs P2P Platforms

Loan origination involves rigorous risk assessment through detailed credit scoring, income verification, and collateral evaluation to minimize default rates. Peer-to-peer (P2P) lending platforms rely on alternative data and automated algorithms to assess borrower risk but may entail higher default risks due to less stringent underwriting. Institutional lenders maintain lower risk exposure by applying standardized risk models, whereas P2P lenders often face increased volatility influenced by borrower transparency and platform-specific credit evaluation methods.

Regulatory Compliance: Loan Origination vs Peer-to-Peer Lending

Loan origination is subject to strict regulatory compliance, including adherence to federal and state lending laws, borrower qualification standards, and anti-money laundering requirements, ensuring robust consumer protection. Peer-to-peer lending platforms must also comply with securities regulations, investor protection laws, and data privacy standards, which vary by jurisdiction and can impact platform operations. Both financing methods require continuous monitoring and reporting to regulatory authorities to prevent fraud and ensure transparency.

Cost Structures and Fees Compared

Loan origination typically involves higher upfront fees and interest rates due to stringent underwriting processes and bank overheads, whereas peer-to-peer (P2P) lending generally offers lower fees by connecting borrowers directly with individual investors, reducing administrative costs. P2P platforms often charge origination fees ranging from 1% to 5% of the loan amount, while traditional loans may include additional costs such as application, processing, and prepayment penalties. The cost efficiency of P2P lending can result in more competitive rates for borrowers, but risk-based pricing and investor returns influence overall fees.

Technology’s Role in Loan Origination and P2P Lending

Technology transforms loan origination by automating credit assessments, streamlining document processing, and enabling real-time decision-making through AI and machine learning. In peer-to-peer lending, blockchain and digital platforms enhance transparency, reduce intermediaries, and facilitate direct borrower-lender interactions. Advanced data analytics and APIs further optimize risk evaluation and portfolio management in both loan origination and P2P lending ecosystems.

Future Trends in Lending: Traditional vs Peer-to-Peer

Loan origination systems are increasingly integrating artificial intelligence and blockchain to enhance credit assessment accuracy and transaction transparency, signaling a digital transformation in traditional lending. Peer-to-peer lending platforms leverage decentralized finance (DeFi) technologies and smart contracts to reduce intermediaries, lower costs, and increase borrower access, indicating a shift toward more democratized lending models. The future of lending will likely blend these advancements, with hybrid models combining institutional reliability and technology-driven decentralization to expand market reach and optimize risk management.

Related Important Terms

Automated Loan Origination Systems (LOS)

Automated Loan Origination Systems (LOS) streamline the loan approval process by integrating advanced algorithms, credit scoring, and document management, significantly reducing processing time and operational costs in traditional finance institutions. In contrast, peer-to-peer lending platforms leverage direct borrower-lender connections but often rely on less sophisticated automation, highlighting LOS as a critical technology for enhancing efficiency and risk assessment in traditional loan origination.

Embedded Credit Solutions

Embedded credit solutions streamline loan origination by integrating financing options directly within consumer platforms, enhancing user experience and approval speed. Peer-to-peer lending leverages embedded credit to connect individual borrowers and lenders efficiently, reducing intermediaries and lowering borrowing costs.

Digital Onboarding Verification

Digital onboarding verification in loan origination utilizes automated identity checks and credit scoring algorithms to streamline approval processes and reduce fraud risks. In contrast, peer-to-peer lending platforms leverage decentralized verification methods and social data analytics to match borrowers with individual investors more efficiently.

DeFi Lending Protocols

DeFi lending protocols transform traditional loan origination by enabling peer-to-peer lending through decentralized smart contracts, eliminating intermediaries and reducing costs. These protocols enhance transparency, provide faster loan approvals, and allow borrowers and lenders to interact directly on blockchain platforms with improved security and efficiency.

Risk-Based Pricing Algorithms

Risk-based pricing algorithms in loan origination leverage extensive credit data and predictive analytics to assess borrower risk accurately, enabling lenders to tailor interest rates according to individual creditworthiness. In peer-to-peer lending, these algorithms analyze alternative data and social signals to mitigate default risk while facilitating competitive rates directly between borrowers and investors.

API-Driven Marketplace Lending

API-driven marketplace lending streamlines loan origination by connecting borrowers directly with investors through automated, real-time data integration, reducing processing time and enhancing credit risk assessment accuracy. Compared to traditional loan origination, peer-to-peer lending platforms leverage APIs to facilitate transparent, efficient transactions, enabling diverse funding sources and scalable portfolio management.

Instant KYC/AML Screening

Instant KYC/AML screening in loan origination leverages automated identity verification and fraud detection systems to expedite approval processes while ensuring regulatory compliance. Peer-to-peer lending platforms integrate real-time KYC/AML checks to maintain secure transactions and mitigate risks by verifying borrower identities swiftly without traditional banking intermediaries.

Hybrid Lending Models

Hybrid lending models combine traditional loan origination processes with peer-to-peer lending platforms, offering borrowers access to diversified funding sources and competitive interest rates. These models leverage advanced algorithms and credit scoring techniques to optimize risk assessment while maintaining the efficiency and transparency of P2P lending.

Fractional Loan Participation

Loan origination typically involves financial institutions underwriting and funding entire loans, while peer-to-peer lending platforms enable fractional loan participation by allowing multiple investors to collectively fund portions of a single loan, spreading risk and increasing access to capital. Fractional loan participation enhances liquidity and diversification for lenders within P2P ecosystems, contrasting with traditional loan origination's centralized risk model.

Tokenized Collateralization

Loan origination typically involves centralized institutions assessing borrower creditworthiness, while peer-to-peer lending leverages decentralized platforms to connect lenders and borrowers directly. Tokenized collateralization in peer-to-peer lending enhances transparency and liquidity by using blockchain technology to represent assets digitally, reducing risk and improving access to funding.

Loan Origination vs Peer-to-Peer Lending Infographic

industrydif.com

industrydif.com